What $100 in today's money could have bought you in 1920

Inflation. It's one of those phenomena that, like taxes, we can always count on being there. It's good like that, and although it ebbs and flows, it never seems to stop.

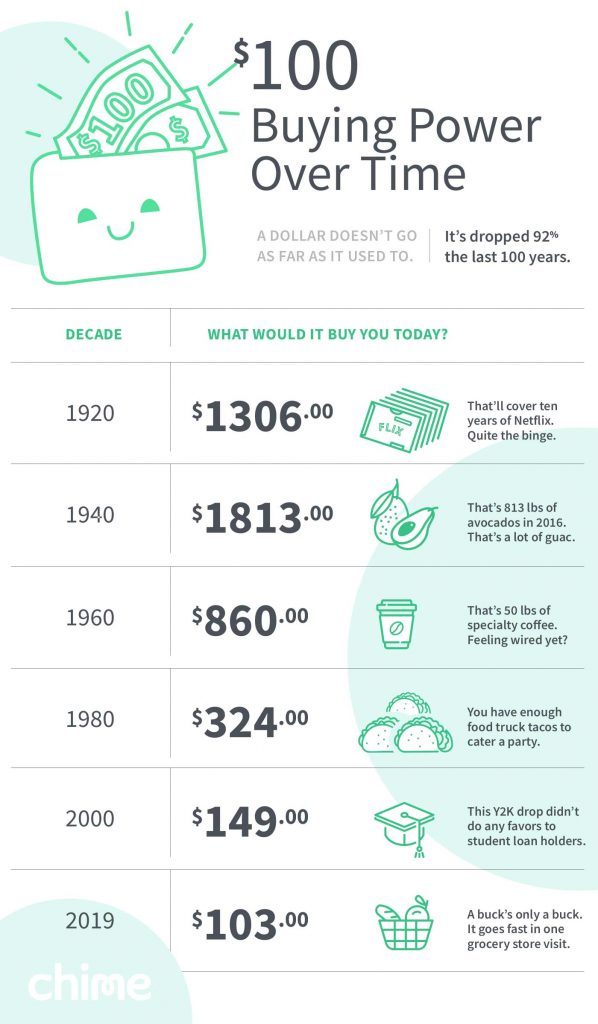

I stumbled on this infographic from Chime, and it got me thinking about how much that $100 bill in my wallet was worth a hundred years ago.

But, who am I kidding...there's no $100 bill in my wallet. I no longer roll that way.

[Quick check] Okay, there's a $20 and a $10. That's it. Uh huh....

The question, though, still stands. How much is $100 in today's money worth going back into history?

$100 buying power over time

Notice the spike around 1940 (thanks Depression!), then the more normalized recovery of the dollar as we get closer to today.

So, let's see. In 1920, $1300 was quite the chunk of change. Think about the gallons of gas or cans of beer that could have been snagged with that kind of wealth. Heck, a dude's dress shirt was generally under .75 cents!

Or as Chime suggests, that money could have grabbed you more than a decade of Netflix (assuming no price increases, of course)!

How about all that avocado toast we could have had in the 40s? Driving to the grocery store would have been no big deal for your wallet as gas was around .11 cents a gallon at the time.

In the 1950s, the average home was valued at a little over $7300. Tuition at a lot of state universities was under $1,000.

Before I dropped out of graduate school, I wasted no less than $21,000 for three classes before I got so disillusioned with higher education. This comparison makes me want to cry.

Inflation eats away at our spending power. We all know that.

5 Effortless Methods to Boost Your Income This Week

If you need extra money, you’ve come to the right spot.

Our team has compiled a list of creative ways you can fatten your bank account this week. Certainly, there’s something here that fits your needs.

This is not a long list, so go ahead and start now, but be sure to bookmark this post so you can easily return later. We’ll keep it updated as offers change or expire.

Is it possible to cheat inflation?

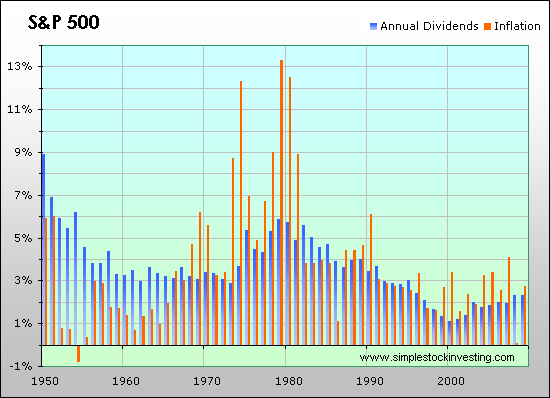

We can’t control inflation, but we can control where we spend and keep our money. Historically, the stock market produces capital gains in excess of inflation, though there have been periods when inflation out-paced the market. Over the long term, the market holds its own.

Believe it or not, not everything is affected by inflation in the same way.

Seriously, it’s true. That computer or mobile device you’re using to read this post costs pennies on the dollar compared to relative technology years ago. As technology advances, things actually get cheaper.

And, that’s not all.

According to U.S. News, for example, housing has matched inflation over the past 17 years, making your dollar today nearly equal to your dollar back in 2000 – when spent on housing. And, your dollar will go even further if you aren’t buying a ridiculously big house, too.

Furniture costs have fallen about 12% since the year 2000, while the cost of your TV is down more than 80%.

Not every job in the gig economy is equal. Here are the best side hustles to consider during your layoff to make the most cash.

A few other items of note since the year 2000:

Large appliances have matched the rate of inflation, while small appliances like toasters and coffee makers have dropped nearly 30%. The cost of clothing has sunk around 8%, new cars around 3% and cameras about 64%.

Food is also cheaper than it’s ever been.

Of course, everything hasn’t fallen in price over the last couple decades. In fact, much of the stuff controlled by the market increases in price over time.

But, that doesn’t mean we can’t control the way we spend our money. Items that we can afford today may climb out of our budget in the future. And, that’s okay. Competition in our economy helps ensure that there are, more times than not, alternatives to the things we may have bought last year.

Inflation does exist, but it doesn’t affect everything equally. As an early retiree, we should pay close attention to how far our money goes and adjust our spending accordingly.

Inflation bites, but it doesn’t have to bite hard.

Smart early retirees don’t spend money on the same ol’ stuff because “that’s what we’ve always done”. Instead, we spend money on things that make the most sense NOW, based on a combination of price and value.

And, the fewer things that we buy in general, the less effect inflation will have on our lives.

Of course, things like homeownership help with inflation due to rising equity in our homes. Stashing our emergency funds in interest-bearing savings or money market accounts, rather than a checking account, can also help our money grow along with inflation.

This helps to prove the importance of investing in appreciating assets, not simply racking up debt because we earn huge amounts of money.

Frequently Asked Questions:

What is inflation and how does it affect our spending power?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It means that over time, the same amount of money will buy you fewer goods and services. This phenomenon impacts everyone, as it decreases the value of currency, making everyday items more expensive and reducing the amount of goods or services you can buy with a fixed amount of money.

Can inflation be "cheated" or mitigated in any way?

While we can't control inflation directly, individuals can mitigate its effects by where they choose to invest or save their money. Investing in the stock market, for example, has historically provided returns that outpace inflation over the long term, preserving or even increasing your purchasing power despite the inflationary trend.

Are all goods and services affected by inflation equally?

No, not all goods and services are affected by inflation in the same way. Technological advancements, for example, have made certain items like computers and mobile devices cheaper over time. Some sectors may see prices that match or even fall below inflation rates, such as furniture, TVs, and certain appliances, due to improvements in efficiency and production.

How has inflation affected housing and other specific categories since the year 2000?

Since the year 2000, housing costs have largely kept pace with inflation, making the value of a dollar spent on housing relatively stable over this period. Other categories, such as large appliances, have matched inflation rates, while costs for items like small appliances, clothing, and TVs have actually decreased, making them more affordable relative to overall inflation.

What strategies can early retirees use to combat the effects of inflation?

Early retirees can combat inflation by adjusting their spending to focus on items that offer the best combination of price and value, and by investing in appreciating assets like real estate or the stock market. Reducing general consumption can also lessen inflation's impact. Additionally, keeping emergency funds in interest-bearing accounts rather than low-yield checking accounts can help savings grow in line with or exceed inflation rates, preserving the fund's real value over time.