Magic of the stock market revealed in a year

This morning I continued my weekly ritual of glancing at how our stocks are doing in the market. Hey, look at that - another up-tick. Believe me, the realization that just a few months ago, I was about $80,000 poorer is definitely not lost on me.

But as of today, all our losses over the past year have been regained - and then some.

Looking back over our investment portfolio's recent history, I realized something amazingly powerful. To anyone who doesn't quite understand the stock market and how it generates passive income, the market just finished showing us exactly how it works. How many will learn from the lesson?

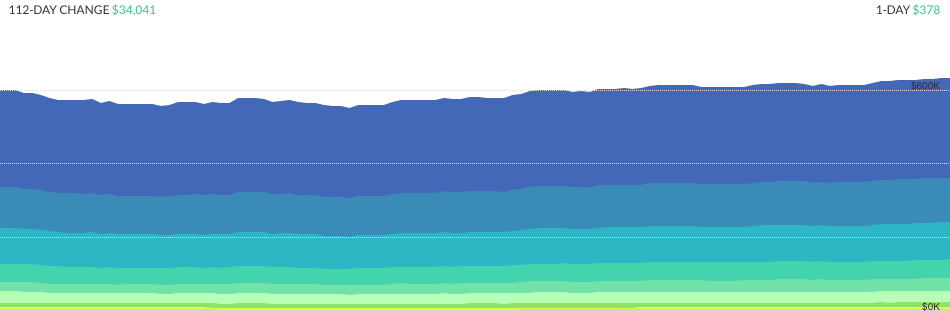

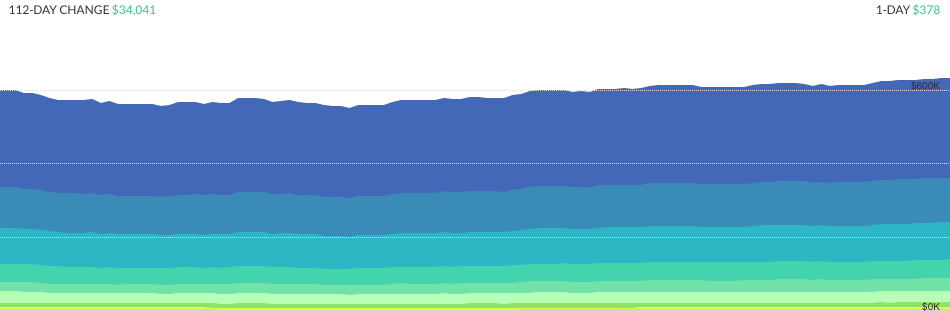

The screen shot from Personal Capital above depicts a nearly $80,000 difference in value and represents our portfolio balances thus far for 2016. Mid-February was our low point, and it seems like each and every day now sets new highs for us. At the moment, the market is doing well.

But that wasn't the case just a few months ago.

Over the past year, investors have witnessed incredible market fluctuations. 2016 started with the worst 10-day stretch in history. Everybody was losing money left and right (93% according to CNN Money). The reasons are immaterial. Some claim the market was generally overvalued. Others believe oil was the main culprit. Whatever. Stock brokers are irrational by nature. ;)

Twitter and other social outlets lit up. Folks were frustrated, questioning the whole concept of relying on the stock market for passive income.

The causes - whatever they are, don't matter. What is amazing is how well the last year represents the core workings of the market over the long term. It's almost as if the market reached out and bitch-slapped the American people across the face, exclaiming "Watch this, you might learn something!"

The stock market naturally ebbs and flows

There are few "sure things" in this world, but the stock market, historically over the course of history, has proven to be a money maker. The key is to understand that short-term investing is incredibly risky and volatile. Looking at investment returns over a 6-month (or 6-week) period in a market designed to generate consistent long-term gains is dangerous and confusing.

Understand that just like people, the stock market is very emotional. Emotional people tend to exhibit wild swings, acting completely bat-shit nutty at times for no apparently reason. As an investor, you can't control these swings; they just happen. Like your crazy uncle who won't shut the hell up about a looming communist invasion, you just gotta go with the flow and let him do his thing. Take the bad with the good. After all, he is your uncle. And he's always been a bit off.

Again, what the market does in the short term is immaterial; every once in a while, the market will go crazy. An economy controlled by people almost requires a dose of insanity every now and again.

Whether you are investing through an established brokerage company, like Glanmore Investments, or are going it alone - we all feel the same weirdness (craziness?).

Make no mistake about it: the frustration we experienced as of late is nothing compared to market craziness in our nation's history. Think about the Great Depression when the market lost a ridiculous 11% of its value at the opening bell on "Black Thursday" - October 24th, 1929. Or the years of "stagnation" during the 1970s. Or the housing market collapse in 2009 which is a bad trader setup. These were serious blows to our market and virtually every investor.

But look around you. We recovered.

The idea is to make money over the course of years, which turn into decades. Market growth is exponential. Money makes money, and more money makes even more! Thus, frustrations and market criticisms of short-term market losses are generally unfounded and ignore the entire point of investing. The market isn't a get-rich-quick scheme. That is the lesson it just tried to teach us.

If Joe had invested a ton of money in the market last December, but didn't understand how the market works, Joe probably would have cried into his beer some time in mid-February. I'll shed a tear for him too, but only due to my sadness over Joe's inability to understand the plain and simple workings of the stock market.

For example, since its inception in 1928, the S&P has realized an average rate of return of 10% - or 7% after adjusting for inflation (the buying power of money). If dividends were reinvested over the course of this 90-year period, gains would be quite a bit higher. Not bad.

However, this doesn't mean investors are guaranteed a 10% return on their money virtually any time they invest. Thus far in 2016, the S&P's rate of return is right around 1.1%, but it bottomed out February 11th at NEGATIVE 10%. We all lost money - temporarily.

It happens, and it's primarily dumb luck how well you do over the short-term. But as the market has shown over the course of its history - and even over the course of the last year, clamoring over ebbs and flows is a fool's game because the market will always ebb and flow. It's what it does.

And now, the great majority of us are making cash again because the market now flow-eth. That is also what it does.

Enjoy the ride!

How many of you lost a bunch of money last February, but are now enjoying an overall increase in your year-to-date investment portfolio?