The 3 things you should do to build wealth in 2019 (updated regularly)

In December, I celebrated my two year anniversary of early retirement from full-time work. In 2016, I quit the rat race at 35 to pursue projects that I actually cared about (imagine that!).

Without the relatively comfortable full-time paycheck.

It's been an amazing ride. I've learned a ton about freedom and what it really means to control every second of your day. Believe it or not, it's not quite as cut-and-dry as many people believe.

I've written about my story a lot, and I'm as transparent as I can possibly be. We're not your rags to riches story.

Both my wife and I enjoyed a solid upbringing as children. Neither of us struggled through college or to find a job. We both earned highly-marketable degrees and made good money in the technology sector.

In fact, we pulled down a combined $250,000 in our last years working.

We know how to build wealth, and those techniques enabled us to quit full-time work pretty damn early. We're both in our 30s and we're proud of what we've accomplished.

How did we manage to build so much wealth? It's simple, though not necessarily easy. And, it generally takes a lot fo time. Let me explain.

How to build huge wealth in 2019

First, let's set the record straight about high incomes.

If you believe that earning a big salary is the only way to build massive wealth, then you're wrong.

Just. Plain. Wrong.

It makes us feel better to believe that we'll never be able to retire early without a huge income, but that's just not true. The truth is a high-income job often comes with a set of assumed requirements that keep high-income earners churning on the hamster wheel for years.

You might be surprised at how many high income earners still live paycheck to paycheck just to maintain their high income job.

The strategies that I'm about to talk about apply to anyone - with any level of income. Big incomes or small, building wealth ultimately comes down to a small set of insanely basic principles.

Principle #1: Invest Your Cash

Nobody ever got rich just by "saving money". Those articles about how to save money by ordering water instead of a soft drink in restaurants? Yeah, that's nonsense. That's not how we build wealth.

Wealthy people build wealth by devoting years of their life to investing their cash in appreciating assets.

Wow. Okay, what does this mean? It means we're not just putting our money in a bank. That only makes banks rich. Instead, we're placing additional value on our cash by investing it in assets that gain value over time.

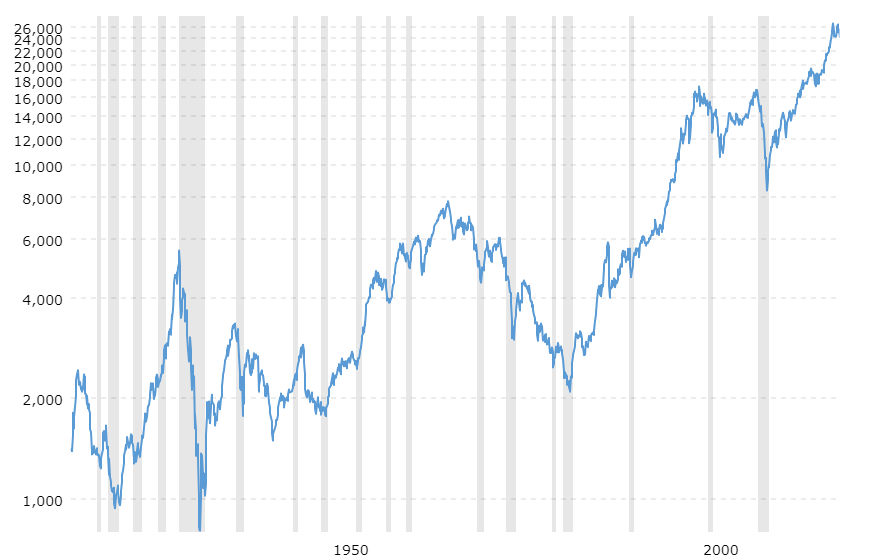

Historically, the stock market builds serious wealth for investors. This chart from Macro Trends shows how the Dow Jones has performed over the years. Over time, Wall Street investors tend to build wealth because their investments appreciate. They go up in value as this chart demonstrates.

Others have chosen real estate investments through house flipping. The idea is investors buy undervalued "fixer-upper" homes that need some love. They fix them up and re-sell them at a profit.

Jeremy Biberdorf from Modest Money says that to be a successful house flipper, get as many properties as you can. Go all in or don't even start.

Jeremy's tips include:

- Resist a total remodel; instead, look for undervalued properties

- Know your budget and stick to it (it's easy to go overboard)

- Understand the neighborhood and its pros and cons

- Never say No to an inspection; it might save your butt!

In whatever way you choose to save your money in 2019, investing your cash in appreciating assets builds wealth over time.

How much should you invest? There isn't a one-size-fits-all approach.

I always encourage new investors to talk to a financial advisor to develop an investment strategy that works best for them. But if you're looking for high-level advice:

- If you don't have an emergency fund, start one now. The immediate goal is to build up at least three months of living expenses to account for an unexpected job loss or health issue.

- Take advantage of company-sponsored 401ks. Many companies match contributions made by their employees. This is free money. And, 401ks reduce your taxable income. Talk to your company about investment opportunities. They might even provide free financial advisor services.

- Streamline your expenses. Spend a weekend diving through your expenses. Take a look at your bank and credit card statements and make judgment calls about each and every expense. With every dollar that you're spending, is it actively contributing to your happiness? Be honest. And, be brutal.

Principle #2: Stop Believing That You Suck

I am thoroughly convinced that life is nothing but a mind game. The things that we believe - right or wrong, become our reality.

In 2019, believe that you can. Expect good things to happen, then get your butt off the couch and make it come true.

This reminds me of the story I published about one Ph.D.'s struggle with impostor syndrome. Fay, who is also a personal friend of my wife's, struggled with a feeling of not belonging for years.

“Impostor syndrome is based on the belief that you are good at nothing except fooling the people around you. In a sense, you believe that the people around you are idiots because they can’t see past the facade.”

How depressing, but it's a very real battle. It happens to a lot of us.

And, these feelings systematically murder our chances at success - success at work as well as at home. Our ability to focus on our goals gets tougher.

And, we won't build much wealth because we are distracted by the belief that we're inferior.

It sucks, so stop it.

Principle #3: Start Asking Questions

Asking questions has made a remarkable difference in my life. Once I shed the belief that I didn't need the help, things suddenly started falling into place.

The fact is building wealth and being "successful" often comes to those who ask for it.

It’s remarkable. In fact, about half of my promotions and raises throughout my working career in corporate America have come as a result of my asking. Asking means you’re serious and confident. It shows your organization that you are a productive team player who wants to contribute more (or feels undervalued). Either way, it can be incredibly persuasive.

What do I mean by asking?

- At work, ask for opportunities for advancement

- At home, ask for ways to improve your quality of life

- Anywhere, ask for how you can help

However! Before you ask, be sure to understand the following tips.

Know what you want

Before asking for success, know what success means to you. For example, do you really want a management position? If so, know what you’re getting yourself into – at least to the best of your ability. Picture yourself doing the job, not just enjoying the title. I fell into this trap, and trust me, it was a painful lesson! More on this tip below.

Be confident

Believe you’re the baddest motherf-er in the room. Seriously, believe it. Those who exude confidence are natural leaders. It shows. Even if you’re wrong, the confidence to make a decision and pursue it full force is what separates followers from leaders.

Act like the person you want to be

If you want to be the leader, act like the leader. Don’t ask for a promotion into management and then continue doing what you’ve always done.

Take the initiative.

Volunteer to help your coworkers. Brainstorm ideas. Offer your suggestions. Be upfront about your willingness and ability to lead. Help your manager in any way that you can. Most people are all talk and very little action. Make it obvious you’re about action by separating yourself from the pack.

One of the best pieces of advice I’ve ever received came from one of my former jobs. I asked for a promotion to a position that sat vacant, but the organization was not ready to make a change – yet. I asked what I can do NOW to better equip me for the promotion later. The answer I got was simple and direct: “Pretend you have the job“. I stepped up and accepted the responsibility of that position before I even had it. Within a couple of months, the position was mine. True story.

Do not fear failure

Those who are afraid of failing rarely get to where they want to be. The reason is simple: When people fear failure, they resist taking risks. They refuse to put themselves out there. They remain huddled in their comfort zone waiting for something to happen to them.

This natural but devastating habit keeps us from taking risks and going after what we want out of fear that things might not work out perfectly. I have a secret to tell you: Perfection is unattainable, so stop trying to get there. You WILL fail. It is a natural part of life. I’ve failed. My neighbor has failed. We ALL have failed. It happens. Get over that fear – fast.

If you want something bad enough, go-the-fuck-after-it. Make it happen. If you fail, you fail. Big deal. Try again next time.

Be prepared to back it up!

If you stroll into your manager’s office to ask for a raise, be ready to back up your argument with facts. Pick out the times where you went the extra mile to help on a project. Those 60-hour weeks should count for something. That uncompromising deadline that you met? The report you pulled out of your ass but knocked the socks off of that client? The new business you brought in? Yeah, this stuff.

Bonus Principle #4: Increase Your Income

Though high incomes alone won't necessarily get you rich, increasing your salary can. But, a bigger salary only helps if you save and invest it.

Don't fall into the trap of lifestyle inflation. Otherwise, you'll wind up like so many high-income earners who live paycheck-to-paycheck.

How can you increase your income in 2019?

- Ask for a promotion or salary increase at work. However, understand that we aren't all cut out for management positions! :)

- Change jobs. Throughout my career, a job change has always netted a 10% to 20% increase in salary.

- Go back to school or take weekend classes to develop a new skill. Use that new skill to boost your salary.

- Start a side hustle (outside of work). Side hustles help improve cash flow and could even turn into your full-time gig.

What say you? What are you going to do in 2019 to build serious wealth?