How to manage student loans for college like a boss

Today's generation of young people are the most educated in history, but student debt is also higher than ever. Most graduates consider their student loans worth the price due to higher earnings potential.

As much as I generally dislike the idea that college is a necessity for everybody, statistics overwhelmingly prove that those with college degrees not only earn significantly more money over a lifetime but also enjoy lower unemployment and a more fulfilling work life.

Marketable college degrees are becoming more and more valuable, and college graduates earn an average of $17,500 more every year than the average high school graduate. In fact, they are also more likely to consider their work "a career", which generally increases job satisfaction.

Today’s generation of young people is the most educated in history with more than a third holding at least a bachelor’s degree. This tells us that the value of a high school diploma is rapidly decreasing in favor of a 4-year degree. Most graduates consider their student loans worth the price due to higher earnings potential.

The data is very clear - those with a college degree have an easier shot at making good money and keeping their jobs, and high school diplomas are rapidly shrinking in value.

But holy shit, college isn't cheap.

In fact, the Class of 2015 is the most indebted group of students - ever. On average, college graduates in 2015 are saddled with more than $35,000 in student loans. And, more students than ever are taking out student loans to earn their degrees. Nearly 75% of 4-year degree holders now have student loans to pay back.

So what gives? How can America's college generation maximize their time earning a college degree, while at the same time minimize the impact of student debt?

Three keys to managing student debt

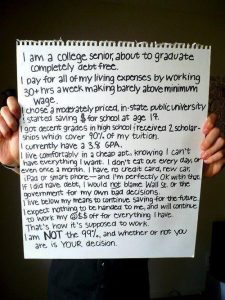

For many students, it's nearly impossible to eliminate the need for student debt. But, there are simple techniques to make sure that the debt incurred has as little of an impact as possible after graduation.

1. Think of college as the beginning of your career

Too many of our nation's youngsters view college as their chance to go wild. Hell, this is our opportunity to move out of our parent's house and begin to make some damn choices for ourselves, isn't it? Yes...but also, no.

There is nothing wrong with having a little fun while in college. In a way, college is a reward for the responsibilities of being a kid and dealing with our parent's shit for so many years. But remember, college is also the first step in determining our course in life, and this responsibility should not be taken lightly.

Instead of throwing caution to the wind and letting the chips fall as they may by worrying about the rest of your life later, consider college the beginning of the rest of your life. The earlier that we set ourselves up for success, the easier it will be to achieve our hopes and dreams.

But let's be honest, shit is going to happen. I know that many of us will wind up getting totally blitzed at a wild rager at some point in college. It happens. No big deal. This is something that can be overcome...generally.

What's tougher to overcome? A hospital visit or jail cell. Drug use. Running off with that smokin'-hot chick you met at Jeremy's house party last night.

Just...don't be stupid. I found myself mumbling "Don't be an idiot, Steve" a lot in college.

Basically: Have fun, but stay focused; unlike Las Vegas, things that happen in college may not stay in college - and mistakes made here can very much effect the rest of your life.

2. Choose a degree with reasonable earnings potential

Admittedly, there is a very fine line between choosing a degree that you will thoroughly enjoy and choosing one with a nice salary potential. Clearly, choosing a degree program based solely on post-college earnings is ripe for failure. None of us want to spend four years in a program that we hate, much less work many years at a job that we don't enjoy.

However, finding a high paying job after college enables us to pay back those loans as quickly as possible, which in turn frees us from retirement-killing debts that keep us working for years longer than necessary.

Think about a few things before you declare your major:

- First, think hard about your future and what makes you happy.

- Second, how do you want to draw your paycheck after college? Self-employment? Working for an established company? Peddling money on street corners?

- Third, what degree program will best prepare you to achieve your dream?

There is wisdom in designing our college program around our future. For example, taking a look at companies and reading through job requirements in our chosen industry may reveal appropriate degree programs for us. Observing industry trends is another good technique.

Understand that not all degree programs are created equal, and your earning potential may suffer because of it. For example, Forbes published an article back in 2012 with the 10 worst college majors. Topping the list is anthropology and archeology with an unemployment rate of greater than 10% and relatively low yearly salaries.

Other underperforming majors? Art degrees (like liberal arts, fine arts, film, video and photographic arts, etc), Philosophy and Religious Studies, Music, History and Literature.

Basically, some of the "softer" majors - possibly due to their low barrier of entry and rather undefined career prospects. If you take out student loans to earn a degree in an area of study with higher unemployment and lower salaries, you might find yourself struggling to manage your student debt.

What are the 10 best degrees? Forbes says Finance, Accounting, Computer Science, Mechanical Engineering and other related business and technical fields.

While it's true that we aren't all entrepreneurs or scientists, understanding market demands can make our career prospects much more bright and our student loans quickly a thing of the past.

3. Select a state university over a more expensive "prestigious" school

Although there are exceptions, racking up more debt to attend a so-called prestigious university may not be worth the cost of admission. Though highly-publicized national rankings attempt to set some schools above others, state schools generally provide perfectly good educational opportunities for the great majority of us, setting us up to be just as successful as those who paid more for their "designer diplomas".

In fact, research suggests that "an elite education is likely to leave half to two thirds of graduates demoralized and broke", according to these researchers. Part of this is due to a reduced likelihood of success at schools with higher academic standards and a more gifted student body. In other words, the more strenuous the environment, the more difficult it will be to academically succeed.

There are exceptions, but I would argue that a quick scan of college costs vs. 30-year salary is a fairly hollow and much too simplistic metric.

Remember, most companies simply want their job prospects to have a degree that relates in some way to the job. In my experience as a hiring manager within a variety of organizations, we routinely hired candidates with degrees from virtually any university. In fact, I cannot recall a single instance where the university made any sort of difference in our decision to make job offers.

What did make a difference? Side projects during school and any extra curricular activities, which demonstrates a motivation to get involved and go above and beyond. We cared much more about experience and achievements during college than the name of the university.

My advice: Save your money and excel at your less expensive state school, because a properly-motivated student at virtually any university can (and generally will) be successful in life.

What else?

Working during college can dramatically reduce the need for financial aid and may also provide a little bit extra for savings - not to mention a potential job after college.

Several other techniques can help minimize your debt after college, like only taking out the bare minimum of what you need to get through school. Also, there are a wide variety of college scholarships available that can help pay for college; some even foot the entire bill!

Other techniques include living at home to avoid expenses. When that isn't possible, finding an apartment with a roommate might make the most financial sense or, of course, a dorm room on campus (I lived in a dorm room for my first year of college).

Consider attending a community college for the first two years and then transfer into a 4-year university. Community college credits very often transfer to state schools and offer students a less expensive way to get required classes out of the way. Community colleges also tend to offer more night classes to help those who work full time while going to school.

What other tips or techniques do you have to keep student loans low during college?