I need to stop fretting about the market and live for today

A few weeks ago, I got an email from someone who just read my newsletter about the passing of Jack Bogle. In the email, I reflected on some of the growth strategies that I'm employing this year.

I'm talking about things like:

- We will continue to invest our income (which turned into way more than I ever imagined possible in 2018) with index funds

- We are building RV and travel-related courses to expand our income

- We are speaking at the RV Entrepreneur Summit in March to escape our comfort zones and get more involved in the RV community

About the speaking gig, this is a main stage thing. Like, keynote style.

Check out my head shot:

Talk about intimidating! But, I talk about the wisdom of getting out of your comfort zone a lot on this blog, so it's time for me to take a little bit of my own medicine. It's time to get in front of people and talk.

Anyway, in the email I asked my subscribers how they are planning on growing in 2019. I expect things like investments or earning extra money, getting involved in side hustles or even quitting a job.

But, one person replied with something that cuts so butter-smooth through the murky dialog of FIRE that I couldn't help but write about it:

I need to stop fretting about what’s happening in the market and live for the day

The freedom of living for today...today

I love that quote, and it's so utterly important in life whether or not you're gunning for early retirement or not. Living for today means you're way more likely to be happy and content with your life.

You're not expecting more. You're not killing yourself to make more money or get that next job promotion.

Instead, you're enjoying the shit that you have, now.

And most important, stop that daily check-in with your stock portfolio or whether the S&P 500 is up or down today. Trust me, once you become addicted to those numbers, it never ends.

I know it's easier said than done, but the market's going to do what the market's going to do whether or not you're aware of the play-by-play.

But, we can rest assured that the market, historically, makes money for patient investors.

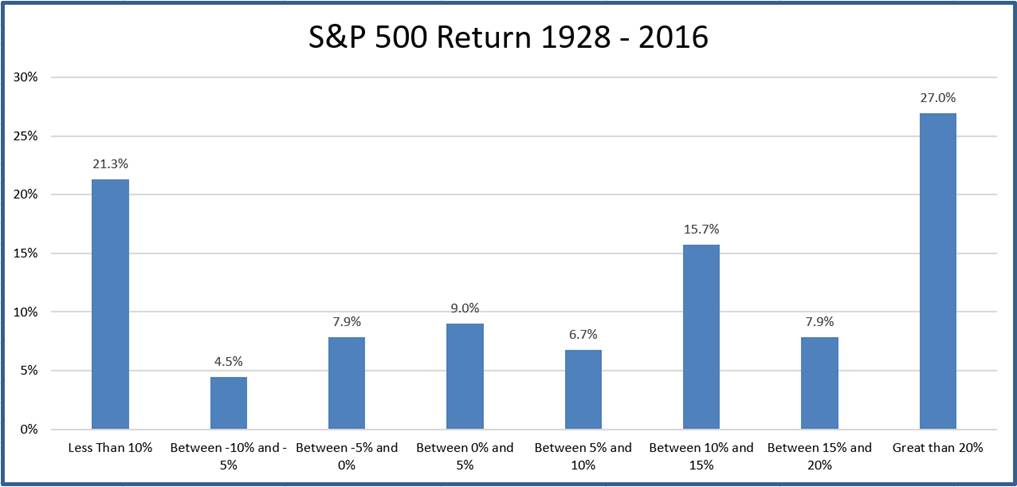

For example, since its inception in 1928, the S&P has realized an average rate of return of 10% – or 7% after adjusting for inflation (the buying power of money). If dividends were reinvested over the course of this 90-year period, gains would be quite a bit higher. Not bad.

However, this doesn’t mean investors are guaranteed a 10% return on their money virtually any time they invest. Back in 2016, for example, the S&P’s rate of return is right around 1.1%, but it bottomed out February 11th at NEGATIVE 10%.

We all lost money – temporarily.

It happens, and it’s primarily dumb luck how well you do over the short-term. But as the market has shown over the course of its history – and even over the course of the last year, clamoring over ebbs and flows is a fool’s game because the market will always ebb and flow. It’s what it does.

And now, the great majority of us are making cash again because the market now flow-eth. That is also what it does.

Enjoy the ride!