A guide to house hacking your way to retirement

House hacking is a clever way to use real estate to build enough passive income to do whatever you want in life, including retire.

When I first heard the term "house hacking", I was instantly intrigued. I knew what house flipping meant, and I also know how much money people can earn with this truly clever technique.

But, house hacking is different. It's not just about buying a house and re-selling it. It's a whole other technique that, when used correctly, not only provides for the potential of a LOT of passive income but also gives you a place to live, too.

What is house hacking?

House hacking is a term that describes a multi-unit living situation that supports multiple families living in separate units, each paying separate rent to the landlord (you).

A duplex or triplex are good examples, but even mobile home living may count as house hacking.

Here's a video from Bigger Pockets that describes this super unique technique.

"House hacking is the ideal housing choice for young homeowners who are willing to take the extra effort to learn how," wrote veteran real estate owner Chad Carson. "If you start with house hacking as a young adult instead of the normal housing options (renting or buying a house), you can build much more wealth over the years."

Today, I bring you the story of Erik who is using a combination of house hacking and a high income together to retire early and enjoy the rest of his life without the need to work a full-time job or even house hack.

Erik is a 27-year old blogger, living in the Midwest, who writes at The Mastermind Within. He writes about personal finance and self-improvement and is passionate about sharing his tips for building wealth as a millennial and helping people unlock their full potential in life.

Erik, it's all yours.

House hacking and a high income

When I first starting working, around the age of 21, achieving financial freedom and financial independence has been my focus and goal.

The first step to achieving financial independence for me was growing my income and then avoiding lifestyle inflation to keep my savings rate high.

Hi, my name is Erik, I’m 27, and I work as a statistician/programmer at a bank. Currently, my yearly cash compensation is $115,000 (salary and bonus), and I’m trying to use this high income wisely on my way to financial independence.

I’ve achieved my goal of becoming a six-figure earner in my 20s, and now am focused on using my income to level-up my life.

For example, I:

- invest in me,

- build entrepreneurial endeavors, and

- expand income-producing assets

Right now, I’m about 5 years into my journey to FI, and have a net worth of just over $250,000. Through intentional decisions with my spending habits, smart investing, and consistent actions, I’ll be financially free sooner rather than later.

In this post, I’m going to share with you what I’m doing with my high income to build wealth and achieve financial independence. In the coming sections, I’m going to talk about my investing and saving strategy, how I’m avoiding lifestyle inflation, and other thoughts I have for high-income earners looking to achieve financial independence.

What I Do to Make Money and Where I am in My Journey to Financial Independence

Before getting into the meat of what I'm doing to achieve FI, here’s a little more context of my financial situation, and how I got into pursuing financial freedom.

When I was 20, I was working as a bookkeeper and started to think about what I wanted my life to look like. The main driving force was my dad who invested in a few businesses in his 30s.

He successfully built his wealth over time to provide a financially stable situation for his family.

I wanted this for my future family, too, and started searching for books and articles about how to build wealth.

After graduating early with Bachelors in Math, I jumped right into a Masters in Financial Math, as I found out through my studies that a high income would be important for growing wealth.

After my Masters, I secured a job that paid $63,000 with 8% bonus. Being 23 with a relatively high salary, my work was just getting started on my journey to becoming rich.

With this first real job, I started to invest in my 401k, get my student loans knocked out and bought a house with the intention to house hack.

The Power of Real Estate and House Hacking for Financial Independence

During the summer of 2015, I bought a 3-bedroom home to house hack and rent out to 3 of my friends.

Buying this house was one of the best decisions I made, but also a very risky decision. House hacking will always contain at least some risk.

When I bought the home, I put down about $5,000 on a $290,000 mortgage and had only $1,000 in the bank after closing. Phew, talk about spreading myself thin!

While I was able to essentially live for free for the next year, I could have been wiped out if something bad would have happened with the house.

It was a calculated risk and one that I'm glad that I took.

Luckily, nothing bad happened, and after 4 years of house hacking, I’ve collected nearly $50,000 in rental income and reduced my living expenses drastically.

If becoming rich at a young age is your goal, I believe it’s essential to build situations where you can take risks with the possibility for outsized returns.

Four years ago, when I bought the house, I had a negative net worth (hello student loans). Fast forward to today, I recently just sold this house and netted roughly $100,000 in cash from the sale. These are the outsized returns from taking the risk that I’m talking about.

(It’s very possible I just got lucky in this endeavor, but I played the hand I was dealt and found success)

By taking a risk, and using the power of real estate to my advantage, I was able to live inexpensively for 4 years, and now have the liquid capital to continue to grow my wealth.

Use House Hacking to Speed Up Time to Retirement as a High Earner

If you are a high-income earner, house hacking can speed up your time to retirement immensely.

Real estate is one of the best asset classes to invest in. With house hacking, you can get into real estate with less risk than a rental property because you live in the property and reduce your living expenses directly.

And naturally, as with any investment, there will be pros and cons.

I think the pros outweigh the cons.

One of my favorite quotes about real estate is the following:

“Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.” - Andrew Carnegie, billionaire industrialist

I’m a huge fan of real estate for a number of reasons. If done right, it can be a great deal. Why?

- Anyone can buy real estate

- There’s the potential for appreciation

- You can buy on margin and borrow against the equity

- Real estate is rentable and improves cash flow

- You can improve your properties

- Finally, the tax benefits are great.

There’s a lot to love about the thought of real estate investing!

With a high income, real estate investing, and in particular, house hacking can help you make more money and speed up your time to early retirement.

House hacking has been a big component of how I’ve grown my net worth, but I’ve also been doing other things to compliment my house hacking gains.

Saving Money, Investing and Growing Net Worth to Achieve FI

Once I got my housing situation in a good place, the next steps on my path to financial independence were growing income, learning new skills, and investing.

I discussed this briefly above, but I want to touch on risk again.

Risk is a funny concept.

There are so many people who talk about risk like it’s something concrete or tangible.

Heck, I work in the risk department at a bank and feel uneasy about how we define certain things.

As defined by Wikipedia, risk is the potential of gaining or losing something of value. Typically, risk has a negative connotation, but in my opinion, there is a good risk, and, of course, bad risk.

To build wealth and become rich, taking good risks is key and can have a healthy payoff.

The key to taking good risks is to limit your downside and create situations with large upside.

With this thought of taking good risks, I’ve looked to apply this in my free time with entrepreneurship, in investing, and at my day job.

Starting a Business to Speed Up Your Time to Financial Independence

One of my favorite finance books is The Millionaire Fastlane.

The main idea of The Millionaire Fastlane is that if you want to become rich, you need to start a business.

With a business, you leverage a new wealth equation where your wealth is growing from the business income AND the business value.

With a job only, you only can grow wealth from your personal income.

With this thought in mind, I’ve now started a few different projects, quit a few different projects, and learned a lot along the way.

I’ve tried my hand at blogging, a subscription box company, and a print-on-demand company.

My most successful entrepreneurial endeavor has been blogging (where I make about $500 a month in revenue), and my least successful was the subscription box company (I lost $25,000 over 2 years).

The paradox of side hustling

While I have spent hundreds of hours on these things, my personal growth through these endeavors heavily outweighs any financial or time loss.

I’ve learned so much about product development, user experience, marketing, sales, accounting, operations, programming, etc., and am thankful I’ve had the opportunity to take these chances.

With these skills and maturity, I’ve noticed my day job performance has benefited greatly. This is what I call the paradox of side hustling (through wanting to quit your job to side hustle, you end up developing skills which result in promotions and more responsibility at work!).

While I haven’t seen direct returns from my entrepreneurial endeavors, these hustles certainly have not hurt me. In fact, they have helped me to build the skills and experience I need and use every day.

Also, with a high income, I have the capacity to make investments in these endeavors and look to scale them over time without stressing about the money.

Searching for Asymmetric Returns in Investing

One of my goals is to become wealthy at a young age. With this goal, I need to be okay with taking a risk and shooting for strong returns with my money. House hacking is a good way to put this into place, but it's also not the only way.

I’m not afraid of risk, as I’ve described in some of my thoughts in the previous section, and look to apply this in the markets.

While the message of “take a lot of risk in the markets when you are young” is similar to other personal finance and financial independence advice, what I do is different.

The current advice (2015 onwards) is to invest 100% of your retirement and brokerage accounts in low-cost index funds, as the stock market has gone up over time.

I believe that you can time the market

For me, though, I believe you can time the market and use risk management to your advantage. I love index funds, but currently, I am heavily invested in short term bonds and a little in equities.

I look at economic data every day at work and personally believe that stocks are overvalued and due for a correction.

Also, there are certain sectors which are very undervalued, which could see gains as certain events occur - and I want to see if I can take advantage of these market moves.

Another asset class I have money in is cryptocurrencies. I have over $15,000 invested in cryptocurrencies, as again, this follows from my thoughts on using risk and my income to my advantage.

With the volatility of cryptocurrencies, if I can turn $15,000 into, say, $75,000 in 2-4 years, this will have a huge impact on my path to financial independence.

And the thing is, with a high salary, if I lose the $15,000, then I will be fine as an individual (yes it will suck, but this is my mindset and thoughts on it).

7% a year is great, but if I can get 50%+ gains a few times with bets, this will be very beneficial for my long term goals.

Now, I’m going to talk about the flip side of building wealth: being frugal and keeping expenses low. If I make a million dollars and spend it all, I won’t have made any progress on my goals!

My Mindset Towards Being Frugal to Achieve Financial Independence

Up until this point, we’ve only been talking about how I’ve made money and how I’ve invested my savings.

Now, I want to talk about frugality and avoiding lifestyle inflation on the way to financial independence.

Being a high-income earner allows me a lot of flexibility in my budget if I want to spend more.

However, it does NOT matter how much you make if FI is your goal – it matters how much you save and what your annual expenses are.

Luckily for me, my parents stressed to me the importance of saving and being careful with money.

When I was going to school, I took the bus through 11th grade and brought my lunch to school 4 out of 5 times a week. Eating out was always a treat, and my parents emphasized vacations and activities versus stuff for how we spent our money.

Once I got into college and the real world, I’ve kept those habits.

Over the last 5 years, I’ve averaged a post-tax savings rate of roughly 50%, and after selling my house, will hopefully be around 60%.

However, there are some things I’ve had to be wary of with regards to lifestyle inflation!

How I’m Avoiding Lifestyle Inflation

For me, I’ve realized over time that I don’t need much to be happy.

The house I owned was 1900 square feet, and now, the one bedroom apartment I’ve moved into is 600 square feet.

I feel completely okay with this, and, at some point, want to try tiny house living.

For me, location is what is important – being close to work, close to different parks and lakes, and close to my friends is what matters.

I also don’t have cable TV or Netflix, I don’t have a gym membership (I work out at home, go biking and running, or go to a park for pull-ups), and don’t really care about new gadgets.

I drive a used 2014 car and am fine with my hand me down furniture.

Even though my income has grown, and I can “afford” these new gadgets and things, I don’t want to afford them.

One thing I have experienced some lifestyle inflation is eating out. For work, I don’t like packing my lunch and usually will eat out for lunch.

When I started working, I was bringing my lunch to work, and typically was spending about $100 a month on food.

Now, I’m up to around $350 a month – still pretty good I’d say.

Also, as someone who values health, this extra amount spent on healthy food is worth it.

Really, my best advice for avoiding lifestyle inflation is to focus on what makes you happy and focus on aligning spending with what makes you happy.

My Advice for Other High-Income Earners

The purpose of this interview was to share my high-income story and provide some advice and tips for other high-income earners on the path to FI.

Appreciate what you have

First, be thankful for your position. Many people would love to trade places with you.

At the same time, realize you have an opportunity that many people do not have, and this opportunity should not be wasted.

With a high income, you have an opportunity to save a lot of money in a short amount of time. This money can be used to start a business (like house hacking), take a vacation, fund a lifestyle change, pay down debt pursue financial independence, or do anything else you want and desire.

The key point is that with a high income, you have the opportunity to set big goals and hit them in a short time frame.

With more money comes more options, and with a high income, you can reach this faster than with a low income.

Take chances

My second piece of advice is to not be afraid to take chances with your time and money.

What I mean by this is that by being a high-income earner, you have a lot of room for error if a business or investment doesn’t go the way you want.

If you want to learn something and grow as an individual (with a course, degree, etc.), you can afford to do this and this should add to your value as a person! Likewise, if you want to try your hand at entrepreneurship (on the side of your job), even if you fail, with a high paying job, you will be able to recover.

Track your money

Finally, my last piece of advice is to track where your money is going over time and let the power of time happen for you.

High-Income Earners Have No Excuse to be Poor

Here’s a blunt statement for you: if you make over $100,000, you have no excuse to be poor.

$100,000 is $8,333 a month.

I think you can find some money to save in this income.

Even $1,000 a month grown wisely over time can result in you becoming a millionaire over time.

I’ve been saving $3,000+ for the last few years, and it’s been amazing for my financials.

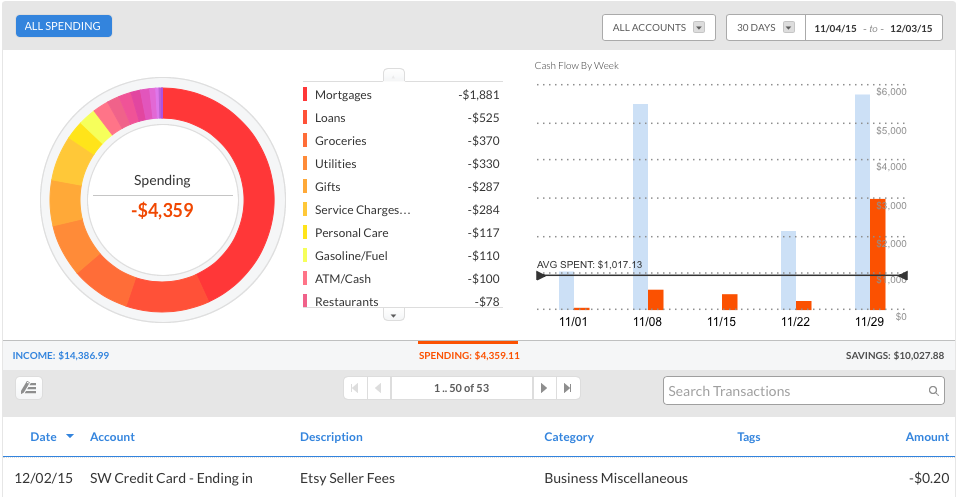

For me, tracking my money in a spreadsheet has been beneficial so I can pinpoint exactly where my money is going each month.

For you, you may prefer to use a tool such as Personal Capital, YNAB or Mint.

The key takeaway for you here is that things will take time.

You aren’t going to become a millionaire from one month of saving.

However, by tweaking things in your budget, cutting out bad expenses, and living intentionally, you can use your high income to save a lot of money and create options for your future self.

You are the master of your life. Take action today and get on the path to your dreams.

Hopefully, this post has been thought to provoke and inspiring for you to want to save money and improve your financial situation!

Thanks for reading. :)