If you make good money but are always broke, you’re probably falling into the nearly invisible trap of money mismanagement that plagues so many high-income earners.

Good money often means an expensive lifestyle that goes along with it. What’s the problem with that? You guessed it…we gotta pay for that lifestyle somehow. Our high salaries are what do that, but that leaves us with fewer resources to save.

And, most of us aren’t building wealth because of it. We are earning good money, but we aren’t actually managing our expenses well which prevents us from accruing substantial personal wealth.

The mission of this post is to learn more about this finance related paradox in which high income doesn’t necessarily correlate to high wealth.

Do you fall into the pseudo-affluent trap?

The pseudo-affluent is a growing collection of people that value the material world by buying things that convey success.

Author Dr. Thomas Stanley refers to these items as “prestige products” and said that the majority of these people want us to know just how much stuff they have by displaying their personal success (apparently, that’s like half the fun!).

In The Millionaire Next Door, Dr. Stanley lays out a remarkable reality. He says that those of us who appear the richest financially tend to fall into one of two categories: They are filthy rich with a net worth north of $10 million, or they earn a high income but have very little wealth to show for it because they spend the majority of what they earn.

The high-cost automobiles, big houses, an assorted collection of high-end clothing, and other perceivable high budget expenses help shape a fake facade for many. One that demonstrates that you’re perhaps financially successful or even air on the side of “intelligence.”

In their pursuit of higher income jobs and often associated wealthy lifestyles, the pseudo-affluent learn a false understanding that those of us who wear the latest fashions, choose to drive around in “consumer” cars, live in affluent neighborhoods are in fact rich. However, are we truly managing our personal finances correctly?

As we start to dig deeper, we finally see a different reality. We are not rich because we don’t act rich. We are, in fact, doing what makes the least sense financially. For a start, we are not managing our personal budget wisely and failing to protect ourselves from obvious traps such as racking up large expenses and revolving credit.

The more we do this, the further into debt we fall. We finally need to change the shape of this detrimental cycle of money mismanagement.

In this wicked cycle, we learn the terrible habit that high salary enables high spending. And as our lifestyles continue to inflate, our standards do the same.

You might ask, how are we going to finance this new lifestyle?

And suddenly we find ourselves on the dark side, having initiated the start of an addictive behavior. We are in a position where we NEED to start earning more and more money just to finance our lifestyle.

We aren’t saving. We aren’t investing. We’re spending. And in sum, we are not managing our money effectively and our personal finance reserves are either remaining stagnant or going downhill.

Let it be said, the cycle almost never stops until something dramatic happens.

Why you are always broke even if you make a high income

This is an important question to ask. Believe it or not, rich people live paycheck-to-paycheck just like poorer people do. And, many of them are knee-deep in credit card debt.

Throughout my career, I always made a damn good income.

In fact, my starting salary out of college in 2005 was in the mid-50s right out of the gate. By the end of my career some 14-years later, I was pulling down around $130,000 including bonuses.

Earning that type of money was awesome, of course. Naturally, most people thought I was rich. That I had it all. They assumed I never worried about money and could buy virtually whatever I wanted.

I fell right into the trap that envelopes so many high-salary earners.

Like doctors.

I'm a doctor and I'm always broke

The medical field is an excellent example of high-income careers. But, not all doctors enjoy a lifetime of financial security.

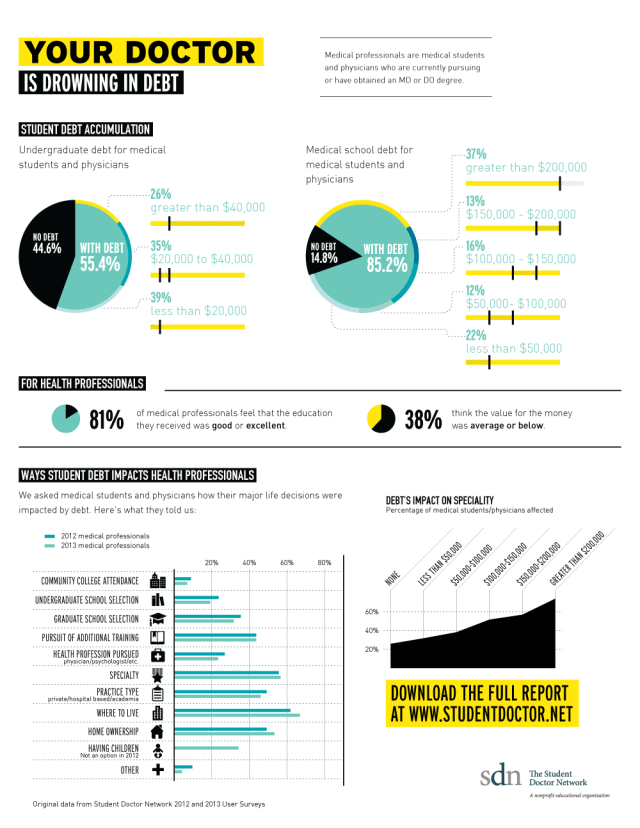

Check out the infographic below:

Many doctors are saddled with debt at the start of their career. Most of that debt results from the high cost of medical school, but that’s only just the beginning.

“When I started out with a net worth of negative $208,000 at the end of training,” a doctor who blogs at The Physician Philosopher told me, “one of the most helpful things was realizing that the panhandler on the street or the toddler with a few dollars in their piggy bank (and no debt to their name) is wealthier than I was.”

“The time spent getting all of that training does make physicians feel like they “deserve” to spend a lot of money on nice things,” he continued.

To high-income earners who spent many years in school, the tendency to amass debt and expensive lifestyles because they worked so hard (and long) in school is common.

Business managers suffer the same fate.

I'm a manager and I'm always broke

Like doctors, business managers swim within a culture that’s driven by high salaries. Promotions and additional levels of responsibility in business bring with it an expectation of success.

And more specifically, looking like we are successful.

I chatted with one executive who writes about financial independence in a high-income career at Stop Ironing Shirts. The expectation that high level executives “act the part” is a very real part of the job.

“When I got into the realm of making $200k+year, that job carried a “President” title and many of my peers feel the need to drive fancy cars, buy expensive watches, and join high-priced country clubs.”

His boss maintains several different homes, a couple purely for entertainment purposes. They drive expensive cars, wear costly suits and live in ritzy markets where their customers are.

“Think about jobs like large law firms, accounting firms, investment banks, commercial banking,” he told me. “They all sell/offer a near commodity service then it becomes about “Deal flow”. How many deals can you look at? This requires these employees to run in circles of people that are much wealthier than they are.”

How do I stop being broke all the time?

The first step to changing these detrimental ways is to recognize that maybe you have a spending problem. Is it truly hard for you to not spend and resist the impulse to buy, buy, buy?

Or maybe you can’t help but want to “keep up” with your friends or family members for the sake of vanity and constantly try to display some alternative persona or simply look cool.

Having researched this topic in depth, and personally avoided these financial pitfalls, I will provide below five sure-fire ways to escape the retched cycle of debt, especially if you earn good money:

Tip #1: You pay yourself first

Paying yourself first means we fully fund our retirement accounts before paying anyone anything…yes, even the government. And best of all, there is nothing illegal about it. It’s called a 401k (or a 403(b), or SEP IRA) plan.

Read more about paying yourself first.

Tip #2: You live in a reasonably-sized house

The median size new home is now 2,687 square feet, an increase of nearly 1,000 square feet in the last four decades. Perhaps more interesting is the average household size – meaning, the number of people living in the home – has actually decreased from 3.01 persons per household 40 years ago to 2.54 today. Fewer people for bigger homes?

Read more about a remarkable home-size study.

Tip #3: You understand good debt vs. bad debt

I do not believe “good debt” exists. I do accept that some debts – like student loans for the right degree, can improve our financial position over the long run. But, we Americans also need to be keenly aware of exactly what we’re doing and understand the gravity of our choices before debts can turn into a positive.

Read more about good debt vs. bad debt.

Tip #4: You live a sensible lifestyle that’s within your means

The truth is you can live well – in fact, in the lap of luxury, and still set yourself up to achieve financial independence and retire super early. The key is living a more sensible lifestyle by making smart decisions with your money. Think about your happiness, first and foremost. Forget adequacy. That’s boring.

Read more about how a “sensible” lifestyle is superior to minimalism.

Tip #5: You are humble, yet confident

Being humble means that we understand the world that surrounds us. I acknowledge that there’s a lot in my life that’s simply gone right – and, I had very little control over that. Then again, there’s also a lot that’s gone right…that I DID (and DO) have control over.

Read more about how I mix these two traits together.

How much money per year is "good money"?

While salary requirements can vary from person to person depending on a number of factors, including where you live or whether you have other family members to support, “good money” should be looked at as more of a way of living and spending responsibly, versus as purely a high dollar figure that enters your bank account on a bi-monthly basis.

No matter how much you earn, you must also remember to budget wisely and save.

In an article posted by the Teachers Insurance and Annuity Association, it is recommended that you save between 10%-15% of your income for retirement. You should also set aside enough money for an “emergency fund” that can cover 3-9 months of living expenses. In total, a good rule of thumb is that at least 20% of your income should go towards saving.

Outside of saving, another practice that can help you amass “good money” is to rise above the tendency to compare yourself to others. A failure to “keep up with the Joneses” from a materialistic standpoint is actually a financial win if accumulating “good money” is your goal.

Spend consciously. Only purchase the things you really need. Sure, you can splurge on occasion and “treat yourself,” so to speak, but make sure these indulgences are limited and don’t become too frequent of a habit.

Honestly, are you pseudo-affluent? Check out my Kill It! article series for more on removing the “pseudo” part of that statement from your life!