Two financial planning strategies that you must know

Financial planning is one of those things in life that you don't want to get wrong. Before making a plan, understand these strategies.

Financial planning is one of those things in life that you don't want to get wrong. Your financial plan has profound impacts on your life, and the more purpose that we give to our money through a sound financial plan, the better our future will be.

The process of developing a sound financial plan to set yourself up for retirement involves turning the fruits of a decades-long career into all of its eventual goals and plans. It is the key to a comfortable life after an individual's many working years.

The process of developing a sound financial plan involves turning the fruits of a decades-long career into all of their eventual goals and plans. It is the key to retirement and to a comfortable life after an individual's working years.

Individuals can earn hundreds of thousands of dollars more over the course of their lives simply by making the right planning choices - as early in their lives as possible.

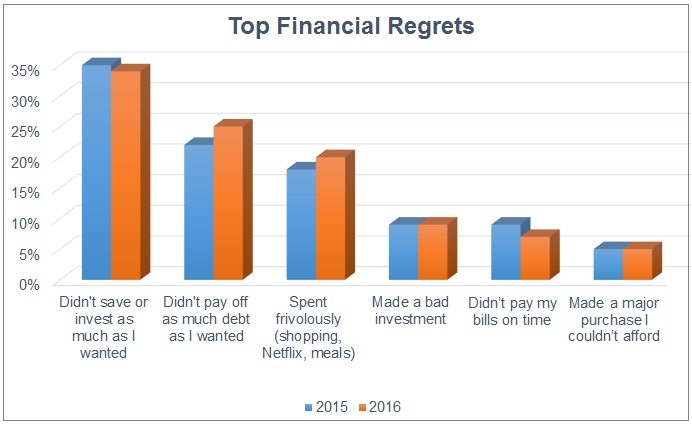

Unfortunately, financial regrets plague too many people in this country, and a lot of it has to do with neglecting a sound financial plan, especially when we're young.

But, most individuals are overwhelmed by the language and prospect of financial planning.

There are so many hundreds of options available to the average investor that many simply do not know where to begin. In the financial planning process, the best place to start is by deciding on a broad school of thought first - then, dive in to get it right.

Picking this school of thought will help orient an individual's decisions and will lead them to make the best possible decisions. And, I'm going to tell you exactly what you need to know.

Two financial planning strategies explained

Strategy #1: Probability-first

One of the most common forms of financial planning strategy is to focus on probability.

This focus emphasizes the possibility that different strategies will make money over a period of time. The vast majority of investments have a chance of losing money over a certain term.

Even supposedly "guaranteed" investments can lose real value from inflation.

A probability-first strategy, therefore, focuses on probabilities instead of a desire to never lose any money whatsoever.

These probabilities involve the chances that a stock or bond will lose some or all of its value, but over time, you stand a better chance at making rather than losing - on the whole.

Over the long term, the potential to make money is huge.

A few points to consider with probability-first financial planning:

- Some stocks or bonds have a considerable chance of losing money but almost no chance whatsoever of completely losing money.

- Other investments, like the stock market as a whole, have lost money in the past but have always rebounded. That rebound will mean different things to investors of different ages.

- Individuals who start investing early can take on more risk with their investments because they have a greater chance of recovering when an individual finally does retire.

The point of a probability-first strategy is to maximize the income that an individual will be able to generate. An individual interested in this strategy often wants to live as comfortably as possible in retirement. They know about the risks involved in retirement investing and want to leverage that risk in order to make the highest safe returns possible.

As a result, these individuals will be satisfied with riskier investments.

Such a risk often leads these investors to pursue less traditional means of investing. Probability-first strategies may include more real estate and international investing options than many other investment strategies. Real estate and international companies are massive sources of wealth that a large number of American investors are not interested in.

Example strategy

An example of a probability-first approach to financial planning would be one that diversifies according to a wide variety of asset classes and their associated risks.

For instance, a financial planner may put together a portfolio that includes high-risk stocks and real estate assets as well as mid-cap stocks, bonds, and cash accounts. They would express the makeup of this portfolio in terms of the probability of each asset losing money every year.

Therefore, the planner could mandate that the account has at least 20% of its assets tied up in investments that have at least a 60% chance of making money in the next five years.

At 60%, those assets may include investment vehicles like:

- international stocks,

- speculative ventures, and

- bonds that have a high yield rate

They may include some stocks that have a chance of popping or losing all of their value in the course of a few days or weeks because of ties to clinical research or the machinations of the small-cap market.

Then, there would be 50% of stocks that had between a 70% and 80% chance of not losing any money. This area would include perhaps an index fund or a basket of diversified stocks from all different sectors of the economy.

Finally, probability-based strategies have a certain degree of safety baked in.

Few individuals want every dime of their savings tied up in assets that may lose their value before retirement. This safety would come from assets that have between a 90% and 100% chance of making money. Such investments would include savings accounts and even money market funds.

Almost every money market fund over the past 100 years has delivered at least a marginal sum or broken even.

The downside to probability-first financial planning

The most likely pitfall associated with this strategy is considerable losses.

The probability strategy involves individuals taking on a risk that they might lose a significant amount of money. There may be only a 10% to 15% chance of losing a large amount of money. But anybody who embraces this strategy must realize that such a possibility may happen at any time.

An individual may lose thousands or tens of thousands of dollars in a short-term window. There is only a small chance that an individual will lose much money over a period of years or decades in traditional investments.

The moral of the story is the longer you're invested, the better your chances of making money.

However, probability-first investors need to have a plan for severe losses. Individuals who embrace a probability strategy also need to have investments that pay a percentage rate every year.

This payment can be in the form of either bonds or assets that pay a regular dividend and have paid that dividend for many years. In that case, they will be able to take advantage of diversification and make money even if their stock choices are losing a considerable amount of money.

Individuals should also have a sensible strategy for changing their asset allocations on a regular basis. There are certain events that completely remove any chance for upside for a stock, bond, or other forms of investment.

Individuals embracing a probability strategy need to be aware of these possibilities and position themselves to move out of certain investments at a moment's notice.

Strategy #2: Safety-first

Safety-first approaches operate from the premise that an individual is looking at keeping their money safe in less risky investments.

Individuals who are keen on safety-first approaches are often cautious at heart.

None of them want to lose money over a period of years or even months. They know that there is a certain level of safety in simple savings accounts and they want to embrace investments that will make money while also not losing a significant amount of money.

Many of these people are understandably concerned about the constant stories emanating from media sources about the stock market and a looming "market correction".

- They read that trillions of dollars are wiped out on the market on single days.

- Sometimes, they see stories of stocks losing all of their value and leaving individuals with nothing in their retirement accounts.

Even though these effects are rare and can be mitigated, the risks are often too much to stomach for a large number of individuals. These people want safety to be the top priority for their accounts and are willing to trade some of their possible returns for that security.

The general focus of a safety-first strategy is to meet established goals over a particular period of time.

Individuals should know that they are not going to maximize profits and should not want to.

Instead, they wish to invest enough where they can meet modest goals. Therefore, their money should be put at risk in a limited way. In many instances, there should be only part of a portfolio that is put at any risk at all.

An individual can then notice their returns and change their investments accordingly.

Example strategy

An example of a safety-first strategy would be one that emphasizes investments that have a low chance of losing any money.

Individuals would most likely tie up a large percentage of their income in bonds.

These bonds would pay a potentially substantial interest rate depending on the length of their maturation term. Bonds and savings accounts would be used to help an individual reach their most basic retirement goals.

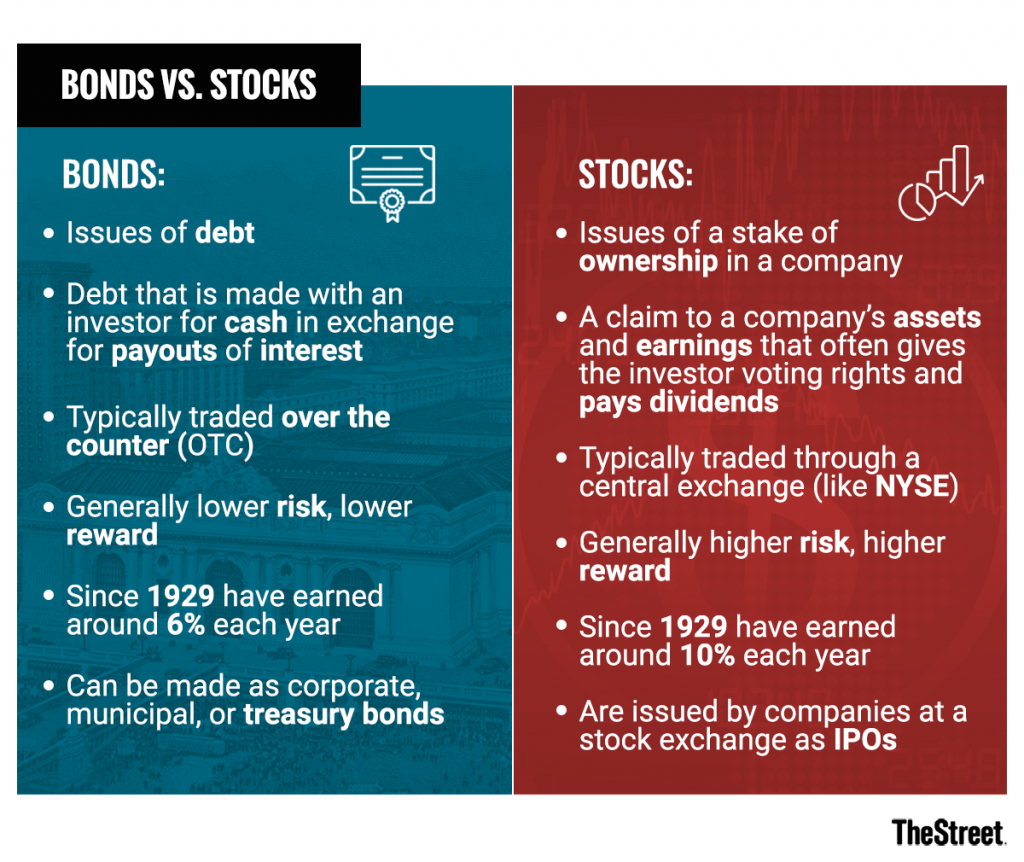

"While a bond is an issuing of debt with the contingency to pay interest for the money, stocks are stakes of ownership in a company that is given in exchange for cash," wrote The Street.

Once those goals were met, they may consider investments in an index fund.

The index fund would buy large amounts of a wide variety of stocks - like every stock currently listed in the S&P 500. The strategy would involve an individual checking in on these investments periodically and keeping them for long stretches of time.

The money would be immediately withdrawn from an investment if it seemed clear that the investment would lose money over the long-term. Though, this type of market timing is extremely hard to get right.

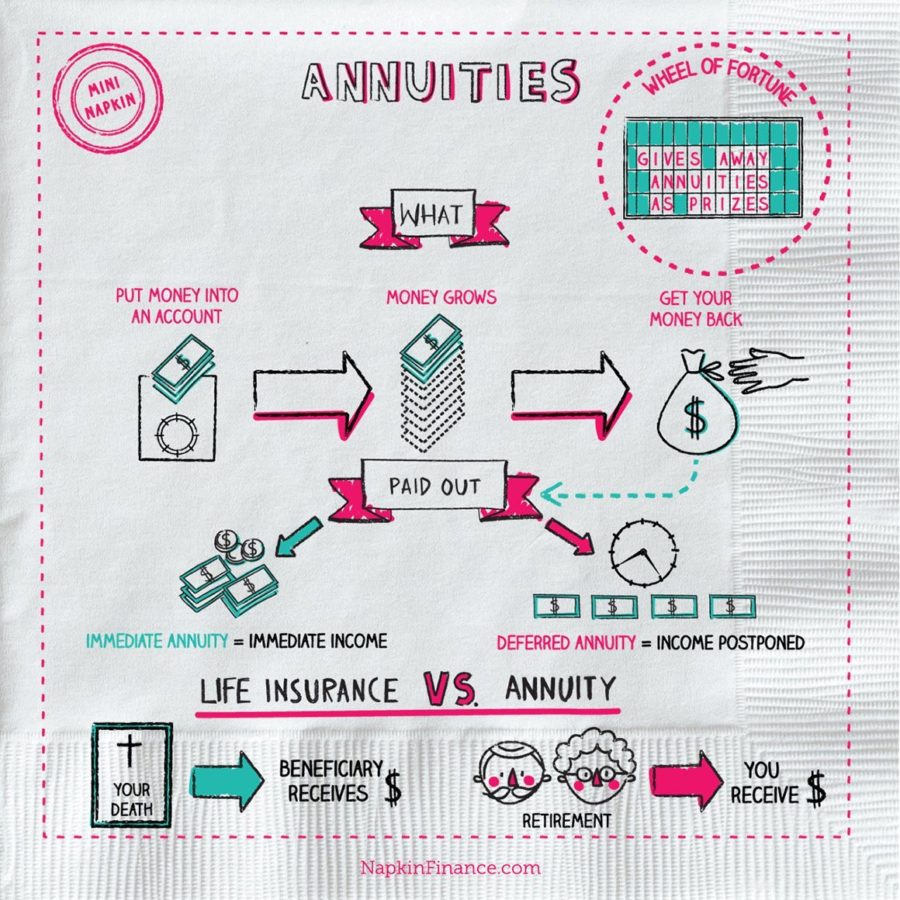

There is also the possibility that a safety-first strategy may make use of annuities. These instruments are complicated and are often only recommended for special circumstances.

In an annuity, an individual sets aside a particular amount of money for an extended period of time. This money may be set aside for five to ten years or even longer depending on its structure.

The money is left in the annuity to accumulate and grow.

At a certain point, the annuity starts to make fixed or variable payments that are guaranteed never to fall below a certain point. An annuity strategy has numerous downsides such as high fees and a low level of income liquidity.

But in the end, it can deliver returns without putting any of the money that a person invested at substantial risk.

A constant potential problem with this type of investment strategy is the chance that an individual will not have enough money for long-term retirement.

They may be thousands or tens of thousands of dollars short of their ultimate goal.

This issue may cause a serious problem if an individual cannot go back to work or find some other form of income. They may have to radically alter their retirement lifestyle and live off of money from either the government or from friends and family members.

The best way of avoiding this potential pitfall is to have benchmarks along the way of retirement.

Individuals should know how much money they should have saved up at a variety of different points in the savings process. If they have not met those goals, they should have a plan for changing their allocation and perhaps taking on more risk or consulting a new financial adviser.

The safety-focused investment approach can result in an individual taking on slightly more risk and new investment vehicles that bring in more income.

Like with probability-based strategies, safety-based strategies are not ironclad or permanent.

They can change regularly based on the circumstances involved and the needs of the individual. While many beginning investors do not believe it, it is certainly possible for a person to be too safe with their money and for safe assets to turn into unproductive assets.

What to do

Individuals who are considering a retirement plan need to first lay out all of their financial data.

This data must include:

- yearly income,

- yearly expenses, and

- all debts

Using this information, families should formulate their goals. They need to know what they want to buy in retirement and how they want to spend money. This information will also tell individuals whether or not they need to start investing in the first place.

There are a number of high-debt individuals who should not invest at all.

A better option for people with a large amount of debt might be continue paying off their debts before looking at retirement accounts.

A quick financial check of expenses and current payments, along with the amortization rate and a person's credit score, can tell any family whether they need to start investing or continue focusing on debts.

Next, individuals need to know what their parameters are.

Every family has a different parameter and no suggestion is applicable to every possible circumstance. People who are looking at financial planning and investing must know what they are and are not comfortable with. Individuals should set these parameters at the beginning of the process rather than at the end.

Eventually, they need to enlist the services of a certified financial planner.

This planner can help them at nearly every stage of the financial planning process. The amounts of help that they can provide vary widely. Some people only want a financial planner to set them up at the beginning and give them advice along the way.

Others need a professional to draw up and then implement their financial plan for a period of years and even decades. Every individual is different and needs a different amount of planning.

Being prepared from the very beginning can greatly aid an individual's plans when they do reach that professional.

Conclusion

There is no perfect strategy for investing for any individual. Some individuals hate the minuscule returns and bland prospects of safety-first strategies. They do not like the idea that their returns could be diminished by inflation.

Others cannot stand the thought of putting their money substantially at risk and are turned off by probability-based investing. These people do not want to have their hearts sink every time there is a negative story about the stock market on television.

Investing is an art as much as it is a science. Investing and financial planning must be tailored to an individual's needs and tolerance for risk.

A strategy must be flexible and it must be able to bring in enough money for an individual to meet all of their goals and comfortably retire.

However, finding a financial adviser and setting a plan greatly increases the chances that an individual will pick the strategy that best fits their needs.