My car crash of a portfolio

Whenever I want to talk numbers, I like to ask someone else to do it - this time, it's Actuary on Fire, who's a financial professional who's let his own portfolio become an epic train wreck of truly strange proportions. Today, he writes about it.

Gather round folks. I don't usually advocate rubbernecking but you are going to witness a real car crash of a portfolio and it will be difficult to resist. Does every financial blogger hide a secret? Because the steaming turd that I quietly sweep under the rug is my sadly neglected portfolio that I have not tended to in a long time.

How's this happened? Well, I can make excuses to you - family commitments, work pressures, kids... but the fact is I have a train wreck on my hands and it's time to get out the poop bags and commit to you that I'm going to clean up this mess and come out on top.

This was a learning experience for me (and not a little humbling too) so if you come away with any nuggets for yourself then this rubbernecking will have had some use.

But first the backstory.

Backstory

Why is this a big deal for me? Well, in my professional life I advise large institutional investors on their portfolios. Maybe you have a traditional pension plan from an employer? In that case I might be advising them. That endowment your Alma mater relies on? It could be me recommending their asset allocation.

I'm not trying to toot my horn, but I'm good at this and my clients would say the same. But somehow I have never shown the same dedication to my own money.

The problem is that at heart I'm not a details person - I just don't have the stomach for the minutiae. So I over-compensate in my job where I've had to pedal very hard, but the flip side is that I've been coasting with my own portfolio. The result is that I've left myself with investments that are over-complex, difficult to maintain, expensive and sub-optimal.

Don't take my word for it, take a look here.

Take a breath - there are 56 line items.

I'm gonna tell you that in comparison, an institutional portfolio of hundreds of millions of dollars might have fewer than twenty line items. So it's not surprising that I find it impossible to re-balance, monitor and generally keep my own portfolio in check.

Some issues

I picked my way through the wreckage and found some quick wins.

- I've got a load in cash in my Vanguard brokerage. You might have been congratulating me on my liquid emergency fund, but the sad fact is that I did not realize it was there. I dimly remember harvesting some losses, but it's an unwanted performance drag that I can quickly put to work in the market.

- Betterment: I quite like their recommended portfolios and I chose an aggressive model. But it's exhausting to look at. There are too many funds and I can't keep track of them. So my immediate job is to drastically simplify this circus. That's one of the issues with robo-advisers; they are fine if that is your only portfolio, but they can't take account of your other investments elsewhere.

- I have some very small positions in quite niche asset classes, for example Betterment has put me in Emerging Market Debt (EMD). Seen through Betterment’s eyes this might be reasonable, but when I roll up to my total portfolio the exposure is only 0.2%. This is not worth having. In my view, any asset allocation less than 5% of total is not going to move the needle, and really if you want to express any kind of conviction you probably need around 10%. So either I feel strongly enough about EMD to go with 5% or I scrub it.

- Lending Club. The failings of this investment deserves a post in its own right, but I am winding this down, so over time it will disappear.

- In my 401k I got sucked into the actively managed PIMCO real return fund. Unlike many in the FI community I'm not opposed to actively managed bond funds, but over three and five years this has not outperformed net of fees. So I'm going to axe it.

- My 401k is a disaster all by itself. I'm using the target date funds, and they are just too conservative and I need to exit them.

- PeerStreet: I like this investment, and if you're interested in more details I'll write a post on it, but I want to build this investment north of 5%.

- I have a plethora of 529 accounts. Different states and different kids means that these are now becoming burdensome. In addition I am in some pretty high expense funds, so I will rationalize them.

- Group Variable Universal Life (GVUL): this is as opaque as it gets. I wrote the provider an email directly asking them the costs and they were not able to tell me. I know that the FI community universally frowns upon insurance products but a GVUL can be a tax efficient vehicle so I need to do some work to penetrate its secrets.

That's a quick run through some of the issues I spotted initially, but I have a bigger concern. In the wider context of my net worth this portfolio is simply too conservative, so let's look at the wider asset allocation.

Wider Asset Allocation

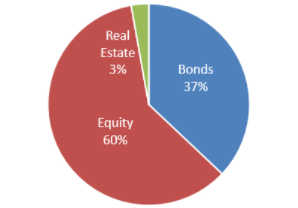

My portfolio that I shared is my pre and post tax savings and has the following asset allocation.

I'm way underweight where I want to be with equities, and ideally, I want something like 75/25 equities/bonds. So I have some work to do in terms of re-balancing efficiently from bonds to equities, but that should be pretty straightforward.

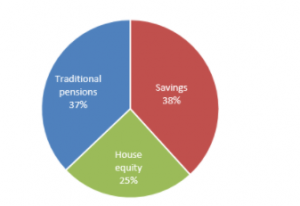

However, my net worth also includes the equity in my house and I should also count some traditional pension plans that will kick in when I am older. If I factor in these additional assets you can see my asset allocation in a wider context below.

The key thing I realized is that my portfolio only represents 38% of my total wealth, and of that 38% only 60% is equities. So I am way, way, way underweight equities in my opinion.

The traditional pension plans provide a guaranteed stream of income later in life, so that is essentially a bond, and I put these plans in the "bond" bucket. Therefore, I have 37% of my total wealth tied up in bonds and another 25% in real estate (i.e. my house equity). The remaining 38% of my assets are all that remains to put to work in the stock market.

By not positioning that 38% slice of the pie more aggressively, I'm clearly selling my growth prospects short.

[Incidentally, if you are wondering what actuarial trickery allowed me to convert my traditional pension plans to a cash equivalent then leave a note below and I might write a post on this. It's pretty simple, to be honest.]

Where does that leave me?

I've given myself a face-punch, so don't feel you have to. My portfolio is a car crash and I am massively underweight on equities. When I then factored in my traditional pensions and house equity, my portfolio really was far too conservative. I've been missing out on a great run in the stock market and need to jump back in. So let me now tell you face to face - I've got this. I'm going to bounce back and next quarter I will clean the egg from my face and report back.

This has been a cathartic experience with a few key points:

- I need to examine savings in the wider context of my wealth and re-balance back to equities to maintain stock market exposure

- Remove small asset allocations and simplify

- Move out of higher expense, underperforming funds

How is your portfolio? Any secret corners that need cleaning out? Any horror stories that you want to share. Want to gloat, or commiserate? Let me know in the comments!

Actuary on FIRE is not to be confused with actually on fire, but instead is an actuary with a family on the east coast and he’s revving up his game after a recent financially indolent interlude. He blogs at actuaryonfire.com.