Community Spotlight: Brian Brandow - blogger and volunteer

Welcome to the very first installment of the Community Spotlight! These posts highlight some of the amazing work that people are doing within their communities at home, abroad, and everywhere in-between.

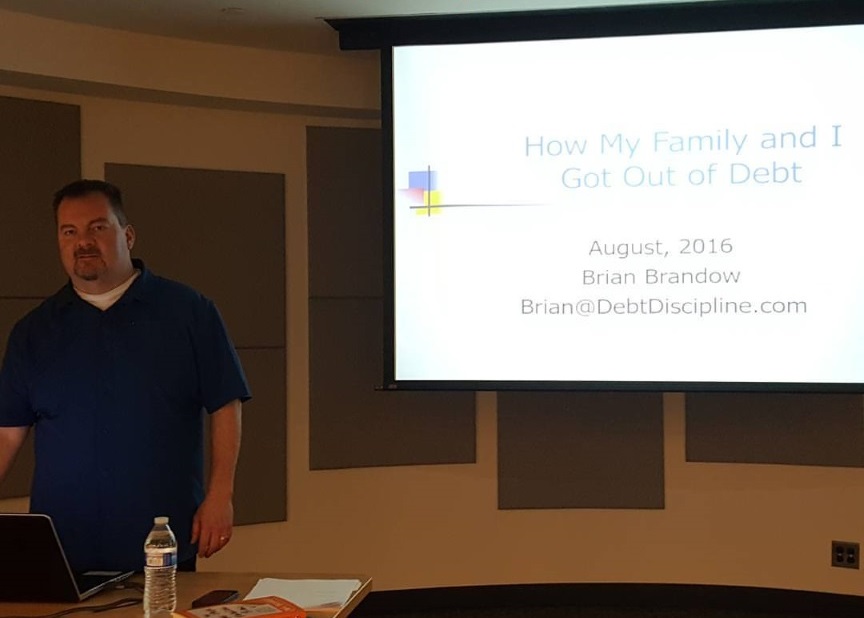

Today, I'm featuring Brian Brandow who blogs over at Debt Discipline.

These posts contain a series of short questions - in bold. Please reach out to Brian and show him some love for taking his precious time to give back to his community. We need more people like him around.

1: What exactly are you doing within your community?

I'm doing several things to make an impact on my community. It all started when my family and I became financially aware in 2010 and debt free in 2014. After realizing we were financially naive for years, we figure others were too and could benefit from the knowledge we gained. I began sharing our personal "get out of debt story" at local libraries, which included tips on how others could do the same. I have hosted this presentation six times in the last two years and continue to look for additional opportunities.

I'm also the father of three teenagers. My wife and I taught them as much as possible about money over the last several years as they begin their financial lives. We quickly realized that they were not being taught any of the basic principles of managing money at school. I made a call to our superintendent and inquired about financial literacy. What I found is that my school's administrations welcome feedback from parents. I quickly became involved with a superintendent-appointed-committee to help improve the curriculum and better prepare students for the real world after high school.

I have volunteered my time for the last three years as a part of several committees - all with the personal goal of promoting financial literacy. Last year I became the chair of a financial literacy committee, and we were approved by our BOE to implement a three-year plan to introduce financial education in all 10 of our schools within our district K-12. We will continue to evaluate the program, and the end goal is to make a full year personal finance class mandatory for graduation for all students.

[Steve: This is wonderful! Financial literacy is lacking in the United States. I learned very little about personal finance in school, nothing about compound interest or how the stock market works, debt or budgeting in school. Brian's doing wonderful work to help change that.]

Finally, I also work with a local 501c3 coalition. The goal of the coalition is to unite our community through active participation, education, and collaboration.

https://www.facebook.com/Connetquot-Cares-1417560691593300/

Earlier this year we hosted an "Avoiding Student Debt" night. I organized the event and provided some overall insight on the topic. We viewed the documentary, Broke, Busted and Disgusted, and then finished the evening with a speaker from a local Universities Office of Financial Aid and Scholarship Services.

2: How is it impacting your community? Can you recall any success stories?

In those six speaking presentations, the combined debt of those in attendance was 1.4 million dollars. From the Q&A at the end of the event and the follow-up emails I receive, I know that basic personal finance information is widely needed, and my small effort is having an impact. Often the follow-up emails are thanking me for started someone on a path to getting out of debt.

Overall the response has been positive. I often hear comments like "I wish I were tight this in school" or " I wish I knew this stuff earlier," but overall people in my community are in need of basic financial information.

The financial literacy work at the school district has been well received. During this work, we took a survey of past graduates. One of the top things they wish they would have learned at our high school was money management. It's clear there is a need.

3: What is your motivation for giving your time?

I wanted others to have the knowledge I have now. Before 2010 I was not financially savvy. I did not track my net worth and spent more than I made. I know better now and want others struggling with debt or who don't understand money to know the same.

I enjoy blogging, but there is something special about working directly with people and having a direct impact on their futures.

I believe its so important we teach our youth the basics of money management. It's a life skill and needs to be taught in our schools. Its one of the main reason I got involved with our local school district.

4: Where can people find out more about what you're doing?

I have covered the topic on my blog many times. If someone needs more information, they can email. I'd be happy to answer any questions they may have on volunteering or approaching financial literacy with their school district or any other general questions they have.

http://www.debtdiscipline.com/connecting-offline-online-world/

http://www.debtdiscipline.com/sharing-personal-journey-debt/

http://www.debtdiscipline.com/sharing-personal-journey-debt-part-two/

http://www.debtdiscipline.com/1-4-million-reasons-help-someone/

Thanks, Brian, for your participation in my first Community Spotlight. And, an even bigger thank you for your work in your local community advancing the cause of financial literacy. Like you said, even a basic understanding of personal finance is badly needed. Our schools offer classes like advanced placement calculus, but completely neglect much more practical life skills like money management and debt avoidance.

Thanks again, Brian!

Wait, don't leave yet!

Do you know someone who might be right for a Community Spotlight feature? I am looking for folks who are active in their communities and making a difference. And, they need to be willing to "talk" (aka: write) about it in this kind of format. Maybe YOU are that person? Contact me.