10 simple steps to invest in a Roth IRA

The magical Roth IRA … You’ve heard that you need one. Or if you have one, you’ve heard that you should be taking full advantage of it. What is so excellent about a Roth IRA?!

Hey you investment loving number-crunchers! I've got a guest post today from Andy Hill who runs the Marriage, Kids and Money podcast. Sweet program that's both clean and fun. And best of all, I was on it! Anyway, today Andy is talking Roth IRAs. Give it up!

The magical Roth IRA … You’ve heard that you need one. Or if you have one, you’ve heard that you should be taking full advantage of it. What is so excellent about a Roth IRA?!

For starters:

- This retirement account grows tax-free. Anytime you can get Uncle Sam out of your pocket, you’re winning when it comes to retirement savings.

- You can withdraw 100% of your contributions at any time without penalties or taxes.

- Your options for investing are plentiful including mutual funds, bonds and real estate.

And, did you know there's a Roth Conversion ladder that lets you access your money before traditional retirement age?

Jeremy Biberdorf from Modest Money writes, "Any funds you have moved from your Traditional IRA to a Roth IRA can be withdrawn after the five-year waiting period."

It's an amazing option. But, there's also a downside.

Tax-free growth, flexibility and a multitude of investing options are great descriptions when it comes to retirement planning. If you’re convinced (or at least intrigued) and you want to start a Roth IRA, here are 10 simple steps that can help you plan for your future today:

1. Make Sure You’re Eligible

The Roth IRA has some age, contribution and income restrictions that you should be aware of before you open your account. As of this writing, here are some of those 2017 Roth IRA guidelines:

- If you’re SINGLE and you make more than $133,000 per year, you’re not eligible.

- If you're MARRIED, you file jointly and you make more than $196,000 per year, you’re not eligible.

- $5,500 is the max annual contribution limit for people under 50

- $6,500 is the max annual contribution for people over 50

I’d venture to say that the majority of Americans qualify under these guidelines. If you fit the bill with the above information, let’s move on to step 2!

2. Have an Emergency Fund in Place

Don’t start saving for retirement in your Roth IRA until you have a 3-month emergency fund in place. God forbid your car breaks down, you lose your job or you have an expensive home repair … and without an emergency fund, you’ll feel forced to take it out of your retirement account. BIG NO-NO! If you take money out of your retirement early, you’ll be hit with huge penalties and taxes. It will negate all the hard work you put in.

Ensure you have enough saved up in a separate savings account that will cover you for these emergencies. Getting on a budget will surely help.

3. Save Up for the Minimum Investment

For Vanguard and Fidelity (the only options I suggest for starting your Roth IRA), you’ll need to have at least $2,500 to get started. If you don’t have $2,500 today, that’s okay. Set up a monthly automatic withdrawal of $250 in your savings account and in 10 months you’ll be ready.

This does three things for you:

- You now have the $2,500 you need. Score!

- It gets you in the habit of the doing monthly automatic withdrawals. Something you’ll have to do when you open a Roth IRA anyway!

- It will also help you get used to living without $250 per month - a good monthly starting deposit for your Roth IRA.

4. Choose the Right Investment Firm

I have used Fidelity for over 10 years. They have a wide variety of mutual funds to choose from and their online interface is intuitive and easy to understand. Best of all, they have a LOT of low-cost mutual fund options.

Vanguard is another industry leader that I trust because of the reputation it has developed. This company is completely geared toward helping its investors succeed in their retirement planning by providing simple, low-cost retirement solutions like index funds.

Now there are many other options to consider. Please do your homework. Read some of your favorite personal finance blogs, talk with your friends about who they use and weigh the pros and cons.

I like Fidelity and Vanguard because I feel like I have control over my money, I understand where it goes and I know how much I’m being charged. I do not receive commissions, affiliate kickbacks or any form of compensation from either of these firms. I’m just a fan.

5. Understand Expense Ratios

Most all mutual funds charge an expense ratio. This is a fee that covers the fund’s total operating expenses, management and administrative fees.

For example, a mutual fund like Fidelity OTC Port (FOCPX) has a 0.91% expense ratio. So for every $1,000 I have in my account, I’m charged $9.10 annually. You can see how this can add up over time. If my account grows to $1,000,000, I’m paying $9,100 per year.

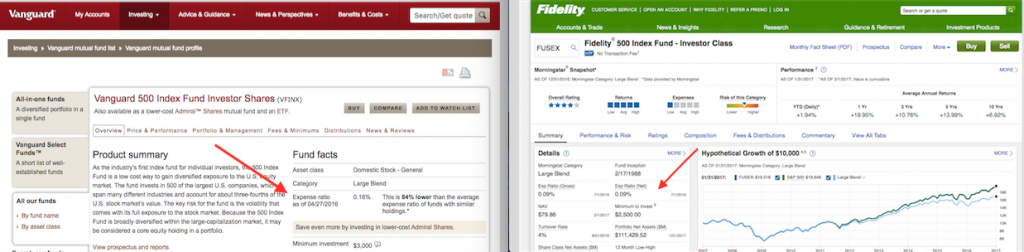

The lower your expense ratios, the more money you keep in your pocket. The Vanguard and Fidelity websites make finding the expense ratios very easy. I looked up Vanguard’s VFINX and Fidelity’s FUSEX and did a screenshot for you below showing where you can find the expense ratios.

6. Take Advantage of Index Funds

Speaking of low expense ratios, I’m a big proponent of index funds. These are mutual funds that track the components of a market index like the S&P 500. If you invest in the Vanguard 500 Index Fund (VFINX), you are investing in 500 of the largest US companies much like the S&P 500. Because index funds track different market indices, it takes a lot of the guess work out of the process for you, the investor.

The major benefit of index funds is that they have a super low expense ratio. Using the Vanguard 500 Index Fund (VFINX) as an example again, the expense ratio on this fund is only 0.16%. So for every $1,000 I have in my account, I’m only charged $1.60 annually. If I get up to $1,000,000 in the account, I’m charged $1,600 annually. This is a dramatic reduction from the non-index fund example above.

Billionaires like Warren Buffet are big fans of index funds too! In fact, Warren Buffett gave this advice to his wife regarding his estate when he dies:

“… Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund … ”

I gave similar advice to my wife for the life insurance money if I were to pass away unexpectedly. If it works for Warren Buffet, it works for me.

7. Diversify to Win

You’ve heard the old adage “Don’t put all your eggs in one basket”, right? The same goes with investing for retirement. If you put 100% of your money in an S&P 500 index fund, then you are only investing in the equity of US-based companies (Large Cap). If the S&P were to decline, so would the value of your shares.

Balance out your portfolio by investing in options like bonds, international companies, small cap (another name for smaller and aggressively growing companies) and real estate (through REITs). By doing this, you won’t be as vulnerable to huge market swings. The mix is up to you and what is best for your age, income and your proximity to retirement.

A simple rule of thumb for stocks and bonds is as follows:

120 - YOUR AGE = STOCK PERCENTAGE

For me this would be:

120 - 35 = 85% Stocks

So based on that rule of thumb, my portfolio would be based on 85% stocks and 15% bonds. I like to add real estate into the portfolio as well to diversify it even further. This works for me. It might not work for you. Here is the diversification breakdown that I use in my Roth IRA:

- 50% Large Cap US Based

- 15% International

- 15% Small Cap

- 15% Bonds

- 5% REITs

As I get older, I will increase my bond holdings as that is typically a less volatile investment. The older you get, the more conservative you want to be so your money doesn’t all disappear in a big market crash right before you retire.

8. Consider Partnering with a Financial Planner

If you need help in laying out your portfolio or reviewing your current portfolio, consider partnering with a FEE-ONLY CERTIFIED FINANCIAL PLANNER (CFP). I put it in all caps because I do not recommend working with someone who gets a commission based on selling you specific products. Been there. Was burned. Don’t recommend it.

You can pay an hourly rate for someone’s review or development of your portfolio. Resources like XY Planning Network can help you find the right fee-only CFP that works for your situation.

9. Have Discipline to Invest for the Long Haul

Investing in your Roth IRA is a long-term play. There will be some major ups and downs in the market during the time you have your money invested. If you get all freaked out during another recession and pull your money out, you’re going to lose out on the big returns.

Have the discipline to stay the course. You can do this in a “set it and forget it” way through dollar-cost averaging. This is a fancy way of saying you make regular, consistent and automatic contributions to your account each month regardless of the share price. This way, you’re not tempted to “time the market” or pull out of funds when times get rocky.

10. Rebalance Your Portfolio Annually

Remember when we talked about the importance of diversification?

As your portfolio grows, your allocation percentage will begin to shift as well. Let’s say your original asset allocation was 90% stocks and 10% bonds and it was a great year for the equity market. After year one, your portfolio might have shifted to 93% stocks and 7% bonds. This can easily be corrected by selling your stock mutual funds and putting the proceeds into your bond mutual funds.

Also, as you get older and near retirement age, you’ll want to adjust your allocation appropriately (120 - YOUR AGE = STOCK PERCENTAGE).

I’d recommend you do this annually. If you need some help with this, ask for it from a fee-only certified financial planner. If you’re going to go it alone, set a Google Calendar alert for the same time each year when you can spend some dedicated time reviewing and rebalancing your portfolio.

The Roth IRA is an essential tool to have on your journey toward retirement. By following those 10 simple steps, my wife and I are maxing out our Roth IRA accounts at $5,500 per year and our accounts are growing consistently. We still have quite a few years before we reach retirement, but at least we know we’ll be ready.

How close are you to retirement? What has been the best asset allocation for you?

Andy Hill, a mid-30’s father of two living in the metro Detroit area, pens the MarriageKidsandMoney.com (MKM) blog and hosts the MKM Podcast taking you through the trials and tribulations of being a young parent and husband who is planning for his family’s future and winning with money.