How to retire with a high income: A definitive guide

If you're wondering how to retire with a high income, you won't want to miss this definitive guide from early retirement expert Steve Adcock.

I'm about as transparent as they come - in the last year both my wife and I worked full-time jobs, we earned a combined $250k. The year before that, it was about the same, give or take.

My first job out of college in 2005 was worth $55,000 a year to me. Each year, I'd get cost-of-living raises and every time I switched jobs (a tactic I highly recommend to maximize the growth of your earnings), I enjoyed a nice bump.

About 14 years after I started my career, I increased my salary by a factor of three.

In other words, I know what it's like to earn a bunch of money and then retire early ... way more money than what I needed to provide for the basic needs of life. Way more than I truly ever thought that I would earn.

And if you're sitting in your career earning big bucks, I'm going to drop some wisdom into your lap that might just transform the way that you think about your salary and your lifestyle.

5 things to know about high incomes

A high income is different from big wealth

If you are not familiar with the term "pseudo-affluence", here's what you need to know. Earning a high salary doesn't necessarily mean you're financially stable. The pseudo-affluent are people who typically earn high incomes and do certain things to make themselves look rich.

But, looking rich doesn't mean that you are rich.

The pseudo-affluent generally:

- Earn a high-income, but spend the majority of what they make

- Wear expensive suits or carry Louis Vuitton purses

- Drive high-end luxury or sportscars like BMWs, Porsches, and Mercedes

- Genuinely believe that rich people act rich

Naturally, this does not mean that everybody who drives a BMW is pseudo-affluent. The world isn’t black and white enough to make such a concrete statement. However, those who do spend the vast majority of high incomes DO tend to drive these cars and live in wealthy neighborhoods to display their wealth.

“Many are good people, well-educated and perhaps earning a six-figure income,” writes Alexander Green, author of the book Beyond Wealth: The Road Map to a Rich Life. “But they aren’t balance-sheet rich because it’s almost impossible for most workers – even those who are well paid – to hyper-spend on consumer goods and save a lot of money.”

Moral of this story: Your high income is worthless if you're spending the majority of it.

High-income families still battle with debt

You might be surprised at how many high-income folks still live paycheck-to-paycheck. And, high-income debt is a thing that a lot of people struggle with.

Nearly eight in 10 workers in the United States live paycheck-to-paycheck, and it's not just low-income earners that account for those numbers.

"More than half of minimum wage workers said they needed to hold down two jobs to make ends meet, while one in 10 workers earning $100,000 or more yearly say they live paycheck to paycheck," wrote U.S. News.

And, that's only those who actually admit it.

Here's the thing: High-income jobs also come with an unwritten expectation to "look the part". When we're in high-level roles, we aren't expected to drive to client meetings in a 2001 Toyota Corolla. Why? Because we look more successful when we're rockin' the brand new 7-series Bimmer.

But, lifestyle inflation has a way of eating through the hard work that we put into our careers.

A couple of the best graphics I’ve seen about this “fake wealth” come from Zack Van Zant who mapped the average Joe’s savings level relative to income and perceived “needs”.

There are Average Joes and Extraordinary Joes.

To the average Joe, savings rates increase marginally as our lifestyle – along with our income, increases substantially.

The average Joe is in contrast to the “Extraordinary Joe’s” savings level, who resists the temptation to increase perceived needs along with income:

Moral of this story: Your lifestyle paints a better picture of your financial freedom than your income. Earning a high salary is a wonderful thing, but if we spend the majority of our earnings, it's tough to truly get ahead.

Your income is your most important tool

Think of your income as a tool in your workshop. Each tool has a purpose. But, the implied purpose of every tool is to build something. Tools build things that can be used to add value to your life or somebody else's. Tools build tangible things. They are purpose-driven and useful.

Your money, though shaped differently than a tangible tool, is essentially the same thing. Treating your money as a tool and giving it the purpose that it deserves means your wealth is adding value to your life.

Your money's purpose might look something like:

- supporting your favorite charity

- funding your child's education

- providing life-changing healthcare

- enabling the freedom to retire early

Naturally, this will look very different for each and every one of us. Whatever your situation is, treating your money as a tool provides the focus and clarity that you need, as a high-income person, to ensure your money isn't carving out a hole in your life.

Moral of this story: Treat your money as a tool by giving it purpose puts you in a much better position to provide for your family and fund the things that are most important to you.

High incomes don't remove the need for a budget

Though your budget doesn't need to look exactly as mine did, tracking your spending and controlling where your money is going is equally important in a high salary as it is a lower one.

In fact, there's a good argument to be made that it's more important with a high income because high incomes enable more spending. Your means are greater, and as a result, more money can be spent on more expensive things that, if not controlled, can systematically squeeze the freedom out of your financial situation.

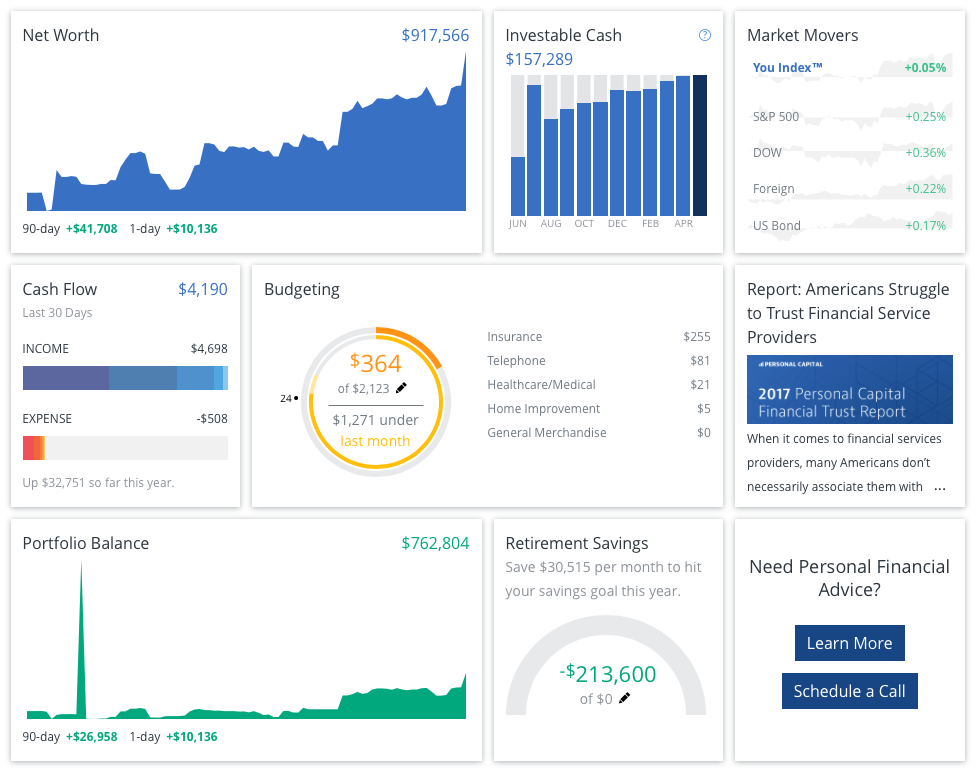

High-income earners need:

- financial visibility

- cashflow tracking (money in vs. money out)

- a financial roadmap to help focus spending and investments

We use Personal Capital to provide the financial visibility that we need. We also track, through the use of spreadsheets, our cash flow and general trajectory toward our money goals even though we're no longer earning a consistent income.

Personal Capital is one of the easiest financial applications I've used. Works well. Colorful. Gets the job done.

If you are a high-income earner, what are some of the things you're doing to keep yourself honest? High incomes are great, but only when we design a system where we keep the majority of the money that we earn. They can lull us into a false sense of security.

How are you using your high income to secure your financial freedom?