Have you seen the new Personal Capital dashboard?

If you haven't logged into your Personal Capital dashboard lately, then you may have missed the new dashboard interface that they rolled out recently. I hope you like dark blue, though.

A classy Disclaimer: This blog post contains affiliate links! All kinds of affiliate links. Affiliate links galore! You have been warned, my good financial friends. Honestly, don't we all assume these types of posts contain affiliate links by now? ;)

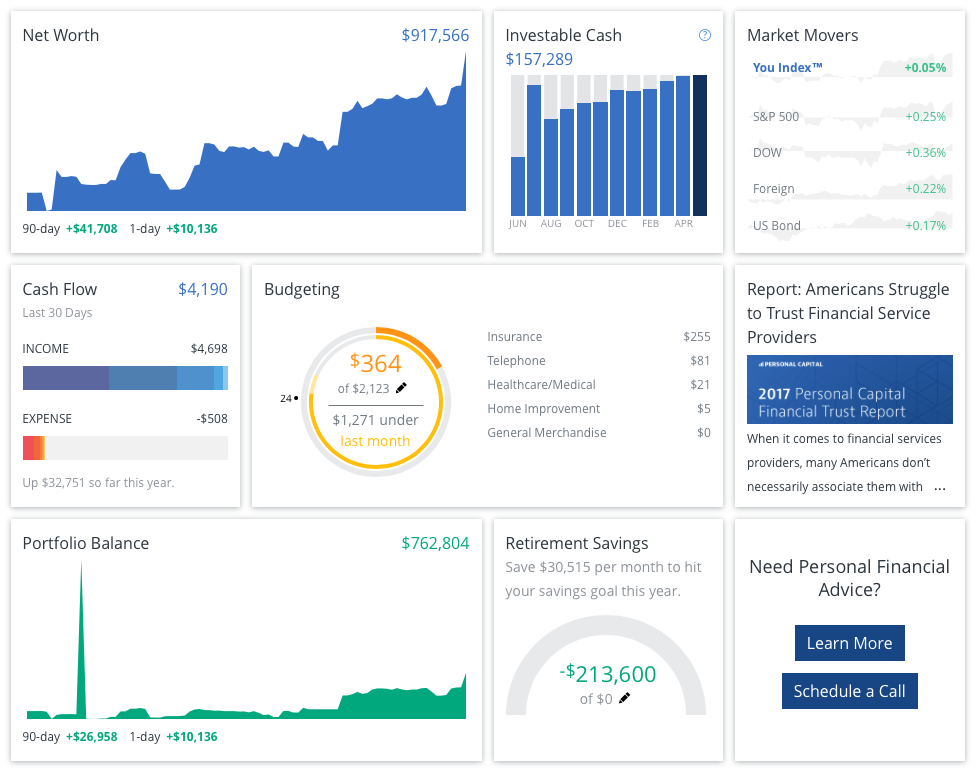

Here's what my Personal Capital Dashboard looks like (from a Desktop device):

Okay - what makes this even more beautiful is the fact that the market generated a $41,000 increase in our net worth over the past 90 days, which is pretty screamin' cool. But beyond the numbers, I'm digging the new interface.

The colors are lovely. Calming blues in the midst of [hopefully] exciting financial times. A more compact look and feel requires far less scrolling than the previous interface.

Less hunting and pecking to find data that probably interests those who are tracking their financial picture on Personal Capital - like, for example, Net Worth, Investable Cash, Market Movers and Cash Flow right there. No clicking. No scrolling.

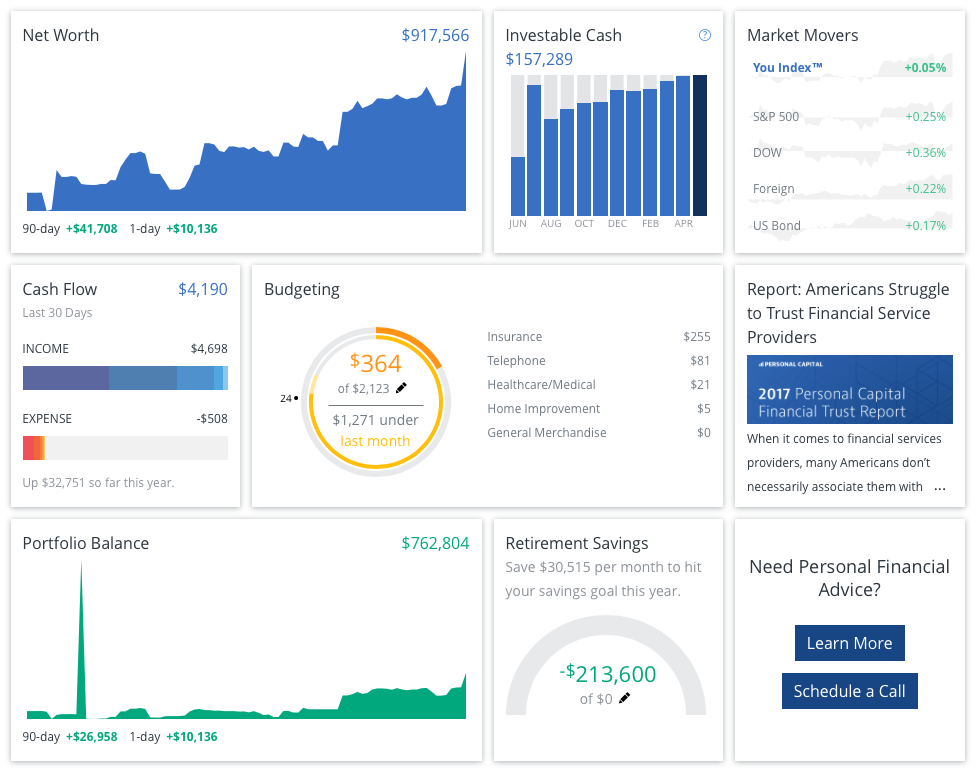

The graphs changed a bit, too. Previously, the Cash Flow graph contained circles. Now, we're gettin' a couple of bar charts:

Here's the new Cash Flow page - virtually identical in substance. We aren't necessarily seeing more information. Instead, we're seeing it differently:

It's a Personal Capital Dashboard facelift

As far as I can tell, no additional functionality was added to Personal Capital. This update accomplished nothing more than a change to the look and feel of the Personal Capital Dashboard. But still, I respect the fact that Personal Capital wants to keep things fresh and improving.

What was wrong with the previous interface?

As far as I'm concerned, nothing. My major gripe with Personal Capital has always been their inability to connect to some financial institutions. And I'm not talking about small, inconsequential companies, either. Major businesses, like Ally. We haven't been able to connect our Ally credit card up with Personal Capital since we first got it - months ago.

If there was nothing wrong with the Dashboard, why change it? I can't answer that question. But, it's a fair one. Many of us were used to the previous look and feel. But hey, like I said, I like it when companies try new things and push the envelope a bit.

It makes me feel like I'm doing business with people, not some nameless corporation.

So, tell me - what do you think of the new Personal Capital Dashboard? Improvement or a step backward?