Can we still talk money when we are money opposites?

How can we talk about money when we're married to someone who believes in very different money priorities? Almost like our financial opposite? Here is how.

My husband and I are money opposites.

I save, he spends.

I enjoy tracking our money, he’d rather watch paint dry.

I feel joy when I read an article about early retirement and he feels joy when I don’t ask him to read an article about early retirement!

With money being one of the main topics couples fight about, and one of the largest factors in why couples get divorced, this leaves me to wonder...why are we so often attracted to our money opposite?

Opposites don’t attract, but money opposites do.

We’ve all heard the saying, “opposites attract.”

Yet, some researchers say this isn’t necessarily the case. At least not when it comes to factors like attitudes, values, or even attractiveness in married couples. When it comes to these things we tend to flock to people who are more similar.

However, when it comes to money the research shows that opposites do in fact attract and this might not necessarily be a good thing.

Why are we attracted to our money opposite?

One theory for why we are attracted to our money opposite is that we tend to look for partners who possess traits that are opposite to the things we dislike about ourselves.

So, if I’m a bit of a tightwad when it comes to money and this prevents me from being spontaneous or getting out and having fun, then perhaps I’ll look for a partner who’s a bit more free with their money, someone who will help me to loosen the purse strings a bit in an effort to have more fun.

In other words...when we don’t like something about ourselves we look for the opposite trait in our partner.

When we love something about ourselves we look for traits that are similar in our partner.

This is why opposites don’t necessarily attract.

If we think we have a good attitude and good values and a rockin’ face and bod, then we don’t look to pair up with a boring, asshole who is also unattractive.

Instead, we look for a partner with the same positive traits.

When it comes to money we don’t deliberately search for our money opposite, this is more of an an unconscious decision. And, because money habits aren’t necessarily apparent right away it’s hard to avoid falling for someone who doesn’t have the best money management skills.

When I met my husband I didn’t think, “hmmmm, he seems bad with money, this is my kind of man!”

The attraction just happened.

What money values do we want in a romantic partner?

A study by Ally Bank asked Americans what kind of money values they want their partner to have, 55% of respondents said they wanted a frugal partner, someone who’s into budgeting and saving their money.

So, while most of us say that we value frugality this sentiment doesn’t always translate into reality.

This isn’t surprising. What we say we want and what we actually want often don’t line up!

What we know will make us happy in the long run, presumably a fiscally responsible partner, isn’t necessarily what we’re attracted to in the short term.

Similarly, what we know will make us happy from a cognitive perspective doesn’t necessarily equate to an intense physical attraction that makes us want to jump on a prospective partner.

I mean who would you rather go on a first date with...

A fiscally responsible tightwad that takes you to an all you can eat buffet for $10.99 per person or, a slightly more irresponsible spender that flies you firstclass to Italy for a pizza?

Ummm, I’d rather go to Italy.

But, unless you have unlimited resources, this extravagance will only lead to some serious debt and fighting. Again, this isn’t the person you want to be with long term is you’re fiscally responsible.

What do differing money values mean for romantic relationships?

So, what happens when money opposites get together?

Do their complementary views on money allow them to moderate each others perspectives on spending?

Or, do their opposite spending habits lead to a decrease in marital wellbeing?

In general, when a spender and a saver get together this results in more fighting about money, an increase in marital dissatisfaction and an increase in the likelihood that the relationship will end badly.

Not great news if you’re currently with your money opposite, as I am.

However, there are always exceptions to the rule.

My husband and I’ve been together for 12 years. We’ve had countless fights, arguments and conversations about money. It’s taken a lot of time and effort but we’ve found our money groove.

Don’t get me wrong, we still have the occasional money related bitch session but these have reduced in frequency and we’ve found a system that works for us.

The good news, you can to.

How to talk about money when you're money opposites

There are things you can do to get on the same financial page as your partner. But, you have to be willing to put in the effort.

Talk early and often

Don’t wait until you’re married to talk about money. Honestly, you shouldn’t be making any major commitments to a partner, be it marriage, parenthood or home ownership, until you’ve had a discussion about your finances.

Before you get in too deep with your significant other you should know the answers to these questions:

- Are you a saver or a spender? It’s good to have a general understanding of your partners views on money. Then it’s up to you to decide if you can deal with their financial perspectives.

- Do you have any debt? There’s a big difference between $3000 of student loan debt vs. $60,000 in gambling debt. The former can likely be paid off pretty quickly without any major lifestyle changes. The later is going to take some serious time and budgeting to clear. Ask yourself what sacrifices you are willing to make in order to pay off your partner's debt?

- Have you ever declared bankruptcy? If the answer is yes be aware that this will show up on your partners credit score for 7-10 years. This can have a major impact on your financial future. If you and your partner are looking to make any large purchases together (car, mortgage) it will affect your partners ability to borrow money.

- What is your credit score? Maybe don’t open with this question on your first date but, similar to the previous question, make sure you know the answer to this before you make any major financial commitments. A low credit score will also result in difficulties when it comes to borrowing money.

- What are your financial goals? If your partner has no response to this question, because they’ve never even thought about it, this might be a bit of a red flag. BUT, if they are willing to think it through and talk about it, it doesn’t have to be a deal breaker. The impact of this question will also differ if your partner is 18 vs. 35. At 18 I’m not sure how much thought I’d given to my financial goals, other than “I want to be rich!!” At 35, you should have a more well thought out answer.

If you’re looking for more financial questions to discuss with your partner checkout 4 Financial Questions to Ask Your Significant Other

Be Honest

If you’re really bad with money and you have a ton of debt, or you have a gambling problem, or you yourself have declared bankruptcy, you need to be honest with your partner. The communication has to go both ways.

Don’t hide your financial issues.

Trust me, this conversation won’t get easier to have with time.

You don’t have to reveal all of your financial details immediately but if you see the relationship getting more serious than you need to speak up.

I think we all know that relationships based on lies and dishonesty don’t end well.

Compromise

You might think that the way you handle money is the “right way” and the “only way.”

I know this is how I thought about it for a long time.

I was the saver, I was good with money. My husband was the spender, he was bad with money.

But, you need to try and understand where each other’s coming from and find a compromise.

When I realized that my husband and I were polar opposites on the financial spectrum I had to ask myself a series of questions.

First, do I want to be in a relationship with someone who has completely different money values?

Also, ask yourself questions like, why do I like to save? Why does this bring me legitimate joy? And, on the other side of the fence, why doesn’t my husband get off on adding to our retirement savings?

Most of our money values are learned from our parents or earlier experiences with money so it’s useful and interesting to take a bit of time to try and figure out why you are the way you are with money.

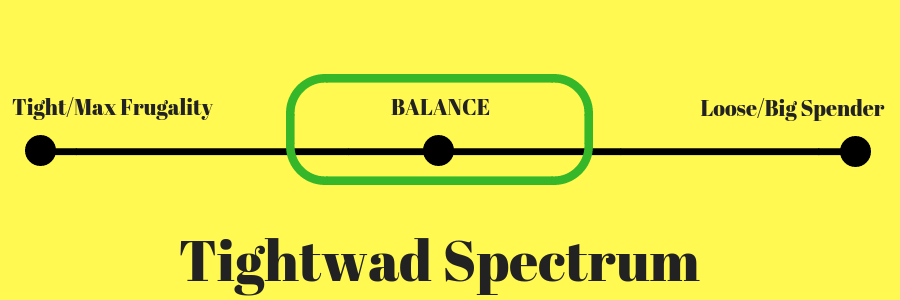

I tend to veer way too far to the frugal, tightwad side of the spectrum and I know I inherited this from my mom.

I’m so far on the frugal end that I will happily go months without going out on a date or making any kind of non-essential purchase in the interest of saving. I’m all for delayed gratification.

My husband helps me to find some balance. He’s the reason that we will splurge on a nice meal or a night out and honestly, I need this.

Build a foundational financial plan together

You and your partner should build a solid foundational money plan together. This doesn’t have to be complicated, in fact -- the simpler, the better.

Before you put your plan together you and your partner should increase your financial literacy.

Whether you think you’re a superstar with finances or not, it’s really useful to educate yourself on the topic of personal finance. In order to make a useful financial plan it’s helpful to know some personal finance basics.

There are so many wonderful (and free!) resources available, be it blogs, podcasts or books that you can borrow from your library.

No matter where you’re starting from there’s always more to learn.

Once you’re familiar with some personal finance basics you can begin to build your financial plan by creating a simple budget. Determine how much you make, then see how much you need for fixed expenses (rent/mortgage, car payments etc.), whatever you have left over can go to variable costs (food, drinks, entertainment etc.) and savings.

The goal here is to work together, so you both have a say in where your money is going and how it is being sent.

If you want a budgeting template or feel like you need more guidance on how to create a simple budget just do a quick google search.

You might also want to discuss things like how you will communicate about big purchases.

For instance, I have some friends that only consult each other about purchases over $100.00. Other couples might agree that they’ll only discuss purchases over $250.00 or $500.00 together. For some it might be $25.00, the magic number is up to you.

Managing your money….do what works best for you as a couple

There’s so much money advice out there. It can be overwhelming and often contradictory.

- “Couples should share all bank accounts and combine all of their money.”

- “Couples should keep all of their money separate.”

- “Couples should have one joint account for bills and then separate accounts for spending.”

Ultimately this is your relationship. You need to do what works for you.

My husband and I have opted for option three...we share a joint account for bills and then separate accounts for spending. We also have some combined investment accounts and some separate. This is what works best for us.

You should also agree on who is going to manage your money.

Is one of you going to take over all of the bills and investments or are you going to share in the responsibility? Or, maybe you keep everything separate and you each manage your own shit.

Again, there’s no right answer.

In our relationship I do all of the money management.

I enjoy it and I think I’m pretty good at it. My husband has zero interest.

This is what works for us.

If you’re in the same boat and only one of you is doing the money management do make sure that the disinterested partner is at least aware of all of your bank accounts, investment accounts and how to access them.

Just in case something happens to you.

Make sure you’re having regular conversations about where your money is and be sure to have a centralized location with all of your money information (including user names/passwords to your accounts).

Seek professional help

If you and your partner are constantly at each other, fighting about money, and you can’t come to any resolutions by yourselves then it might be time to seek professional help.

There’s no shame in seeing a money counsellor and you should do this as soon as you recognize that there’s an issue.

A professional money counsellor can provide you with useful tools that might ultimately save your romantic relationship.

We don’t always know what we want

When I was in my early twenties I had a mental list of things I wanted in a potential romantic partner.

Looking back it’s funny to see how what I thought I wanted wasn’t necessarily what I was attracted to.

Don’t get me wrong, my husband checked most of my boxes but, he also has many qualities that I never thought I’d be attracted to. They aren’t necessarily bad, they just weren’t on my list (e.g. risk taker, 9 years older, avid spender!)

The same goes for most people. Who we think we’ll end up with and who we actually end up with don’t always line up and this can be for the better, or for the worse.

Just as many women say they’re looking for a “nice guy” only to be attracted to the “bad boy,” the same goes for many of us who say they want a “frugal partner” only to end up with a “big spender.”

Bottom line, you can’t always help you’re attracted to. So, if you find yourself with your money opposite you might have a rockier road ahead then if you’d paired up with your money value equivalent.

Be prepared to have some differing opinions but know that with some open conversations, effort and time you can get on the same page financially.

What about you. Are you with your money opposite? If so, how do you manage your differing opinions and habits on money?

About the Author: Jessica is a professional researcher and freelance writer. She writes about all things related to personal finance for beginners, psychology and education on her blog, The Financial Graduate.