Budget November 2015 ~ Too Many Gifts!

Budgets don't work for everyone and in the future it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we've set for ourselves.

Ever since we decided that the path for us is out of the rat race and into an early retirement of our choosing, the Mr. and I have been keeping an eye on our finances and scaling down our spending. Neither one of us were complete clowns, but we certainly weren't looking out for our future selves at anywhere near the level we want/need to be.

So in comes the budget. Budgets don't work for everyone and in the future it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we've set for ourselves. Read more about how we budget here.

We are labeling November the month of too many gifts.

Why? Because not only do we have 4 family members birthdays in November we also bought the majority of our Christmas presents! Yay! Luckily we planned for this month of gifts and we stayed right on budget in our Fun Money category (even with our yearly Pie Party this month as well).

On to the numbers!

- Fixed Costs (Mortgages, HOA, Loans) $2550/ $2550

- Utilities & Other Necessities (electricity, gas, water, cars, fuel, etc.) $625/$851 Average month and no big payments.

- Groceries $311/ $350 Getting the hang of this gluten-free thing! The costs for the Pie Party food were put under our Fun account so this is just our actual grocery expenses for the month. Meanwhile visiting family helps with this....

- Fun (Travel, Mr.'s fun money, Mrs.'s fun money, Mr.'s camera fund, gifts, restaurants) $862/ $1051. Yay under budget on fun money!

- Additional Income: $619 Payment for the Ridge along with our normal random assortment of checks, interest and other sundries that came in this month. Unexpected money is a plus! We reinvest all our dividends, etc. so those don't get counted in this roundup. This month we also held a Holiday Yard sale to make a little extra cash off of all the stuff we're been downsizing. Nice!

Another great month on the books.

Now, let's take a look at the money-shot numbers.

Total November 2015 income: $14,742 (Steve's quarterly bonus)

Total November 2015 expenses: $4,347

This means our total November 2015 Take Home Savings Rate came in at: 70.5%.

And our November 2015 Total Savings Rate: 73% (includes maxing out our 401ks).

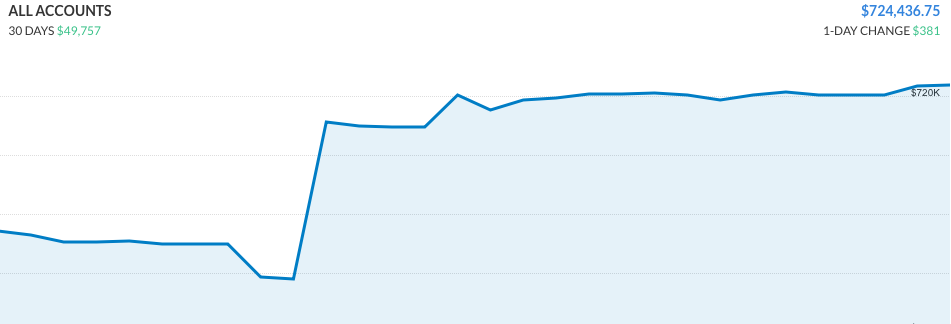

Our net worth: $724,436. Let's see this number grow!

Our Personal Capital net worth graph for the month

Note: That huge spike in the graph above was due to a retirement account that Steve lost track of when we combined our finances into Personal Capital.

We're doing great! Just gotta keep on keeping on.

Another adventure awaits!

-- Groceries: $311.24--

Fruits and Veggies: $190.57

Canned Goods: $113.71 (some Pie Party here)

Vegan 'Meat': $9.03

Meat, Seafood and Dairy: $30.96 (mostly for pie party)

Dry Goods: $67.62 (more pie party)

Minus 65 cents from our bag credits. Gotta love a little extra savings ;)

Also subtract $100 (which we put into our fun money expenses since Pie Party is not normal grocery spending).