My social status turned into a financial shit show

Your social status is solid. You're looking the part, kicking ass and taking names. But, where's all your money? Are you working forever?

Imagine for a moment: Your social status is solid. You're looking the part, kicking ass and taking names as a high-income earner. Society believes that you have it easy. Got lucky. Privileged.

After all, you make great money, live in a big house and buy practically anything that you want. You're the perfect example of living the American dream.

Until you sneak a peek at your bank account and realize, despite racking in north of $200k a year, you only have $1,800 available cash sitting in the bank.

Today, I'm bringing you the story of John (yes, that's his real name). John's a high-income earner. He's living the good life, earning a ton of cash and buying the things that he believes make him happy.

Until one day, panic mode sets in.

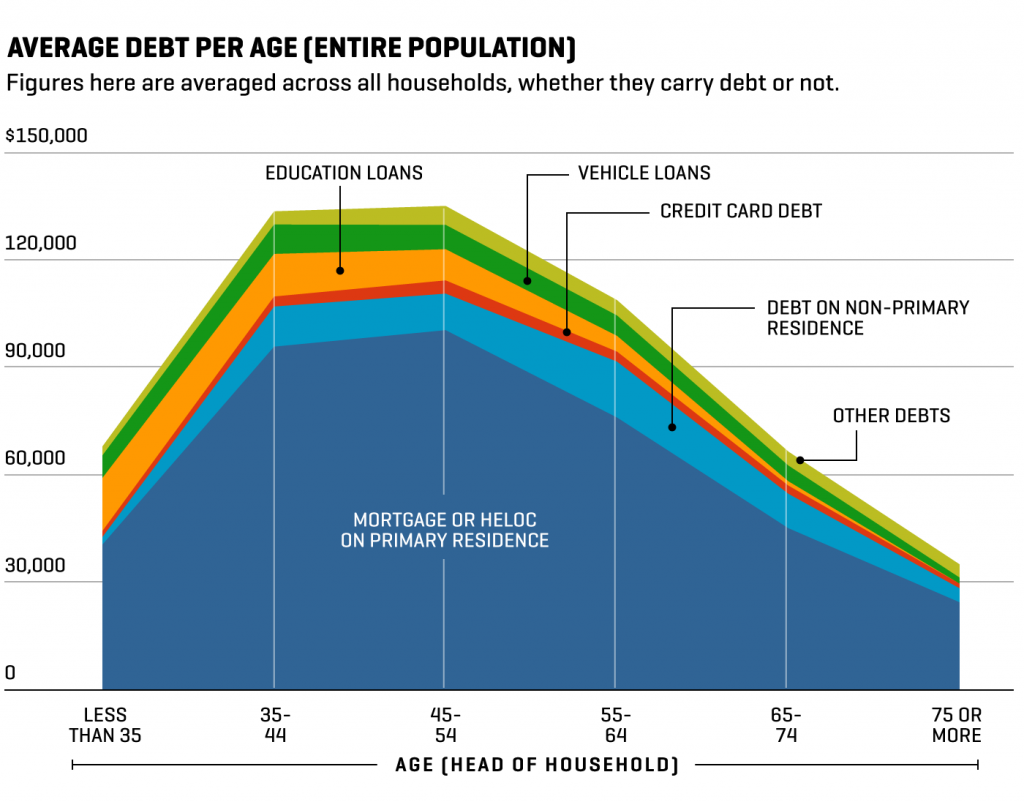

Social status and debt

My name is John. I am 46 years old. When Steve asked for a high earner to share their story of financial idiocy, AKA lifestyle inflation, and an addiction to social status - and how they approached fixing their finances to achieve FIRE, I knew I wanted to give it a try.

Steve and I both hope that my story may be of some value to high-income earners struggling with their finances but I also hope that no matter where you are on the income scale you can take something of value from my story.

My wife and I earned $205,000 last year. We have earned over $150,000 for the last ten years and over $100,000 for the last fifteen.

Six years ago, we had $312,000 of debt that was comprised of two cars, a mortgage, student loans, and a small credit card debt (I was always really proud of that last bit). Our net worth was in the red.

Debt is a big business in the United States.

We had $1,800 in a savings account and enough in our checking account to do nothing more than make ends meet. Our 401k’s didn’t even add up to $100,000. I was 40 and had earned over a million dollars in my life at that point. Our finances were a shit show.

How in the hell did this happen?

Lifestyle inflation began immediately

I didn’t graduate college and fall into a high paying job. In fact, I didn’t go to college at all.

My wife did but didn’t finish her degree until she was nearly 30. We are highschool sweat-hearts from upper lower class backgrounds. Saving wasn’t a thing in our childhood homes and investing was a word we never heard.

This is not a story of privilege.

This is a story of hard work and bad financial decisions that seemed like the right thing to do at the time, but more than anything it is a story of luck. My wife and I would be the first to admit we are lucky. Lucky we have the life we do and lucky we stumbled upon the FIRE concept.

Our lifestyle inflation began immediately. I began working right out of HS in the electric utility industry and soon bought a brand-new truck ($10,000, it was over 20 years ago) and a fixer-upper down the street from my parents’ house with no money down ($50,000).

My debt journey had begun. I was making about $35,000 and my then fiancé, now wife, was going to college – on loans. No one told us we were heading in the wrong direction.

No one we knew would have known.

Over the next 20 years; we had two children, I changed companies twice, I took 3 promotions from my current company, we built two homes (each bigger and more luxurious than the last in order to match our “status” in the world), had two children, my wife dropped out of college, my wife went back to college, my wife became an RN and we continuously upgraded our cars, clothes, and vacations.

Income increased but we didn't save

Over those twenty years, our income jumped drastically a few times and rose steadily in between those jumps. We didn’t save shit, which leads to the horrific numbers you saw above.

When it came to our kid’s education, we paid (borrowed) our own way and so would they. It would be a good life lesson for them. Yeah, that was misguided.

When my son was nearing graduation and college decisions became serious my world nearly blew apart. I realized we earned too much money for him to get much in the way of student loans and I realized we didn’t have enough money on hand to pay, or enough room in the monthly budget.

My wife and I would have to take out loans in our name to pay for college.

Activate panic mode

I was in a full-blown panic. It was the first time in my adult life I had ever faced the facts about the financial situation I was in. I will never forget when I did the math and realized the magnitude of our debt while staring at $150,000 more to get two kids through college.

We had spent the last 20 years building a life that looked great on the outside but was a financial shit show.

Here is where I must admit a hard truth to you.

My wife is naturally frugal, but I had always taken “care” of our money. I paid the bills and encouraged the spending. If we could afford the monthly payment I was all for it. My wife trusted me and I led us to $312,000 of debt, no money to pay for college and a situation where one job loss would have meant complete disaster. Way to go genius.

Oddly enough, I am now thankful it all happened.

My panic had lead to a desperate search for a way out. First, I stumbled upon minimalism and realized my life was pretty much a materialistic nightmare. I was, as much as I hate to admit it, a consumer sucker with no awareness of that fact.

And, I don’t particularly give a shit about cars but there I was with $35,000 of car debt that didn’t make me happy. I didn’t need a big fancy house in the suburbs that took a full day to clean. It didn’t make us happy. I began to realize none of the junk I had wasted our money on made us any happier.

Now is the time to act - hello, debt snowball!

We were working our asses off and buying stuff that meant we had to continue working our asses off.

Time to act.

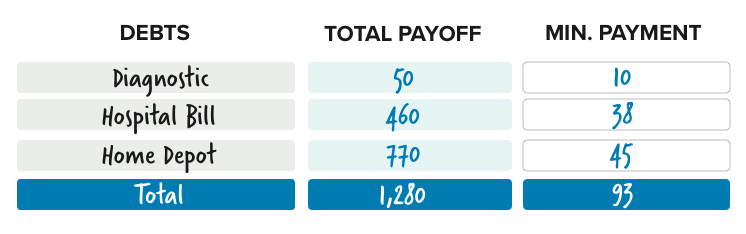

For me, the debt snowball method trumpeted by Dave Ramsey and others was our way out of debt. It was simple yet required discipline to execute. The discipline that would serve me well for what was coming. The get out of debt method you choose doesn’t matter. Just get your ass out of debt.

That alone is a liberating feeling beyond belief.

We made our plan, adjusted it along the way and began to think about money in a totally different way. And, we knew material items weren’t making us sustainably happy. We had been spending money on material things to look successful and had missed out on countless opportunities to do the things that really made us happy.

We were living a poor life with a wealthy appearance. Pseudo-affluent much?

While paying down debt I was still researching personal finance and stumbled on this guy called Mr. Money Mustache who introduced me to the FIRE concept through his easy to grasp articles and occasional face punches. A new FIRE was lit, pun totally intended.

I went back to the drawing board and realized that not only could we get out of debt, but we could also achieve this FIRE thing. Just knowing what's possible makes a world of difference. That became our new mission and driven by the ever-increasing sense of freedom as our debt got smaller, we knew it was the right move for us.

Did I mention our careers weren’t making us all that happy either?

We began to understand what was possible

Full of new energy, we began to make some tough, and sometimes counter-intuitive decisions.

- We had reached the point where credit card debt and one car were paid for in just over a year and a half.

- We had been able to cut enough expenses to use my yearly bonus to pay for my son's first year of college tuition.

- I sold my truck and bought an 8-year-old used Toyota in great shape. I had to finance it, but in doing so I could reduce our debt timeline by a full two years!

This led to the decision to sell our big fancy custom home and find a smaller home in a cheaper neighborhood closer to work.

Right after our daughter graduated from high school, we sold our big house and bought a century home in a cheaper neighborhood 25 miles closer to my office (which I now ride a bike to at least twice a week).

We decided to put the minimum 20% down on the new house and use the rest of the profits from our old house to finish off our debt. I smiled for a solid week after sending the check to pay in full, the last of our debts.

Aside from the $130,000 mortgage, we didn’t owe anyone anything after 3 and a half tough but liberating years.

We began making smarter money decisions

The house is everything we both really wanted all along and all that we need. It is less than half the size of our previous house. The kicker is, the property came with a two-bedroom cottage at the rear of the property that had a renter in place!

We were suddenly owners of income-generating real estate. The rental income goes directly on top of our mortgage payment.

What else?

- We pay cash for college tuition and now save/invest half of our take-home income.

- Both my wife and I max out our 401k plans at work ($38,000 yearly) and contribute an additional $3,500 a month to a Vanguard ETF ($42,000 Yearly).

- We are setting aside an emergency fund as well.

- Our saving rate will be around 75% when we are done paying college tuition (3 more years).

Our net worth is now north of $400,000, we are happier than we have ever been and will reach our FI number in roughly 6 years.

I plan to work until I am 55 to take advantage of the fact that my company is one of the rare ones that still provides a pension and reaching the magic age of 55 and 30 years of service makes an enormous difference in the pay-out. The pension will provide an extra cushion for unknown things like healthcare or allow us to travel more than we currently have planned.

Getting out of debt is worthwhile pain

I can’t stress this enough; getting out of debt should hurt a bit. If it doesn’t you are not doing it right. Once you are debt free, you need to find the perfect balance between spending and happiness. That is a completely personal endeavor.

I will wager that your optimal happiness does not require near as much money as you think.

When you have a high income and have squandered it over the years, there are several mental hurdles and tough decisions you should be aware of when deciding to pursue FI.

For example:

- What will people think when you show up in an 8-year-old car?

- Will people you know see your lifestyle change and assume you have money problems?

- What will people think when you downsize your house?

- What will people think when you stay in a tent on vacation instead of the all-inclusive resort?

- Could we lose friends over this?

These are just a few examples. Some of this might be seen as “rich people problems” but it doesn’t diminish the fact that they can be very, very real.

Ridding ourselves of the financial nightmare

In our case, we both wanted FIRE badly and the nightmares in our head were much worse than reality. We took one thing at a time and each “lifestyle correction” step we took assured us we were doing the right thing and no harm would come to us or our reputations.

No one noticed I swapped my truck for an old Toyota except my family and they didn’t give a shit. Unless you are one to brag about the car you drive this probably won’t be an issue for you either. People don’t care as much as we think they do.

If you recognize and avoid lifestyle inflation in the first place, you can avoid all that mental anguish and live a long, work optional, fulfilling life.