We are millionaires once again, but how long will this last?

In this market, it seems like everybody is making money hand over fist. We wake up in the morning and, look at that, the market was up once again the previous day. This "making money" stuff is pretty easy, huh?

By the way, I'm going to be speaking at the Chautauqua event in Ecuador in November - more on this at the end of the article. :)

It's kinda tough not to make money these days, and as an early retiree, watching the net worth increase, rather than decrease, is a pretty damn cool thing to see.

And according to Personal Capital, we've crested the million dollar mark once again, but as usual, it hasn't changed the way that we live.

It doesn't matter how well the market is doing, we need to keep the fundamentals of sound financial management at the forefront of everything that we do. If we screw up, we might find ourselves finding part-time work.

And, going back to work is the absolute last resort.

Making money doesn't change how we live

The million dollar mark doesn't change a damn thing for us. It can't. If it did, we'd be living off of the whims of the market, and frankly, that doesn't sound like much fun.

Instead, we are staying true to what got us in this position to begin with.

As you might recall, we retired with less than a million in the bank, and we were able to do that for three primary reasons:

1. We keep a ton of cash in short term savings

We have damn close to four years of living expenses in our Ally savings account, which is now generating more than 2% interest (not bad for a savings account!).

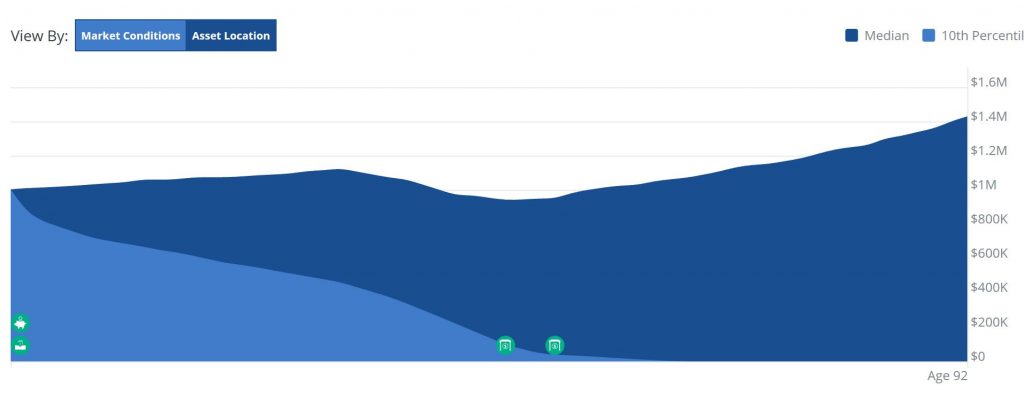

Living off of this cash has allowed our investments to grow during the onset of our post-retirement life. We won’t withdraw from our investment accounts until our savings dwindle down to the point where all that remains is emergency saving.

Thanks to the ability to earn money in early retirement – something that we didn’t count on going into this, we’re only withdrawing 1 to 2% to live on instead of our anticipated 4%. Pretty cool!

2. Our lifestyle can be uber cheap

Our lifestyle is super duper cheap. In fact, we can make our lifestyle about as cheap as we want it to be.

Like you know, we sold both of our homes and bought an Airstream RV named Charlie in cash. We live in Charlie full-time around the country, seeing everything that there is to see around the United States.

Our planned post-retirement spending budget was in the neighborhood of $25,000 to $30,000 a year, but due to the market and our ability to earn money, we’re spending closer to $50,000 now.

But, this additional spending is purely discretionary. We can cut back at a moment's notice, though we wouldn't want to. :)

3. We remain flexible and willing to change

In the corporate world, the term was "super Gumby". Meaning, the more flexible you are, the easier you'll be to work with (though management termed it "easier to get your job done").

And, I tout our flexibility a lot on this blog, but it happens to be a critical element of our post-retirement lifestyle.

If things don’t work out exactly as we planned, we change. We find a solution. It might include us working a seasonal job or two. Or, maybe we look for ways to reduce our spending.

Choosing a lower cost of living area is another idea, to include overseas travel to areas like Thailand and Costa Rica, or spend a few months visiting my BFF, Jim from Route to Retire, in Panama.

It is amazing what the impact earning $10,000 a year doing odd jobs has on our long-term probability of success. When your expenses are low, every earned dollar is that much more valuable to your lifestyle.

Earning an extra $10,000 a year for someone who spends $100,000 is nothing. But, an extra $10,000 a year for a couple who doesn’t spend a penny over $30,000 suddenly becomes meaningful earnings.

It's easy to be rich when the market is great

Over the years, I’ve heard a few lines of thought within the community that’s troubling.

Paraphrasing:

“Everybody’s an expert when things are great. Let’s see what happens when the market tanks.”

“I wonder how many of those index-fund millionaires are still millionaires after the market dipped 1,500 points today.”

“Things are always great and every money decision you’re making now is spot on – until it isn’t.”

It’s similar to another line of thought I’ve always found to be disheartening:

“I can’t wait until the market tanks! Then, stocks will be on sale.”

Pardon me for saying this, but these remarks sound condescending and entirely unhelpful in the money blogosphere and personal finance in general. This community has been so uplifting and supportive over the years. Let’s keep it that way by offering something truly constructive!

The different types of early retirees

We are all very different people, capable of very different things and comfortable with very different degrees of risk.

These include:

Risk-averse: These are retirees who have padded their wealth as much as they can, to include working longer than might be necessary to make double (and triple) sure that their savings will last through virtually any market situation, including a recession. If you live in a high cost of living area, you’re likely one of these people.

Risk-tolerant: These are retirees who are willing to accept the added risk of retiring sooner than most people might feel comfortable with, but also tend to be ready and willing to make adjustments in retirement to account for unforeseen circumstances, like market dips, health concerns or anything else.

Somewhere in the middle: These are retirees who worked a little longer than necessary to pad their savings just a bit, but pulled the plug on their working careers early with a reasonable expectation that things will be fine in retirement. These people tend to be accepting of a little risk, but not as much as those who are more risk-tolerant. My wife and I fit well in this category.

It is okay to be risk-tolerant!

My wife and I are on the more risk-tolerant side of early retirement. We quit our jobs at 33 and 35, respectively, with around a million in the bank.

But regardless of our personal situation, I believe taking risks is smart. Risks put us in a position that forces us to remain vigilant rather than complacent. Risks help us to understand the world around us and accept the fact that things might not go right.

Are you risk-tolerant, or risk-averse?

There is a lot more to many of us bloggers, or redditers, or personal finance junkies, than what meets the eye. What might sound risky to some isn’t a big deal to others. They might have a much higher cash flow than you think. Or be able to start up a dormant side hustle at a moment’s notice. Or slash their expenses by half…call in a favor to someone…you know, adjust.

In other words, that whole “don’t judge a book by its cover” sort of thing.

Where are you on the spectrum of early retirement?

I'll be at Chautauqua in November

I'll be joining Physician on FIRE and Paula Pant in Ecuador this year as speakers at one of the most rewarding and fun financial independence conferences that exist.

The benefits to joining us in Ecuador include:

- Everyone will have a one-on-one session with one speaker.

- We will have great discussion groups on all matters FI and also what to do post-FI.

- And, we are doing some really cool things........we will visit a weaving cooperative eating Indigenous foods and watching how weaving was done in the past while meeting a man who fought for Indigenous rights. We will make music with an Andean musician who makes his own instruments. We will boat ride in an active volcanic crater lake. We will tour the oldest hacienda in Ecuador and stand on the equator.

Check it out at AboveTheCloudsRetreats.com.