Early retirement explained

Early retirement has become a thing. And, it turned into more than just a thing for me. After retiring at 35, it’s a way of life. It’s become reality.

Early retirement has become a thing. A big thing, in fact.

And, it turned into more than just a thing for me. After retiring early at 35, it's a way of life. It's become my reality, and my last day of work back in December of 2016 is a day that I'll never forget.

Early retirement changes lives. Every day.

Though we millennials have been called a cult, the growing early retirement movement has captured the awe (and anger) of mainstream publications, and personal finance blogs are popping up all the time.

It's wonderful that early retirement is getting the recognition that it deserves, but there's a growing element of our population that hates what we do.

And it's not all their fault, either.

Personal finance bloggers can come across arrogant. Or, flat mean.

Other times, we don't exactly divulge everything on our blogs. For example, we might save a lot and live frugally, but we never mention that we earn $250,000 a year and have access to daddy's sizable trust fund. We appear untrustworthy.

And, we aren't exactly trained financial advisors, either. We tend to throw out blanket advice that just won't be right for everyone, and that paints the picture that we're a bunch of cowboys and cowgirls who are shootin' from the hip without much regard to who or what we're hitting.

It worked for us, so it must work for everybody else too!

We also have the tendency to believe that since we retired early, everybody else should as well. That's simply not true. This lifestyle won't be right for everyone. Just like being your own boss, there's something scary about no cash flow and being 100% responsible for your own time.

When it comes to credibility and authenticity, the outspoken early retirement community is hit or miss.

This needs to change.

First, here is a secret: Financial Independence is more important than early retirement

Early retirement gets attention in the media because that's a popular buzzword that generates clicks. And, I get it. People are naturally interested in early retirement because it's way different. It goes against the norm.

And because of that, it's also super controversial.

But, it's the financial independence part that's the more important element of this whole retirement business, and the reason is very simple.

Financial independence means we've accumulated enough money in our savings, investments and things like home equity to live out the remainder of our lives with a reasonable chance of never running out of money.

Note: A lot of us use the Trinity study as the foundation for figuring out when financial independence has been achieved.

When we achieve financial independence, we no longer have to work a traditional job - though we still can if we choose to. We are no longer required to maintain consistent cash flow to live our lives.

Early retirement, on the other hand, implies the financial independence part. After all, we can't quit our jobs (for good) without having enough cash to live. But, it also means we've gone that extra step and quit our jobs.

In ER, we quit our jobs after achieving financial independence.

But make no mistake about it: Financial Independence is much more important than Early Retirement, and most retirees value the FI part more than the ER part.

How do we retire early?

At a high level, early retirement is enabled by achieving financial independence, or the point where we no longer need to hold a full-time job to fund our lives. Once we are FI, we can do whatever we want.

Whatever makes us happy.

How is financial independence achieved? Through a combination of reducing our expenses to our "happiness threshold" without the additional wasteful spending.

The happiness threshold looks different for each and every one of us.

It is the point where we reach genuine happiness. We are happy with our lives. We are happy with our stuff. Happy with everything we do. And, we actually enjoy getting up in the morning to begin our day.

You know what I'm talking about. Just...genuinely happy.

For example, my wife and I sold both of our homes and bought an Airstream RV. It's a lifestyle that can be practically as cheap as we want it to be, and we are happy as clams.

Our expenses, which add up to around $40,000 a year, are streamlined. And, we have a good idea of what we can spend on...and what we can't.

For others, they prefer the traditional sticks and bricks homes, satellite television and all the fixins of life.

That's fine, too.

The happiness threshold comes down to this:

The more that we need [to spend] to meet that happiness threshold, the longer we'll need to work to accumulate the funds necessary to maintain our lifestyle without consistent income.

Downsize your life enough and your retirement date gets way closer.

Early retirement misconceptions

The misconceptions of early retirement are as inaccurate as they are prevalent. At least, for most early retirees.

Popular misconceptions of early retirement include:

Early retirement is only for the rich

While it's true that early retirees do need more money (we call this their "net worth") than the average Joe who works a full-time job with a consistent income, that doesn't necessarily mean that we're all rich.

We all didn't sell businesses for millions of dollars, or win the lottery, or born with a silver spoon in our mouths.

In fact, my wife and I retired early with less than a million to our names.

We aren't even millionaires, yet we're doing this anyway.

My wife and I aren't filthy rich, and neither are many early retirees. Yes, there are retirees who are very wealthy, but they don't represent the great majority of us who are quietly chipping away at our debt and building enough wealth to quit the rat race early.

It's true that we cannot be broke to retire early. But fortunately, we don't need to be rich either.

Early retirees will get bored

Here's the truth: Early retirement isn't really about retirement at all.

When you're 65 or 70 and retire from a long career in the workforce, that's when we're more likely to slow way down and just chill. But when we voluntarily quit working in our 30s, 40s, or 50s, most of us do so for a different reason.

We're the opposite of bored. Boring people get bored. We don't.

Smart early retirees retire to something rather than from something. This means that instead of retiring from a full-time job, we retire to our next line of work.

Not a job. Work.

Yes, work and jobs are mutually exclusive.

Our jobs enable our work. The work, however, stands on its own and is independent of money and structure. We don't need jobs to do our work.

For example, I retired to writing. I write on this blog. I also write on my other blog about digital marketing. And, I maintain a growing YouTube channel with my wife.

We keep plenty busy. Sometimes, too busy.

Or, how about John from ESI Money? He's much too busy to be bored.

"I am busier now than ever," John told me. "The difference is that I’m spending time on things I want to do, not things I have to do."

The kinds of things that keep him busy in early retirement?

- Spending more time with family

- Traveling more

- Running three websites

- Playing video games

- Watching Hallmark movies with my wife

- Reading (listening actually – just finishing a 30-hour or so series on the Civil War)

- Exercising – longer sessions and less tired when doing them

- Walking – Will average almost 17,000 steps per day in 2018

And – best of all – the ability to do whatever I want whenever I want.

Who has time to be bored?

Millionaire Mob told me "Retirement is not the end. It’s actually the start of a new chapter; mentally, financially, physically and more. Early retirement is not crossing the finish line tape. It’s a new marathon, a new challenge."

"It’s like being reborn, " he added.

Early retirement ruins relationships

In concept, this might make a little sense. After all, spouses are around each other a LOT more if neither of them have a full-time job. And, it's true that relationships can suffer if the participants won't budge.

But in my experience, I haven't seen any of this. At least, nothing that got to the point of "ruining" a relationship.

That said, it's now well-known that the grandfather of personal finance blogging, Mr. Money Mustache, is getting a divorce. Then again, that might have something to do with the incredible fame and fortune that he deals with all the time, not the early retirement part...obviously, not sure.

I'm not there.

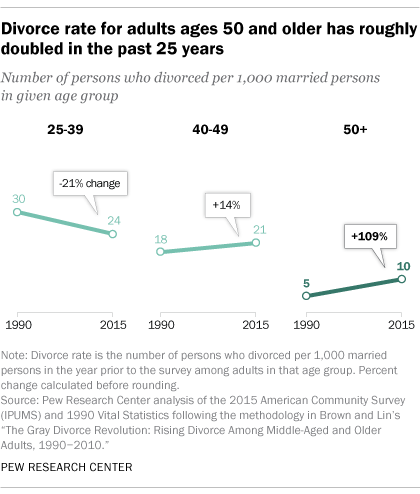

But, it does happen, even to early retirees. Though baby boomers are divorcing at a stunning rate, there's no evidence to suggest that early retirees are suffering the same fate

"Most early retirees are not sitting at home staring at each other in boredom waiting for sweet merciful death," finance advisor Michael Dinich said, who blogs at Your Money Geek.

"Planning for early retirement is one of the best ways to strengthen your marriage and relationship. Money disputes are one of the most reported causes of divorce. So getting your finances to the point of retirement is eliminating one of the biggest threats to your marriage; money woes."

I can attest to this. Before we retired early, my wife and I would talk about our future retirement plans every night as we walked our dogs around the neighborhood.

Focusing on our future goals was a wonderful experience and it certainly helped to keep both of us happy and determined.

Most early retirees are living in trailers and eating raman

For the typical early retiree, our insistence that personal finances matter has enabled the great majority of us to maintain perfectly fruitful lives that don't look all that different from our lives before we quit our jobs.

Except for holding down a job, of course.

Though we live in an Airstream RV, we chose to do so. We eat healthy, high-quality meals every day that include fresh veggies, meat, and my personal favorite: Parmesan cheese.

In fact, many early retirees aren't even all that frugal.

Carl at 1500 Days drives around in an Acura NSX. A lot of us attend financial conferences (like FinCon) on our own dime. We go out to restaurants, movies and take vacations just like everybody else.

Early retirement isn't about being cheap or living on nothing. It's about valuing every second that we're alive by doing things that make us genuinely happy.

Early retirees don't earn money in retirement

I'm the first to admit that I earn money in early retirement, and I'm extremely proud of that fact. I don't try and hide it.

In fact, we earn money in four primary ways:

- ThinkSaveRetire.com - through display ads, affiliate marketing, and the occasional sponsored post.

- YouTube - we have a YouTube channel at A Streamin' Life that tracks our digital nomad adventures, and we earn additional change through ad monetization.

- Videography - I've earned thousands of dollars by shooting and editing B-Roll footage for media companies.

- Consulting - I like to keep my skin in the game through IT consulting work every now and then.

One of the remarkable things I’ve learned about early retirement is how many opportunities there are to make money after calling it quits from full-time work. Making money after early retirement has been way easier than I had expected.

Once your mind is free from the distraction of full-time work, we’re able to take in many more options than we had back when we worked. These options very often produce cash flow.

In fact, there’s a slew of ways to earn money after calling it quits. A ton. And, I had no idea they existed until after hanging up my hat.

Arguably, I am busier in retirement than I was working a full-time job. Of course, I spend a lot of time maintaining this blog, and I’ve monetized it to the point of covering about a third of our expenses. I also manage the operational side of Rockstar Finance, one of the most popular and well-known sites in the personal finance blogosphere.

I do these things because I enjoy them. And the second that I no longer enjoy that work, I've promised myself that I'll stop.

That's the luxury of financial independence.

Early retirement buzzwords and acronyms

Though I've published these buzzwords and acronyms before, it feels necessary to regurgitate them here. There's a ton of buzzwords that we use, and they all mean something very different.

Let's take a look at what the most common buzzwords mean.

MMM

Mr. Money Mustache, the dude who’s informally known as the father/initiator/inventor of early retirement blogging. He blogs at mrmoneymustache.com and he’s this relatively wealthy fitness fanatic who builds homes in his spare time. He also owns a co-working space in Longmont, CO.

F.I.R.E

Financial Independence Retire Early – The most common acronym in the financial independence and early retirement blogosphere. People use it all the time…arguably too much, in fact. I’ve never been a huge fan of this acronym, though I have used it from time to time.

F.I.O.R

Financial Independence Optional Retirement – A newer term that refers to the idea that early retirement doesn’t necessarily need to be a part of financial independence. Meaning, one can keep working a full-time job even after achieving financial independence. In fact, I believe there to be incredible wisdom in this.

F.F.L.C

Fully-Funded Lifestyle Change – Another term that generally revolves around the idea that early retirement does not need to be tied at the hip with financial independence. To my knowledge, this term was coined and spear-headed by the Slowly Sipping Coffee blog.

Here’s how those coffee-sipping bloggers describe it:

- We don’t want to drop out of the workforce totally, but rather find something we can do that we are passionate about — regardless of the pay

- We want more time to spend with family. We don’t want to fit in the family around our jobs – but have our jobs fit in with our family life.

- Full retirement wouldn’t be fulfilling to either of us, but volunteer work, teaching, mentoring… that is what we dream of

S.H.I.T

My wife came up with the perfect acronym for our lifestyle: Side Hustle Income Travelers, or S.H.I.T. We travel in our Airstream full-time and enjoy some cash flow through our side hustles that’s covering over a third of our monthly expenses.

Pivot

In one of the more annoying (read: the early retirement equivalent of a “business buzzword”) phrases in personal finance, the “pivot” is another way of referring to a lifestyle change or shift away from the more traditional full-time work lifestyle to one that’s less demanding or more enjoyable. A pivot is a conscious and purposeful change and one that prioritizes happiness and fulfillment over money, power, and rank.

VTSAX

You’re not a “real” index fund investor unless you own Vanguard’s Total Stock Market Index Fund – or so you might believe in the personal finance blogosphere. It’s all the rage.

Y.N.A.B

You Need A Budget. It’s a popular and well-known “FinTech” web application for budgeting.

DINK, DINKWAD, SINK, etc

So many acronyms, so little time. There are a slew of acronyms that describe a person or family’s current state of financial affairs.

J. Money from the Budgets Are Sexy blog gave us 40 of ’em. Here’s a small subset:

- DINKs – “Dual Income No Kids”

- SINK – “Single Income No Kids”

- DINKY – “Dual Income No Kids Yet”

- DINKER – “Dual Income No Kids Early Retirement”

- DINKWAD – “Double Income No Kids With A Dog”

- DINKYANDE – “Dual Income No Kids Yet And No Dog Either”

- SIK – “Single Income Kids”

- SILK – “Single Income Lots of Kids”

- DIK (hah!) – “Dual Income Kids”

- DEWK – “Dually Employed With Kids”

- SITCOM – “Single Income Two Children and Oppressive Mortgage”

- MUPPIE – “Middle-aged Upcoming Prosperous Professional”

- KIPPERS – “Kids In Parents’ Pockets Eroding Retirement Savings”

- SINBAD – “Single Income No Boyfriend And Desperate”

- GLAM – “Greying Leisured Affluent Married”

- PODWOG – “Parents of Dinks WithOut Grandchildren”

- WOOF – “Well Off Older Folk”

Latte Factor

The stupid shit that you spend money on (almost every day) that, if completely eliminated as an expense, could add up to significant savings. For some people, it’s buying latte coffees, but it could refer to nearly anything.

Author David Bach made the term popular and describes it: “The Latte Factor is based on the simple idea that all you need to do to finish rich is to look at the small things you spend your money on every day and see whether you could redirect that spending to yourself. Putting aside as little as a few dollars a day for your future rather than spending it on little purchases such as lattes, bottled water, fast food, cigarettes, magazines and so on, can really make a difference between accumulating wealth and living paycheck to paycheck.”.

FatFire

The term FatFire refers to spending more (sometimes significantly more) money than the more typical budgets of early retirees. Spending $150,000 in early retirement probably qualifies as FatFire, though there is no standard or “official” definition for exactly what constitutes FatFire other than spending way more money than the typical early retiree.

FYI: We spend around $30,000 to $35,000 a year, which is NOT FatFire. We’re more in line with the LeanFire principle, which is described below.

LeanFire

The term LeanFire refers to extremely streamlined spending that might sound absolutely crazy or absurd to the average consumer. If you spent $100,000 a year when you were working, but cut your expenses down to $40,000 or less, you’re probably a member of the LeanFire camp. LeanFire requires living a small and frugal lifestyle, sometimes after one or more rounds of downsizing. Smaller (or paid for) homes, non-exotic cars and living in non-ritsy neighborhoods is common with the typical LeanFiree.

Side Hustle

A side hustle is a passion project that one performs “on the side”. Many early retirees pursue side hustles (including me!), but one does not need to be an early retiree to have a side hustle. Anyone, regardless of their phase or position in life, can have a side hustle. Note that side hustles are NOT typically full-time jobs. The “side” part of side hustle implies that the effort does not completely consume a person. Rather, it’s done “on the side” or in their spare time.

Travel Hacking

Travel hacking involves the creative (and legal) exploitation of credit card points and other deals to travel the world on the cheap. Many travel hackers maintain a wide selection of credit cards that offer bonus points and other perks when used as a part of one’s normal expenses. Those points can generally be traded in for flights, hotel rooms or other travel-related services.

Personal Capital

It’s the “Blue Host” of FinTech apps, Personal Capital is one of the most widely used and commonly advertised services in the money blogosphere. Approximately 100% of all mentions of Personal Capital are linked to an affiliate account (like this one!) primarily due to Personal Capital’s relatively high payout. For the record, the large majority of those bloggers who display Personal Capital affiliate links actually use and like the service. Like, legit.