When can I retire?

Maybe you just did your budget, or got a raise, or had a bad day at work (hopefully not), but no matter what drove you here, figuring out when you can retire is a very important exercise in future planning—and an important form of self care.

What is a FIRE Calculator?

If you’re not familiar with FIRE or the FIRE movement, a FIRE calculator might seem like something you’d use in physics or chemistry or maybe at Burning Man. In personal finance, FIRE stands for Financial Independence Retire Early and a FIRE retirement would apply to anyone who leaves their job or career because they aren’t dependent on the income anymore.

Some people have achieved a FIRE retirement at 35 or earlier based on being able to maximize their income, savings and investment style and minimize their expenses down to only spending on things that bring joy and fulfillment.

Many FIRE retirees spend their time traveling the country or world. Ultimately, you don’t have to make a ton of money or start from silver spoon beginnings to achieve this new definition of financial success. Anyone can join the FIRE movement—and there’s a pretty compelling case for why everyone should retire earlier than 65, as the government would have it.

How to use this retirement calculator + tools for tracking retirement

Not to be confused with a crystal ball which might tell you when you’ll retire or get hit by a bus, this retirement calculator takes in your information and savings habits and shows you how long it could take you to retire.

Be honest with yourself but feel free to get hypothetical! We recommend testing a few different scenarios—it’s always good to see how little or big life changes can affect your timeline.

Things to have handy:

- The current balance of any or all of your retirement savings accounts (401k, IRAs, etc.)

- An estimate of your social security benefits (around 2-3% of your average annual income)

- Your current monthly retirement contributions

In addition to this calculator, there are so many great tools for tracking your money aside from just your bank statement or Mint account. Mint is nice for getting a breakdown of your spending and debt, but it lacks one key part of the financial planning puzzle: the future.

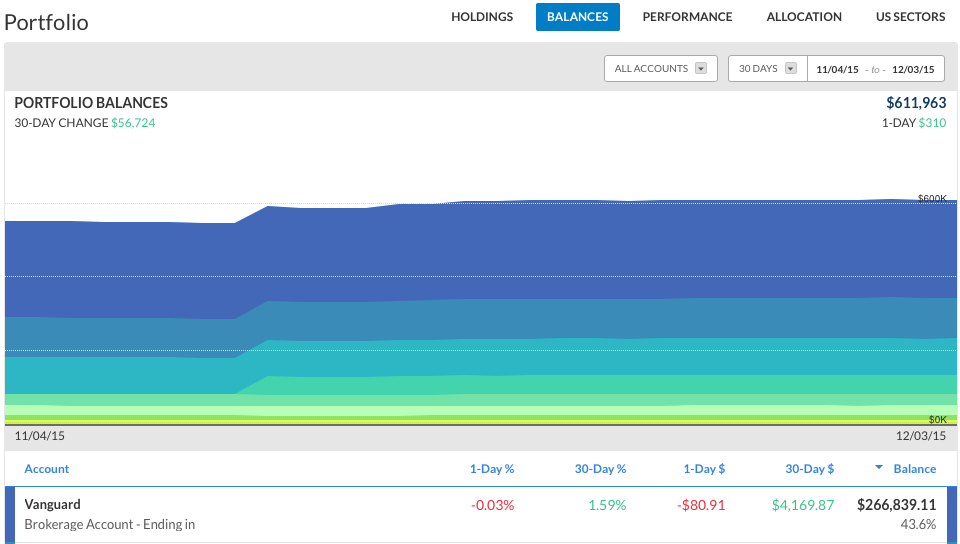

Personal Capital on the other hand, will change the way you track your finances. Yes, it has the same helpful, simple, colorful charts and graphs. It also links in your accounts so you can see everything in one place—and doesn’t break nearly as much as Mint does, if at all.

The best part about Personal Capital is that it actually has retirement planning built in (see above) so you can actually forecast and evaluate your retirement in the same place you can check and see the inverse relationship between how much you spent at restaurants vs. on groceries each month—so cool!

My countdown to retirement

I’ll be totally honest, according to this calculator, my current strategy leaves me with about 33 years left until I can retire comfortably. As someone who hasn’t even been alive 33 years, that seems longer than I’d like to be working. Using this calculator, I was able to go back and adjust the numbers to see what it would take to get on track with a more optimal retirement timeline that fits my future plans.

What I found is that it’s never too late to get started—no matter how aggressive you want to be with your retirement timeline.