Budget September 2015 ~ NY NY

So in comes the budget. Budgets don't work for everyone and in the future it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we've set for ourselves.

Ever since we decided that the path for us is out of the rat race and into an early retirement of our choosing, the Mr. and I have been keeping an eye on our finances and scaling down our spending. Neither one of us were complete clowns, but we certainly weren't looking out for our future selves at anywhere near the level we want/need to be.

So in comes the budget. Budgets don't work for everyone and in the future it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we've set for ourselves. Read more about how we budget here.

We are labeling September NY NY.

Why? Because our week in NY was definitely the biggest expense of the month as we anticipated. It was a normal month income wise (which means low in the grand scheme of things) and a high expense month as planned due to our trip. Not to mention the market being what it is.... O well. We're still happy where things stand.

As I mentioned last month we changed our format a bit and might still tweek it in the coming months to get it more in line with what we're hoping to have setup when we go full time. Money amounts changed slightly but really its just a categorization.

Meanwhile while the budget numbers are accurate our net worth number was not taken on 9/30 as we were on vacation for our anniversary. So

On to the numbers!

- Fixed Costs (Mortgages, HOA, Loans) $2550/ $2550

- Utilities & Other Necessities (electricity, gas, water, cars, fuel, etc.) $724/$851 Actually low on gas this month. Yay motorcycle weather!

- Groceries $342/ $350 Still wheat free and low carb and it seems to be helping my migraines...so we shall see. You can see the breakdown of grocery costs down below. You'll notice we no longer include restaurants here...that is now included in Fun Money below.

- Fun (Travel, Mr.'s fun money, Mrs.'s fun money, Mr.'s camera fund, gifts, restaurants) $1391/ $1051. This is high because of our trip to NY (though we did pretty well eating out considering). Also Steve bought some new camera equipment and still needs to sell back a lense to balance things out.

- Additional Income: $457.69 Payment for the Ridge along with our normal random assortment of checks, interest and other sundries that came in this month. Unexpected money is a plus! We reinvest all our dividends, etc. so those don't get counted in this roundup.

Another great month on the books.

Now, let's take a look at the money-shot numbers.

Total August 2015 income: $11,751.55 (some overtime)

Total August 2015 expenses: $4,999.42

This means our total August 2015 Take Home Savings Rate came in at: 57%.

And our August 2015 Total Savings Rate: 69% (includes maxing out our 401ks).

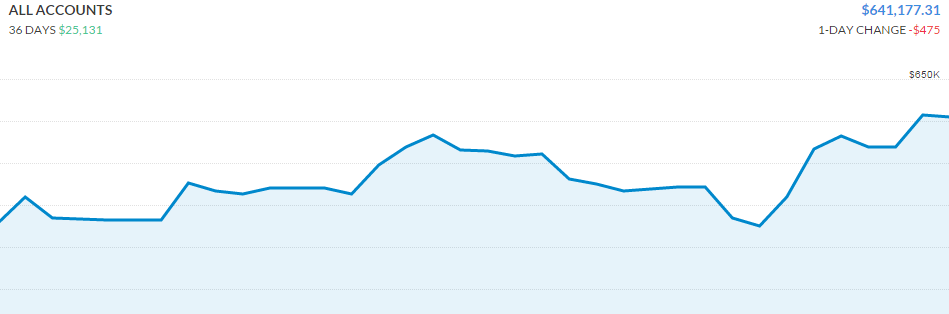

Our net worth: $641,177.31 (as of 10/6/2015). Let's see this number grow!

Our Personal Capital net worth graph for the month

We're doing great! Just gotta keep on keeping on.

Another adventure awaits!

-- Groceries: $342.75--

Fruits and Veggies: $188.27

Canned Goods: $52.55

Vegan 'Meat': $9.43

Meat, Seafood and Dairy: $14.95

Dry Goods: $77.10

Minus 45 cents from our bag credits. Gotta love a little extra savings ;)