Who Does it Best? Money Management By Generation (Warning: This might hurt)

You've heard it before. I know you have: “Millennials are lazy snowflakes that’ll never move out of mom’s basement… They can’t handle money! Us Boomers are leaving them the keys to the castle and they’re ruining the world!”

…Or…

“Millennials will be the best generation since the greatest generation! No group has done more - with less - than us!!" No matter your opinion on the matter - It’s wrong! Or at least that’s what the other side would have you believe.

I’m done with hearing that argument…

If only there were some way to settle this argument… (we’ll get back to this)

Whether it’s politics, your absolute favorite sports team, or the generation you were born into, we are so blind to alternative viewpoints, even (sometimes) in spite of overwhelming data. You’ve got your candidate, club, and peer age group and no matter what someone representing a different group might say - your (_______) is the best and you’ll hear it no other way!

Think you’re above it? That you have an elevated viewpoint…?

Trump - Obama - The Yankees - Manchester United - Real Madrid - Alabama Crimson Tide - Boston Red Sox - Notre Dame - Ohio State - Duke Basketball - …Millennials… ? There’s nothing up there you can’t stand? I can keep going. It’s ok - you’ve got company. But that doesn’t make it right.

What are we doing?!?!

Don’t waste your time with theoretical arguments! We’ve got data for that!!

I come to you today to settle one of the more common arguments I’ve overheard the past few years at family gatherings, sporting events, and at random splash pads on Saturday afternoons… Are millennials really lazy snowflakes that will perpetually live in their parents' basement because they can’t handle money? Or are they the best thing since a glass of wine on a peaceful Friday night?? (We can all agree on that, right?).

Here's how I'll settle the argument

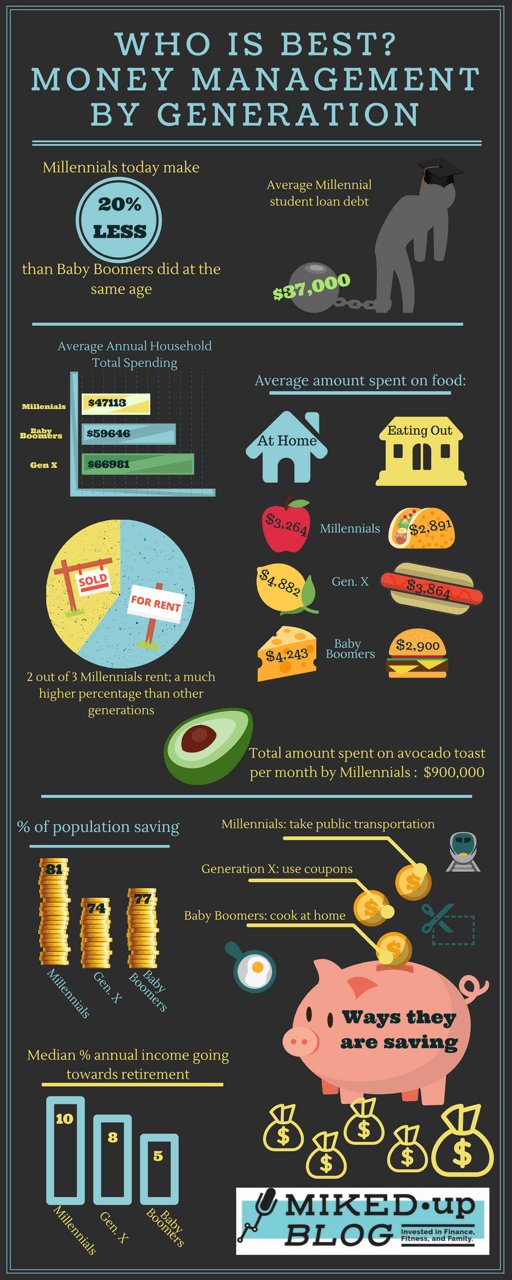

I’m going to deep dive into exactly how millennials handle money as compared with generations that have been around longer (read: are more experienced and should have a better head on their shoulders). I’m examining multiple aspects of saving, spending, and earning to put all the chips on the table and see who comes out ahead. This is gonna’ be awesome! Feel free to reference the below infographic as we move along, but let’s get a few things cleared up before we get started.

I am an unbiased and impartial arbitrator

That’s not entirely true. You should know that I’m a card-carrying millennial. Just got my 32-year chip a few months ago. However - I am a forensic scientist who has to testify as an unbiased expert in court on a regular basis. It’s not the most joyful experience in the world, but I am trained to just analyze the facts... (I’m going to assume you’re sold on this point, as it’s critical to the validity of this competition).

How we’ll decide who wins

I am a former American Football player and we’re going to use football scoring (sorry to my European and very trendy American millennial friends - that includes you, Canadiens). What this means is that we will play a game that is 4-quarters in length (earning, saving for retirement, saving in general, and spending) and we’ll earn points this way:

- 7 Points for a clear victory

- I’ll use my “Independent Arbitrator Hat” to decide how many victories (scoring events) there are in each quarter.

- 3 Points for a marginal victory

- -2 Points (for doing something incredibly stupid when it comes to any aspect of money (I’m lookin’ at us, millennials - I’m sure we’ve done something stupid)

At the end of the match ? we’ll tally up the score and ultimately decide which generation (i.e. Baby Boomers, Gen X’ers, or Millennials) is best at handling all aspects of money! No more arguments at Thanksgiving, fist fights at your kid’s soccer games (sorry - “football”), or disappointed stares from your grandfather as he looks at “all you’ve done with your life” while he ponders his sacrifices in Vietnam. I’m drunk with all of this power and I’m not gonna lie - feels good.

Let’s tee it up for kickoff!!

Because of how the data have been reported this game will be played as Millennials vs. “The Field” (Boomers and X’ers combined). Millennials are classified for the purposes of this “study” - ages 18-34 Generation X - ages 35-54 Baby Boomers - ages 55+.

First Quarter - Who does a better job of earning money?

Well, The Field is out strong with an undeniable lead here. For starters, Millennials have earned 20% less than their same-aged counterparts did in 1989 ($40.5k and $50.9k, respectively).

And they didn’t stop from pouring it on. This is not shown above, but The Field had also procured about double the amount of assets (in 1989) as compared with us current avocado eatin’ folk (that’s slang for: Millennial). 7-Points to The Field (M : 0 - TF : 7)

Excuses for why this was a loss for Millennials

Where to start… Oh, I got it! Student loans! The average Millennial is saddled with $37,000 in student loan debt before they truly enter the workforce. That has more of an effect on earning potential than you may realize. I’ll speak from experience.

When I was finishing my master’s degree in the heart of the recession, my wife was just starting out in her graduate school path (4-year program). I didn’t have the luxury of waiting for the perfect job to come along. I needed “a job” and I needed it quickly.

That desperation forced me to take a position earning $37k annually when my skills and experience could’ve seen 50% more. And I was happy to do it because that job meant that we’d have health insurance and that we’d be able to pay rent and eat while my wife was in school. Many of my peers in graduate school weren’t as "lucky”.

Excuse #2 - Your initial starting salary says more about your eventual earning potential than most other factors

Let’s lay out a scenario. You walk into a job interview with desperation at your back and the need to earn an income, health insurance, or some other benefit. You go through the interview process, check all the boxes, impress the hiring manager, and are offered a starting salary of $40k/year.

Person 1 is thrilled to have an offer in hand and blindly accepts after the 24-hour “sleep on it” period.

Person 2 doesn’t feel the desperate need for a job. Perhaps they don’t have student loans hanging over their head or they have a working spouse. Whatever the case, they’ve got other options and aren’t afraid to explore them. Person 2 says $40k is no good and that she’ll need $45k to take the position. The Company, thrilled to bring on such a qualified candidate happily goes up to $45k/year.

What’s the difference over 30-years?

I’m going to make an ass out of you and me - and assume that Persons 1 and 2 will earn 3% raises over the next 30 years. Here’s how it looks over the 30 years:

Not too bad, right?

In year 30, Person 1 will be bringing in $97,090.5/year. Not quite at that 6-figure mark, but nothing to shake a stick at either. But when you look at Person 2 earning $109,226.81/annually in year 30, Person 1 starts developing the stink-eye toward Person 2.

And then when I tell you that by asking for the extra $5k up front, Person 2 earned a total of $250,013.39 more during their career when compared with Person 1 ($2.25 million vs. $2 million) - now we’re back to the fist-fight at your kid's soccer match.

The point

Starting salary matters. And if there’s additional pressure to take a job, any job out of school, that can drive down an individual’s total earning power over their career.

Second Quarter - Who does a better job of saving in general?

The Millennials are earning some ground back at the start of Q2, when we see that 82% of millennials are saving some money - any money - in some way.

Comparing that with 74% of Gen-X and 77% of Boomers, the avocado’s tasting a little... gooey-er (what does avocado actually taste like? I have no idea - but Millennials are gaining ground).

Then we dive deeper and find that 35% of Millennials saved more in 2017 than the previous year. Compare that with 25% of Gen-X and 22% of Boomers, and the money-saving habits of Millennials are showing positive momentum. 3-Points to the Millennials (M : 3 - TF : 7) .

I’m awarding a field goal (3 Points) here because as Boomers reach a retirement age, it’s understandable that they may be currently saving less.

25% of American’s aren’t saving a dime… (WHAT!?!?)

Let’s break that down by generation… 61% of Millennials reported having more money in savings than in credit card debt. And although the research didn’t put a number on it, Boomers are more likely to have more saved than in credit card debt as well (which makes sense as that generation is at or near retirement age). Our Gen-X friends can’t say the same.

More than half of Gen-X participants reported having a higher $ sum in credit card debt than $ in savings. Not good, friends. 3-Points to the Millennials (M : 6 - TF : 7)

Before we get to excuses for Gen-X’ers, let’s look deeper at some habits

67% of Millennials report the act of saving for some specific goal, which is more often than Gen-X and Boomers (56% and 49%, respectively). Goals are important (you’re welcome, friends to the north)

Have you heard the expression, “What gets measured, gets results”? Essentially what that means is that what you focus on is what will produce a higher return on investment (ROI) for you. And you don’t know what to focus on if you don’t have an overarching goal. Goals = Important

Excuses for Gen-X not having saved as much

As Millennials were coming of age during the Great Recession, you Gen-X’ers were in the heart of your career/high-earning stage. And while we found it difficult just to get started, many of you were either set back or, at a minimum, stuck in place earning-wise.

Then as the recession moved onward, your bills, mortgage, and loans still required payments. It didn’t take long for the growing proportion of expenses to overcome your stagnant salary. And if you’re not hyper-diligent and resourceful during times like that, saving money - any money - can be incredibly difficult. You all had a raw deal with that… And that’s why I’ve issued field goals (3-points) rather than touchdowns (7-points) above.

Third Quarter - Who does a better job at saving for retirement?

Are you familiar with Bill Belichick?

He’s the current coach of the New England Patriots and arguably the best (American) football coach of all time (anyone that’s interested, we can have that argument in a different post). One of the reasons why Belichick is the best is because of his ability to make half-time adjustments with his teams and come out much stronger in the second half.

That’s exactly what Millennials have done here. Head’s up - The Field

In sheer percentage of income going toward retirement (for working individuals only), Millennials (10%) outpace Gen-X (8%) and Boomers (5%).

Let’s go back to scenario land. If each generation started their careers over again at age 23, earned an annual 3% raise every year (based off of a $75k starting salary), assumed a 7% rate of return, and only varied their savings rates (as shown above)… Here’s how it looks at age 67:

- Millennials - $2.771 million

- Gen-X - $2.217 million

- Boomers - $1.307 million

Woah! 7-Points to the Millennials (M : 13 - TF : 7). Think savings rate is insignificant...? Didn’t think so.

Some interesting facts:

Parents in all generations save more for retirement than families without kids

Despite the added costs of having and raising kids, more parents are saving something for retirement (84%) than non-parents (69%). But don’t worry, Millennials, I found a way to turn this sub-category into an additional scoring event.

When we look at what percentage of parents in each generation are saving over 15% toward retirement...

A higher percentage of Millennial parents (38%) save more than 15% of income toward retirement than Gen-X'ers (24%) or Boomers (23%). And when asked if parents contribute more than 10% of their income toward retirement, nearly half of Millennials (45%) responded ‘yes’. 3-Points to the Millennials (M : 16 - TF : 7).

When we look at who isn’t saving toward retirement at all (0% savings), only 7% of Millennials and 8% of Gen-X’ers admitted no savings, while 18% of Boomers raised their hands.

Excuses for Boomers weak retirement savings strategies

I know the surveys looked only at working Boomers, but these folks are much closer to retirement age and may be scaling back the annual amount contributed toward retirement. That’s a conceivable scenario. They’re just much closer to the finish line.

Excuses for Gen-X’ers weak retirement savings strategies

The main excuse here would have to be difficult financial situations resulting from the Great Recession. High debt levels coupled with stagnant wages or even layoffs could’ve lent to an inability to focus on retirement planning.

But Millennials are playing on the same field (are starting families, buying assets (just not as many), growing their careers, etc.). Somebody help me out in the comments because all I can come up with for these differences are bad habits, an inability to successfully adapt, and a lack of focus…?

Fourth Quarter - Who does a better job at controlling their spending?

The. Rout. Is. On… Maybe our foes have lost a step in their more advanced age…? When looking at the sheer numbers, Millennials spend about 79% of what Boomers do and about 70% of what Gen-X’ers typically spend. 7-Points to the Millennials (M : 23 - TF : 7).

But let’s not be too quick to judge. We’ll break it down and see how these differences manifest themselves

Of the categories examined (housing, clothing, eating out, food at home, entertainment, and miscellaneous spending), Millennials spent the least amount in every single one…

We can start with housing and go from there

The annual average spent on housing for Millennials ($16,505) is 90% of what Boomers spend ($18,320) and … only 75% of what Gen-X’ers typically shell out ($21,954). One way that Millennials have saved on short-term housing costs is by renting (67% of Millennials), which is a much higher percentage than either of their foes (in this battle).

Another spending category with a big difference is the amount spent on food at home

$3,264 annually for Millennials represents 67% of Gen-X’ers ($4,882) and 77% of Boomers ($4,243). I wonder what impact this may have on potential health benefits… (maybe the next infographic?)

So Millennials must spend much more when eating out, then?

Not so fast! Although Millennials come in only $9 under Boomers, annually - that’s still under. Also, we must find inexpensive avocados while eating out, because Millennials spend 75% of what Gen-X’ers do on food outside of the house. That same trend continues for the remaining categories...

The Field is out of excuses, so here are some fun facts!

Each generation is getting an ‘A’ for effort! Here are the unique things each generation does to try and spend less:

- Generation X-er’s agree with my take that coupons aren’t dead, as they’re making good use of the ‘coups’ to cut on spending.

- Boomers have decided that their cooking is far superior to any of those chain restaurants. They’d rather eat at home to save cash.

- Millennials are exploring via public transportation. Sell the car, cancel the insurance, don’t pay for the gas - just get a metro ticket and we’re good to go!

This game has turned into a thrashing

BUT - There’s one thing I can’t stand about a team that has a win sewn up with time still left on the clock. And that’s undisciplined play. Getting complacent- lackadaisical (thank you, spellcheck). As our strength coach used to sayYELL - FINISH THROUGH THE WHISTLE!!! Well, it pains me to write this but Millennials spend $900,000 -a-month on avocado toast… Yeah… It’s not a typo… Safety (-2-Points to the Millennials…) Sad. Final Score - (M : 21 - TF : 7).

Post game wrap up

First things first, I had a blast working on this project. It’s been awesome to try and uncover these trends and ultimately force you to go back to fighting about politics with your respective families at the Thanksgiving table. You’re welcome. Because it’s unequivocally decided that Millennials are far superior at handling money.