Our net worth revealed

It's been a long time since I published our net worth on the blog, but today - the day that we set sail, I'm spillin' the beans right here.

It's been a long time since I published our net worth on the blog, but that doesn't necessarily mean I've been keeping it private. In fact, it's been published on the Rockstar Net Worth Tracker all along. But today - the day that we set sail, I'm spillin' the beans right here.

True to form, I'm not making you read a bunch of text before I reveal the number, so here goes:

Our net worth: $890,000

Why did I wait this long before publishing? Because I can. Truthfully, no other reason. I wanted to do something special on our first day of full-time travel, and I figured that officially revealing our net worth fit the bill quite nicely.

Wait, you don't even have a million?

No sir (or ma'am). Like I wrote about previously, we don't need a million to retire in our 30s. Our lifestyle is frugal enough to support our love of travel and adventure now. Life is short, and it's just not worth the additional months of working unfulfilling jobs just to acquire double-comma status. Another year of working would easily bump us up over a million. But...

We just don't care.

Most retirement calculators have us accumulating a million years down the road anyway, even without working another hour in a full-time position. But even if we don't, no big deal. Our focus is on happiness and fulfillment, not on money.

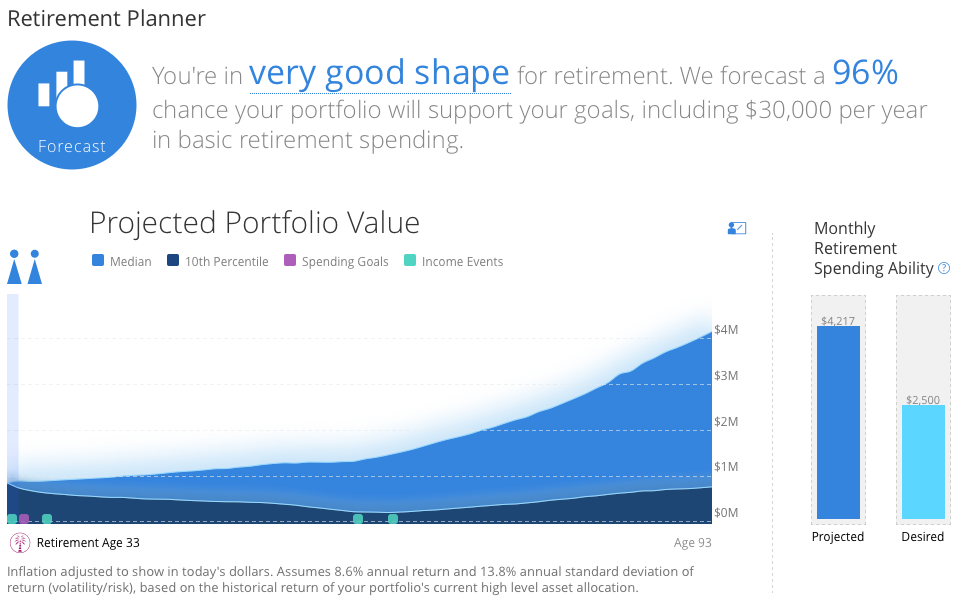

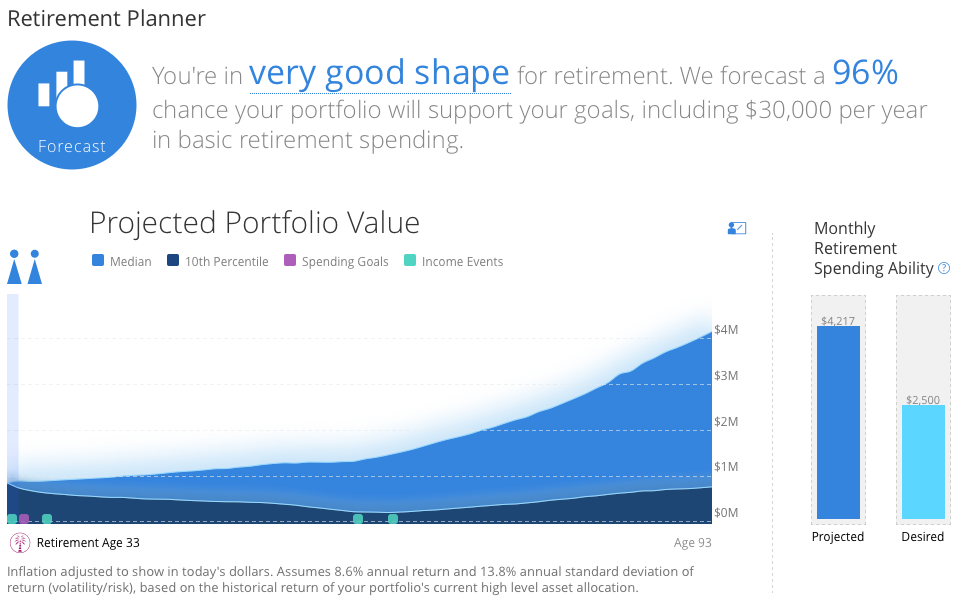

Here's a look at our Personal Capital retirement planner:

Since November, the market has been amazing. We've bumped our net worth up another $100,000 or so, making this transition into full-time retired life easier for my wife (who is the worrier in the family!). She ain't worried any more. And we're both super ready.

Speaking of which...you know what we're doing today?

We're leaving Tucson. Today, we officially begin our life of full-time travel.

More to come...so much more.

Why do I publish our net worth?

Publishing your net worth number is a bit of a contentious issue, and folks on both sides feel equally as strong about why they do, or don't, publish their number. For me, it's quite simple: I publish our net worth because I know how helpful it is to others who read my blog.

It's that simple.

When I first started to pursue early retirement, knowing this number from those whom I followed was an incredible benefit. It helped me to understand how close my situation was to theirs. It provided the context I needed to begin putting the pieces into place to make early retirement happen for me. These numbers taught me that you don't need $10 million to retire early. In fact, you don't even need a million.

Knowing my favorite blogger's net worth helped me tremendously. The least I can do is return the favor.