Try doing these 6 things for the rest of the year

Habits are a bitch unless they are good ones. Most of you know by now that I'm not a fan of endless repetition. Even the habits that work, I still try to modify. To tweak. I love trying new things.

In honor of trying something new, I come to you today with a challenge: For the rest of the year, do something different. Anything.

Just, try.

I've come up with some ideas to consider. Read them and consider those that make the most sense to you. But remember, the idea here is to push you outside of your comfort zone a bit. Out of your element.

How many of these are you committed to trying?

Try these 6 things for the rest of the year

1. Max out your 401k at work

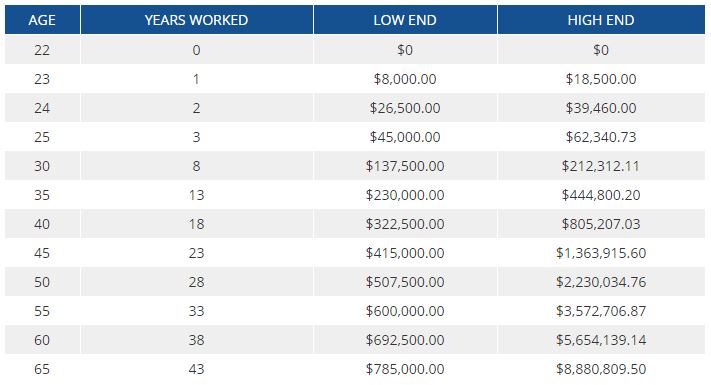

If you're saving the company-match at work (typically around 4%), good for you! That's literally free money and you're smart to at least invest the match. For the rest of the year, make a goal to max out your contributions for the year, which currently stands at $18,500.

Maxing out your 401k has powerful benefits. It skyrockets your savings rate and reduces your taxable income even more. If you can support it financially, do it. Your future retirement will thank you.

In fact, check out Personal Capital's savings potential chart to see how your savings are stacking up.

Already maxed out your 401k?

First, a huge congrats. Not many people choose that route, but your retirement will be stronger because of it. But now, you have a little additional money to play with after maxing out your 401k.

Luckily, I've written about what to do after maxing out your 401k before. If you already have your retirement accounts maxed, you have several options. First, you can start padding your emergency fund a bit (more on this in #2), open a Health Savings Account (HSA) if you don't already have one or start a brokerage account.

Of course, there are a bunch of options for what to do after maxing out your retirement, and you'll be the only judgment for the method that works best for you.

2. Establish/double your emergency fund

Emergency funds are critical to both peace of mind and also just the ability to cover unexpected expenses. Think a $7,500 medical bill or a car accident. If you don't already have an emergency fund, start one.

Now.

If you don't have a ton of cash to spare, start small. Earmark $10 from every paycheck. Put it aside and don't touch it unless you need the extra dough to cover an emergency, job loss or any other catastrophic event. Also, don't cheat and convince yourself the new iPhone is an expense that you gotta make with that money. That's not an emergency and you know it!

If you already have an emergency fund, increase it. Pad it with a little extra. Whether you actually double it or not is up to you, but don't let it just sit there and collect dust. Add to it. Make it as robust as possible. If you lost your job today, how long could you keep paying the bills?

3. Every week, choose a device-free night

Once a week - every week, turn off the damn television. Close the laptop monitors. Put the tablet away. Pretend that you're living 100 years ago out on the countryside without an electronic device at your damn fingertips in any direction you turn.

Instead, do something old-fashioned like take a long walk with your spouse and talk about your future (my wife and I did this a LOT before we retired, and it helped keep us focused and motivated). Or, read a book. Work on a project that you've been putting off. For just one night a week, actually do something.

You might be surprised at how small changes in your routine - like this, can add up into seriously life-changing improvements. And who knows, you might actually like spending time that way!

4. Toss one item each and every day

By "toss", I don't actually mean throw away. Perfectly good items can be donated, but the point is to spend a little time every day by getting rid of something. Instead of de-cluttering your place by simply rearranging your crap, begin systematically removing that crap instead.

Good Will that shit. Give your junk a new home and let it provide extra value to those who might need it more than you. Then, begin living in your house...I mean, actually living in your space knowing that there is one less thing hangin' around to cause a mess.

Personally, I've never met a single person who couldn't use a little de-cluttering every once in a while...and that includes us, and we live in a 200 square foot Airstream!

5. Choose one thing that you think you'll do after retirement and start doing it

I hate the phrase "I'll do that after I retire/get a raise/get a new job/etc".

I retired from full-time work at 35, and I can tell you that if you aren't already doing something before you reach your ultimate goal, it is not as easy as it might seem to just pick up new hobbies.

Yes, it's true that you have more time. And, generally less stress. But, that also does not mean you'll instantly start running 5 miles a day or working in your garden more. That stuff still takes motivation even if you aren't pre-consumed by life (and a job).

Choose just one thing that you've said you'll do once you reach your major life goal (like early retirement) and begin doing that now. This week. Start developing those habits before you get there.

If you aren't doing it now, there's a good chance you won't do it later.

6. Remember those New Years Resolutions that you made last year?

You probably know that I don't believe in making resolutions. They are much too easy to break - so easy, in fact, that they've become relatively meaningless. The gym is a perfect example.

I am a huge gym-goer, and every new year I see an influx of new faces at the gym. The first couple weeks of January, it's pretty consistent. February, it's still pretty consistent, but the pattern is beginning to break. By March - and certainly by April, we're back down to the regular group of gym fanatics grinding it out each and every week.

We're excited to start, but then motivation dissolves into nothing.

That said, most of us still make resolutions. If you made a few last year, now might be the time to look into whether you've completely ignored the ones you made or not. Be honest with yourself, but don't be judgmental.

Of course, this assumes that you'll actually remember what those resolutions were.

For those that you do remember, set a fall goal to achieve that resolution. Weight loss is a common one, so is education and getting involved with something new. If you haven't addressed any of your resolutions, choose one and conquer it.

Okay, lay it on me. Is there anything else that you'll do differently for the rest of the year that might improve your life?