Uh oh...my wife is beginning to worry a bit about our finances

As we sat enjoying a glass of wine in a local winery in Pahrump, Nevada - talk about money came up (as it often does). I mentioned to Courtney the day before that the market tanked that day. I found out on Twitter as I do with most things because I don't watch the news.

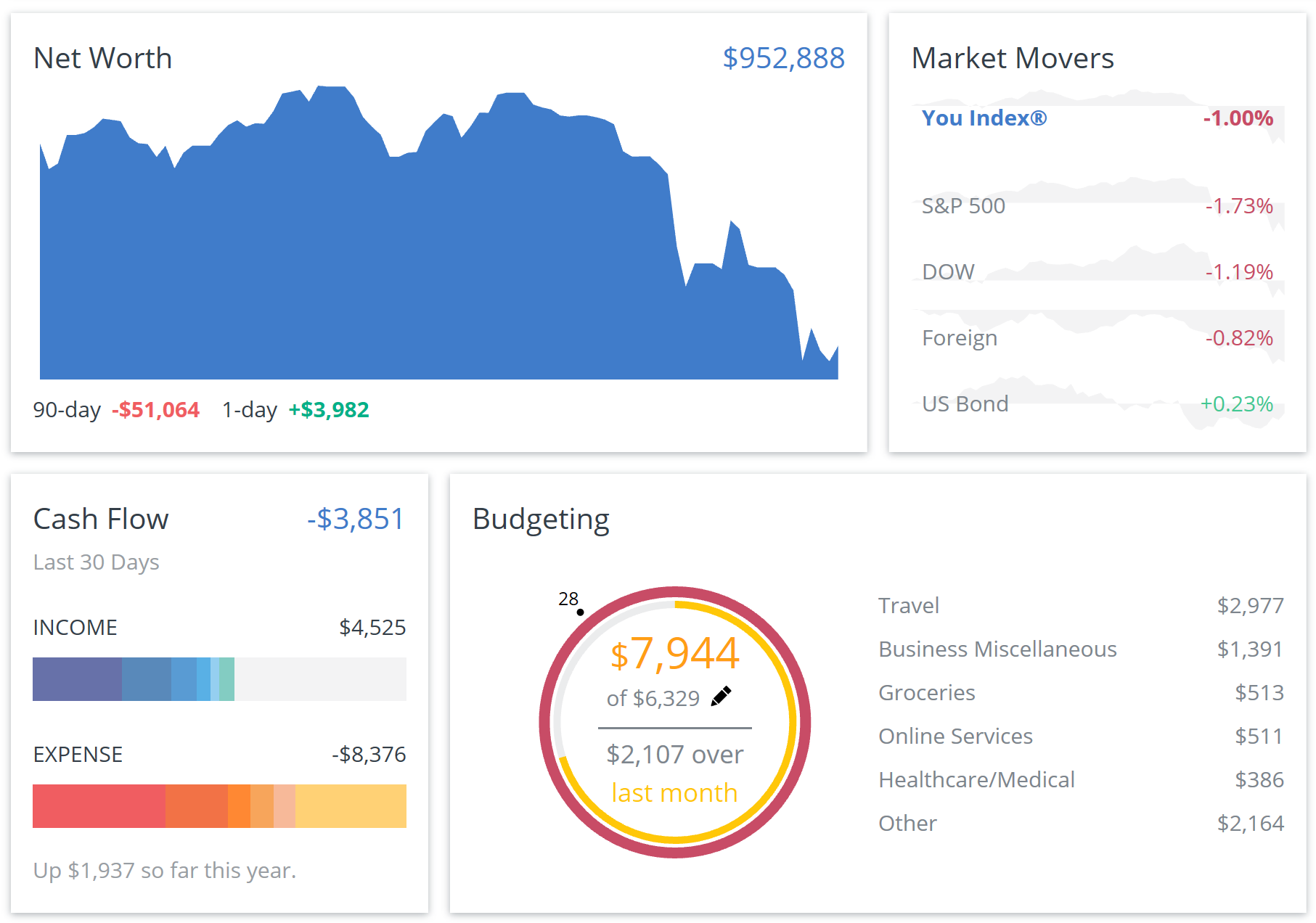

She pulled up Personal Capital on her phone and let out a "Womp" sound. It wasn't a number that she was used to seeing.

It turns out we're down about $70,000 after that week.

Phew! That's quite a bit of cash. And, we're now under a million in net worth, and we're both in our mid-30s without a job. In fact, just last week my wife officially told her company that she's not coming back from her sabbatical that she took in April.

The final lifeline has been cut, officially. And now, the market drops.

She mentioned that if we can't recover, we probably won't be sipping glasses of wine any longer (at least in wineries)...not until things recover and our finances re-join the double-comma club.

No problem - that was always the plan. Live a little "spendier" when the market is doing well and then cut back when it's not.

My wife handles the finances

This may not be typical, but my wife is the one who handles the finances in our relationship. She has a degree in Aeronautics and Astronautics and is clearly the brains in the family when it comes to money and, frankly, math.

Also, she's definitely the more risk averse one too, which makes her the best person to be in charge of the money when neither of us holds full-time jobs. Better safe than sorry. Her personality makes it natural for her to handle the money.

She practically eats spreadsheets for breakfast and is detailed-oriented, meticulous, sharp and clever. Yes, she NEEDS to be the one handling the finances, not me.

And, here's the thing:

We have the flexibility to cut back - a lot

Most of you know that we sold both of our homes and live in an Airstream RV and travel the country for a living. It's a wonderfully-freeing lifestyle. We get to change our backyard any time we want and, just the other week in Death Valley, I started thinking once again about why we're doing this.

Why we took the risk of calling it quits and retiring in our 30s.

Part of it was because of our chosen lifestyle. Living in an RV, this life can be almost as cheap as we want it to be. Seriously, our rent can be 100% free if we need it to be. BLM (Bureau of Land Management) land is common out West. It's free for overnight camping for up to 14 days.

That means we can stay two weeks rent free - then move to another BLM area and do it all over again.

And, that's a big part of why we spend so much time out west. Both of us believe this side of the country is way more scenic than the east and, in many ways, it's just cheaper too.

Our Airstream has solar power and we are completely self-sufficient for weeks at a time. Last year, we didn't hook into the electrical grid for months. That's so damn freeing.

When we owned homes, we never could have done that. We just didn't have that flexibility. After all, the mortgage is the mortgage, and that's that. We could certainly live cheaper by cutting back on things like restaurants and discretionary spending, but we can't exactly cut the mortgage temporarily.

After all, this isn't 2009! :)

Why our flexibility is keeping us grounded

The market hasn't exactly tanked, but we know it will (as we also know it'll bounce back because, well, that bad boy runs in cycles). Eventually. This too reminds us that - as heavy index-fund investors without a ton of diversification into other areas like real estate, we're at the mercy of the market. When the market is good, we're good. When it's not, we're not.

It's also important to note that we're cash-heavy, too. We have over three years of living expenses saved in an Ally savings account, which is one of the primary tenants of how we manage our money.

But, here's the remarkable thing in all this.

We live a Digital Nomad lifestyle that's perfect for this scenario. It was practically made for exactly our situation.

Why?

- We can live rent-free whenever we need to

- We can drive less and stay at each place longer, saving diesel costs

- We have ZERO utility payments other than what we use in propane

- We can increase our workload a bit to earn extra money through side hustles, freelance writing or anything else online

- We can work on more online courses (our first one is doing amazing) to bring in additional dough

We don't have children. We don't have traditional homes. We live incredibly small with our two dogs and can significantly adjust our lifestyle on a dime because discretionary spending is our biggest spending category.

By far.

This means we live a more extravagant lifestyle when the market is doing well. You know, things like going out to dinner a bit more or sampling the local wine or beer as we travel, taking more day trips with the truck that require diesel, grabbing an extra bag of chips or opting for the better cut of meat at the grocery store, etc.

We've designed our lifestyle so we can cut back. If we perpetually lived on the razor's edge of frugality, then we might not have to make adjustments quite as quickly...but then again, adjustments might not be possible, either - short of going back to work.

This is what LeanFIRE is all about

My wife and I chose LeanFIRE - or, calling it quits without several million in the bank and with the understanding that frugality and living sensibly will get us by.

Though we have three years of living expenses in the bank, we also aren't living a lifestyle where spending $80,000 a year represents a tiny fraction of our overall net worth. We chose the riskier option.

We chose that because I was genuinely unhappy working a full-time job in Corporate America. I just couldn't do it any longer.

As a result, the market will dictate a lot of our lifestyle - which, of course, is both good and bad for obvious reasons.

In the end, we are okay cutting back because our lifestyle allows us that incredible freedom.

Oh, and before you go! I'm starting a new project that I'm releasing in January 2019. If you run a blog, you're probably in tune with Digital Marketing for your blog. Email lists. Writing styles. Content management.

I'm designing the resource that you're probably looking for without all the "Hire me to improve your site!" stuff that's way too common.

I'd be honored if you'd sign up to be notified when the site officially goes live!