Planning our retirement by the numbers

If I were to save an extra $50 a month starting today, what does that mean for … this, that the other thing down the road?

If you have been a reader of Think Save Retire for any amount of time, you probably have a general idea of our plans for the future. Save, buy townhome in Sedona, pay off townhome in Sedona, move to Sedona, eventually buy our home in Sedona and rent out townhome to cover home costs. Live happily ever after.

Throw in figuring out side income streams, traveling across the US in an RV and other assorted randomness and you’ve just about got it. However, through all this online talk, there is something that has been missing - the numbers!

Okay, this might get a little messy. But you'll love it, I promise!

I freely admit it. I am a numbers freak. I love spreadsheets. I love lists. I love sitting down and figuring out what ifs. If I were to save an extra $50 a month starting today, what does that mean for … this, that the other thing down the road? It gives me shivers. Total math nerd right here.

Steve, on the other hand, is not a numbers freak like me. He doesn't mind the numbers - especially the ones you will see below - but certainly does not get the same thrill from playing with them. So he asked that I share my numbers love affair with our readers so they can see our plan - our Plan by the Numbers.

Mostly, I think he just wants to make the point that we aren't just full of crap with this whole "retire early" business. :)

Caveat Number 1: We KNOW we cannot 100% plan for the future. Things happen. Thus, all of this is a mix of best case, what we know, what we think and some reality thrown in.

Caveat Number 2: While planning is important, due to caveat #1 we don’t want to get ahead of ourselves. You’ll see that while our short term goals are pretty firm, the longer term ones are more conceptual. This works for us. We’re constantly re-evaluating, and as time goes on and we accomplish our short term goals, we will start making new ones.

Here we go!

How do we track our income?

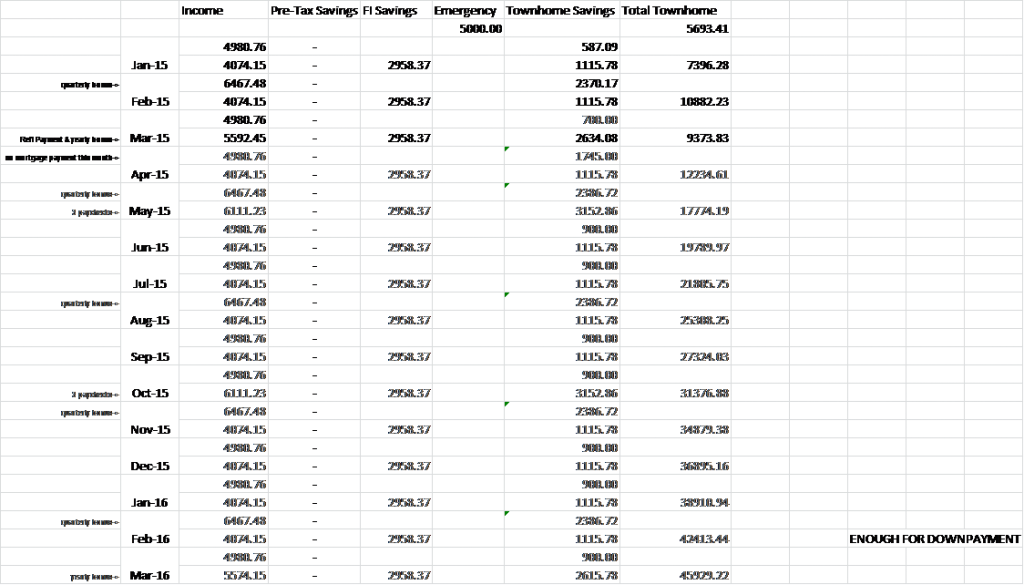

First where is all the money going? And why? Below you will find one of my many spreadsheet tabs documenting our income for the next couple of years. Obviously, this is an estimate. I tend to estimate conservatively so no raises are included. Do we know what we’d do if either one of us got a raise? ABSOLUTELY! It would go into savings with the rest of its kind.

This is a look at our estimated income and where the money is going in terms of saving over the next couple of years. By sticking to our budget (which we’re doing a decent job of so far and actually hasn’t been that tough), we’re not only maxing out our 401ks, and saving my entire paycheck, we’re also saving on average about $700 a month from Steve’s paycheck.

As the spreadsheet indicates, we have our savings broken down into 3 buckets: Pretax, FI and Town house. The Pretax is just that, maxing out our 401ks and getting the matches our companies provide each month. This one is easy and automatic. Honestly, I don’t even look at this much. Want to see why? Check out this spreadsheet tab.

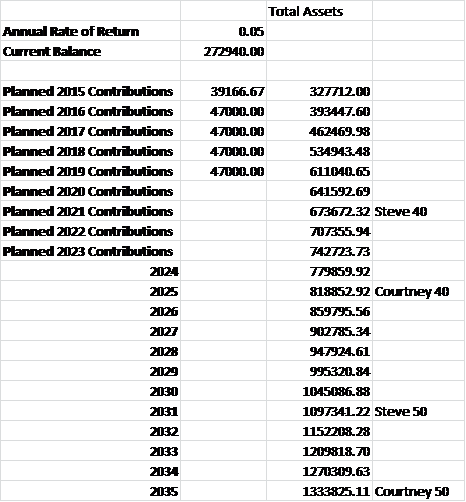

This maps out what our automatic savings would look like if we continue to both work and max out both the 401ks and Roth IRAs through 2019. Of course, we don’t touch them until reaching the proper age. We’re golden. Even if our income pushes us out of the Roth IRA criteria here in the next couple of years…we’re still golden. Before either one of us turns 50, we’ll have over a million dollars. So honestly, I’m not too worried there. Just keep on keeping on.

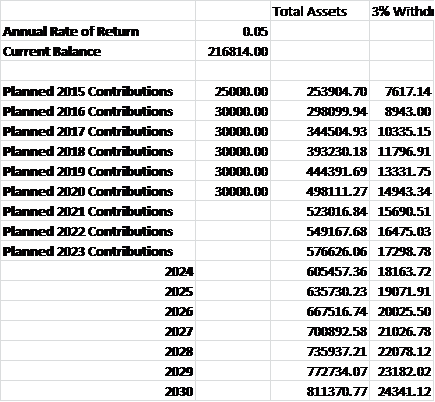

The next bucket is FI. This is our long term savings account where we’re currently throwing $2500 a month from my paycheck. This is also what we will eventually live off of when we stop working for a living, and this is where the numbers get a bit more wishy washy. Take a look.

If we threw all our savings or even all of my paycheck here, we’d be golden by the time we want to stop working fulltime (2021 at the absolute latest so Steve meets his out by 40 goal!). However, it makes me nervous to have all our eggs in one basket. I much prefer having our passive income come from at least 2 sources….hence the townhome (details to follow).

We’re currently only contributing $2500 a month into our retirement savings. At this rate, we won’t have enough dough in those accounts to live off of by 2021 especially if we’re still paying off our mortgage on our home (the second home that we will both live in - not the town house) in Sedona, which we most likely will be. However, we will have a paid off town house generating rental income, and combined with a few additional side income streams, our ambitious retirement goal is still possible. We’re going to continuously re-evaluate as time progresses and figure it out.

For example, my knitting pattern writing venture might take off and start pulling in serious money. Or Steve’s photography, or we get our personal training certifications and start training people to be healthy (one of our possible FI dreams), or I write a best selling novel. Who knows. Worst comes to worst, if we get to the point where we'd like to retire, and we’re not 100% comfortable with our financial situation, one or both of us can keep working a bit longer. Flexibility is key.

The Sedona Arizona town house

The last bucket we’re currently throwing money into is our town house savings. This is a short term savings account where we also keep our emergency fund.

Quick note on the emergency fund: We only have $5000 in this account….though not really. We also keep about $10,000 in our checking account to avoid fees and to have it on hand. Thus, we really have more like $15,000. We both believe this is a reasonable amount to keep around. Emergency funds are meant to be there in case of big catastrophes, like needing a new car ($15000 is MORE than enough), prolonged illness or losing your job. Since both of us pull in a respectable paycheck, if one of us were unable to work for whatever reason, we could easily live off of the other's salary (and probably still save). This would obviously prolong our savings goals, but we could live through it.

Now onto the town house savings. See what we’re thinking below:

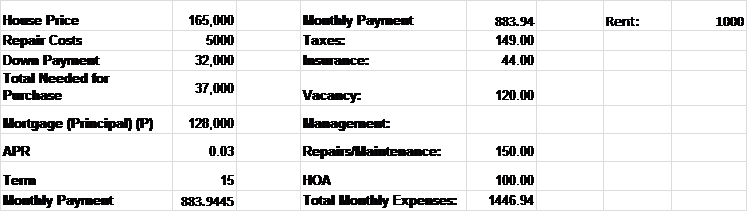

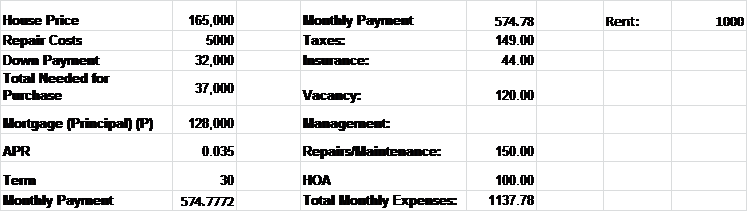

We want to buy a town house in Sedona in the near term to start renting out and paying off as quickly as possible while both Steve and I are still working. Our budget is between $150000 - $175000, though we’d love to spend as little as possible, of course.

Our must haves: 2 bedrooms, 1+ bathrooms, safe area (easy enough in Sedona), good space (not strangely laid out), low-ish HOA, must allow dogs. We are actually hoping for an older property that needs updating in the hopes of picking it up for cheap. We would do the renovations. However, major renovations are not in the plans for this property, so these updates would need to be cosmetic and the property darn close to move-in-ready.

Why do we want the townhome? Three primary reasons:

- First, to rent out and at least pay for itself in the next few years while we are still working in Tucson.

- Second, once it is paid off, we plan to move in and stay there mortgage free while feeling out how we like Sedona and searching for our home. This is why they must allow dogs because our pups will be coming with us.

- Third, once we move into our Sedona home, we plan to rent out the mortgage-free town house to provide us with passive income for the long haul.

Some of you may notice that this plan does not produce much in the way of cash flow immediately. Sedona is a beautiful vacation spot with vast access to breathtaking red rocks, gently-flowing streams and a wealth of outdoor hiking. Due to this, location (and, more specifically, the view from the property) is key.

In our price range, we probably won't get much in the way of a view, and that is okay. Cheaper properties cannot be expected to offer the same views as million-dollar estates. Another option for us is purchasing an older single-family home with a view, but needs fairly major renovations to keep our costs down. This, unfortunately, would push our buying horizon out substantially.

But in the end, we feel that a smaller and less expensive town house, even without a view, allows us to make our purchase next year and begin establishing ourselves in Sedona. Whatever rent we get may cover the cost of the mortgage and HOA fees, but even if it doesn't, the reward is worth the expense in this case.

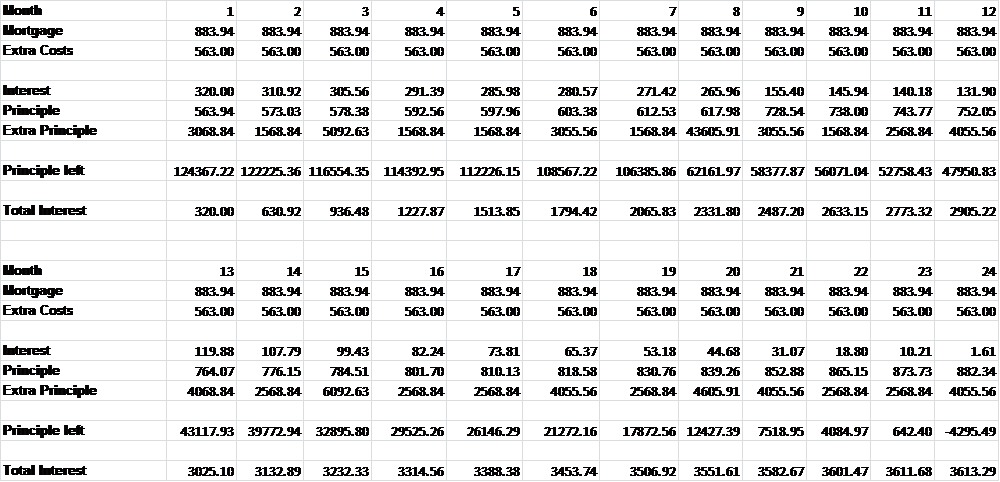

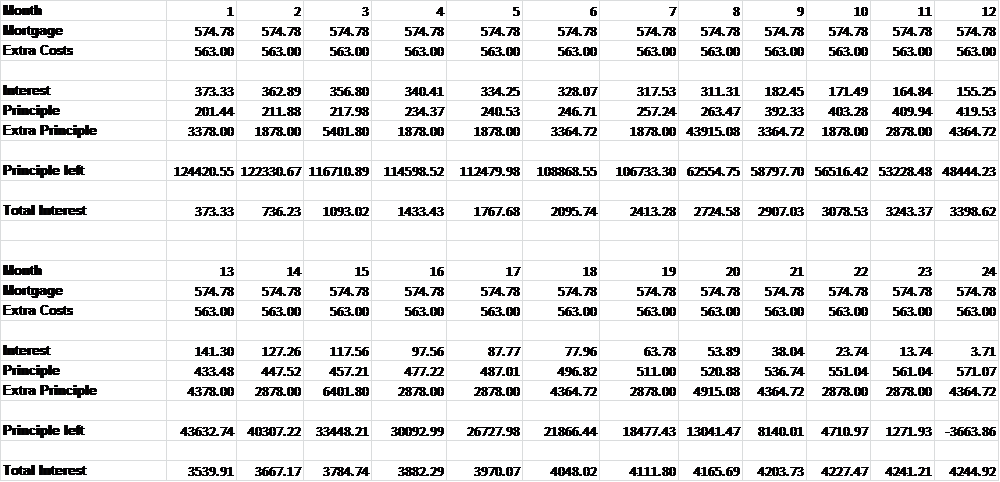

While it is being rented (and we are still working), we plan to throw every spare dime towards the mortgage as you can see from the 'Extra Principle' line in the above spreadsheet. Once the mortgage is paid off, we’ll definitely switch over to a positive cash flow, even with an HOA. Long term, it’s perfect. It also means less outdoor maintenance and great perks for our tenants, such as pools and other amenities.

And, it's kinda nice having a completely paid off property in the place that we love.

You will notice that we plan on getting a 15-year mortgage instead of a 30 for the town house. Does this make sense? In fact, I ran the numbers both ways. You can see the 30-year estimate below (notice I upped the interest rate as well). We still plan on devoting the same amount of money each month to pay off the mortgage as quickly as possible. Does having the 15-year vs the 30 make a difference?

It’s not huge, but it definitely does! Since we KNOW we’ll be able to make the higher monthly payments with the 15-year mortgage, it makes total sense to go this route for the town house. For our eventual home in Sedona, on the other hand, I’m currently estimating a 30-year mortgage. This is because I do not KNOW that we will have the income to pay a higher monthly payment (even though we’ll be shoving money at the mortgage for as long as we can). When we get there, we might realize that we do have the security of meeting the 15-year payments and therefore should go that route. We shall see.

Phew! That is our current plan by the numbers….though, one can only assume and anticipate the future to a certain degree, as I have hopefully explained. I’m okay keeping things a bit wishy-washy and updating the numbers as we go along. That’s half the fun in my opinion - to see how far we have come!

The plan from this point

Given this plan, what do we do now?

- Keep on keeping on. Stick to the budget. Save every extra penny, just the way we've planned.

- Try to establish some dependable side income streams. See what works and what doesn't work. Side incomes will make everything go quicker, run smoother and facilitate getting out of full time work that much faster.

- Sit down every month and evaluate where we are (communication is key!). Do our plans still meet with our goals? People change. Goals change. We need to keep our plan flexible so we can make on-the-fly adjustments in our pursuit to completely nail this goal - the first time.

So how about that RV trip around the United States that I mentioned a couple thousand words up? Ah, glad you asked!

Steve and I have become inspired by the first season of "Departures", available on Netflix. This show follows two Canadian 20-somethings (and their camera man) as they take a year off to travel the world. They started by renting an RV and traveled across Canada east to west. They did it MUCH too quickly because they were on a tight schedule. But, that lit a spark within Steve and I.

Some of you may know that Steve’s parents lived in an RV and traveled the country for 12 happy years. They loved it. They were ready to move on when they were done, but no regrets. We think a 3-6 month trip across the US would be a trip of a lifetime! This is still very much in the idea phase (not even close to planning), but we’re keeping it fresh.

We would probably do this after we bought our home in Sedona and finished working full time. We would probably rent out our home as a furnished vacation rental while away, which would help with some of the costs. Sounds awesome, but not yet in the plans.

What is in the plans? Travel. Food. Our vices. As many of you know, this is the first year we are actively tracking every cent we make and spend. This should give us a very good idea of our base spending needs. We are not going without. We are learning if $300 for groceries and $200 for dining out works for us. We are figuring out if we can travel the way we want for $300 a month. If not, we will adjust the budget and our future needs. Again, this is why so many of our numbers are wishy-washy. We need to figure out our base needs, add in a buffer for unexpected problems and that will determine how much we need to live on.

In other words, we are using this time to establish a simple baseline.

So, that’s it. Our plans by the numbers. You will notice there is no ONE NUMBER to rule them all, or some "magic net worth number" we need to hit before we’re done working. Could I come up with one even with all the what-ifs in our plan…probably. But we don’t need one. It’s nice to see our net worth number grow, but in truth, that is not what encourages us at this phase.

Right now, seeing our town house savings grow is what makes us dance with joy. That’s step one and where our focus is. I’m not planning on figuring out the magic net worth number as of yet, and possibly never will. It will probably end up being a set of magic numbers that allows us to retire: Mortgage on town house rental, mortgage on home, emergency savings, long term savings accounts, retirement accounts, and don’t forget side income streams.

The next couple of years should be exciting, and I hope you’ll continue learning with us as we go. :)