Why working until 65 is a risky decision: The case for early retirement

There is no question about it - early retirement is a risk.

There's no doubt that quitting your full-time source of income in your 30s or 40s and expecting to live not 20, 30, or even 40 more years...try, 60 or more, without a dedicated income for more than half of your life, is a risk.

But for most of us, it's a calculated risk.

Calculated risks are referred to as "calculated" for a reason. And no, I'm not talking about math or something you do with a calculator (okay, maybe a spreadsheet). I'm talking about you. You're the only equation that matters.

But, it's all in his or her head. It's a mind game.

All that organic chemistry that collectively makes up every tiny bit of YOU is the primary driving force behind early retirement, and the risks of quitting the rat race early aren't deep-seated in math. Not in the stock market. Not real estate.

They are seated within you.

The risks of early retirement go both ways, you know

I don't know about you, but I've heard too many stories that go something like this:

"My dad retired at 65. Three weeks after retirement, he went in for a routine checkup and the doctors found a baseball-sized growth on his kidneys. He was dead in three months."

Frankly, I'm sick of those stories. I hate them. Every one.

People ignore the proven and statistical risks that come from jobs - especially stressful ones. As ABC reports: "A growing body of research stands testament to this fact: lack of sleep has been shown to tax the hearts of the stressed executive and the stressed day worker alike.

"Layoffs," the report continues, "can take their psychic and physiologic toll in the executive suite and on the production line; the burden on those left behind, who work more overtime to shoulder a heavier workload, can be life-shortening; and living in fear of losing a job, or staying put in a hostile workplace, also boosts the risk of an earlier cardiac death."

I hate the risk of not retiring early more than the opposite. To work the vast majority of our life and then retire during the portion of our life where we're more likely to get sick is a dreadful thought. To develop cancer. Suffer from mobility-inhibiting aches and pains. It's painful to even think about.

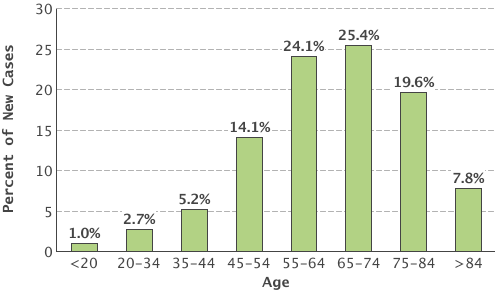

Consider this graph from Cancer.gov. The wide majority who develop cancer are above the age of 50.

The highest incidents of cancer occur between 65 and 74 which, coincidently, happens to coincide closely with the age that we can draw social security without penalty: 62. Does anyone else see a problem with this?

This flat freaks me the hell out.

To me, it's way more risky to retire during the period when we're most likely to develop a health problem than it is much earlier in life.

At what point do we begin to consider the risks of NOT retiring early and weigh those against the risks of quitting the rat race early?

Risk is a two-way street, my friends.

I've been asked before: "What if you develop a debilitating disease and need expensive healthcare? You'll never be able to afford it."

My response is simple: "Okay, but what if I don't?"

The risks of early retirement

This post isn't meant to diminish the risks of early retirement. Risks of early retirement exist. Popular arguments for risks include:

- Heavy index-fund investors are setting themselves up for failure upon the next market crash

- The Trinity 4% "Rule" is based on old and antiquated data

- Early retirees don't have a diversified asset class, which makes single points of failure likely

- Retiring during a bull market is easy, but it's not quite as easy once the bull is replaced with a fury little bear

Frankly, none of these arguments are necessarily "wrong". Yes, heavy-index fund investors do stand to lose money when the market tanks. And yes, the next bear market will test many of us who retired in the last couple years.

But, let me be clear about the Trinity 4% rule: I hate the term "rule".

Contrary to popular critique, the 4% safe withdrawal rate is not some one-size-fits-all approach that people – come hell or high water – must blindly and stubbornly adhere to for the duration of their retirements.

Doing so would mean that we humans are purely robots, programmed to aimlessly march forward using the same infantile cognitive powers that we have always had, unable to think for ourselves, make our own choices and adjust to the times.

Instead, a large majority of us are using the 4% rule as a guideline.

Meaning, we choose a number that we believe to be a reasonably safe withdrawal rate and start into our retirements by withdrawing from our investments that amount of money.

But, as well-known personal finance and early retiree blogger Mr. Money Mustache writes (and one who happens to believe in the 4% principle), there are no guarantees in life and we should always adjust our expenditures based on economic conditions.

In other words, critics of the 4% rule are missing the point that many early retirees grasp: We aren't blindly following any "rule", here. Early retirement isn't about rules.

In fact, it's precisely the damn opposite. We don't follow the rules.

We march to the beat of our own drums and do so on our own free will. The risks inherent in the 4% foundation, along with those of heavy index-fund investing or asset classes are only as serious as the innate willingness of the early retiree to morph and adjust to the changing times.

The fact is we humans can endure a LOT...when we need to.

Early retirees aren't robots; we adjust to risk and meet them head on

On paper, it might seem that early retirees are accepting too much risk. But what the paper misses is the motivation and determination of those people and families to do whatever it takes to make it work.

What we're missing here is the very nature of most early retirees.

We aren't your average Joe or Jane. We are typically creative and determined. Most of us retired early because we possess a vision for our future that's light years better than the default behavior of working into our 60s and hoping we have some productive years left.

Most retirees are Gumby-like humans, capable of moving, twisting and contorting to position themselves to accurately confront economic conditions.

If a retiree’s portfolio losses 30% of its value – as many did during the housing market crash of 2008, most adjust their spending habits and lifestyle – like good little human beings capable of making sound adjustments.

Picture this: you’re standing in the middle of the road and there’s a fully-loaded semi-tractor trailer barreling in your direction. The tractor-trailer, in this case, is analogous to a looming recession. Or some kind of catastrophy that we can see coming.

At first, you’re enjoying your position in the middle of the road and stay put. After all, it’s entirely possible that the trailer will turn and instead head down a side street before it hits you.

It is also possible that the trailer will simply stop, stare you dead in the face but not actually approach your position. Maybe it’ll suffer a flat tire and be forced to the side of the road. Who knows – the trailer may not hit you.

But eventually, that trailer gets closer to you. 250 yards. 150 yards. 50 yards.

Okay, this thing isn’t stopping.

What happens at this point? Naturally, we move our asses off the road and let the trailer pass us by, suffering dust inhalation as it passes and maybe a thrown pebble or two.

We don’t, on the other hand, stand there like idiots and let this thing plow into us.

We adjust like brain-powered human beings, and our financial situation is no different, especially after retirement when the paychecks stop floating in.

We take our initial position and enjoy it. We notice an oncoming threat and we move if it gets close. If we haven’t seen a threat in 6 months, we might lay down and spread out a bit.

Being flexible is our calculated hedge against risk.

The risks that can bite us in the ass

At the beginning of this post, I said that early retirement is a risk. I still believe it is. But, I believe it's a calculated risk. For many of us, it's a risk worth taking because, though one of the endless "what ifs" of life could happen, there's also a sure thing:

If we don't retire early, we WILL be stuck in an office during the most productive years of our life, retiring only when we're most likely to develop health problems that can significantly affect our quality of life.

Sorry, but it's not worth it to me. That risk is too great, and based on the numbers, it's darn near impossible to avoid.

There are risks that we cannot possibly avoid, such as:

- Developing a rapid health problem that requires expensive hospitalization

- A week-long 50% drop in the stock market

- A lawsuit that wipes you out of your savings

- A car accident that leaves you saddled with medical bills forever

Frankly, the risks are endless.

But, here's what I believe: Those risks are inherent with every one of us regardless of whether we hold full-time jobs or not.

I won't live my life based on the what ifs. I refuse.

If something happens, I deal with it when it happens. But, I'll always have the years of freedom to look back on. All those mornings that I got up without a care in the world and the whole day in front of me to do with as I please.

Those memories can't be taken from me (okay, except for alzheimers).

I'm risking the what ifs in retirement because I can't stomach the risks of spending the rest of my life doing a job that I don't enjoy. That's not what life is about.

You only live once. I don't want to work it. I want to live it.

Related articles about early retirement:

What do we do about health care? We use Liberty HealthShare

How to retire early—the healthy way

How to address the "what if" scenarios of early retirement