Guest post: 4 things (New) lifers say and how to stop grieving your career

Hey look, another guest post (the second, in fact). Today, I am publishing a response to my Seven things those who will never retire say from the perspective of a 20-something, the guy behind MyMoneyWizard.com who managed to accumulate over $100,000 by the age of 25. Nice, job well done!

Alright, Money Wizard - take it away!

Anyone who is serious enough about early retirement to share their secret intentions with friends, coworkers, or family has no doubt experienced what I like to call, “The Look.” The Look is that completely confused, eyebrow raised expression you are guaranteed to receive the moment you suggest retirement before age 60 is possible, without winning the lottery.

If you choose to really push the envelope and share your secret early retirement plans, well then you better be prepared to answer a gauntlet of questions and accusations that would make an FBI interrogator proud.

Two weeks ago, Steve published a great article on the seven most common protests he experiences when sharing his early retirement plans. If you’ve been keeping up with ThinkSaveRetire.com, and/or you haven’t been living under a rock, you know that Steve is a 35-year-old who’s done an amazing job of putting himself in the envious position of retiring in approximately 6 months. Way to go Steve!

On the other hand, even if you haven’t been living under a rock, you’re probably less familiar with my story. I started MyMoneyWizard.com this year after saving $100,000 by age 25, which for the purposes of this article and more importantly than my humble brag, means that I interact with a group of people at an entirely different point on the career scale timeline.

Put simply, Steve’s peers, which were so perfectly summed up in last week’s article, consist primarily of mid-career employees. My peers, on the other hand, are those fresh-faced college graduates excited about their entry level opportunities while asking you entry level questions.

And this difference was shockingly apparent as I read through Steve’s article. As someone more used to discussing early retirement plans with 20-something recent grads, I noticed an overall trend of underlying contentedness among the mid-careers speaking through Steve’s 7 common quotes.

The mid-career lifers immediately formulate a knee-jerk reaction for why “staying the course” for another 20 years makes the most sense. Let’s take another look at some of the comments from last week’s article:“Seven things those who will never retire say”

- "I don’t need to retire, I like my job."

- "I could never retire early, I’d be so bored."

- "You will completely lose your purpose in life."

What do all these comments have in common? They are all content. Whether that’s a bogus sense of purpose or feigning enjoyment in the job, the immediate reaction is there’s no reason to try to buck the system. Sure, early retirement might be possible, but why bother? I’ve got a pension to collect in 20 years. Or something…

Even the last comment of the article, which said, “Remember, if you earn a dime after retirement, then you aren’t truly retired,” could be roughly translated to “Why would I want to pursue financial independence and take on a dream job, when I could keep rotting in this cube on a comfy salary forever?”

4 Things Those “New” Lifers Say

What shocked me the most is that through all of my sharing and blogging about early retirement to a group of mostly 20-somethings, I’ve seen the gamut of knee jerk reactions. Yet those reactions are completely different from what Steve experienced.

My newly career’ed peers aren’t content in any way. In fact, they almost always see the benefit of being free from a job (I don’t think anyone goes into a first job expecting it to combat boredom) but they instead immediately formulate reasons for why early retirement isn’t even an option.

1. I don’t make enough money to retire early

Without even seeing your finances, odds are you probably do. The catch is that your first job out of school might not earn you enough to retire early while footing the bill for that new status symbol ride to impress all of your facebook friends.

If you earn more than $32,400 per year, you are already among the richest one percent of humans on the planet. Meanwhile, the median starting salary for new graduates in 2014 was $45,000. Prioritize what is important to you and save the rest.

2. I can’t save enough to retire early

Yes, you can. And you probably won’t even notice. I currently save 65% of my income. If I doubled, or even triple my spending and slashed my savings, would my life be any better? It might look better to strangers, but my true happiness wouldn’t change.

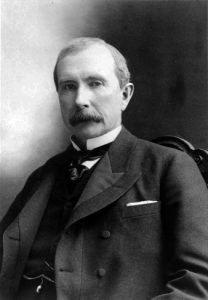

And therein lies the key. We live in a time of unprecedented decadence. The poor American today enjoys luxuries John D. Rockefeller, a man with an inflation-adjusted net worth of $340 billion, (yes… with a B) couldn’t even dream of in the late 1800s. Recognizing this fact is the first step in exposing the frivolous, keep up with the Joneses spending for the ridiculous insanity that it is.

If you want to get hardcore, Jacob from EarlyRetirementExtreme lives happily off just $7,000 per year. Kill your debt, then save $35 a day for just 10 years and you will have a portfolio fully capable of early retirement.

3. What do I look like an investing guru? And besides, the market could crash and ruin all your savings.

You’ve watched too many movies. Forget the charts, graphs, and mathematical equations drawn on glass windows. Index fund investing is as simple signing up for Twitter and avoiding your next impulse purchase.

And honestly, I welcome the next market crash. A 25-50% sale on stocks would do wonders for my cost basis. Remember Warren Buffett’s words of wisdom:

“You want to be greedy when others are fearful. You want to be fearful when others are greedy.” –Warren Buffett

Let’s assume the stars really align to derail my plans, and the market crashes the day before my early retirement. Worst case scenario, I’ll wait out the recovery for a few years and still retire decades before the average person. If you’re worried about a complete world economy collapse, well then I’ve heard of a show called “Doomsday Preppers” that you should audition for.

4. I want to have kids one day

So do I. And I can only imagine that not having to miss baseball games and dance recitals because of conference calls and client meetings will make me a better parent.

Yes, kids are expensive. But the notion that having a child somehow automatically binds you to spending hundreds of thousands of dollars is pretty darn similar to the widespread wives’ tale that you can’t retire on less than a million dollars.

Your spending is within your control, and just like every other expense, your kid related spending is a function of your willingness to conform to the norm.

A Shifting Attitude

What are we seeing here? Take a look back at the four most common protests I hear and compare them to the most common protests Steve hears.

The mid-20s attitude towards early retirement could be summed up as, “I can’t do that.” Then, after a 10 year beat down of conference calls, micro-management, and the daily grind, the mid-30s attitude shifts to, “I don’t want to do that.”

Psychology already has a name for what we just watched unfold over those 10 years. It’s called the 5 Stages of Grief: beginning with shock & denial and ending with acceptance.

The Working Career’s Five Stages of Grief

Although the 5 stages of grief model was developed by psychologist Elisabeth Küber-Ross as an attempt to explain the mourning process with terminally ill patients, she later expanded the model to include any major loss. In Dr. Küber-Ross’s words, this included such wide-ranging areas as death, divorce, and even the loss of a job.

Dare I say, the rat-race lifestyle is such an unnatural version of human life, that this model is equally applicable to the acceptance of a job. Let’s take a look.

Stage 1 – Denial

“The first reaction is denial. In this stage individuals believe the diagnosis is somehow mistaken, and cling to a false, preferable reality.”

Imagine the denial inherent in the wide-eyed optimism of a newly hired college grad. There they are, ready to take on the world, nod their head, and climb that corporate ladder until they’re CEO at 65. They just graduated school, scored a job, and life is good. To suggest there’s an alternate path, one that allows them to reach retirement decades sooner, is met with flat out refusal.

And besides, early retirement isn’t possible anyway. After all, “I don’t make enough. I can’t save enough. I’m not an investing guru, and I want to have kids someday. Anyone who suggests otherwise is just naïve, and those wack-Os will be hit with the harsh reality of the real world soon enough.”

Stage 2 – Anger

“When the individual recognizes that denial cannot continue, they become frustrated”

It always takes a few years for the birth of the disgruntled employee, doesn’t it? And they’re angry. Angry with the company, mad at their boss, or just frustrated with the daily grind.

I’ve been a part of the real world for a little over 3 years now, and I’ve started to see stage two unfold for nearly all of my similarly experienced co-workers. The anger usually starts with a smack in the face of the reality of the corporate ladder; someone gets passed up for a promotion or misses out on a bonus. Or more likely, the new college grad takes a step back from the fake smiles and reaches the startling conclusion that the corporate world sucks.

Stage 3 – Bargaining

“The third stage involves the hope that the individual can avoid a cause of grief.”

Soon after the anger, then the mid-career crisis kicks in. Facing down the barrel of another 25 years in the working world, the worker attempts a compromise to regain control.

- “What am I doing here? If only I would have pursued my true passions.”

- “I always wanted to be an artist…”

- “Maybe if I just work harder, I’ll finally get that promotion and life will be great.”

- “It’s about time I got that sports car I deserve.”

All of these are an attempt at bargaining through the issue. Whether it’s a new car or a new career, the worn down worker day-dreams of a bargain to regain control of their fate.

Stage 4 – Depression

“During the fourth stage, the individual despairs at the recognition of their mortality.”

As the worker recognizes the likelihood of a long, drawn out career, the sadness kicks in. We have all seen the depressed co-worker, dragging their weathered-self to work every day. Maybe you’ve even been there…

Stage 5 – Acceptance

And finally, we reach acceptance. The worker accepts that the working lifestyle, day in and day out for years on end, is the only path for them. Dreams of hitting it big and pursuing that dream are pushed aside in favor of stability and predictability.

“Besides, this job isn’t so bad… in fact it’s kind of likable. And I’d be bored without it, or lose my purpose… Early retirement might work for you, but it’s just not practical for me…”

Pulling the Plug on the Slow Acceptance

It doesn’t have to be that way. There’s an alternate path to the generally accepted working career: a road less traveled, an unnoticed side door, and a well-kept secret. It’s called early retirement, and people like Steve are proving it is entirely attainable for normal people.

So, which path will you choose? The soul-sucking slow grind that elicits a grieving process, or the early escape to freedom and frolicking in fields of dandelions?