How to game the system to your advantage

The most successful among us game the system. They take advantage of opportunities and focus on using the system, not fighting it. Here's how.

Gaming the system to achieve financial freedom is simple to understand but definitely not easy. Save a significant portion of your income, invest it diligently and after some time you will no longer need to work for money. Boom! Simple, huh?

The very first step is to start saving a lot of money. You have two options -

- earn more and/or

- spend less

Earning more is possible through increasing your salary, taking on a second job or a side hustle.

But when you first get on the FI/RE path, you may be more attracted to the other half of the equation - reducing expenses. After all, it seems a bit more under your control than increasing income.

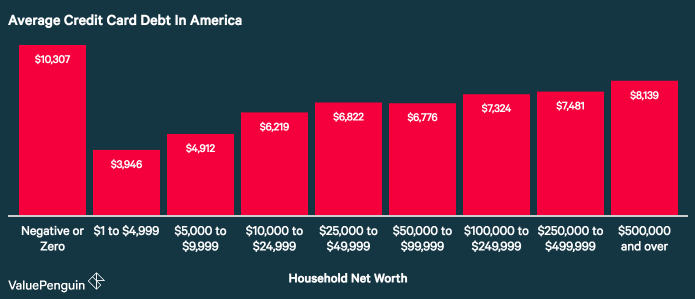

The numbers also suggest that it’s needed, even for those who are not seeking FIRE. 80% of Americans are in debt and 41% carry high-interest credit card debt. That’s indicative of a spending problem, and it exists across the wealth spectrum.

Now don’t get me wrong, a lot of people manage to spend less by cutting consumption. But is it sustainable over the long investment horizons that FIRE requires?

To make your spending strategy sustainable until you FIRE, you got to hit the right balance between frugality and living large. If you feel that your reduced spending is impacting your quality of life, you are going to have a very miserable and ‘boring middle’ of your FIRE journey.

Make your money life more sustainable

I propose a more sustainable way of attacking spending. Decide what is important to you and what’s not. Focus on getting great deals on the things you cannot compromise on, and be ruthlessly flexible on those you don’t care about.

Our financial system and capitalist markets give us consumers a lot of choices. While this is great for the smart ones who’ll shop around, most consumers sadly don’t benefit.

It’s not just laziness, it's human nature.

Marketers call it customer inertia. Most of us just put up with poor or expensive service and don’t think twice about whether we are getting value for money. Switching to a competing service may be time-consuming or a major hassle.

But what sets apart those pursuing FI/RE is that powerful drive to do things differently.

"Live like no one else, so later you can live like no one else." – Dave Ramsey

Don’t accept the status quo. We achieve amazing goals not by bending the rules but by playing the game and gaming the system (legally).

Here are some of our favorite ways of working the system to our advantage:

- Credit card churning & travel hacking

- Manufactured Spending

- Checking account opening bonuses

- Negotiating with service providers

- Lower your car insurance by driving ‘boring’ cars

- Rent not buy one-off expenses

- Side hustles

Let's look at each one of these below. I'll show you exactly what we do to take complete advantage of the opportunities afforded to us.

How to game the system to your advantage

Credit Card Churning & Travel Hacking

Banks and credit card companies are in a race to the bottom to increase their customer base. As always, the discerning consumer wins.

Credit card churning means opening and closing credit cards purely to earn signup bonuses. It is 100% legal and as long as you follow the fine print, you will come up tops.

Credit cards are not evil, as long as you pay off the balance in full every month and don’t go crazy with opening dozens of them simultaneously! They are also perfect for travel hacking. Plan your travel in advance so that you can look for credit cards that give spend bonuses or miles on airlines you want to travel on.

Having a well-planned approach to picking airlines, routes and fare classes also helps us earn the most air miles. This also comes into play when we redeem our miles. For example, certain routes or those with a stopover may have a lower $/mile rate, and business class upgrades are better value than bagging free economy flights.

A word of caution on credit card churning – do keep an eye on your credit score. Churning can affect it negatively if you are not careful and slip up.

Manufactured spending

There are 3 ways we manufacture spending to maximize returns:

- Time large purchases such as cars or holidays to get a sign-up bonus on credit cards

- Use cashback sites such as TopCashBack.com for everyday purchases. If you are churning credit cards, use those. But even if you are not into churning, use cashback credit cards to double-stack that cashback!

- We also time non-urgent purchases with offers that pop up regularly on the cashback sites. Delaying gratification is a required quality here, but it can be learned.

- We are also not tied to a particular company for a service (Uber vs. Grab etc.), and are not brand-loyal as long as the product is of decent quality (laundry detergent comes to mind).

Checking account opening bonuses

Just like credit cards, banks want you to open accounts with them and will pay you to do so. This works for them because the average lifetime value of a customer is greater than the average cost of acquisition of a customer. Why? Because lots of people go into overdraft and then pay interest fees to the bank!

Since you are a smart customer, you take the signup bonus but never go into overdraft. So the bank loses money on you. Who’s winning? You! This sounds mean but is just another way that the financial system rewards those who care enough about their money.

Some checking accounts also pay bonuses for depositing your salary in it, hitting a monthly spend level, etc. Do your research and snap up the best deals when you see them.

Negotiating with service providers

Loyalty doesn't always pay! I used to think everybody haggles and negotiate their car insurance, broadband, cable, and phone bills because that’s what I have always done. But then I found out that most of my co-workers simply pay the sticker price!

What they may not know is that the sticker price invariably includes a buffer that is given back to the customer as cash back, or a discount because the customer haggled.

Most service providers will want to retain you as a customer. They usually will go out of their way to keep your business if you hint that you are ready to leave if the price is not right.

A great example is when I helped a colleague reduce his 4-digit annual house cable bill a whopping 50% and got a free Wi-Fi modem/router thrown in. Just imagine - he had been paying the full price for over 6 years before this and thought he was just being a loyal customer!

Another example where negotiating pays off is when I consolidated our separate car insurance policies at different insurers into a single multi-car insurance policy to get a 40% discount overall. Some insurers even offer this as a standard service so that you don’t have to negotiate!

Lower your car insurance by driving ‘boring’ cars and other hacks

Typically a used car that is less valuable will cost you less to insure. But your car insurance premium is not dependent just on the replacement value of the car. Insurers also use car specifications and accident statistics to price premiums.

Certain makes and models of cars may be much cheaper to insure than others. This typically depends on engine performance and the claim rate for a specific car model.

Do your research and identify boring cars that are usually driven by cautious drivers. These tend to have relatively the lowest premiums. We don’t get hung up on the brand; we go in the car that gives us the best bang for our buck. And, we do have a slight preference for Japanese brands due to higher reliability and lower repair costs.

There are other ways of reducing your car insurance:

- Put your partner, a family member or even a friend on your insurance policy. This reduces the insurance, especially if you are a young driver and add an older person to your policy

- If your job can be genuinely described in different ways, experiment with that and see what happened to the premium.

Rent - not buy - for one-off expenses

For instance, do you really need a 7-seater SUV for that one time your family visits? Or, how about that second vacation home that stands empty for most of the year?

Do you really need to buy that wedding dress?

I have a tendency to prepare for the worst-case outcome in my planning. To avoid surprises, perceived inconvenience or even potential embarrassment, I spend more to lock safety and security. This is often an emotional decision, but it has a real cost and is one that compounds over time.

Instead of higher car payments and higher property taxes, we are flexible and will rent if what we already have doesn’t fit the bill.

Side Hustles

So far we have been looking at paying less for stuff. But don’t forget about increasing your income.

The one life hack that has contributed the most to our journey to financial independence is online side hustles. That they are location-independent is the icing on the cake!

Most of my colleagues and friends work their 9-5 jobs and then spend the rest of the evening in front of the TV. The average American spends 238 minutes (3h 58min) daily watching TV. That’s 36 days of watching TV a year. 36 days a year of being a slave to the system.

We decided to fight conventional wisdom. We ditched cable, cut the cord and our TV watching reduced drastically. At the same time, our online side-hustles blossomed. They now cover all our expenses every month! A happy coincidence? Nope.

Using our free time to build up semi-passive online side hustles instead of wasting it watching TV has meant that I have saved an additional $100,000 in the last 4 years. Not to mention the thousands saved in cable subscription.

Also, my online business itself is an asset that has a resale value.

Conclusion

A basic understanding of how money works may be adequate for those who desire an ordinary life.

But if you aspire to an extraordinary life, the system can be your friend - use it to your advantage.

How have you been hacking the system? What’s worked best for you?