I live my life at the intersection of humble and confident

My wife and I retired from full-time work in our 30s because we are both humble and confident. We acknowledge the help we were given along the way and took full advantage to make those advantages work.

Even after reading just a couple of my posts, you probably get the impression that I am, well, confident. Extremely confident. I understand my strengths and weaknesses and focus as much energy as I can to maximize those strengths.

But, I'm also an incredibly humble person - though, that might not come across quite as clearly through my writing. And, that's okay. My strength is confidence, so I play to it.

Being humble means that we understand the world that surrounds us. I acknowledge that there's a lot in my life that's simply gone right - and, I had very little control over that. Then again, there's also a lot that's gone right...that I DID (and DO) have control over.

Want specifics? Check out my frequently asked questions for some juicy details.

I am both humble and confident

The biggest example is my upbringing. I was born into a loving family. We lived in the suburbs, not the inner city. All of my needs were provided, plus some. Though my dad worked his ass off to build himself up into a successful businessman, I didn't struggle nearly as hard as he did. He came from a very modest family and certainly wasn't instilled as a child with good spending habits.

I believe in the value of hard work primarily because of my dad. He showed me the incredible power of showing up every day and doing the best you can - consistently, dependably. I've seen it work, time and time again.

I'm also a white dude. Statistically, white dudes are more successful in the United States due to a variety of factors that, frankly, are well beyond what I prefer to talk about on a personal finance blog. :)

My parents completely funded my college education. That's right, I started out my life post-college with absolutely zero debt (though, I immediately went into debt buying my first real car - a 1999 Corvette Convertible). My dad also helped me get my first job through one of his ex-coworkers. In addition, my folks assisted me with getting out from underneath a high-interest home mortgage.

In other words, I've had a lot of help. I freely admit that I didn't work nearly as hard as many of my peers. I didn't need to struggle. Frankly, I also didn't push myself either. I never strived for advanced placement classes in school (I'd rather play sports or earn money working). I chose the easier degree in information technology rather than computer science - the latter being a much more rigorous and math-focused program.

I knew that math wasn't my strength, so I avoided it. Information technology stood as that perfect middle-ground, representing a degree that's close enough for the work that I wanted to do (software development) while avoiding diving too far down into the weeds with theory, formulas, and science.

That's my economist showing again. Though I freely admit to enjoying a lot of help over the years, that's also not the whole story.

I'm proud of the choices that I made. I wouldn't be in the position that I am today without giving a shit about my future and actively striving to succeed in my goals.

You are, too. Don't let anybody tell you different.

I'm confident (to a fault?)

Confidence doesn't mean you're full of yourself or believe that you're always right. See, that right there is arrogance. Take confidence too far and you begin flirting with the a-word. Frankly, I make mistakes all the time.

I'm proud of the decisions that my wife and I made to get to this point. We both took full advantage of the life we were dealt and made for ourselves. We both enjoyed a ton of help along the way, but we also made decisions that were in our best interest to achieve our goals.

For example, our salaries.

Both my wife and I worked in engineering fields and earned good money. If you just read about our story for the first time, you may focus solely on those high salaries as the primary (or ONLY) explainable reason why we were able to retire early.

But, that's also not the whole truth. If we decided to live like the majority of Americans, we would probably have a big house and nice cars right now. We'd eat at nice restaurants, take expensive vacations, buy all the things we believe make us happy - or at the very least, everything that we want!

But, we'd also be working too.

Instead, we saved 70% of our combined income and lived as if we only earned a fraction of the money we actually brought in. It's easy to dismiss early retirement among those who earn high salaries because, well, it's easier to retire early if you earn a ton of money. That part IS true.

However, pushing through society's vision of "success" that we plaster in every magazine, newspaper, radio and television commercial is not easy. When people have the means to buy almost anything they see, discipline is the only thing standing between them and a lifetime of high earnings and gigantic debt.

Nobody just hands you discipline. That's a choice.

Or, remember the job I talked about that my dad helped me get?

You might solely focus on the help I got. And yes, that's part of it. But the other part is I graduated college Summa Cum Laude with a 3.9 GPA. My dad didn't pull that one out of his ass. I did. I worked hard throughout college to do the very best I possibly could to prepare myself for my working life ahead. The assistance helped, but with a 3.9 GPA out of college, you're setting yourself up for a HUGE advantage as you look for your first job.

And only YOU earn high GPAs in school.

What about the fact that we retired from full-time work at 35 and 32?

Did we have help along the way? You betcha! But, we also sold about 90% of our belongings. Both of our homes. Our cars. We downsized from a 1600 square foot home into a 200 square foot travel trailer and now travel the country for a living.

From the outside, folks may look at our situation thusly: "So they pull down a quarter million a year and retire early? If I made a quarter mil a year, I could retire early too."

Actually, you probably couldn't.

Okay okay - yes, you could. With those resources, early retirement is possible at such a young age. But, we don't fully grasp and appreciate the whole story when we only look at those things that we believe make it easier for people to accomplish their goals, as if to make ourselves feel better that we aren't accomplishing ours.

Yep - we quit work in our mid-30s due in part to high salaries, starting off life without student loans and knowing that we both have loving families. There's no doubt about it, that makes a difference.

But, it's not the only difference. We also maintained discipline and saved 70% of what we earned. Sold everything. We live in 200 square feet, a mere pittance compared to the average new single-family home - which stands at a whopping 2,600 square feet. I don't know what we'd do with all that square footage.

And, here's the truth: We wouldn't be retired right now if we lived in a traditional single-family home of 2,600 square feet, even with the money we made and all the help we've enjoyed throughout our lives.

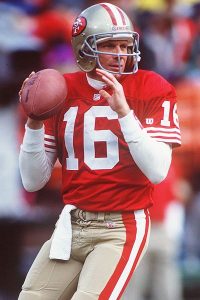

What about Joe Montana?

When people think about Hall of Fame Quarterback Joe Montana, they usually remember his sheer skill. He was one of the best quarterbacks to ever play the game of football. He was smart, athletic and routinely shredded defenses with pinpoint accuracy to his throws. In other words, the guy was good. Real good.

Did Joe Montana have help along the way? Of course he did (the biggest help may have been Jerry Rice)! Montana had help along the way that many other quarterbacks didn't. But, most of us don't focus on Montana's personal trainers, or coaches, or advisors, do we? No, we focus on Joe's accomplishments. His skill. His decision-making on (and off) the field.

I do believe wholeheartedly that hard (and SMART) work is critical to achieving your goals. Help helps (<-- see what I did there?), but nobody handed Joe Montana his Hall of Fame induction in 2000 for nothing. And likewise, nobody handed me early retirement on a silver platter either.

Let's return to personal finance. Consider this quote from The Millionaire Next Door:

"America’s wealthy seldom get that way through an inheritance or an advanced degree. They bargain-shop for used cars, raise children who don’t realize how rich their families are, and reject a lifestyle of flashy exhibitionism and competitive spending."

At first blush, you might ask: What does that say about those who aren't wealthy? Does this quote imply that poor people make stupid decisions, don't work hard and, more or less, are idiots?

In a phrase: Of course not.

When I say that hard work breeds success, that also doesn't mean those who aren't "successful" don't work hard. Just like we don't chalk up Joe Montana's success to all the fitness trainers and coaches he had along the way (even though we KNOW that played a part), we need not think of anyone's success (or quotes like these) in personal finance or early retirement as any different.

Those of us who consistently achieve our goals are those who took full advantage of the help they've received throughout their lives by combining that help with hard (and smart) work.

I brim with confidence not because I think that I'm always right or because I didn't have any help along the way (both are categorically false!). My confidence stems from being proud of what we've accomplished and the new life that we've built for ourselves. We wanted this life, and through a reprioritization of what's actually important to us, my wife and I made it happen.

And, we couldn't be happier.