How To Get Out Of A Timeshare: 7 Legit ways

If you want to get out of your timeshare, there is no need to panic. Instead, use these 7 ways to rid yourself of that depreciating asset.

I don't think anyone goes into their timeshare purchase with the idea that they may someday be researching how to get out of a timeshare. But then again, things change. Priorities morph.

At $10.2 billion, the timeshare industry is surprisingly large (fun fact: that is bigger than Major League Baseball, or the entire music industry). Over 9.6 million U.S. households own some form of a timeshare.

Some fun statistics about timeshare sales:

- The average age of a timeshare owner is 44

- During the timeshare stay, vacationers have dropped over $7 billion

- 84% of timeshare resorts offer a rental program (more on this later)

- Timeshares enjoy over 80% occupancy on average

It's safe to say there is demand for the product, and people find a benefit to owning timeshares. If you're looking for the Dave Ramsey "all timeshares are evil and you're an idiot for buying one" speech, you won't find it here.

Heck, my own parents are timeshare owners! I've enjoyed the benefits of a family timeshare that my parents own for annual family gatherings and even at resorts in Europe.

Unfortunately, circumstances can sometimes change. Maybe you've run into health issues, or the timing no longer works, or you just can't afford the ever-increasing annual maintenance fees.

My parents are facing this issue right now as their travel patterns have changed and they no longer use the timeshare they used to love. What seemed like a no-brainer deal for endless summer vacations every year can turn into a nightmare when you realize that getting out of a timeshare agreement is infinitely harder than getting in.

How to Get out of a Timeshare

The truth is that getting out of a timeshare obligation can be a difficult and confusing process. If you do just a cursory search on Google, you'll see there are countless companies, forums, and resources dedicated to helping people free themselves of their financial burden.

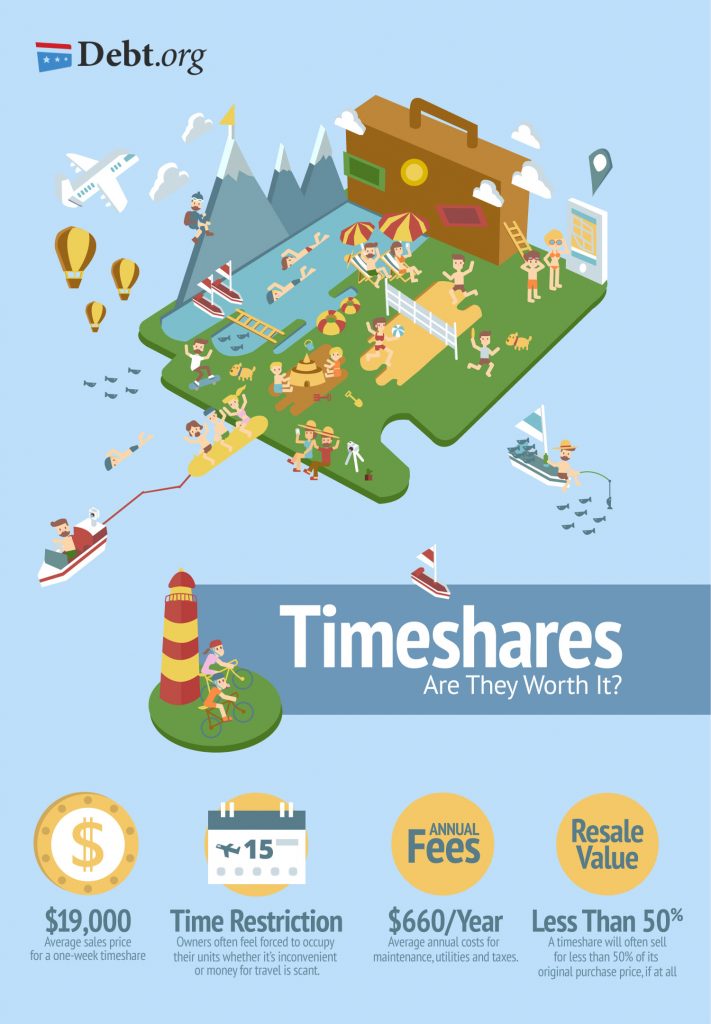

But you do have to face the fact that you bought a depreciating asset that is worth much less than what you paid, despite what the timeshare company at the flashy resort seminar may have told you.

Even though some timeshares are actual deeded slices of real estate, they are not like real estate investing where your property gains value over time. In fact, with ongoing annual fees for maintenance, they can quickly become a liability.

The good news is, you're not alone, and there are many options to get relief from the burden of ongoing timeshare costs. If you are trying to figure out how to get out of a timeshare, here are 7 ways to go about it, loosely ranked from your best-case to worst-case option.

1. See If You Can Cancel Your Contract

I remember when I was little, my family went on a beautiful resort vacation. We had lots of fun swimming, sight-seeing, eating, and other activities. But I also remember restlessly sitting through a 2-hour seminar in the middle of the trip (try sitting through 2 hours of anything as a grade-schooler).

Looking back, I now realize we were able to take that vacation because my parents had signed up to listen to a timeshare sales pitch in exchange for a free or almost-free resort stay.

Fortunately for them, they didn't succumb to the sales pitch, but many people are unprepared for the pageantry and salesmanship that goes into trying to get you to sign up NOW before prices go up!

If you recently signed on the dotted line and are having second thoughts, read the contract and your state laws. Most timeshare contracts are required to include a rescission period (a fancy word for "cooling off" period), where you are able to back out of the contract if you change your mind. Laws vary state-to-state, but this retraction period can be anywhere from 3 to 15 days.

For example, according to Nolo:

- In Alabama, the rescission period is five days, not including Sunday if that is the fifth day. (Ala. Code § 34-27-53.)

- In California, the rescission period is within seven calendar days of receipt of the public report or the date you sign the purchase contract, whichever date is later. (Ca. Business and Professions Code § 11239.)

- In Colorado, the purchaser has up to five calendar days after the sale to cancel a timeshare contract. (Colo. Rev. Stat. § 6-1-703.)

- In Florida, the purchaser has the right to cancel the contract until midnight of the tenth calendar day following the execution date or the day on which the purchaser received the last of all required documents, whichever occurs later. (Fla. Stat. Ann. § 721.10.)

If you take advantage of this clause, make sure you follow it to the letter and do whatever is required to officially annul the contract.

2. Sell Your Timeshare Yourself

While the resort companies themselves don't make it easy to sell or transfer your timeshare, there is a booming secondary market for resales. However, supply (the number of people looking to sell their timeshares) greatly exceeds demand (the number of people looking to buy timeshares), so you have to be realistic about price.

In fact, most timeshares sell on the resale market for 0-20% of the price you originally paid according to TUG BBS, an online forum and resource for timeshare owners.

There are a number of websites that serve as a secondary timeshare market. As part of an exit strategy, some folks opt to list their share on sites like eBay, Craigslist, and Facebook.

Two online portals that specifically cater to the timeshare resale market are the aforementioned TUGBBS.com or Redweek.com. You can list your timeshare for sale on one or more of these sites, and check around the other listings to see what you might be able to expect in terms of a timeshare resale price.

This is actually how my parents ended up buying their timeshare - through a secondary resale market. I don't know exactly how much they paid, but I'm sure they got a great deal compared to the previous owner!

5 Effortless Methods to Boost Your Income This Week

If you need extra money, you’ve come to the right spot.

Our team has compiled a list of creative ways you can fatten your bank account this week. Certainly, there’s something here that fits your needs.

This is not a long list, so go ahead and start now, but be sure to bookmark this post so you can easily return later. We’ll keep it updated as offers change or expire.

3. Sell Your Timeshare Through A Broker

If trying to sell it yourself seems too overwhelming, or you tried without success, there are also companies that will help you sell your timeshare for a fee.

Remember that, especially if you have a deeded timeshare, you are essentially buying and selling real estate. While there's a little less paperwork involved than selling a house, you still need the proper contracts, signatures, and closing process.

There are real estate brokers that specialize in timeshares who can help you navigate the transaction in exchange for a commission on the final sales price.

While there are many legitimate brokers and companies out there, be aware that there are also scammers looking to take advantage of your situation. Always do your due diligence on any company before you do business with them.

Here are a few guidelines to avoid scams:

- Contact the Better Business Bureau and see if the company has any complaints filed against them.

- Ask for references of past clients and contact them to evaluate their experience.

- NEVER pay money upfront for the promise of getting your timeshare sold.

- Read the contract carefully so that you understand what fees, commissions, and other costs are involved, and what services will be provided.

4. Give or Sell Your Timeshare Back to the Resort

Read your contract and see if there is a provision that allows you to sell your stake back to the timeshare company at a predetermined amount. This is rare, but you could be one of the lucky few. While you will likely be taking a steep loss versus what you originally paid, at least you can avoid the ongoing annual fees and maintenance costs that continue to accrue.

While most resorts won't buy it back, some have a program where they will allow you to give your timeshare back for free. With the current average cost of a new timeshare hovering around $22,000, relinquishing it for free might seem like a terrible waste.

But if you truly can't use your timeshare anymore or don't have the means to continue paying the annual dues, it could be your best option.

If you're down to this point on the list, you owe it to yourself to at least call your resort and see what your options are and if you can work something out.

5. Give Your Timeshare Away for Free

If you can't sell or work something out with the resort itself, there are still options to give your timeshare away for free or sell it for a nominal amount.

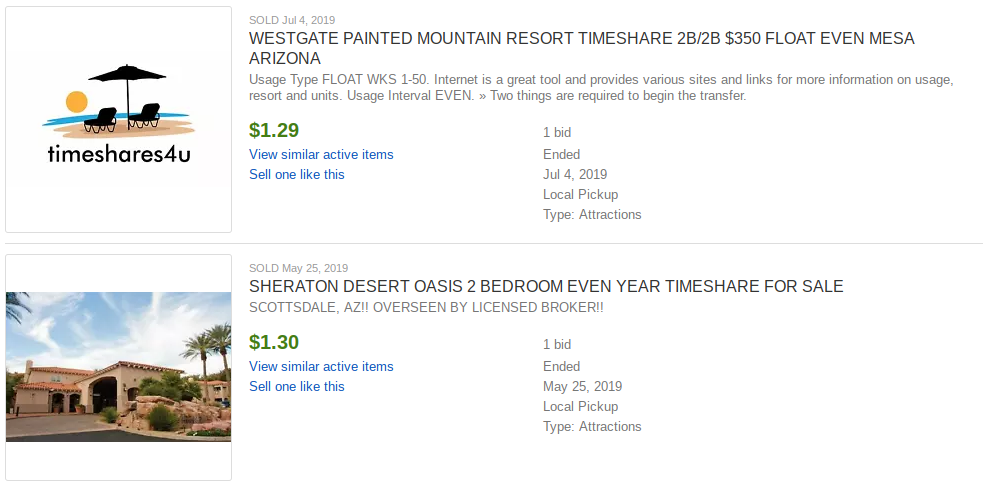

Most of the same platforms you can use to sell your timeshare you can also use to give it away. For example, if you look at the recently sold timeshare listings on eBay, you'll see that most of them sold for under $100, and many sold for just $1.

You can sweeten the deal for potential buyers by giving away your current year's stay away for free, or even offering to pay the transfer and closing fees. It can be painful to think that your $20k investment is now worth $1 or less, but if you're losing $1,000 - $2,000 year after year on maintenance fees, don't give in to the sunk cost fallacy.

Getting rid of it now, even at a loss, can save you a lot of money and stress in the long run.

6. Hire an Attorney

If you can't sell your timeshare, the resort won't take it back, and you can't even give it away for free, there is a cottage industry out there of law firms that specialize in helping clients get out of timeshare contracts.

There are some legal strategies you can use to try to extract yourself from a contract. But be warned if you go this route, not only will you most likely not get any money for your timeshare, you will also be paying for the lawyer's time and effort.

7. Rent Out Your Timeshare

Renting out your annual resort stay is one final option you have when you are looking for how to get out of a timeshare. This doesn't actually get you out of it at all, but could pay for the annual maintenance fees or maybe even turn a profit!

Both TUGBBS.com and Redweek.com allow you to list your timeshare for rent or sale. You can even list your timeshare on AirBNB like any other short-term rental.

One site that focuses specifically on renting is ResortShare.com. They are a full-service property management company that does all the work to rent out your timeshare and shares in the revenue they generate.

Especially if you are in a short-term cash crunch, or for whatever reason can't use your timeshare in a particular year, renting out your week could make a lot more sense than selling.

There are even people that buy timeshares (usually on the resale market for cheap) specifically as an investment to rent out. The math and logistics are certainly different than your typical one percent rule rental properties, but the numbers can work out in your favor if you do your homework.

Not every job in the gig economy is equal. Here are the best side hustles to consider during your layoff to make the most cash.

Other Questions to Consider

Timeshares are a unique product and the contract, sales process, and the overall industry can, unfortunately, be hard to navigate. Here are a few questions that come up in regards to how to get out of a timeshare.

What happens if you stop paying on your timeshare?

If you stop paying the annual dues on your timeshare (or loan payments if you took out a loan to purchase it), you would no longer be allowed to use your time.

Not only that, but the delinquency will be reported to the credit agencies and it will severely hurt your credit. After enough time, you can even face foreclosure.

Keep in mind that all late fees, court costs, and other foreclosure costs will be tacked on to the final bill. So not only will your credit be ruined, you will still owe a significant chunk of money. As shown above, there are many legitimate ways to get out of a timeshare. Burying your head in the sand and not paying your annual dues or loan payments is not a recommended strategy.

What is the average cost to get out of a timeshare?

As you would imagine, it's difficult to get an average cost, and almost no one who provides services to get out a timeshare provide that kind of data upfront. I was able to find one data point where a company called Timeshare Exit Team quoted an average figure of $4,000.

I think it is safe to say that between costs of paying a broker, lawyer, or another intermediary, the closing costs, and annual maintenance fees while you are still holding it, you can expect to pay anywhere from a few hundred to a few thousand dollars before the process is done.

Is a timeshare a good investment?

I don't think all timeshares are a bad idea, or that no one should ever buy a timeshare.

For certain people and certain situations, they make a lot of sense. But money spent on a timeshare should be considered an expense on a depreciating asset, kind of like a luxury car that you not only pay for upfront but have to pay annually to keep it running in good condition.

The only difference is at least with the luxury car, there is not a lot of hassle or expense to sell it should the need ever arise, unlike a timeshare.

If you are looking for great ways to invest your money, there are lots of options - stocks, bonds, real estate, businesses, etc. But I would never consider a timeshare an investment that would appreciate in value over time.

Wrapping Up - 7 Ways to Get out of a Timeshare

The bottom line is that if you find yourself stuck with an unwanted timeshare, there's no need to panic. There are many good options to sell or at least give it away. In summary, here are 7 ways to get out of a timeshare:

- See if you can cancel your contract

- Sell your timeshare yourself

- Sell your timeshare through a broker

- Give or sell your timeshare back to the resort

- Give your timeshare away for free

- Hire an attorney

- Rent out your timeshare

Frequently Asked Questions

What is a rescission period, and how does it work in the context of timeshare contracts?

A rescission period is a specified timeframe, usually outlined in timeshare contracts, during which a buyer can cancel the agreement without facing penalties. It allows individuals to reconsider their decision and potentially back out of the timeshare contract.

Can I sell my timeshare on my own, and what challenges might I face in the resale market?

Yes, it is possible to sell your timeshare independently. However, the resale market is often oversupplied, leading to lower resale values (sometimes as low as 0-20% of the original purchase price). Realistic pricing and patience are essential when attempting to sell a timeshare.

Are there reputable companies or brokers that can assist in selling my timeshare, and how can I avoid potential scams?

Yes, there are legitimate companies and brokers specializing in timeshare resale. To avoid scams, it's crucial to research any company thoroughly. Check with the Better Business Bureau, ask for references, never pay upfront fees, and carefully review contracts to understand all associated costs.

Is giving my timeshare back to the resort a common option, and what factors should I consider in this process?

While it's not common, some timeshare contracts may have provisions allowing owners to sell their stake back to the resort at a predetermined amount. Owners considering this option should weigh the potential loss against ongoing annual fees and maintenance costs.

What happens if I stop paying my timeshare annual dues, and is this a recommended strategy for getting out of a timeshare?

If you stop paying annual dues, you may lose the right to use your timeshare, face damage to your credit score, and even risk foreclosure. It is not a recommended strategy, as it can lead to financial consequences and does not address the underlying issue of wanting to exit the timeshare agreement. Exploring other options listed, such as selling or giving it away, is generally advisable.