Do these three things after maxing out your 401k and Roth IRA

In October, I maxed out my 401k and Roth IRA contributions for the year. Now, my paychecks are larger because those automatic deductions are no longer happening. Talk about an awesome first world problem to have!

As you probably know by now, I'm a bit of a saver. Though, I definitely wasn't born that way. But, I quickly learned as I approached early retirement that creating a good retirement plan and maxing out my 401k contribution made a huge difference.

In 2016, in fact, I turned into a turbo-saver by throwing every last dollar that I can into savings, including my workplace 401k, in preparation for the ever-sweet departure date at the end of 2016, which I achieved.

What happens when you max out your 401k?

In October of that year, I maxed out my 401k plan and Roth IRA contributions for the year. My paychecks were larger because those automatic deductions no longer happened. And of course, my modified adjusted gross income was higher, reducing the amount of tax benefits I usually have in comparison my previous annual deductions.

Will my 401k automatically stop at the limit?

Younger people can only contribute $19,000 to their 401k and $6,000 to their IRAs in 2019. American citizens age 50 and up can contribute up to $25,000 in a 401k and up to $7,000 in an IRA.

Hitting my contribution limit to achieve early retirement in exchange for having to pay taxes at a higher rate – Talk about an awesome first world problem to have!

What in the hell do I do with all this extra cash?

For fun, I did quite a bit of research online to find out what the typical advice is when you have a higher gross income because you have exceeded your contribution limit on your 401k and traditional IRA, and I'll be honest - it's confusing even to me who has a fairly solid grip on investments and retirement planning.

I can only imagine how confusing it might be to the casual investor looking for help on what to do with the money after maxing out their 401k.

Here, I'm going to make it easy for you and give you my top three strategies for using that extra money wisely. Hint - what I am about to tell you is going to prioritize your future happiness.

Three things to do after maxing out your 401k and Roth IRA

1. Check your emergency savings

If you don't have an easily-accessible emergency savings account with at least 6 months of living expenses, use the extra dough to build this pot of money up as fast as you can. We use Ally for our emergency savings.

While it is true that this money won't grow at nearly the same rate as it would if fully invested, it may also be a life-saver if you need substantial cash down the road.

The two critical elements of an emergency fund are safety and accessibility - meaning, your money needs to be both safe as well as accessible at a moment's notice.

This means storing $10,000 under your mattress is a bad idea because while the money is accessible (when you're home), it's definitely not safe.

What happens if your home catches on fire while you're at work, or your dog chews through your mattress (and money stash!) one day because he's pissed that you didn't fill up his food dish before you left for work? This violates the safe rule.

It also doesn't use the power of compound interest to build, either.

Storing your emergency fund in the stock market, while safe (notwithstanding capital losses, of course!), does not offer the accessibility that we need out of our emergency funds.

Stocks can be sold, but the process can take a couple of days before we actually see that cash in our hand. Emergency funds need to provide us with immediate cash, often necessary in an emergency.

My wife and I maintain an easily-accessible Ally high-interest savings account to keep our emergency savings with an annual percentage yield of over 1.00%, which isn't bad for savings accounts.

A money market account is another good option. Emergency funds can be saved anywhere so long as the money is "liquid", or in other words, easily withdrawn into spendable cash any time.

Do you really need 6-months of living expenses in your emergency fund?

"Need" is such a strong word and there are no established rules in play here, but it comes down to the level of risk that you are comfortable taking on. My wife and I prefer a larger emergency fund to account for job losses or any major expenses due to "shit happens". Your level of risk may differ, and that's okay.

We keep four years of living expenses in our emergency fund.

The bottom line: Establish an emergency fund if you do not already have one, and if you do, ensure that you are comfortable with the amount that's in it.

2. Open an HSA (Health Savings Account)

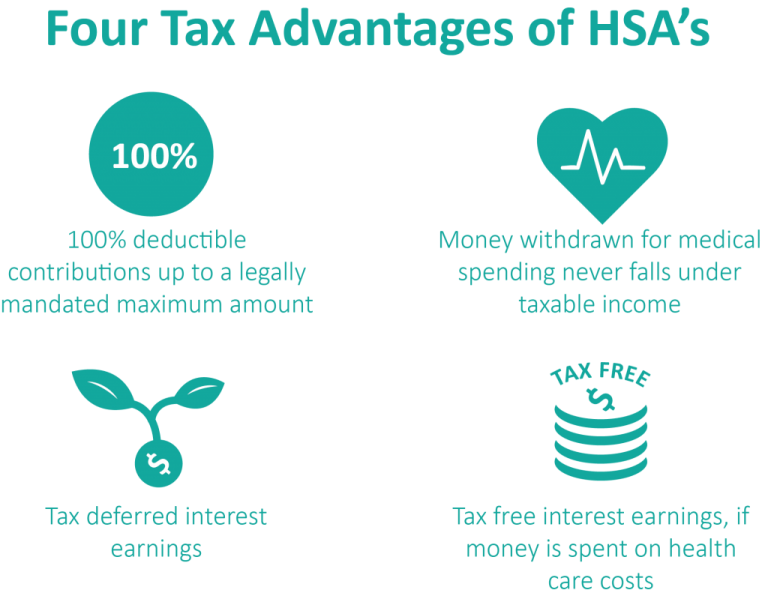

One of the better-known smart guys in this investment business, the "Mad FIentist", calls the HSA the "Ultimate Retirement Account" as part of a solid retirement plan, and for good reason. An HSA is a tax-advantaged (aka: pre-tax) account available for those who are enrolled in a high deductible health insurance plan.

The idea is since your deductible is so high, the HSA will help provide an incentive to save for those potentially costly deductible payments. Please keep in mind that an HSA cannot be used to premiums like life insurance unless you meet very specific criteria.

The best part about the HSA is its tax-advantaged status which, like your traditional 401k, reduces your taxable income by the amount contributed. Thus, if you contribute $3,000 in a year into an HSA, your taxable income gets reduced by $3,000 as well.Even better, an HSA account can provide tax-free contributions, growth, and withdrawals because there are no hard and fast rules that state HSA money needs to be used to pay for deductibles directly.

This means that deductibles can be paid by using a regular credit card (instead of the HSA debit card), allowing us to keep that money within our HSA longer. We can then decide when to pay ourselves back - so long as we keep the deductible payment receipt. Check out the Mad FIentist article (linked above) for more detail on how this might work.

If HSA money is never used, it can be withdrawn from the account at age 65 without penalty, which essentially turns this account into another tax-advantaged 401k. This money will be subject to income tax at the time of withdrawal, but don't forget that this money also enjoyed years of tax-free growth, all the while reducing your taxable income during your working years.

At the present time (2019), individuals can contribute $3,500 and families $7,000 into HSA accounts.

3. Open a brokerage account

If your emergency savings is up to snuff and you've looked into an HSA as another pre-tax savings option, consider opening a taxable brokerage account.

Brokerage accounts provide investors with another way to invest money in the stock market similar to a traditional 401k, except you're investing after-tax dollars. Any capital gains are taxed upon withdrawal.

Investors pay a fee to the brokerage house with each transaction.

My wife and I have a brokerage account with Vanguard with holdings in stocks, bonds as well as mutual funds. Less experienced investors who wish to invest their money in something without needing a lot of knowledge might consider the Vanguard LifeStrategy Growth Fund, which is a broadly diversified 80/20 stocks to bonds collection of funds.

Frequently Asked Questions:

What happens when I max out my 401k contributions?

When you reach the annual contribution limit for your 401k, your automatic deductions from your paycheck will stop. This results in larger paychecks, but it may also lead to a higher modified adjusted gross income, affecting tax benefits.

Will my 401k contributions automatically stop once I hit the limit?

Yes, once you reach the contribution limit, your 401k contributions will automatically stop. For individuals under 50, the limit is $19,000, while those aged 50 and above can contribute up to $25,000.

What should I do with the extra cash after maxing out my 401k and Roth IRA?

Consider three key strategies: First, check your emergency savings and ensure you have at least 6 months of living expenses. Second, explore opening a Health Savings Account (HSA) for additional tax-advantaged savings. Finally, if your emergency savings and HSA are in good shape, you can open a taxable brokerage account for further investments.

Is it necessary to have 6 months of living expenses in my emergency fund?

The amount in your emergency fund depends on your comfort level with risk. While there are no strict rules, having at least 6 months of living expenses is a common recommendation. Some individuals prefer a larger fund to account for potential job losses or unexpected major expenses.

Why consider an HSA after maxing out 401k and Roth IRA?

Health Savings Accounts (HSAs) offer tax advantages and are often referred to as the "Ultimate Retirement Account." Contributions are pre-tax, reducing taxable income, and if not used for medical expenses, funds can be withdrawn penalty-free at age 65, making it a valuable long-term investment tool.