Average Retirement Savings by Age (How You Compare to Most Americans)

Average retirement savings by age in the U.S. for 2026. See median vs average balances, benchmarks, and how you compare.

Disclosure: This article is for informational purposes only and is based on publicly available data, historical trends, and inflation-adjusted estimates. It should not be considered financial or investment advice. Individual retirement needs vary based on income, expenses, risk tolerance, and personal circumstances.

Retirement can feel far away until suddenly it isn’t. One of the most common questions Americans ask is simple but stressful: How much should I have saved by now?

Looking at average retirement savings by age can help you understand where you stand, what’s realistic, and how far off (or ahead) you might be. In this guide, we break down the latest U.S. retirement savings data for 2026, explain what the numbers actually mean, and show you what to do if you’re behind.

Key Takeaways

- Most Americans approaching retirement have less than $135,000 in median retirement savings, well below common benchmarks

- Average retirement balances are 2–3× higher than the median, largely skewed by high-income earners

- Americans under 35 typically have a median of about $18,000 saved, but time remains their biggest advantage

- Being “behind” on retirement savings is common and doesn’t make retirement impossible, but it often requires higher contributions, later retirement, or lower expenses

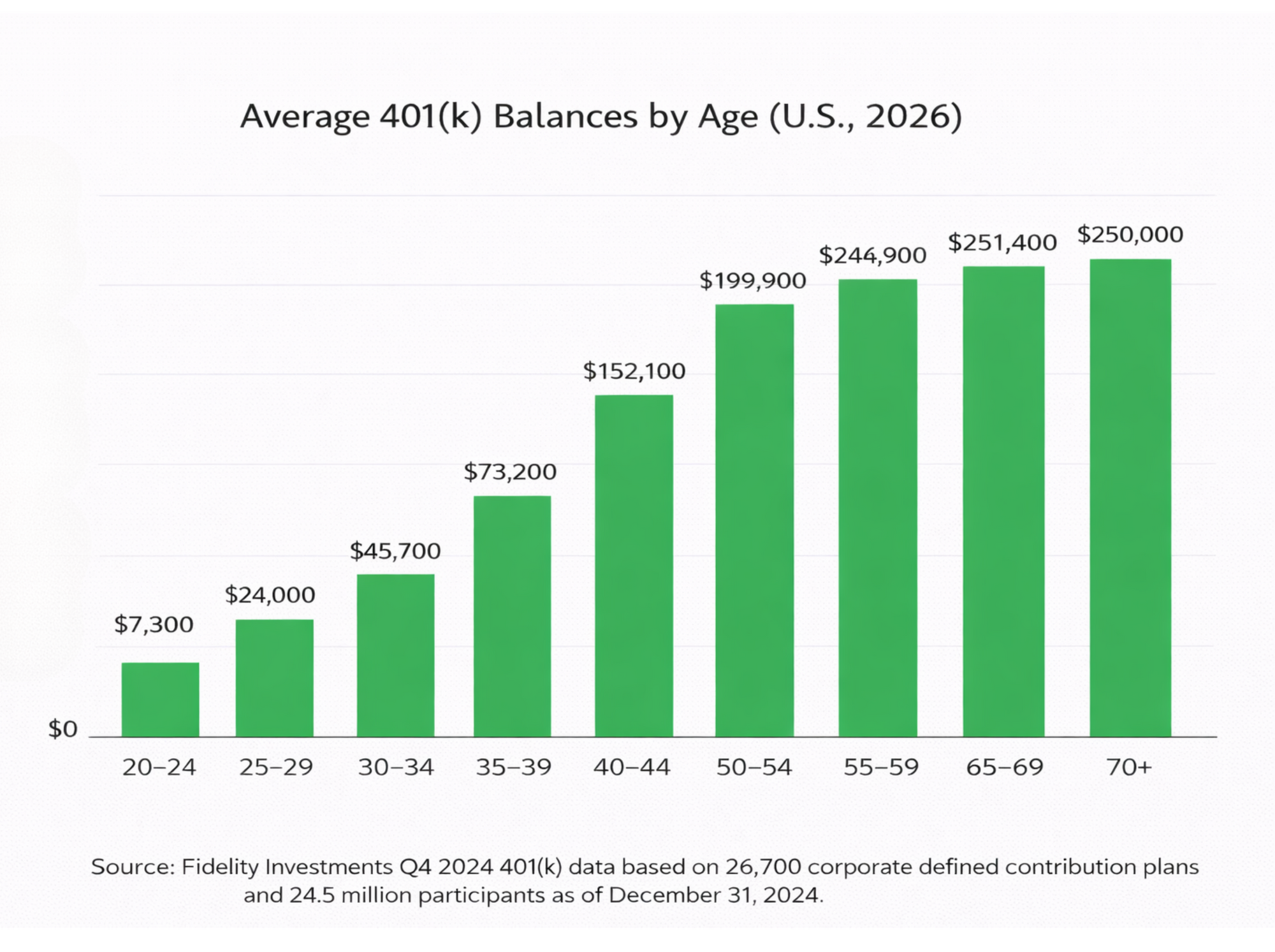

Average Retirement Savings by Age (United States – 2026)

The table below reflects combined retirement savings, including 401(k)s, IRAs, and similar tax-advantaged accounts, based on the most recent nationally available data and inflation-adjusted trends.

| Age Group | Average Retirement Savings | Median Retirement Savings |

|---|---|---|

| Under 35 | $50,000 | $18,000 |

| 35–44 | $145,000 | $45,000 |

| 45–54 | $275,000 | $82,000 |

| 55–64 | $410,000 | $120,000 |

| 65–74 | $450,000 | $135,000 |

| 75+ | $420,000 | $120,000 |

These numbers represent what people have, not what they should have, and the gap between the two is where stress often begins.

Note: These figures represent estimated total retirement savings, including 401(k)s, IRAs, and similar tax-advantaged accounts. Amounts are rounded benchmarks based on Federal Reserve survey data and industry summaries, not exact account balances.

How Much Should You Have Saved for Retirement by Age?

Many financial planners use simple income-based benchmarks:

- Age 30: 1× your annual income

- Age 40: 3× your income

- Age 50: 6× your income

- Age 60: 8–10× your income

When you compare these benchmarks to the table above, one thing becomes clear: most Americans fall short, especially in their 40s and 50s.

This doesn’t mean failure; it means the system is harder than it looks.

Why Most Americans Are Behind on Retirement Savings

Several factors contribute to lower-than-expected retirement balances:

1. Rising Cost of Living

The rising cost of living has been a real issue. Housing, healthcare, and insurance costs have grown faster than wages in many regions.

2. Inconsistent Access to Retirement Plans

Millions of workers still lack employer-sponsored retirement options.

3. Debt Delays Saving

Student loans, credit cards, and medical bills often take priority over long-term investing.

4. Late Starts

Many people don’t begin saving seriously until their 30s or 40s, losing years of compound growth.

Is the Average Retirement Savings Enough to Retire?

For most people, no, especially without additional income sources.

A rough rule of thumb:

- $1 million in retirement savings supports about $40,000 per year under the 4% rule

- The median American nearing retirement has far less than that

This is why Social Security, part-time work, downsizing, and delayed retirement are increasingly common in the U.S., especially with rapid inflation.

🚗 Compare Car Insurance & Save 🚗

Find your best rate in minutes. Compare quotes from Progressive, Travelers, Nationwide, and 50+ providers — all in one place. Stop overpaying and start saving today.

Get Your Free QuoteFast. Secure. No obligation.

What to Do If You’re Behind on Retirement Savings

Being behind doesn’t mean you’re out of options.

Focus on What You Can Control

- Increase contributions when income rises

- Capture full employer matches

- Reduce high-interest debt

Use Catch-Up Contributions

Workers over 50 can contribute more than standard limits to 401(k)s and IRAs.

Adjust Expectations (Strategically)

- Later retirement

- Lower annual spending

- Supplemental income streams

Progress matters more than perfection.

Why This Data Is Often Misleading (But Still Useful)

Retirement savings statistics don’t account for:

- Pensions

- Home equity

- Inheritances

- Regional cost differences

Still, they provide an important reality check. The goal isn’t to match the average; it’s to build a plan that works for your situation.

Final Thoughts: Use Benchmarks, Not Comparisons

Looking at average retirement savings by age can feel intimidating, but it shouldn’t be paralyzing. Most Americans are navigating the same challenges, and many still retire successfully with thoughtful planning.

The most important step isn’t catching up overnight. It’s starting where you are and staying consistent.

Data Sources & Methodology

The retirement savings figures in this article are based on a combination of nationally recognized data sources and inflation-adjusted trend analysis.

Primary reference points include the Federal Reserve Survey of Consumer Finances (SCF), which provides detailed insights into household retirement balances across age groups, as well as publicly available summaries and research from major retirement plan providers such as Vanguard and Fidelity.

To reflect current conditions, older datasets were reviewed alongside more recent reporting and adjusted for inflation using long-term Consumer Price Index (CPI) trends. Figures shown represent combined retirement account balances, including 401(k)s, IRAs, and similar tax-advantaged retirement plans.

Because retirement savings vary widely by income, access to employer plans, and market conditions, the numbers presented are intended to provide general benchmarks, not personalized financial advice.

FAQs

1. What is the average retirement savings by age in the United States?

Average retirement savings in the U.S. range from about $50,000 for adults under 35 to roughly $450,000 for those near retirement age, increasing steadily over time.

2. What is the median retirement savings by age?

Median retirement savings are significantly lower than averages, ranging from under $20,000 for younger workers to around $120,000 for people in their early 60s.

3. How much should I have saved for retirement by age?

A common guideline suggests saving 1× your income by age 30, 3× by age 40, 6× by age 50, and up to 10× your income by age 60.

4. Is the average retirement savings enough to retire?

For most Americans, average retirement savings alone are not enough to fully fund retirement without Social Security or additional income sources.

5. Why is the average retirement savings higher than the median?

Average savings are skewed upward by high earners and households with large investment balances, making median figures a more realistic benchmark.

6. Am I behind on retirement savings if I have less than the average?

Many Americans have less than the average retirement savings, and being below average does not mean retirement is impossible with proper planning and adjustments.

Explore Related Retirement Guides

Helpful reads to plan smarter and feel more confident about retirement.