The secret to retiring early? Make lots of money and don't have kids

If you want to retire early with kids, you might think that it's impossible. After all, kids are expensive. It's true, kids are pricey, but...

Let's face it, early retirement isn't rocket science. In fact, this whole "quitting the rat race early" thing is actually pretty easy. Those of us who understand the formula reap its beautiful rewards.

What's the secret formula? If you want to retire early, just make lots of money and don't have kids.

And there it is...the secret is out!

It's true, and the secret formula works.

And, it's one of the things that a lot of people pick out of early retirement stories posted around the Internet. The most recent story was about Mark and Tanja over on Making Sense of Cents.

The story talks about how the couple called it quits from full-time work super early in life. Like, before either of them hit the age of 40.

In the article, they talked about strategies like:

- Buying less house than we could afford

- Paying ourselves first and automating that

- Not inflating our lifestyle

- Keeping the house at a chilly 55 degrees F in the winter

There is a lot of wisdom in the post. Strategies and motivations. Changing your mindset to live within your means and on way less than the majority of people.

But, one particular commenter picked out one of those elements that seem the most controversial in this entire conversation:

From Brian: "One recurring theme from most of these early FIs is no kids and above average incomes. Those are the 2 most important ingredients I see common across many. [...] If you have kids and make the median US income, good luck getting out before 40!"

And boom, simple as that. Don't have kids and make huge incomes is all you need to retire early, yes? This probably isn't the answer that Brian was looking for, but let me take a stab at responding to his comment.

From experience, his question is quite popular!

Want to retire early? Make lots of money and don't have kids

The answer is simple: yep. Those of us who earn high incomes and didn't have kids CAN have a significantly higher savings rate than those who have neither, and it'll be a hell of a lot easier for us to retire early. We made the right decisions. You didn't. Haha. There.

Is that what you want to hear? :)

Obviously, I don't believe the last few sentences in my answer - they were made in jest. But, maybe that's enough of the truth that people don't think that we childless early retirees will admit.

But you know what? Our lifestyle free from children has a big impact in what we're doing now. For my wife and I, our lack of kids is a huge reason why we were able to retire early at 35 and 33. There are no two ways about it. If we had kids, we'd be working. We didn't choose kids, and therefore, we're retired and living our dream life.

Them's the facts.

Naturally, this doesn't mean that I'm criticizing your decision to have kids. If kids are right for your family, that's great! Have them. Love them. Raise your children the best you can. I won't bat an eye, trust me.

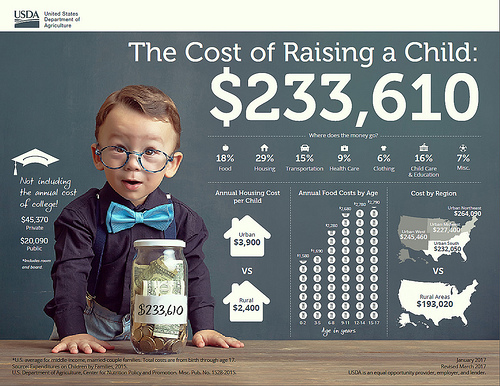

Kids are expensive creatures. According to the USDA, the cost of raising a child was $233,610 - back in 2015. "Middle-income, married-couple parents of a child born in 2015 may expect to spend $233,610 ($284,570 if projected inflation costs are factored in*) for food, shelter, and other necessities to raise a child through age 17. This does not include the cost of a college education," the USDA wrote.

If kids are for you, great! They just weren't right for us. We pocketed that money instead and invested it in the stock market and went on about our lives.

Both my wife and I also chose high-paying degree programs (information technology for me and aeronautics and astronautics for my wife). We brought in a little over $200,000 in our last year of full-time work, and neither of us made small money in our careers.

And so...yep, making a good salary also helps. Putting these two critical elements together - making lots of money and not having kids - is a huge reason my wife and I, as well as Mark and Tanja from the interview, don't commute into a full-time job any longer, and hopefully never will.

It's really that simple.

But, here's the implication in these comments...

When someone points out big salaries and a lack of kids as the primary [or close to it] catalyst for early retirement, even through a richly-packed 2,000-word article full of insight and expertise, they are implying that those who aren't "lucky enough" to earn big money or made the choice to have children are at a systematic disadvantage. It was easy for the childless high earners, but some aren't so lucky.

"All you gotta do is pull down $200,000 and don't have kids; easy!"

Or, "I could retire early too if I made what they made."

Here's the truth:

1: Yup, earning big money and not raising children is a fast track plan for financial independence and early retirement. It gets you there faster and completely streamlines the process. Funny how a big income and few expenses add up into significant net worth numbers!

Think of it like those AP classes that smarter high school students take for college credit (for the record, I was never "smart enough" to get into those classes). By working a little harder in high school, you're fast-tracking your path through college. But, that doesn't mean you need to take AP classes in high school to get through college. If you do, you get through quicker. If you don't, that's fine. You'll still get through.

And...

2: You COULD retire early, yes - but, you probably wouldn't. As I've written about time and time again, making a ton of cash definitely helps, but it also doesn't just hand you a lifetime of success and guilt-free fun on a silver platter.

First, you just gotta want it. Financial independence, I mean. Without that innate desire, nobody is retiring early. Second, a purpose in life outside of a full-time job is a necessary element. Third, saving a large majority of that huge income is the only way to achieve a goal of quitting the rat race early. All three of those elements results in a successful ER.

It's not just the big incomes or lack of kids.

If you're a baller who brings down $200,000 but spends $150,000 on an extravagant lifestyle of expensive cars and big homes, buying designer produce and frequent restaurant visits, you're probably not retiring early.

At least not in your 30s.

The more expensive your lifestyle, the more you'll need after calling it quits. I don't care how much money you make. It doesn't matter.

Don't give yourself the excuse of a "low income" or raising children. Yes, early retirement in your 30s definitely won't be possible for everyone. And yes, some people DO struggle way more than other people. But, making excuses also won't get you any closer to your financial goals. Excuses will set you back, every time.

"In order to retire early, you need to earn $200k/year or more, have no kids, had a childhood in a white suburban mecca of riches and abundance, took AP classes throughout high school and hold a science degree from a prestigious university. If you don't have that, you're out of luck."

Of course, this is categorically untrue.

Why don't we PF bloggers chalk early retirement up to huge incomes and no kids?

Well, think about it. If we just said that we're retired because we made a shit ton of money, how inspiring would a story like that be? Yes, the more honest bloggers do admit to their high level of income, but we tend to highlight other factors in our lifestyle because that's what the majority of people can relate to.

If I told you that in order to retire early, you need to bring in $200,000 a year, what would that say to someone who earns $50,000 a year? Would they give up, assuming they can't possibly achieve that worthy goal? Might as well not even try?

A lot of people can't relate to high incomes or no kids, and although we admit to the impact of those factors, we also don't harp on them when we're writing about our story and giving interviews. Instead, we focus on those elements that people might actually derive insight from. Like, maybe a little bit of wisdom.

Imagine that!

Things like living within your means, spending money only on things that bring genuine happiness. Curbing expensive habits. Downsizing to a smaller home.

You know...things that people from all walks of life and regardless of their income or kids status can do to improve their lives NOW.

We focus on the stuff that impacts the majority of people because the story will mean a heck of a lot more that way. Most of us aren't hiding this shit. Instead, we choose more impactful elements of our story.

And as I've said a ton by now: A high income helps. Privilege helps. But, that's just not the whole story. If that was all we wrote about, we might as well not even blog.