What can you learn in 10 minutes that'll be useful for the rest of your life

I am a sucker for simplicity. Throughout my life, I've very often chosen the easier way to get by. Less work. Less stress. But, there's one thing I always focused on through this process.

I focused on learning as much as I possibly could.

Because if I'm going to put in the effort at all, I want maximum reward for that time spent. It's the economist in me showing itself once again.

And, my natural tendency to prioritize simplicity helps me to focus more directly on stuff that actually matters. The quick and dirty shit that generates the biggest reward for relatively simple effort.

In this post, I'm giving you a little of what I've learned during that process over the previous 37 years of my life. This stuff is both powerful and simple.

And, it doesn't take all that long to learn.

Ready?

Life-long lessons learned in 10 minutes

People don't get rich by saving money; they get rich by investing

Saving money has little to do with getting rich. It's counter-intuitive, I know. But, it's not "saving money" that builds wealth.

There’s nothing wrong with saving some cash by changing up your spending habits you developed over the years that probably resulted in wholesale hemorrhaging of your precious greenbacks from your wallet. Don’t get me wrong, saving money is great. It’s wonderful. It all helps.

It’s just not the magic sauce to early retirement or building wealth.

Wealth comes from a very different source: Investments.

Here, take a look at a pretty graph that puts in chart form what little effect that saving money has over your household wealth. I warn you, however, that there are a bunch of sleep-inducing financial buzzwords that permeate that post. You know, things like “market revaluation” and “consumer durable investments”.

It’s not about how much money we have. Wealth is a direct byproduct of what we do with that money. It’s THIS that gets us rich.

Compound interest is better than gravity

In the first point, we talked about how investing, not just "saving money" builds wealth. How? That's compound interest.

Compounding is the notion (or in investment terms, an actual mathematical formula) that things build on one another, and each step we take originates from a different starting point than the one before it.

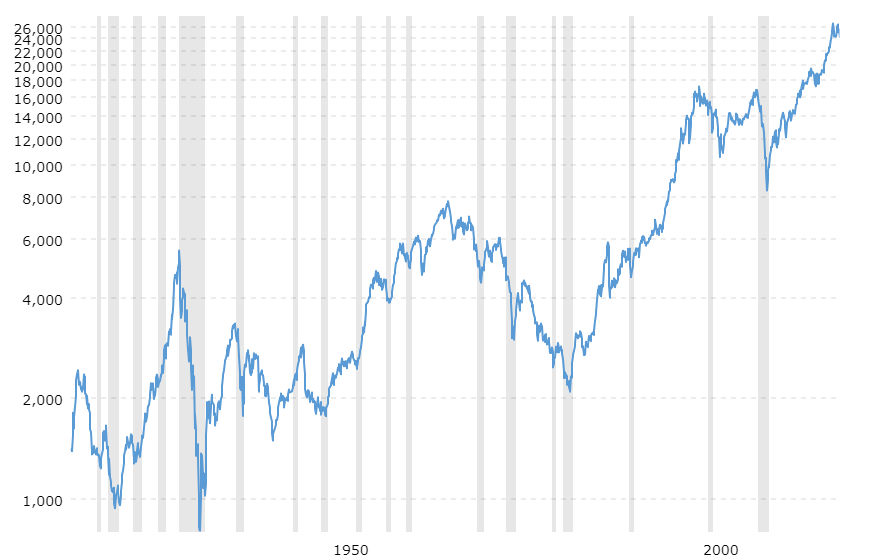

Check out this historical graph of the Dow Jones Industrial Average. That, my friends, is compounding at work!

For example, let’s use simple numbers to illustrate the point using something that most of us have at least heard of: compound interest.

We have $1,000 to invest in a stock account that grows by 10% every year. The first year, we invest our $1,000 and we get $100 growth for a total of $1,100 because:

$1000 * .10 = $100

Great. Now, what if I asked you to come up with the total after five years of growth rather than a single year?

If you didn’t understand compound interest, you might devise a simple calculation that looks something like this:

$1000 * .50 = $500

It seems simple enough. If the money grows by 10% every year, then it’ll grow 50% every five years. An extra $500 bucks, right?

Wrong.

Compounding completely changes the formula each and every year, and it means that we’re generating more of a return than a simple 50% calculation.

Watch this:

First year: $1,000 * .10 = $1,100 total (1000 + 100)

Second year: $1,100 * .10 = $1,210 total (1100 + 110)

Third year: $1,210 * .10 = $1,331 total (1210 + 121)

Fourth year: $1,331 * .10 = $1,464.10 total (1331 + 133.10)

Fifth year: $1,464.10 + .10 = $1,610.51 total (1464.10 + 146.41)

The total after five years is $1,610.51, not $1,500. The magic happens when our new baseline changes year after year. We aren’t starting with $1,000 in year number two.

We perform our 10% calculation on $1,100 instead because that’s the amount we had after the first year. And, each year is governed by this same beautiful compounding magic.

But, here's the other part of compounding that's so remarkable: It's more than just money. The habits that we pursue compound over time. If they are good habits, they will compound positively.

If bad, then we'll progressively get worse and worse.

Darren Hardy, author of the insanely popular book “The Compound Effect”, describes compounding as such: “It’s the principle of reaping huge rewards from a series of small, smart choices. Success is earned in the moment to moment decisions that in themselves make no visible difference whatsoever, but the accumulated compounding effect is profound.”

We aren't all cut out for management

Like most of us who work in a traditional office, my goal coming out of college was to climb the ranks and become the boss.

I started as a low-level programmer, then slowly took on more and more responsibilities until I became a technical lead, which means you’re the guy dishing out assignments and making sure that coding practices are followed and that the code being written isn’t just a pile of crap that barely compiles into something meaningful.

Then, I got the opportunity to direct an entire IT department, as I’ve written about before. Through that experience, I learned something remarkable abaout myself.

Management: It’s not for everybody, especially for those who actually get pushed into it.

I wanted the job.

I wanted to be the boss, and I quickly realized that management isn’t for me. The crap that managers deal with is ten times as frustrating as before.

As a regular staff member, you need to impress a couple of people to get promoted. But as a manager, the number of those people tends to increase, and they are in higher positions within the company, demanding more progress, more efficiency, more production.

And not only do senior managers need to be impressed, staff members demand attention. Conflict resolution. Priorities. Missed deadline. Employee A said something that hurt Employee B’s feelings. Employee C didn’t show up for work yesterday, which made Employee D late on her assignment.

In large part, managers are corporate babysitters, dealing with suit-wearing professions on one side and the petty problems of lower-level staff members on the other. If you are cut out for this type of work, bless you – because corporate America needs more good managers.

Sometimes, it’s better to just DO the work rather than MANAGE it.

The car that you drive doesn't matter...unless it does

The most popular article on this blog is my mini-rant piece about expensive cars and how, though they once impressed me, they no longer have any real appeal to me. $80,000 cars aren't impressive to me any longer.

Several years ago, I read The Millionaire Next Door, and it changed my life.

The book teaches us that wealthy people tend not to drive around in expensive vehicles. They also aren’t wearing $5,000 watches, $1,500 designer suits and living in large McMansions in well-to-do areas of the city. This is why they are wealthy.

Let me say that again: this is why they are wealthy!

Instead, the “real rich” drive 10-year old Honda Civics or Toyota Camrys. Seriously. An Experian Automotive study found that 61% of wealthy people drive Toyotas, Hondas and Fords. They also live in “normal” communities with the rest of us and very often look for sales on their clothes and shop at “regular” stores like JC Penney and even Target. They tend not to shop Lord and Taylor, Neiman Marcus, Talbots or other expensive establishments.

Truly rich people do not blow through money like your typical $80,000 car owner might.

The reason is simple: There is a huge difference between earning a high income (aka: making a ton of money) and actually building wealth.

We'll talk more about that below.

High-income earners still live paycheck-to-paycheck

It might surprise you how many folks who earn huge salaries still, even with all that money coming in, live paycheck-to-paycheck.

According to a Nielsen study, 25% of families making $150,000 a year or more are living paycheck-to-paycheck. One in three earning between $50,000 and $100,000 need their next paycheck to survive. For those earning less than $50,000, that percentage increases to half.

Pardon me for saying this, but that isn't a huge difference.

What accounts for this high-income debt? Investopedia says that a high cost of living (COL) is a primary culprit.

Home values, for example, have increased by roughly one third since 2012, according to Zillow. In certain markets the demand for housing has pushed both purchase and rental prices through the roof, eating up a larger share of high earners’ salaries.

...

Those monthly expenses include payments to student loans and other debts, healthcare, transportation

and childcare. As children get older and prepare to go to college, the burden for some high-income families increases – because, ironically, the kids are only able to qualify for limited financial aid.For the 2016-17 academic year the average cost of tuition, fees, and room and board at a public four-year university was $35,370 for out-of-state students, which can add to the strain high earners feel to make ends meet.

Additionally, high-income earners very often feel the need to "look the part" as an unwritten rule of their high-income jobs.

In other words, if you don't look like you're successful, then you won't be.

I chatted with one executive who writes about financial independence in a high-income career at Stop Ironing Shirts. The expectation that high-level executives “act the part” is a very real part of the job.

“When I got into the realm of making $200k+year, that job carried a “President” title and many of my peers feel the need to drive fancy cars, buy expensive watches, and join high-priced country clubs.”

His boss maintains several different homes, a couple purely for entertainment purposes. They drive expensive cars, wear costly suits and live in ritzy markets where their customers are.

“Think about jobs like large law firms, accounting firms, investment banks, commercial banking,” he told me. “They all sell/offer a near commodity service then it becomes about “Deal flow”. How many deals can you look at? This requires these employees to run in circles of people that are much wealthier than they are.”

It's a vicious cycle.

It's not that hard to look good

Here's the sad truth about today's society: The bar is set pretty damn low, and it's not all that tough to set yourself apart from the herd.

As a child, my dad preached to me how important just showing up for work truly is, and my experience has shown that he was absolutely right. The fact is in many areas of corporate America, it is not hard to look good.

Showing up seems so simple. As a child, I took for granted that people who have jobs actually do them, but in reality, it’s not so simple.

Believe it or not, just being there – with your butt in the chair contributing whatever you can along with your co-workers, is more than 50% of what makes up success in American industry.

Yeah, the bar is set pretty low and I've seen this with my own two eyes.

I've worked with folks who were smart and capable people. But, they also weren't dependable. They would call in sick at a moment's notice. They would leave early. In other words, their butts were not in the seats as much as mine was.

And as a result, I'm the one ended up getting the promotions, not them.

Your network is more important than your knowledge

The phrase “it’s not what you know, it’s who you know” is spot on accurate in corporate America, more than I could possibly describe in words.

And now that I think about it, I have only worked for companies whom I was personally referred to by a respected member already within that organization. Yup, every time – to include my FIRST job straight out of college with the help of my dad.

The opportunities you get through your network will likely far outweigh those directly from your knowledge or experience, or by applying for a job “cold” at another organization.

Job referrals are more important than ever before.

The problem stems from the sheer number of candidates who want to work high-paying positions in respected organizations around the country.

Most hiring managers at well-known organizations receive hundreds – and sometimes thousands, of job applications for each position. Even if you submitted a kick-ass resume, a hundred others probably submitted equally kick-ass resumes.

What separates you from the rest? How does a hiring manager pick you over the flood of candidates with similar resumes?

The answer is very often referrals!

Popular author James Altucher follows four "life hack" lessons

I just can't help but cite four super weird, but also very interesting, life hacks that James Altucher practices:

$2 bills. I have thousands of $2 bills. I always tip with $2 bills. How come? Because then people remember me. They always say, "whoah! I've never had one."

Doctor's coat. I wear a doctor's lab coat most of the time. Like in airports, restaurants, walking around town.

The reason?

- a. It's comfortable.

- b. The big pockets let me put any electronic devices I might need (an ipad mini, for example, plus waiter's pads (see below))

- c. People actually do treat me like a doctor.

If someone said, "I need a doctor" I would not be able to help (unless it's easy stuff in which case I can say, "I'm not a doctor" and then perform CPR or mouth-to-mouth or Heimlich, which are all easy to learn.

But the reality is, people move out of the way if you are an airport and walking around in a doctor's coat?

Waiter's pads. I have about 300 waiter's pads. I order them for about 10 cents a pad in bulk on restaurant supplies website.

How come?

- a. I like to write ideas on pads. I write down at least 10 ideas a day. The idea muscle is a muscle like any other. If it's not exercised, it atrophies. If it's exercised then within six months you're an idea machine. Try it. It's amazing what happens. Don't keep track of the ideas. Just become an idea machine.

- b. Why a pad? A screen messes with your dopamine levels. I like the visceral experience of putting pen to pad.

- c. Why ten ideas? Four or five ideas on any theme is easy. It's the final five or six that makes the brain sweat. This is how you exercise the idea muscle.

- d. Why specifically a waiter's pad?

- It forces you to be concise. A waiter's pad is small lines. You can't write a novel there.

- It's a great conversation piece in meetings. Once I pull out the waiter's pad someone always says, "I'll take fries with my burger" and everyone laughs. Again, I'm shy so it's a good way for me to break the ice.

- In restaurants, when you pull out a waiter's pad, guess what? Waiters treat you better.

- The other day in a cafe I was working and someone potentially violent came up and asked me for money. I held up my waiter's pad and said, "I'm a waiter, do you want to order something?" and they sort of looked at me and grunted and then walked away.

- Watch standup comedy before every meeting, date, dinner, media appearance, conversation, public talk.

I watch Louis CK, Daniel Tosh, Anthony Jeselnik, Jim Norton, Andy Samberg, Seth Rogen, Marina Franklin, Ellen, Bo Burnham, and maybe a dozen others.

How come?

I have a lot of inhibitions when I meet people. I'm scared and somewhat introverted. Standup comedians are the best public speakers in the world and I think they are the most astute social commentators on the human condition.

The reasons I watch them before most social encounters (personal, professional, media):

- it gives me a boost of energy. My "mirror neurons" are going to feed off of their boost of energy for at least 1-3 hours after I watch them.

- it gives me material. I won't steal from a comedian. But the reality is: good artists plagiarize, great artists steal. And at the very least, I often improvise based on material I heard a comedian said. I'm not competing with them. I'm just on a date. Or a business meeeting.

- Studying the subtleties of how comedians get laughs: their timing, their voices, their silences, the way they look at the audience, the way they move across the stage, the way they benefits from the comedians who came before them, AND their actual commentary about life, helps me in my many interactions with people.