Budget October 2015 ~ Sweet and steady progress

So in comes the budget. Budgets don't work for everyone and in the future it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we've set for ourselves.

Ever since we decided that the path for us is out of the rat race and into an early retirement of our choosing, the Mr. and I have been keeping an eye on our finances and scaling down our spending. Neither one of us were complete clowns, but we certainly weren't looking out for our future selves at anywhere near the level we want/need to be.

So in comes the budget. Budgets don’t work for everyone, and in the future, it may not be necessary for us but for now it is the way we are buckling down and meeting the tough goals we’ve set for ourselves. We may actually look into a few different budgeting apps in the near future. Read more about how we budget here.

We are labeling October Sweet and steady progress.

Why? Because we are doing just that. Nothing major from a financial standpoint happened in October, and we're continuing the march down the road to our epic escape date next year.

On to the numbers!

- Fixed Costs (Mortgages, HOA, Loans) $2550/ $2550

- Utilities & Other Necessities (electricity, gas, water, cars, fuel, etc.) $954/$851 We had to replace the kitchen sink this month. We've been without hot water for months now (well it was turned off under the sink since there was no way to turn it off using the faucet). We keep putting off the repair until the cold water went as well. Now after some DIYing we have an amazing deep large sink and are super happy though a little over budget. It's amazing to be able to turn hot water on from the tap...just saying. We felt like total bad asses replacing the sink ourselves. ;)

- Groceries $370/ $350 Still wheat free and low carb and it seems to be helping my migraines...so we shall see. You can see the breakdown of grocery costs down below. You'll notice we no longer include restaurants here...that is now included in Fun Money below. Need to be a little more careful about the budget.

- Fun (Travel, Mr.'s fun money, Mrs.'s fun money, Mr.'s camera fund, gifts, restaurants) $981/ $1051. Yay under budget on fun money!

- Additional Income: $409 Payment for the Ridge along with our normal random assortment of checks, interest and other sundries that came in this month. Unexpected money is a plus! We reinvest all our dividends, etc. so those don't get counted in this roundup.

Another great month on the books.

Now, let's take a look at the money-shot numbers.

Total October 2015 income: $14,524 (3 paychecks for the Mrs. and no more 401k withdrawls for the Mr.)

Total October 2015 expenses: $4,855

This means our total October 2015 Take Home Savings Rate came in at: 66.5%.

And our October 2015 Total Savings Rate: 70% (includes maxing out our 401ks).

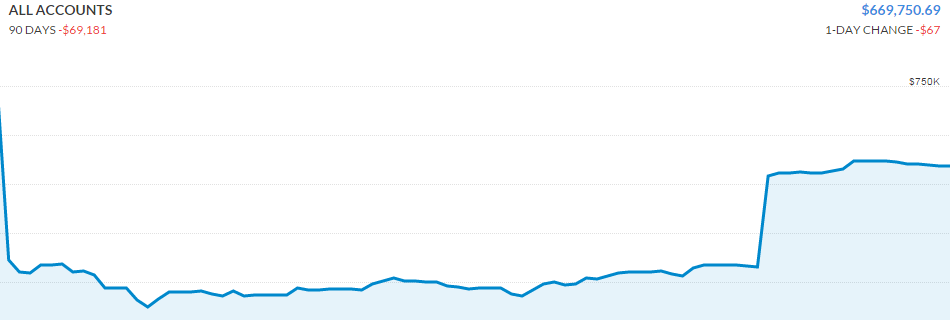

Our net worth: $669,750.69. Let's see this number grow!

Our Personal Capital net worth graph for the month

We're doing great! Just gotta keep on keeping on.

Another adventure awaits!

-- Groceries: $370.45--

Fruits and Veggies: $216.23 (cauliflower is expensive!!)

Canned Goods: $93.61 (stocked up on our refried and black beans)

Vegan 'Meat': $13.21

Meat, Seafood and Dairy: $14.98

Dry Goods: $31.92

Minus 50 cents from our bag credits. Gotta love a little extra savings ;)