5 lessons learned about retirement after my salary hit $100,000 a year

If you are earning over $100,000 a year, you're doing great. But, income alone won't let you retire. How smart are you with your money?

You’ve worked damn hard to earn a high income (maybe even a $100k salary), and that should give you a giant sense of accomplishment. But, here's the next question that you need to ask yourself:

What am I doing with all this money?

There are generally two ways to decrease the amount of time it takes to get to a point where we no longer have to worry about (or even work for) money. While earning a high income helps, it doesn’t change these basic fundamentals to reaching financial independence and early retirement.

It all comes down to two principles (which can exist exclusively of each other):

- Eliminate unnecessary expenses, and

- Earn more money

Unfortunately, cutting expenses is equally as hard, and arguably harder for high-income earners who have let themselves become accustomed to an inflated lifestyle (lifestyle creep!).

Earning a lot of money doesn't necessarily equate to building wealth.

But don’t feel discouraged if you’re one of them, the fact that you’re here reading this means you’re looking for a brighter future.

A little bit about me

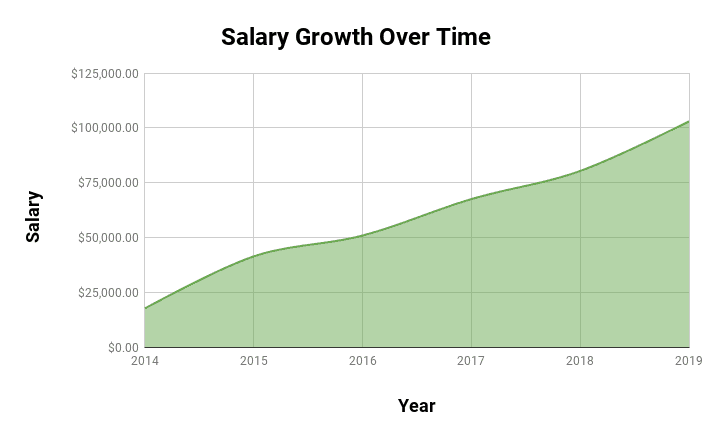

Like most, I wasn’t always a high-income earner. I managed to increase my income to six figures over the course of five years.

In the latter part of college, I was working full-time making a little over 40k/yr. Determined to pay off as much debt as possible, we began living on one income and throwing most of my now wife’s income toward our debts.

Over the course of two years we paid off approximately $35k, cash flowed tuition, saved for a wedding and built up a down payment for our home – all while still going to school full-time.

Within two months of graduating, we purchased our home, got married and I began working full time at my current job. My income grew over $20k with the job change.

Fast forward to today.

I’m 24 and have been working full-time as a software engineer for three years. I’ve received a few raises and a promotion which has now increased my yearly compensation to surpass the six-figure mark. That means I’m now making about $60k more than when I was a senior in college.

What am I doing with all this extra money?

Simply put: I’m saving and investing a very large portion of it.

But –we’re still remembering to live our lives.

Sushi date nights? Travel? Hiring an occasional cleaning service? 80” TV? No problem.

WAIT! I know what you’re thinking – that’s the least frugal thing you could possibly do. Yup, you’re right.

But, I refuse to let financial independence box us into stupid corners by blindly adhering to arbitrary rules and guidelines. Life isn't so black and white.

We value these things and are content with paying a premium for what some would consider unnecessary expenses. That’s the beauty of everyone’s journey, they get to decide that for themselves.

Some will see these purchases as a complete waste of money, but what’s the point in working hard if you can’t enjoy some of it? The key here is we don’t spend frivolously on all of our purchases, and avoid high monthly bills and debt – but spare no expense on the things that bring us joy or add value to our lives.

How I am saving my high-income salary

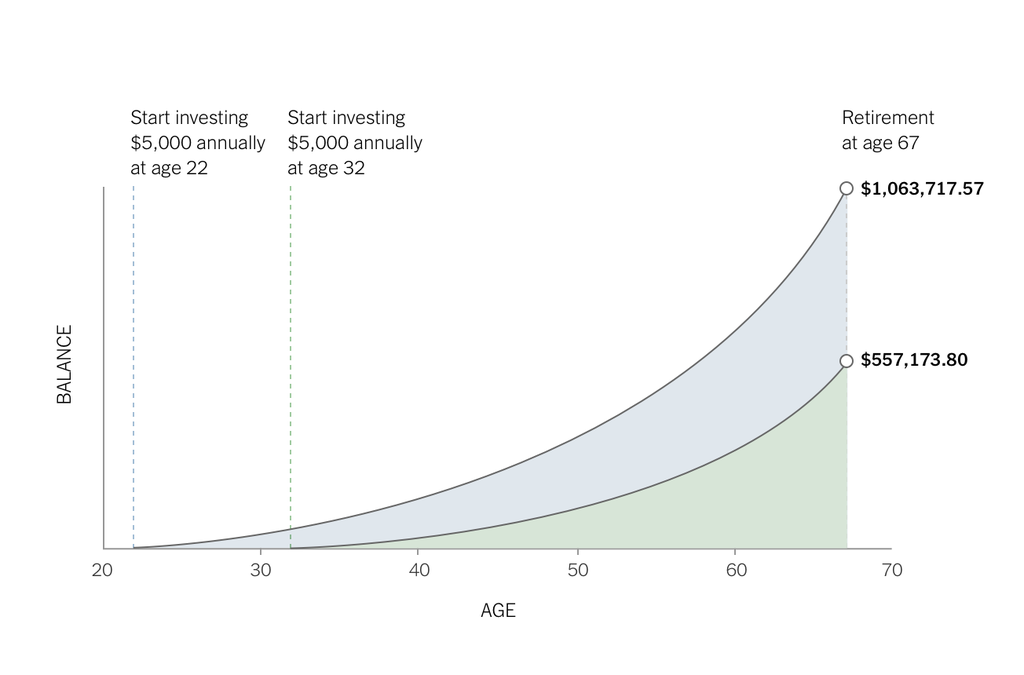

I’m contributing 8% of my salary to my 401k, which allows me to receive a 10% match. And the earlier that you start saving for your retirement, the more you'll have.

Like, by a long shot. Check out this graph from the New York Times that depicts two scenarios. In the first scenario, retirement investments began at 22. In the second, they began 10 years later. The difference between the two at age 67 is substantial and potentially life-changing.

It's never too early (or late) to start investing in long-term retirement accounts.

We’re maxing out our Roth IRAs as well as our HSA. We don’t currently have children, but we do plan to in the future – so we also utilize a 529. The rest of our money goes into a taxable brokerage account.

Staying laser-focused has paid off tremendously for us. We’ve reached CoastFI at age 24! If we never contribute to a retirement account again, at age 65 we’ll over $4 million with average market returns.

That is, assuming we don’t start withdrawing from retirement accounts sooner with early retirement.

Want to see how well you’re progressing towards financial independence? Plug your numbers into the FIRE calculator I built.

5 Lessons Learned from a $100,000 salary

Use these five lessons learned to get the most out of your high salary. Remember that wealth isn't built just through earning big money. We build wealth by being smart with our money.

1: Avoid Lifestyle Inflation (Creep)

Societal expectations are bogus. Ignore what others tell you that you should have and focus on what you need to reach your goals. Depending on your profession, you may feel this more than others.

For example, your vehicle is not a wealth symbol, it’s a machine that needs to get you from point A to point B, that is all.

As my income has grown by over 35k in the past 3 years, I have only marginally increased my cost of living by a few thousand dollars. That has allowed me to save the vast majority of my pay raises. I drive a 7-year-old car with over 100k miles on it that’s worth about $3,000 now.

2: Make Smart Housing Choices

Understanding your living situation and the costs associated with it is very important.

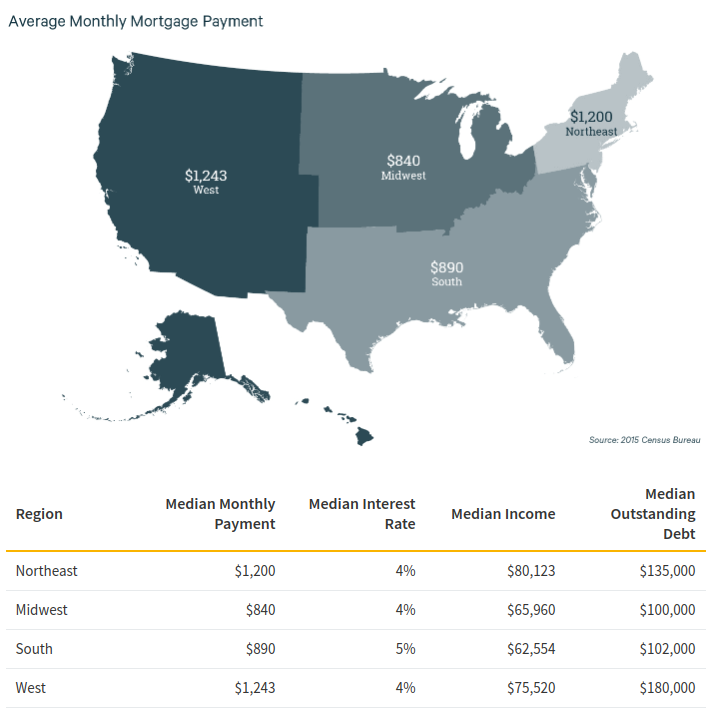

Renting vs. Buying will always be debatable depending on your needs. If you plan on living in one place for a long period of time, buying is almost always cheaper. However, you need to do the math for yourself because this varies drastically based on your location.

Do not assume that the amount a mortgage company approves you for is how much you need to spend or can even afford. Find a happy balance within a reasonable price range that fits your budget.

Also, be aware of how the region of the country might affect how expensive your home is. This picture from Value Penguin clearly shows that certain areas of the country are, on average, more expensive than others.

Our cost of living has gone up since we were living in a tiny apartment in college. However, our mortgage payment is about 60% of what renting a comparable home would cost.

3: Save Early and Often

The sooner you’re able to start piling money away, the faster you’ll be able to get the magic of compound interest to work in your favor. Prioritize and automate your savings and investing strategies. Taking the thought process out of it allows you not to even worry about it.

Set it and forget it.

I was fortunate enough from an early age to understand the importance of saving as much as possible. We paid ourselves first and made it a priority rather than a desire. It’s easy to say you’re going to do something tomorrow, but why not do it today?

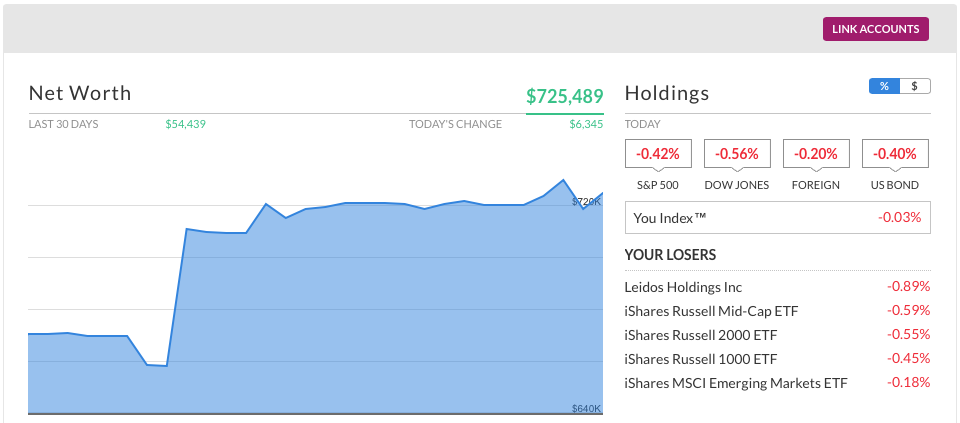

4: Track Your Numbers

The biggest problem I see other people making is comparing themselves to others.

Ignore the noise, focus on your own victories. Continuing to keep yourself motivated and on track is so important. The only comparison you need to worry yourself with is where you were previously with where you are now.

- Net worth: This one is slow to start, but once the compound interest starts to snowball you will see consistent increases.

- Budget: Self-accountability in sticking to a plan is important. If you’re struggling to meet your goals each month, budgeting is critical.

- Eliminate unnecessary expenses: This coincides with budgeting, but as you begin tracking everything begin to identify where you can cut back. Begin to question everything you spend money on each month. Ask yourself – does this non-essential expense add value or bring happiness into my life? If the answer is no, get rid of it! If yes, that's fine too!

- Income: For some, this isn’t as important, especially if you’re established in your career already. But for those who aren’t fully satisfied with their compensation, this is one you’ll love keeping track of. Push yourself further out of your comfort zone, and don’t hesitate to ask for raises. And, change companies to help boost your pay.

- Fees on your investments: Understanding what you’re paying in fees is important. Index funds have been our favorite form of investments because they come with low fees.

And, financial visibility is just so darn important. If you don't have an accurate view of cash flow and where your money is going, along with a strong level of confidence that your net worth is going in the upward direction, then you're doing yourself a disservice.

Personal Capital is one of my favorite tools to use for this, and it's 100% free.

5: Explore Existing Opportunities

Taking advantage of all the benefits my employer offers has been a huge help.

For instance, I’ve been taking full advantage of the $12,500/year in tuition reimbursement – which gets me an almost-free master’s degree. This not only opens up new job opportunities but also gives me more leverage in negotiating a higher salary.

I also receive $250/year towards a gym membership or fitness classes, and every little bit helps!

Identifying ways that you can generate additional income can be huge, especially if you have the additional capacity and desire to do so. Working overtime is likely the easiest way for you to increase your income assuming it’s offered to you.

My personal favorite is starting a side hustle.

I’m leveraging my existing skillset, and earning just as much money per hour as I do at my day job!

I oftentimes step back and ask how I can be providing additional value – or what can I do to discover additional ways to make my company more profitable?

Everything - regardless of how small they seem, can have a ripple effect which adds up over time. These are both great things to add to your performance review, bestowing even more leverage when asking for a raise.

Find ways to differentiate yourself from your peers and your performance reviews will reflect that.

Conclusion

Understand that having a high income doesn’t mean you have to be a high spender. If you work equally as hard at reducing your unnecessary expenses as you did to earn a high income you will begin to build a sturdy financial foundation.

Additionally, earning a high income is not the only way to make traction on your journey.

If you’re new to the concepts of FIRE (financial independence retire early), check out this FIRE Guide.

“It’s not your salary that makes you rich, it’s your spending habits.” – Charles Jaffe