Here is the "no shit" truth about our early retirement

What's the no shit truth about early retirement? In this article, I'm telling you everything we did to actually make it happen. No fluff.

A few weeks ago, I got an interesting email from a reader. After browsing through a few pages on the blog, she quickly understood how I wade through the "softer" side of early retirement. Things like purpose, happiness, etc. Basic stuff. It's stuff anyone can do.

But, she asked, how do we manage the "nitty gritty"? The brass-tax, hard-core, math and science shit that comes with this truly unique lifestyle?

"I'm just wondering if you have somewhere addressed a deeper dive," she asked.

"How much exactly do you suggest or did you have when you pulled the plug on the daily grind? What kinds of insurance do you think a person should have? How did you find health insurance, life insurance, etc? I think when most people get to your column, you've already won them over on the mental attitude, but what about the nitty-gritty?"

Fair enough. A lot of us personal finance and early retirement bloggers talk about the feeeeeeelings that surround early retirement because, well, that's the easy part. Anybody can talk about that stuff.

But when it comes down to actually making it happen?

That doesn't get talked about as much as it probably should, so here's my opportunity to address her questions about how we're actually making this happen for ourselves. Our early retirement.

Here is the "no shit" truth about our early retirement

Let's start by answering her questions, directly.

How much exactly do you suggest or did you have when you pulled the plug on the daily grind?

That will depend heavily on one's post-retirement lifestyle. Clearly, the more expensive it is to maintain one's day-to-day life, the more money that one will need before severing your lifeline to a full-time income.

We had $890,000 when we pulled the plug. But, my wife also went back to work for six months after we spent the first year traveling, so that wasn't a "full stop" quit for her. It was for me, though. I was done in 2016.

We used the Trinity 4% foundation as the starting point to figuring out what we would need before quitting the rat race. Note that while the Trinity study isn't some full-proof, 100% accurate representation of future reality, I still believe it's one of the best foundation tools that we have at our disposal.

Every year, my wife and I reevaluate our financial situation - pretending that we're early retiring all over again.

Can we STILL spend 4% of our net worth, or are we forced to cut back?

Or, maybe we can spend more - as we have been because the market's been doing so damn well? Whatever the answer is, it's prudent to reevaluate your financial picture every year.

It's all about those positive confirmations.

What kinds of insurance do you think a person should have?

I don't have the foggiest idea. Everyone's situation is going to be different and there's absolutely no way that I will ever be in the position to tell people what insurance that they need. Or, frankly, how to live their life.

After all, I'm not a politician. :)

My wife and I have a healthshare plan and other insurance that covers the basic costs necessary for our truck and Airstream, but at the moment, that's it.

How did you find health insurance, life insurance, etc?

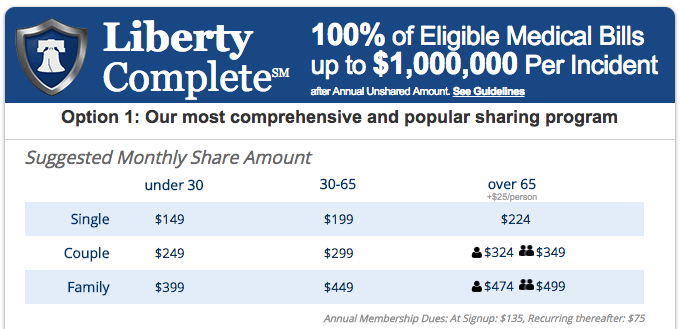

We use Liberty Healthshare - it's NOT insurance because it's not regulated by the insanely complex set of health laws. But, it's also one of the most popular and well-known health options among full-time RVers because you're treated like cash-paying patients at hospitals. No primary care physician.

If you travel for a living like we do - and aren't retired military, you don't have the luxury of heavily subsidized health care or choosing a single doctor as your primary physician. As travelers, you need to be able to go to any hospital at any time.

And, healthshares fit that bill wonderfully. While they aren't perfect, no health provider is perfect. Perfection is impossible, especially when it comes to health coverage.

Also, we don't have life insurance. We don't think it's necessary for us as two mid-30's people who are relatively healthy and without any dependents, so we've decided to save that cash and spend it on alcohol.

Now, let's get into some of the other areas of early retirement for us.

Murder your debts, fast

Debts are big business in the United States, and they bury too many Americans underneath mountains of stress from which are mighty tough to escape. Some frightening numbers, from nerdwallet.com:

U.S. Consumer Debt

By householdTotal debt owedCredit cards$15,675$729 billionMortgages$172,341$8.36 trillionAuto loans$27,865$1.1 trillionStudent loans$48,591$1.26 trillionAny type of debt$132,158$12.29 trillion

These numbers are startling, and I do not believe “good debt” exists. I do accept that some debts – like student loans for the right degree, can improve our financial position over the long run. But, we Americans also need to be keenly aware of exactly what we’re doing and understand the gravity of our choices before debts can turn into a positive.

Debt is NOT a “part of life“. Debt is a choice that each of us willingly accepts. Do not accept debts lightly.

I didn't climb out of debt. In fact, I've never run a credit card past its due date in my life. Every. Never paid any interest on plastic.

Also, no student loans, either. So, this isn't a problem that I've had to deal with, but according to the statistics, it IS a problem that many others are dealing with. Debts will kill your chances at early retirement, every time.

We automate as much as possible

Automation is one of the biggest "Easy Buttons" that exist when it comes to financial independence and early retirement.

Back when my wife and I worked full-time jobs, we had a budget – but we also applied the “Pay Yourself First” principle of funding our retirement accounts – in full – before any money hit our checking account.

You’d be proud, David Bach. Real proud. Bach is the author of the incredibly influential book “The Automatic Millionaire” that discusses the virtues of taking discipline completely out of your financial life.

We maxed out both of our 401ks…maxed them out good. I got the feeling from my payroll representative in my former company that I was basically the only person in the company that maxed out their 401k. Ugh!

Our mortgage was paid automatically. Cable television (which we eventually ditched), telephone service, insurance, everything that could be made automatic, we did.

We even set up recurring monthly transfers from our checking account into an Ally savings account that we used as our emergency fund. Eventually, we amassed a whopping three years of living expenses in that Ally savings account, and we’ve earmarked that money to be used whenever the economy takes a turn for the worst.

And naturally, we auto-paid our credit cards, in full, every month. We’ve never carried a credit card balance over to the next month – ever.

Easy automation stuff to get you started:

- If you have access to a 401k at work, use it; use the hell out of it

- Use auto-transfers to build up a solid emergency fund, and

- Pay off credit cards through automated bank transfers

Our "no-spend" weeks can be really, really cheap

As I explained in my no-spent article, we do no-spend weeks super lean.

Through the magic of solar power and living in our Airstream travel trailer, we can park virtually anywhere that allows overnight parking and live normal lives. Use our computers. Walk our dogs.

Just live like [semi]-regular people.

We bring our own water using an integrated 62-gallon freshwater tank in our rig. We’ve installed a composting toilet, which means we aren’t hauling around heavy (and smelly) sewage waste.

Yeah, we don’t really like sewage.

We hold waste water from sinks and our shower in our gray tank, and we’ve combined that with our black tank because we no longer have a traditional toilet that uses the black tank storage.

If you’re new to RVing, let me explain:

- Gray tank: Holds water from sinks and the shower.

- Black tank: Holds waste products from the toilet (sewage).

Since we’ve removed our traditional toilet and installed a composting toilet, we no longer use our black tank for sewage (because we no longer have sewage). Instead, we’ve combined both our gray and black tanks to hold water ONLY from the sinks and the shower.

This means we have more capacity to store waste water. This also means we can stay out in the middle of nowhere – rent free, much longer.

We are more self-contained and less reliant on services.

We have 500 watts of solar

We love solar. I mean, we really, really love solar. Though expensive to install, it’s been a game-changer for us as we’re able to stay off-grid for long periods of time.

In fact, we’d never need to plug into shore power if we always had sunshine (and didn’t need to run our air conditioner). If there’s sunshine, we’re charging our batteries with our solar panels. Automatically.

When we say #NoSpend, we mean no spend.

Like, no mortgage payments (we don’t have a house and we bought our Airstream in cash). No rent, either, when we are boondocking or mooch-docking. We never pay personal property taxes because we no longer own a permanent dwelling.

Seriously #NoSpend.

The exceptions? We do pay for health coverage. When we drive, we use and pay for diesel. But during those days when we’re home all day, we’re literally spending nothing to live.

Okay okay, we eat food, too. But, we’re about as close to #NoSpend as you can get because of the flexibility of full-time travel.

The bulleted conclusion

Here's the deal:

- Debts make financial independence much, much tougher

- Automation removes the discipline of saving

- A frugal lifestyle makes everything easier

- We use an inexpensive healthshare because we can

- You don't need to be a millionaire to retire early

If you want something bad enough, most of us possess the requisite ability to make it happen. It might not be easy. And it might not be quick. But, it happens...for a lot of us.

Want it. Dream about it. Then, make it happen.