I earn $4m a year, and lifestyle inflation is a thing of the past

I never struggled to earn a lot of money in my career, but here's what I did to avoid lifestyle inflation and control my money.

Throughout my working career, I never struggled to earn a high salary (or suffer from lifestyle inflation!). Straight out of college in 2005, I was pulling down $55,000 a year - great for my experience level!

Over the course of the next 14 years, I nearly tripled that salary. On the one hand, that was awesome. After all, who doesn't want a ton of cash-on-hand? But on the other, I also failed at taking even the most basic steps to save for retirement.

For example:

- I only contributed the bare minimum into my company-sponsored 401k

- And, I bought anything I wanted, including a 1999 Corvette convertible

- Lastly, I budgeted, but I routinely cheated that budget

Today, I have a super awesome story from a 27-year-old (who goes by American Millennial on Twitter) who would easily put me to shame, both in his ability to earn big money as well as his mastery of investments and saving for retirement.

How much does this 27-year-old earn? How about $4,000,000 a year.

Yup, that's $4m. Lots of beautiful zeros in that number.

This piece will discuss how someone who earns a high income can appropriately allocate these resources to achieve their financial independence goals.

Take it away, American Millennial.

What is High Income?

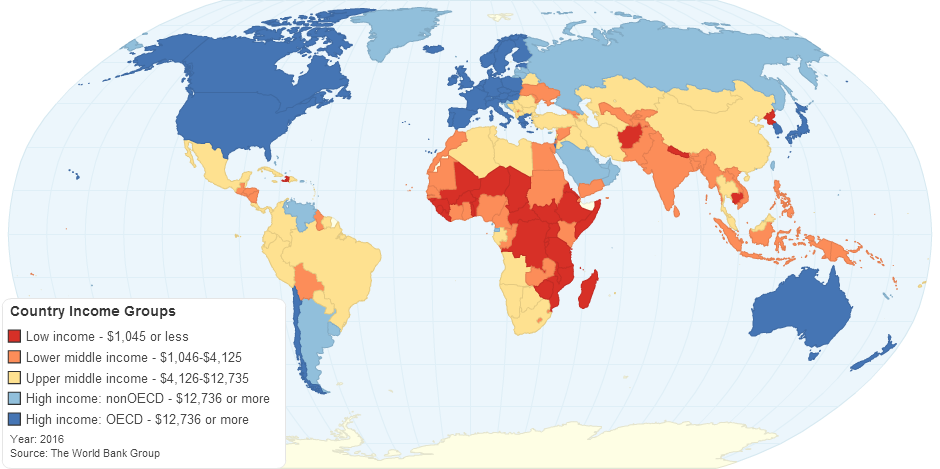

The definition of “high income” varies from person to person, and city to city, so take my assumptions with a grain of salt. ($100,000 in annual income goes a lot further in Medellin, Colombia than it does in San Francisco, California).

$100,000 in Medellin would put you in the top 1% of earners with a lot of disposable income. $100,000 in San Francisco would cover rent and expenses, leaving you with very little left over if any at all.

As a whole, $100,000 a year puts you in the top 10% of earners in the US, and the top 1% of earners in the world. If you’re here then congratulations!! The sooner you achieve this in life, the more you can take advantage of compounding interest in your investments in your later years.

My Story

I’ve been both fortunate and unfortunate, and although I am 27 years old, I could fill a book with what led me to where I am today. I’ve come to learn that attitude is often times the only thing we can control when shit happens, and it is the single most important trait that has led to my increase in cash flow.

The reason I would even include any background on myself in this post is that as my income has risen rapidly in the last 5 years, my focus has shifted away from cash flow generation and to capital preservation, estate planning, and investment opportunities (to ultimately achieve financial independence).

My income history:

- 21 years old: Finished College. Income $30,000

- 22 years old: Income $60,000

- 23 years old: Income $100,000

- 24 years old: Income $150,000

- 25 years old: Income $250,000

- 26 years old: Income $600,000

- 27 years old: Income $4,000,000

My motivation since finishing college to work hard was to gain financial independence as quickly as possible, so I started as soon as I was out.

If you didn’t that’s okay, it’s never too late to start… I will lay out the steps to financial independence I have taken from 21 years old to 25 years old, as these will fall into line with most readers. (Age 26-27 have mostly been about conservation land easements, captive insurance, trusts, LLLPs, and subsidiary companies).

How I earn $4 million a year

Before I get into actionable steps on how to reach financial independence as a high-income individual, let me tell you a little bit about how I got here.

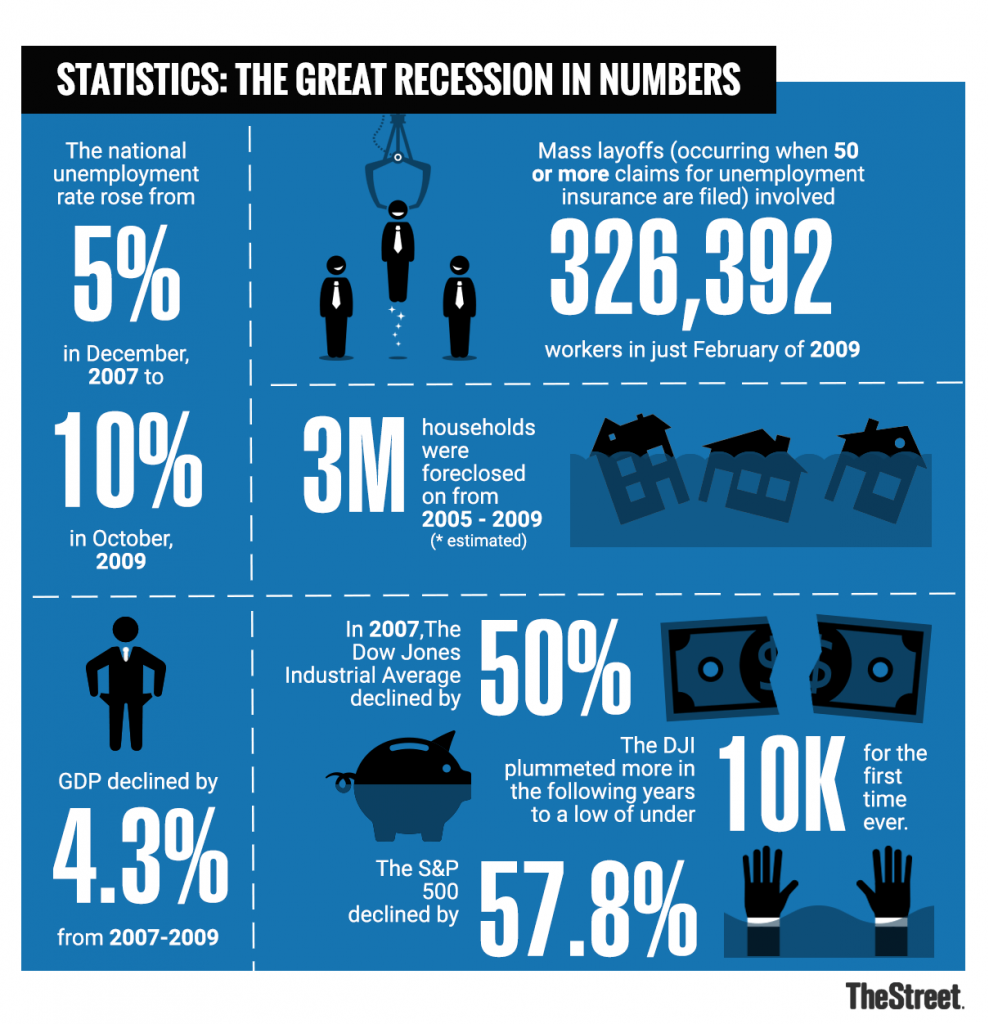

In 2009 when the financial crisis was wreaking havoc on American lives, I was a senior in high school. I was too young to understand the impact of this meltdown on the world, but I knew it was bad because my parents were forced to sell our home in the middle of the year.

It was called The Great Recession for a reason.

I moved into my neighbor's basement while my parents moved a couple of hours north.

After I was granted admission with an academic scholarship into the best public university in my state, I, with my newfound lack of parental supervision, began to party excessively and skip class…

Fast forward to high school graduation, and although I was days away from moving to my new college town, I was in a panic because my poor second-semester grades pulled my GPA a decimal point low enough to have the university pull my scholarship.

Of course, telling my father that I needed $30,000 on a whim during the greatest economic crisis of his life felt not only immoral, but I genuinely was afraid for his health…tough times cause a lot of stress.

I needed money and fast.

My drive to quick money

I had 3 months to pull together the funds. I moved to my college town and crashed with my already enrolled older brother and began to knock on business's doors looking for a job.

I quickly found a job serving tables at the country club (ironically enough this is where I met my first employer out of college), but $12 an hour wasn’t going to make me enough for school, so I frantically searched for ways to make more money.

This was about the time the iPhone 4 came out and was Apple's first major advancement in the iPhone in many years. They under-predicted demand by a long shot releasing a low supply of units in relation to demand, creating a massive spike in prices on the open market like craigslist and eBay.

If I could just get my hands on iPhone 4, I could sell them for a $1000 mark up online…

I cold called every single AT&T Store, Apple Store, and Best Buy in a 150-mile radius racing to be among the lucky few to receive one, even camping out with friends overnight before opening.

Eventually, I reached my target but barely did so, selling enough phones and pulling out the maximum in student loans without a parental cosigner to help.

All in all, I was officially a freshman!!

Fast forward 3 years of ‘having too much fun’ in college, I graduated having discovered my talents in sales and wanted to focus my efforts in high margin, high value, business to business, and technical sales.

Utilizing my relationship at the country club, I was able to break into medical device sales. Being that you are selling to orthopedic surgeons, who are among the most intelligent, skilled, trained of all trades in the world who will utilize your products in high-stress surgical situations, it took me many years of grinding it out in the trenches to legitimately add value in the operating room.

It took me about 2 years to become skilled enough to sell my products on a technical level, but it took 4-5 years for me to foster some very close relationships with clients and mentors, which ultimately, are the most responsible of my success.

I’ll sum major events in a quick timeline.

- Age 21 - Secured first ‘big boy’ job working for a large Fortune 500 medical device company

- Age 24 - Company merged, I was fired and began working at a start-up med device firm

- Age 25 - My first major account conversion, and my realization that when I make $150,000 my company makes 10x off me

- Age 26 - 4 major account conversions later, I had enough leverage to convince my company to let me go full commission with the company and make 30% commission instead of 9%. Also, this is the year my crypto grew from $20k to $150k, and I sold close to the top. (felt like 2008 parabola so I knew I had to sell).

- Age 27 - Now with $200,000 in the bank, I had enough money to scale my own medical device manufacturing and distribution company. I buy products from manufacturers, private label them to my own branding and add them to my existing hospital contracts and sell through my relationships at hospitals. Because I am now a ‘stocking distributor’, taking ownership and therefore more liability and risk, my margins are significantly higher. So within the same 2 year period, I not only grew my total sales, but I now capture more of the pie. So instead of making 9%, and later 30% on a low 8 figure sales territory, I now make 60%.

Yes, I earn a LOT of money, and I am choosing to set myself up for my future.

Lifestyle Inflation

This concept refers to increasing one’s spending when income goes up.

I learned early on that living to impress other people is a fool's game. Fortunately for all of us, it’s ingrained into American culture and The “Keeping up with the Joneses” mentality drives our economy, as it’s motivation for people to work longer hours, get better-paying jobs, and take out all that debt….which is like pouring gasoline on a fire.

Inherently, this behavior is a positive externality on your life as long as you do not participate.

I am a firm believer in NOT following the herd. This means that when you get that raise, that bonus, etc, you allocate it to income producing and/or appreciating assets. Not the BMW, the boat, etc.

Happiness is not about obtaining material objects, it is about mental health, physical health, and relationships with friends and family. Money buys us the one finite currency on the planet: time. Use your hard earned cash to invest in assets that appreciate and produce income yes, but also invest it in your physical and mental health as well as your friends and family. I.e vacation

“Man.

Because he sacrifices his health in order to make money.

Then he sacrifices money to recuperate his health.

And then he is so anxious about the future that he does not enjoy the present;

the result being that he does not live in the present or the future;

he lives as if he is never going to die, and then dies having never really lived.”

- The Dalai Lama

7 Actionable Fiscal Steps to Financial Independence and avoid Lifestyle Inflation

Moving on…here let’s discuss what steps I took to put the income to work for me and some of the ways I avoided the dreaded spiral of lifestyle inflation.

Step 1: 401K Match and Max Out.

401k match is free money. Totally do it. From the get-go, you want to pay as little in taxes as possible. When you’re making $100k plus and more, you want to try to defer tax payments and get yourself in a lower tax bracket. If an emergency happens you can always tap into your 401k. The money put in your 401k won’t hurt you because it’s being offset by paying less in taxes.

And in a rare piece of GOOD financial news (at least back in 2015), the average 401k balance hit a record high of over $91,000 thanks in part to a soaring stock market and people choosing to make contributions into their company-sponsored 401ks.

Step 2: $10,000 Cash Balance.

This assumes you can live off of $3,000 a month. There’s no reason to have more than 3 months living expenses because the unemployment payments can cover your other 2 months (assumption you will never quit without another job lined up). If you are hard working 5 months is more than enough time to secure a new job.

Step 3: Dollar Cost Average.

The important piece to start early and start now. We have been investing a set amount of money monthly into an ETF that matches the S&P 500 for 6 years now. Will companies be larger in 10 years? 20 years? 40 years? Yes to all three.

Avoid the temptation to follow the herd, and buy stocks constantly over time. You get stocks cheaply in downturns and expensive in the high P/E years but over time this will produce a nice health 7% return. Compounded over 20-30 years will exponentially increase your money…

Step 4: Pay Down Expensive Debt.

Some would argue to do this initially, as you are burning into your wallet with high-interest rates…looking back I think the earnings in “up years” in the stock market, tax savings with a 401k match and maxed out, and the comfort having $10k in savings were all instrumental to my financial health foundation.

Pay down credit cards as their interest rates are absurd. Go down the line from high to low, student loan debt if above 6-7% pay it down. (If the S&P returns 7% on average YOY, what’s the point of not paying down any debt above this marker asap). If you have a mortgage, that is fine, but refi to a lower interest rate if possible.

Step 5: Cover Rent.

The next step and one of the hardest to achieve early on is generating passive income to cover rent (and, this will be much easier if lifestyle inflation hasn't taken hold of your mortgage!). I am a firm believer in diversifying into as many streams of income as possible to mitigate risk by not being reliant on one single income source, passive income being the King of them all.

“Side-hustles” independent of your day job are crucial!

These explain why my income jumped so much the last two years. I had many of my start-up side jobs fail, but I did not personally fail because I still had my day job. Finally one took off, and now I am working on transitioning over to it full-time. Passive Income is my new focus.

In fact, here are several examples of passive income streams (ranked from my most to least favorite based on my experience):

- Semi-Passive Side-Hustle (Complete Control)

- Dividend Paying Stocks

- Fundrise Crowdsourced Real Estate Investing

- Muni Bonds

- Physical Real Estate (Semi Passive)

- Money Market accounts and Certificates of Deposit (Cash Allocation)

All of these listed above would warrant an additional post to fully detail. Once you cover your rent or mortgage, you may now consider leverage with a low interest rate.

Step 6: Credit Facility.

This helps you to fuel what you’ve built, and scale your passive to semi-passive income. If you can get a low mortgage rate on a duplex with a 30% down payment, you’re well positioned that your tenants would at least pay your mortgage.

Step 7: Covered Expenses.

We are at the final stages of the journey as this is the Nirvana we are looking for.

Live a good life anywhere in the world after passive income surpasses expenses.

We have a comfortable emergency fund, we have avoided the pitfalls of lifestyle inflation, we have worked hard to lower tax burden on all income streams, we have paid down high interest debt, we have many multiple balanced and risk adjusted passive streams of income, and we have allocated a certain portion of our passive profits to DCA into risk-on assets.

This point is key, to not get into high risk ventures without a complete understanding of the risks of breaking down your hard work. CAPITAL PRESERVATION will be crucial throughout this stage and beyond.

If your income is $100,000 or above, you could start moving along step 1-7 much quicker than somebody who is lower. The more money you make, the more aggressive you can be and the quicker it should be to reach financial independence, although this assumes you don’t increase lifestyle inflation in proportion to your increase in disposable income. Making money is very difficult, and having your money make money for you is just as if not more important.