How I feed a family of five for less than $600 a month

How do I feed a family of five for less than the average cost to feed a family of four? By utilizing simple but effective buying strategies.

Food, and especially the cost to feed a family, is one of the biggest expenses for most households. Of course, if you eat most of your meals out, it can be a huge expense – just ask Steve. He recently told me when I was interviewing him for an article for GOBankingRates that he spent $500 to $600 a month eating out before getting married and getting on a path to early retirement.

But even eating at home can – forgive the pun – take a big bite out of your budget. Just consider the national averages.

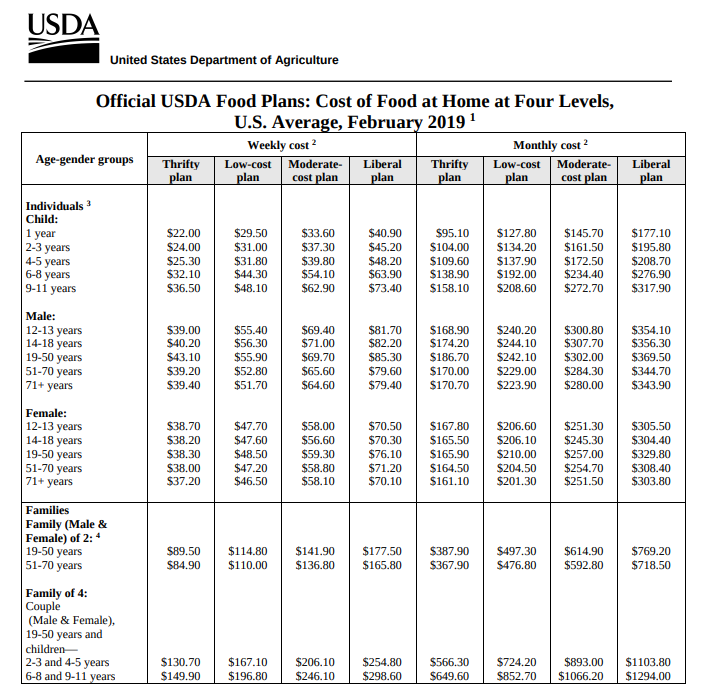

The U.S. Department of Agriculture estimates that a family of four with kids between the ages of 6 and 11 spends $196.80 a week for food at home on a low-cost plan, $246.10 for a moderate-cost plan and $298.60 for a liberal-cost plan.

At the high end, that’s $1,294 a month for well-rounded meals for a family of four.

When I see these figures, I feel pretty good about my grocery spending.

That’s because I feed my family of five for less than the low-cost plan for a family of four. Most weeks I spend $150 or less on groceries. And, no, my family doesn’t survive on just cereal or peanut butter sandwiches.

My grocery cart usually is full of fresh fruits and vegetables and even organic items.

So how do I keep my grocery costs under control? Keep reading to see what simple strategies I use – and that you can use, too.

How I feed a family of five for less than $600 a month

I Don’t Buy Much Meat

Americans are big meat eaters, but my family is not – which is a big reason why my weekly grocery bill is lower than the average American household’s food spending.

Recently, when I bought some steaks, ground beef and fish, I ended up spending about $50 more than I usually do at the grocery store.

If you’re a big meat eater, you don’t have to give it up entirely.

Switch to lower-cost meat such as pork and chicken. And consider eating meat just a couple of times a week rather than several nights a week. You might find that not only will it save you money, but also it might help you lose weight and improve your health.

That’s because eating red meat has been linked to a higher risk of heart disease, stroke, and diabetes, according to the Mayo Clinic.

I Take Advantage of My Supermarket’s Loyalty Program

I’ve found that the easiest and most effective way to save money at the supermarket is to sign up for the store’s loyalty program. The store where I typically shop, Kroger, clearly marks the discounted price on items for loyalty cardholders.

I simply swipe my card or enter my phone number linked to the card when I check out, and the discounts are automatically applied. I typically save $20 to $40 per shopping trip buying items that are marked down for loyalty program members.

I Use Coupons – But I’m Not an Extreme Couponer

I know some people can spend just $10 for $200 worth of groceries by using every coupon trick in the book. I’m not that person. I don’t have time to scour the newspaper or the web for every coupon out there that can cut my grocery costs.

However, I do save at least $10 to $15 a week by spending a few minutes using my supermarket’s mobile app to download coupons directly to my store loyalty card.

And, no, I’m not just getting a bunch of packaged items and snack foods at a discount with coupons. Most of the coupons I find and use are for dairy products, grains, condiments, frozen items, and even fresh vegetables.

I Buy the Store Brand

For most items, the store brand is just as good as the name brand but it costs significantly less.

For example, why spend $1.50 to $2 on a box of name-brand pasta when I can get the store-brand pasta for $1?

There are only a few items in the supermarket that I find are worth spending extra for the name brand.

Typically, I opt for the store brand to save big.

I Stock Up During Sales

When items my family typically eats go on sale, I stock up on them to save money.

For example, one of the items that I always opt for the organic version is milk. For starters, I get the store brand, which is $1 cheaper than the name-brand organic milk. But I typically by only one or two cartons a week because they are $3.29 each.

When they go on sale for $2.79, though, I buy four or five because I know they’ll be consumed before the sell-by dates. Often, when items are on sale, I can find digital coupons to get the price even lower.

I Buy Seasonal Produce

For the most part, I let the seasons dictate which fruits and vegetables I buy. That’s because those items cost a lot less when they’re actually in-season.

For example, strawberries cost twice as much in the winter as they do in the late spring, and they’re not nearly as good. So why pay more for an inferior product? I opt for citrus fruits, which are cheaper in the winter, and wait until the spring to get a better deal on strawberries.

I Don’t Buy Much Junk

The Department of Agriculture’s food plans on which average grocery spending in the U.S. is calculated all include soft drinks – as much as 4.6 pounds a week for an adult. That’s a lot of soda, which isn’t cheap and, as I see it, isn’t a necessary part of any diet. So I rarely buy it.

Nor do I buy a lot of packaged snack items. Limiting junk food purchases does help keep down my weekly grocery bill and keep us a little healthier.

I Always Shop With a List and Meal Plan

Before I go to the grocery, I always make a list of items to purchase based on the meals I plan to make that week. Taking the time to plan meals saves me money because I choose dishes to make based on what I have on hand and what’s on sale at the store.

It also helps me resist the urge to go out to eat because I know there’s something to eat at home. And making a shopping list based on my meal plan ensures that I buy only the things my family needs and helps prevent multiple trips to the grocery to pick up things I would’ve forgotten if I hadn’t written them down.

All of the things I do to save money at the supermarket are relatively easy.

If they weren’t, I wouldn’t do them because I’m a working mom of three kids without the time to devote hours to money-saving moves. I guarantee that if you implement some or all of the strategies I use, you can cut the cost of groceries.

About the author: Cameron Huddleston is an award-winning financial journalist with more than 17 years of experience writing about personal finance. She also is the author of Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances.