Viva Payday Loans Review 2026: Is It a Legit Option?

Wondering if Viva Payday Loans is legit? Read our 2026 review covering loan terms, approval process, costs, and safer alternatives before you apply.

Disclaimer: Viva Payday Loans is a loan-matching platform, not a direct lender. Loan terms, interest rates, and approval decisions vary by lender and state regulations. Borrowers should carefully review all terms before agreeing to any loan offer. This article is for informational purposes only and not financial advice.

When an unexpected expense hits, like a car repair or medical bill, it’s tempting to look for fast cash online, especially if your budget is already tight as is. One name that often appears in searches is Viva Payday Loans.

But is it legit, or just another payday loan trap? In this detailed 2026 review, we’ll break down how Viva Payday Loans works, who it’s for, the potential costs, and whether it’s worth using, or if you should consider safer alternatives instead. We’ve done the research, so you don’t have to.

What Is Viva Payday Loans?

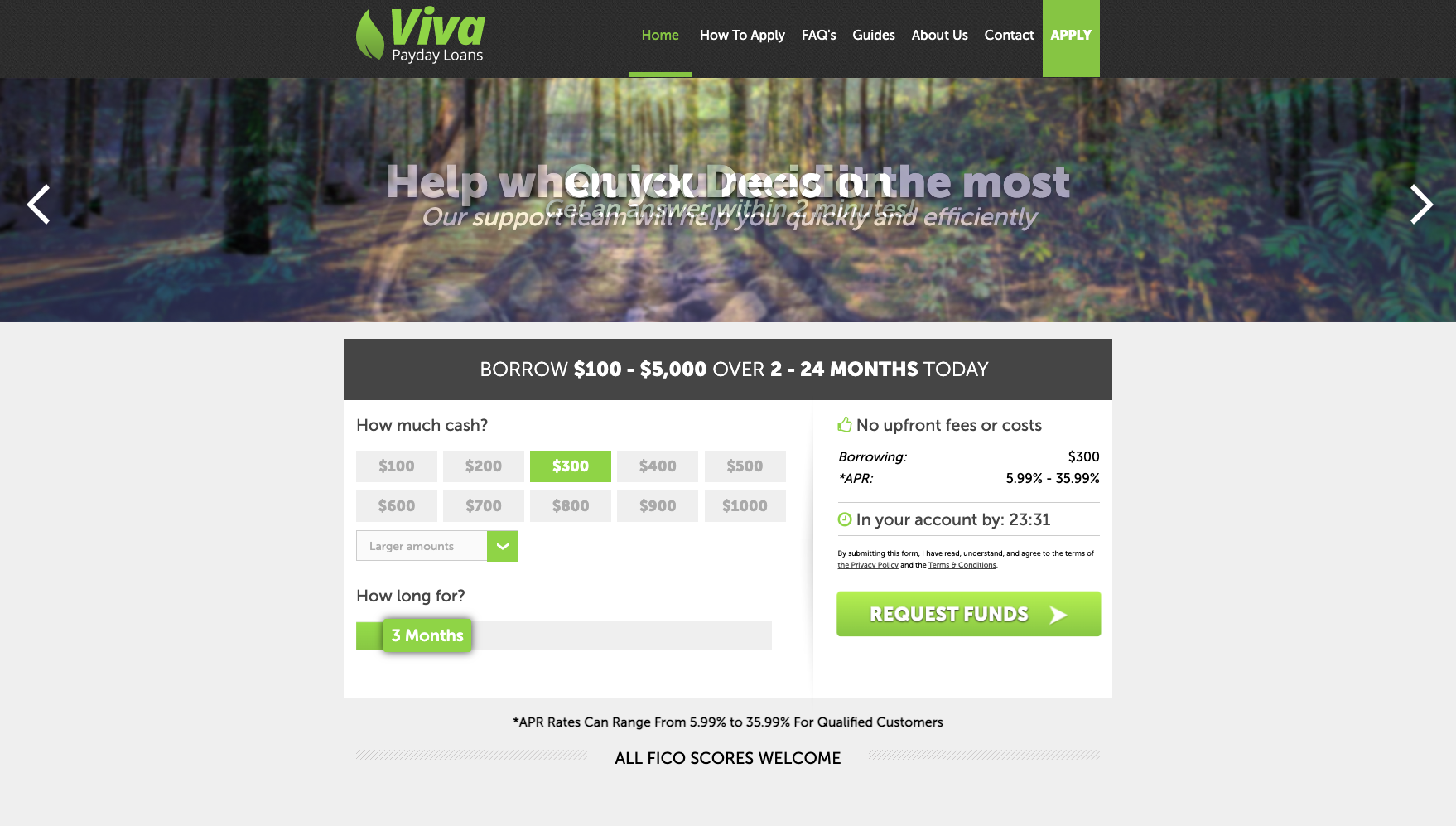

Viva Payday Loans is an online loan-matching platform, not a direct lender. It connects borrowers to a network of third-party lenders offering short-term loans, usually between $100 and $5,000, with repayment terms from 2 to 24 months.

The company markets itself as a fast, accessible option for people with bad or limited credit, claiming near-instant decisions and same-day or next-day funding once approved.

Unlike traditional banks, Viva doesn’t directly fund or underwrite loans. Instead, it passes your application details to potential lenders, who then decide whether to approve and what rates to offer.

How Viva Payday Loans Works

The application process is fully online and takes only a few minutes. Here’s what to expect:

- Choose a loan amount: Typically between $100 and $5,000.

- Fill out your details: Include income, employment, and banking info.

- Match with a lender: Viva submits your request to its network of lenders.

- Review your offer: You’ll see the lender’s rate, term, and repayment plan before accepting.

- Receive funds: Once accepted, funds can arrive as soon as the same business day.

Basic Eligibility Requirements

- Must be 18 years or older

- Have a steady source of income (usually $1,000+ monthly)

- Hold an active checking account

- Live in a supported U.S. state

Since Viva isn’t the lender, exact requirements vary depending on which lender reviews your application.

Loan Terms, Fees & APRs

Here’s what most borrowers can expect when using Viva Payday Loans’ network:

| Feature | Details |

|---|---|

| Loan Amounts | $100 – $5,000 |

| Loan Terms | 2 – 24 months |

| APR Range | 5.99% – 35.99% (varies by lender) |

| Funding Speed | Same-day or next-day possible |

| Fees | No upfront fee from Viva; lender fees may apply |

| Credit Check | Soft or hard pull depends on lender |

While the headline APRs seem reasonable, remember these are averages; some payday or installment lenders may charge more based on your credit, state, and income.

Example: A $5,000 loan over 48 months at 8% APR would result in about $131.67 monthly payments and total repayment around $6,320.

Always read your lender’s contract carefully before accepting! Terms differ across Viva’s network.

💸 Fast & Easy Personal Loans! 💸

Need extra cash for life’s big moments? With Evergreen Personal Loans, enjoy quick approvals, competitive rates, and no hassle. It’s the smarter way to fund your goals today!

No hidden fees. Flexible terms. Get the funds you need, when you need them.

Pros and Cons of Viva Payday Loans

Is Viva Payday Loans Legit or a Scam?

Viva Payday Loans appears to be a legitimate loan connection service, not a scam. It’s mentioned by financial review sites like Financer.com and GlobeNewswire as a valid broker that partners with licensed lenders.

However, it’s important to distinguish Viva Payday Loans from Viva Finance Inc., a completely separate company.

That said, borrow cautiously:

- Viva itself doesn’t set loan terms; its partners do.

- Some partner lenders may charge high interest or origination fees.

- Always confirm your lender’s state licensing and review their repayment policy before agreeing.

On Trustpilot, Viva Payday Loans currently has limited reviews, 1 to be exact, with it being a negative user experience.

“Get your details then send you to other companies then send another 10 messages saying congratulation and offers more a salute scammers steer clear. Need to treat their client with more respect or leave them alone do not trust this company steal your info goodness knows what they do with it.”

Viva Payday Loans vs. Cash Advance Apps

If you’re considering Viva Payday Loans for emergency cash, compare it with popular payday cash advance alternatives below:

| Service | Loan Amount | Turnaround Time | Credit Check | Cost |

|---|---|---|---|---|

| Viva Payday Loans | $100 – $5,000 | Same or next day | Varies | 5.99%–35.99% APR |

| Brigit | Up to $250 | Instant | No | $9.99/mo |

| EarnIn | Up to $100/day | Instant | No | Optional tip |

| Dave | Up to $500 | Same day | No | $1.99–$9.99 |

| MoneyLion | Up to $500 | Same day | Soft | $0–$19.99/mo |

If you need just $50–$250 to bridge the gap to payday, a cash advance app might be more affordable.

If you need larger amounts ($1,000+), Viva’s lenders could be an option, just watch for high interest, because it can quickly put you into a financial hole.

Get Paid for Playing Games on Scrambly

Scrambly lets you earn real cash just for playing games, testing apps, and completing simple tasks. Withdraw your earnings easily through PayPal — it’s fast, fun, and free to join.

Start Earning with ScramblyFree • Fun • Real Cash Rewards

Our Take: When to Use Viva Payday Loans vs. When to Avoid

Use Viva Payday Loans only for short-term, unavoidable emergencies, like:

- Unexpected medical bills

- Urgent car repairs

- Avoiding utility shutoffs or eviction

Avoid it for:

- Regular monthly bills

- Long-term financial problems

- Debt consolidation

Whenever possible, explore lower-cost alternatives like:

- Credit union personal loans

- 0% APR credit cards

- Employer paycheck advances

- Budgeting and savings apps

Payday loans should be a last resort, not a recurring habit.

The Bottom Line

Viva Payday Loans provides a fast, accessible way to find short-term financing, even with bad credit. For borrowers who understand the costs and repay on time, it can be a useful emergency bridge.

However, if you’re looking for a long-term solution or want to save on interest, cash advance apps or credit union loans are often safer, cheaper choices.

Always read the fine print, compare offers, and borrow responsibly.

FAQs

1. Is Viva Payday Loans legit?

Yes, Viva Payday Loans is a legitimate broker connecting users with licensed short-term lenders. However, always review the lender’s credentials before signing any loan agreement.

2. Does Viva Payday Loans run a credit check?

It depends on the lender. Some perform soft credit checks that don’t affect your score, while others may run hard inquiries.

3. How fast can I get my funds?

Approved borrowers may receive funds as soon as the same business day, though timing depends on your bank and the lender.

4. Can I get a loan with bad credit?

Yes, Viva works with lenders who consider applicants with poor or limited credit history. But expect higher interest rates.

5. What states does Viva Payday Loans operate in?

Availability varies by state. Viva Payday Loans restricts access in states with strict payday lending laws; check eligibility before applying.

Explore Related Guides

Hand-picked reads to help you understand payday loans and cash advance options.