Your 5-step guide to a "privileged" early retirement for lucky people

In my FAQ, you learned that I didn't exactly have to struggle much in my life. I was raised in a loving and supportive family. I had my college funded by my parents. They helped me through life every step of the way.

In other words, I didn't exactly struggle to figure things out, or build myself up from nothing, or overcome major adversities to get to where we are today. I was just a relatively normal kid living in suburbia in a family that wasn't "rich", but definitely had more than enough resources to live a comfortable life.

Though I definitely admit that these advantages ("privileges"?) helped in my ability to quit the rat race early and retire in my 30's, they don't automatically hand you a lifetime of success and jelly beans on a silver platter. People like me still need to work - and work hard, to achieve our goals.

We might not work as hard as others, but that doesn't mean we don't have our own version of struggle. It's a different kind of struggle. With a softer landing if we fail.

Okay okay, a much softer landing.

Your Guide to a "Privileged" Early Retirement

First, a couple of assumptions about what "privileged" actually means:

- You aren't super wealthy, and neither is your family; meaning, your family's net worth isn't $50m, and they didn't buy you a Porsche for your 21st birthday, live in a $15m mansion and wipe their asses with $100 bills.

- You're still forced to work in order to build enough wealth to retire early; you had a stable and loving childhood, but YOU are still the one working to build up your own wealth; no trust fund for you!

- You make decent money, more than enough to provide for your basic needs as a human being; you can (and do) save at least a little cash, and you're working in an industry that pays well and with good job prospects

Early retirement for the "privileged" looks remarkably the same as early retirement for the underprivileged, with a couple key differences:

First, we have a lot more resources to play with, and mistakes aren't quite as devastating. Meaning, if we lose $10,000 in a bad investment, it might not be the end of the world. However, for those who aren't in the same financial or life position, those mistakes mean way more.

We can afford to have a stronger risk tolerance.

And second, our time horizon could be much shorter. My wife and I pulled down more than $200,000 in our last year of working full-time jobs, and saving 70% of what we made adds up incredibly quickly. Clearly, making a boat-load of money makes early retirement quicker.

However - your time horizon depends entirely on what early retirement will look like to you. If you're a FatFIRE family, then you'll probably work longer in order to accumulate more wealth to live the lifestyle that you want.

My wife and I chose LeanFIRE, which meant we could escape the wretched demands of corporate America in our mid-30's without working a second longer than we needed.

If you're one of those lucky souls who grew up in a stable and nurturing family, make good money and haven't really had to struggle much in your life, here's your genius-level 5-step guide to achieving this goal that everybody assumes will be super easy for you.

Step 1: Acknowledge your badass life

If you haven't had to struggle much in your life, don't be a jerk and ignore it. I've found that it helps to normalize our expectations when we acknowledge to ourselves (as well as to others) how fortunate we are to have been born into a warm and loving family with a solid support structure and active/involved parents.

It also helps us to realize the world isn't always as rosy as it has been for us. Though we've worked hard for our success, other people have worked harder for the same success.

Our story:

Both my wife and I were born into loving and supportive families, which has been a huge help in getting to where we are today. We don’t represent your typical “rags to riches” story. I never had to worry about my next meal. I’ve enjoyed relatively good health. And, I freely admit that this fortune helped me tremendously.

Courtney’s family went through bankruptcy when she was younger. Her dad spent several years working overseas to build his family back up from disaster to achieve remarkable success through incredibly hard work, sacrifice and determination. We’ve both seen first hand how truly life-changing hard work can be.

Both of our parents, however, came from very modest backgrounds. My dad worked his way up through the military by earning two masters degrees and joining the private sector in the 90s.

And, he’s one of the hardest workers I’ve ever met.

Step 2: Don't confuse income with wealth

You make a lot of money. Good for you. It's definitely awesome bringing home a lot of cash, but all that cash also has a way of lulling us "privileged" folks into a false sense of security if we don't use it right. Vacation homes, expensive dinners, big homes and shopping for designer veggies in costly grocery stores all help to diminish our ability to build serious wealth.

When we think we're rich, bad things start to happen.

And, make no mistake about it: A high income does not magically set us up for early retirement. However! A high income, when used in a smart way, can.

If you earn $200,000 a year but spend $150,000 a year, not only are you not saving much, but you're building a lifestyle of dependence...dependence on a high paying job just to fund the lifestyle choices that you're making.

That won't do us any favors, and your "privileged" status might as well not exist if your goal is early retirement. Readers of the incredibly popular book The Millionaire Next Door (<-- affiliate link!) know exactly what I'm talking about.

Don't fall into the same trap that I did, assuming that to be successful, we also need to look successful. We don't. Millionaires are all around us, and most of them shop at regular stores, drive normal cars and live in modest homes. I wish I had understood that earlier in life.

Step 3: Don't just save. Invest

Here is the thing about saving money: Saving money has little to do with getting rich. It's such a small component of the larger picture of building wealth that it's just one of those assumed techniques that everybody uses to build wealth.

Hardly even worth mentioning.

Of course, spending money is a one-way street to becoming poor (aside from smart investments, of course). If you aren't spending money, you might be saving. Okay, good. Saving is good, but saving money doesn't build serious wealth.

The act of saving money won’t, in and of itself, make anyone rich.

Ordering water instead of soda or beer at restaurants might save you a few hundred over the course of a year. But let’s face it: A few hundred isn’t life-changing money. Those extra benjamins (alone) have no business convincing you to hang up your hat in corporate America.

If ordering water was the easy button to achieving early retirement, we’d all be retired early and sipping margaritas in paradise (after finishing our glass of water, of course!).

Sadly, compound interest doesn’t materialize out of thin air. And, the art of compounding is what makes early retirement a reality for most of us.

Early retirement is enabled by household wealth built through consistent smart financial choices that have compounded over the years.

How much money you have, rather than how much you save. That’s the delicious cream filling that, when enjoyed between two layers of decadent cookies or sweet bread, makes for a damn good dessert.

Or heck, how about gravy over some piping hot mashed potatoes?

You know what I’m talking about…buttery taters lovingly mashed into creamy perfection, sprinkled with a little salt and a pinch of pepper.

Saving is not the magic sauce to early retirement. There is nothing wrong with it, though!

It is true that saving money does not lead to wealth. That said, there’s nothing wrong with saving some cash by changing up your spending habits you developed over the years that probably resulted in wholesale hemorrhaging of your precious greenbacks from your wallet. Don’t get me wrong, saving money is great. It’s wonderful. It all helps.

It’s just not the magic sauce to early retirement.

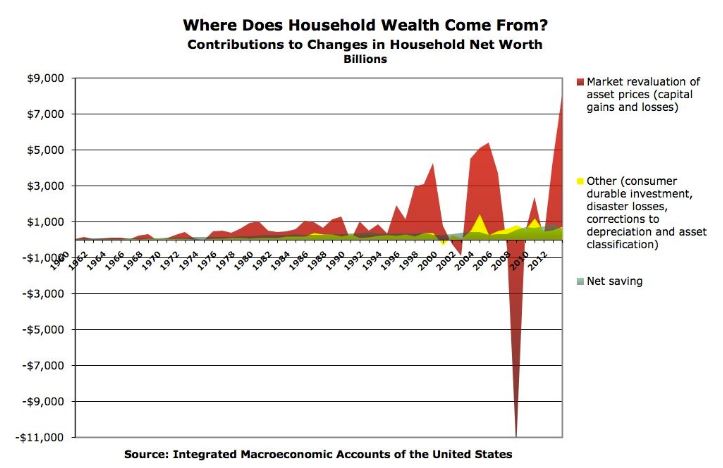

Wealth comes from a very different source: Investments. Here, take a look at a pretty graph that puts in chart form what little effect saving money has over your household wealth. I warn you, however, that there are a bunch of sleep-inducing financial buzzwords that permeate that post. You know, things like “market revaluation” and “consumer durable investments”.

It’s not about how much money we have. Wealth is a direct byproduct of what we do with that money. It’s THIS that enables early retirement.

Keep your savings in a Ziplock baggy under your mattress and you won’t prepare yourself for anything beyond the apocalypse. And even then, I doubt your local merchant will be around anyway to accept your cash for a loaf of bread because their credit card processing machine was destroyed in the nuclear blast that annihilated most of humanity.

Come on, now. Let’s be real.

The nice thing is you don’t need to be the most frugal person on your block. You don’t have to start and sell a company for millions of dollars. Hell, you can even order a Pepsi at restaurants every time you go – if that’s what makes you happy. None of that shit matters as much as one very simple, yet profoundly important, question:

What is your money’s purpose?

Step 4: Give your money a reason for living

By now, we understand that for us "privileged" folks who want to retire early, making a ton of money won't do it. It helps, but this early retirement thing isn't automatic, either. It takes time.

Dedication, too.

We also know that saving money alone won't amass the fortune that we'll need to quit the rat race early. Again, saving money instead of spending it IS good, but just "saving money" isn't quite the answer, either.

How do we build enough wealth to retire early? We give our money a reason for living.

I like to think the equation that solves the early retirement riddle is actually quite simple: Your money’s purpose + Your motivation = Your chances at giving corporate [Insert Your Country Here] the middle finger.

Invested money has a purpose, and the more money that you have to invest, the easier this equation becomes. And, the quicker you’ll be sipping a Sex On The Beach while…having sex on the beach? Okay, at least sitting on it.

How do we give our money a reason for living?

Know where your money is going – You can’t begin to un-screw your financial situation until you realize where your money is going. Budgets can help, but frankly, your bank statement is all you really need to determine where your money is going and, importantly, whether your spending is setting you up to meet, or fail, at your financial goals.

Show me a man’s bank statement, and I’ll tell you what he values.

For example, those damn automated monthly payments for services that you may no longer use are killers. They were for us. Because you don’t have to lift a finger to make those payments, you quickly forget that you’re making them. Bank statements help. Just look at ’em. Can you justify it all?

Give a shit about your future – More critical than most people realize, you need to care about what happens to your future self. Yes, we all want to be “successful”, but what does that mean? Do you actively want to retire early, or are you content with working through the traditional lifespan of a typical worker in our society? In 20 years, do you see yourself living in the same house? Working the same job? Driving the same car? What will change?

For the record, it’s okay if you have no interest in retiring early. But, knowing exactly what you want out of life – whatever that happens to be – will guide your money’s purpose.

Invest – If your company matches 401k contributions, at least contribute that amount. Remember, 401ks are pre-tax money, which means not only is your company shoveling you cold hard cash, but you’re lowering your tax burden by a dollar-for-dollar contribution into your 401k account.

Brokerage accounts work, too. We like Targeted Retirement investment accounts and have heavily utilized their automatic diversification strategy so we don’t have to worry about all that. Seriously, we just throw money into our brokerage account and literally forget it. There’s no secret sauce to getting rich in the market. Besides time. You gotta give it time.

Persistence – Early retirement is easy, but it’s not quick. It takes time, just like most goals worth striving toward. Avoid the rookie mistake of expecting 20% capital gains in the first year of investing your dough. It doesn’t happen that way, even in today’s outrageously lucrative market.

Your life’s purpose takes time, just like your money’s. Don’t expect miracles with your money. Reality doesn’t work that way. Budget and invest. Then, stick with it. I mean stick the hell with it. Keep throwing those greenbacks into your investment accounts. Month after month. Year after year.

Step 5: Persistence wins the game

The previous four steps won't do much good if you lose your motivation and quit building wealth six months after you start because things just got too boring.

If you revert back to spending the majority of what you earn, nobody's retiring early.

Starting is great. We can't get to the finish line if we never start. But, we also aren't getting to the finish line if we stop midway through, either. Keep yourself motivated by breaking down your goals into smaller components that are relatively easy to achieve.

Then, achieve each smaller goal.

And, reward yourself along the way. These rewards shouldn't cost a lot of money, of course. A $10,000 vacation to Fiji isn't the best reward if your goal is to retire early. But, picking up tickets for opening day at the ballpark might be.

It's okay to spend money on your rewards, but make sure those rewards aren't setting you back in your goals. And, don't cheat your reward system by rewarding yourself every damn week.

Cheating your goals means you're cheating yourself. Or your family.

Don't cheat.

That's it! These five steps are the crucial elements to achieving your financial goals, whatever they happen to be. If you were fortunate enough to have loving and supportive parents and a support structure so solid that even Chuck Norris couldn't break through it, good for you! It's great to be in that position.

But, that advantage also doesn't automatically mean that we'll make the right decisions for our future goals. We have a way of kidding ourselves about our lives, especially when we're pulling in a lot of money. It's a recipe that sets many of us up for failure.

A high-cost failure.

Do you consider yourself "privileged"? If so, have you found yourself too complacent in your life, assuming that good things will magically come your way?