With all we know about debt, why are so many people still in debt?

Speakers speak about it. Writers write about it. Bloggers blog about it. Tips and tricks to getting out of debt are all over the place, but yet, people are still in debt. In total, the relentless pool of consumer debt has squeaked past $1.3 trillion.

Okay, WTF?

The NASDAQ says that debt is enslaving the American people. That's tough to disagree with. In our case, early retirement would not have been possible if we had debt. Today, we have zero debt, including a mortgage. Unfortunately, this phenomenon is just not common.

U.S. Consumer Debt

By HouseholdTotal debt owedCredit cards$15,675$729 billionMortgages$172,341$8.36 trillionAuto loans$27,865$1.1 trillionStudent loans$48,591$1.26 trillionAny type of debt$132,158$12.29 trillion

Texas is no exception when it comes to the consumer debt crisis, with the average Texan carrying over $6,700 in credit card debt alone, contributing to the state's overall $88 billion household debt burden. With such high consumer debt levels, many Texans are understandably seeking relief. If you're struggling with debt, it's crucial to take action before it becomes overwhelming. For Texas residents, various debt relief programs in Texas can provide assistance in tackling consumer debt burdens. Exploring these options allows Texans to regain control of their finances and work towards a debt-free future.

These numbers are startling, and I do not believe "good debt" exists. I do accept that some debts - like student loans for the right degree, can improve our financial position over the long run. But, we Americans also need to be keenly aware of exactly what we're doing and understand the gravity of our choices before debts can turn into a positive. That doesn't just magically happen.

More on good debt vs. bad debt below.

Generally, debt is a gosh darn disease and we need to start treating it like one. Not all diseases are preventable, but debt has the advantage. Much of our debt as a society is preventable. It's a choice that so many Americans willingly shoulder. Even with everything we know about debt and how devastating it can be, we still insist on murdering our future selves through completely reckless consumer spending.

#Debt is a gosh darn disease and we need to start treating it like one.

We systematically put ourselves in a position of weakness by owing people money...money we used to buy things that we probably don't actually need (I'm lookin' squarely at you, credit card debt!).

Why are people in debt? Because they don't want to be out of debt.

But wait! Before the hate mail, I understand that some people truly have fallen on bad times, or took a bad deal or just got caught up in something that they couldn't control. Yes, I understand that, sometimes, this happens. Got it.

History and statistics help prove that this isn't the rule. It's the exception. The average household with credit card debt owes over $15,000. Auto loans? Over $27,000. Student loans come in at nearly $50,000. Total credit card debt? Over $930,000,000 (that's billion, with a b). This is no accident.

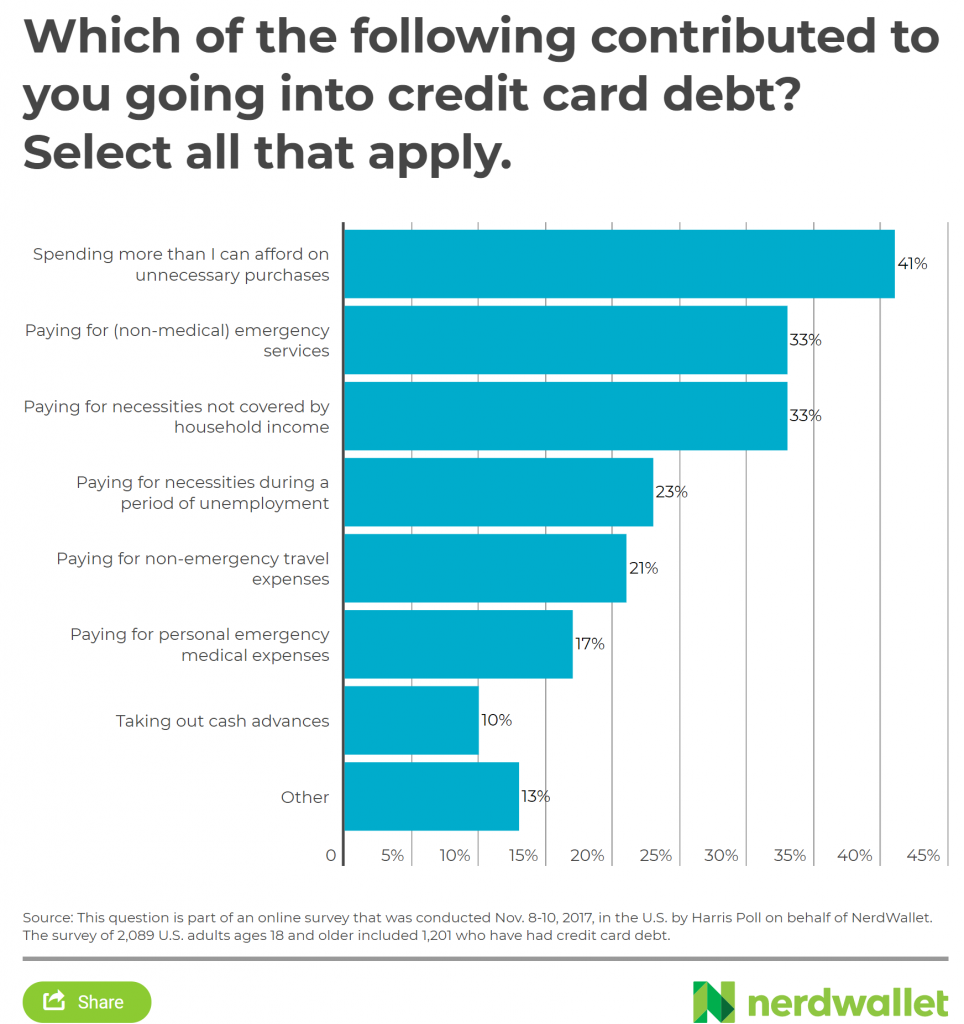

And why? A variety of reasons account for debt. Buying shit we don't need accounts for the top, while "emergency services" comes in tied for second place with general necessities. Non-emergency travel expenses and cash advances (the worst of all debt?) all factor into credit card debt in the United States.

Check out this graph courtesy of NerdWallet:

Not all debt is bad, right?

I do believe there are debts that can turn into something positive. Investments in our future through debt (like student loans) can turn into a net positive. But, student loans don't automatically pay off, either. For most of us, they take many years to eliminate from our lives after earning our degrees.

According to a study published by U.S. News, it takes the average bachelor's degree holder a whopping 21 years (or two decades) to pay off their student loans. Two decades is an incredible amount of time to be saddled with debt and makes choosing the right degree program (perhaps one that's marketable?) all the more important. The opportunity cost of what we could have done with that money factors into this equation, too.

Mortgages are another common debt in the United States, and many Americans earn money on their real estate investments (especially rental properties). But here again, mortgages put us in debt to the tune of over $222,000 on average, and like we learned during the home loan crisis that sent the stock market into a tailspin in 2009, Americans tend to over buy due to some combination of "the American Dream" nonsense and downright predatory mortgage lenders.

Debt is debt however you look at it. Smart debts, like risks, are repaid in full AND put us in a better position than before. Bad debts throw us into a position of constant weakness and force us to pay interest for the greater part of our lives.

Two reasons to go into debt - ever

To this humble little personal finance blogger, only two GOOD reasons exist to take on more debt – and by “debt”, I’m talking about debts that can turn positive. If your situation doesn’t fall into these two categories, it’s might not a good idea (you're the ultimate judge, of course).

1: You’re in good financial standing

Those who are in good financial standing can “afford” debt. They have a good, steady job and earn quite a bit more than the anticipated monthly payment to repay the debt.

They currently have no debts – or very little. If they lose their jobs suddenly, they can afford to keep paying their monthly payments for several months.

They have an emergency fund with at least three months of living expenses.

They don’t live paycheck to paycheck and have a proven track record of paying monthly bills on-time. Automatic monthly payments are even better.

They regularly spend less than they earn.

How much debt to accept: If we are talking about mortgage debt, conservatively, do not take on a mortgage payment of more than 30% of your take-home pay. Take-home pay means after taxes. If you’re willing to accept more risk, then don’t let your mortgage payment exceed 30% of your pre-tax pay.

2: There is a damn good reason / good payoff

The payoff must be worth the risk of taking on debt. For example, using a student loan to fund a computer science degree, for example, can easily turn positive after just a few years of working in information technology – a sector with traditionally big salaries. Business Management, Accounting, and Finance degree programs are other good choices for bigger payoffs.

However, it is probably tough to argue that a $40,000 car loan was worth the risk. Less expensive cars exist – nice cars that “go”. They get you from Point A to Point B just like the expensive car.

Buying a house with a $150,000 mortgage in a real estate market where rents are high may also make sense. But even then, understand how expensive homeownership truly is.

Smart debts offer a quantifiable return.

Is there a quantifiable return on the debt? If so, consider taking on the debt if your financial standing is solid. Or if you’re a student, consider the debt if the degree program produces a reasonable expectation of a good income and dependable job prospects.

For example, the average student loan debt in the U.S. is just over $37,000. What degree programs set us up to pay off the debt quickly? On average, first-year accountants make over $53,000. Finance majors average $55,400. If you’re into computers, you can expect an average salary north of $60k right out of the gate. These wages make repaying student loans easy.

Consider job prospects, too. How likely is it to find – and keep – a job after graduation? Take a look at unemployment rates based on degree programs. Areas like philosophy, hospitality and some of the “softer science” disciplines tend to result in higher unemployment. Do you want a job after graduation?

Why are people still in debt?

More than 1,200 words later, we still haven't answered the question. Now, we will. Remember the reasons why people are in debt.

The NerdWallet chart provided them:

- Unnecessary purchases

- Non-medical emergencies

- Necessity spending

- Unemployment lifestyle spending

- Non-emergency travel

- Emergency medical procedures

- Cash advances

I've italicized the items that most of us could easily reduce or eliminate. Easily. For the others (necessity and emergency spending), there's a tried and true technique to help pay for life's uncertainties and what-ifs.

Let's break down the reasons behind debt into three broad categories:

We spend way too much money

As the NerdWallet chart depicted, spending money on stuff we don't need easily accounts for the #1 reason why the majority of us are in debt. The solution, of course, is to stop spending so much damn money. If you think that you "can't" save for retirement because your income isn't high enough, take an honest (and non-judgmental!) look at your expenses. In a lot of cases, you probably could save for retirement if you're able to cut some discretionary spending.

Easy wins to cut might be that cable/satellite TV service (over the air HD is pretty darn good, ya know...or steaming), yearly cell phone upgrades, spending hundreds on restaurants, buying a pair of $220 Oakley sunglasses (I did that once!) and choosing to buy a depreciating asset with an auto loan (aka: a brand new car) rather than an inexpensive used car with cash.

Cowboy (or cowgirl) up and just stop. Ruthlessly cut frivolous crap you don't need.

Unexpected expenses

Expenses that we didn't account for happen. To all of us. Hell, that's what makes them "unexpected". The key isn't necessarily to reduce unexpected expenses - that's nearly impossible. Instead, establish an emergency fund by putting money aside from every paycheck. Paying yourself first helps to fund both emergency and retirement accounts much more easily.

Strive to accumulate at least six months of living expenses in a separate interest-bearing savings (or money market) account. Use this money to fund unexpected expenses instead of using your easily accessible and debt-inducing credit card.

Emergencies

Yup, these happen too. And again, an emergency fund is absolutely critical to helping us fund emergencies without driving us straight into the hole. If you have no money set aside, this is your #1 problem that needs to be addressed. Address it by using the same technique that I just described above. Take money from each paycheck and set it aside. Make it automatic.

Many personal finance writers point to unexpected healthcare costs as a primary area of concern as it relates to unrelated expenses. While I agree that healthcare costs can skyrocket out of control unexpectedly, that's also a relatively small component of the overall debt picture in the United States. Non-medical related expenses (roof repairs, car accidents, etc) account for almost double that of healthcare-related expenses.

What else? Comment below if you think there's something that I've missed or if you've another technique to climb your way out of debt.