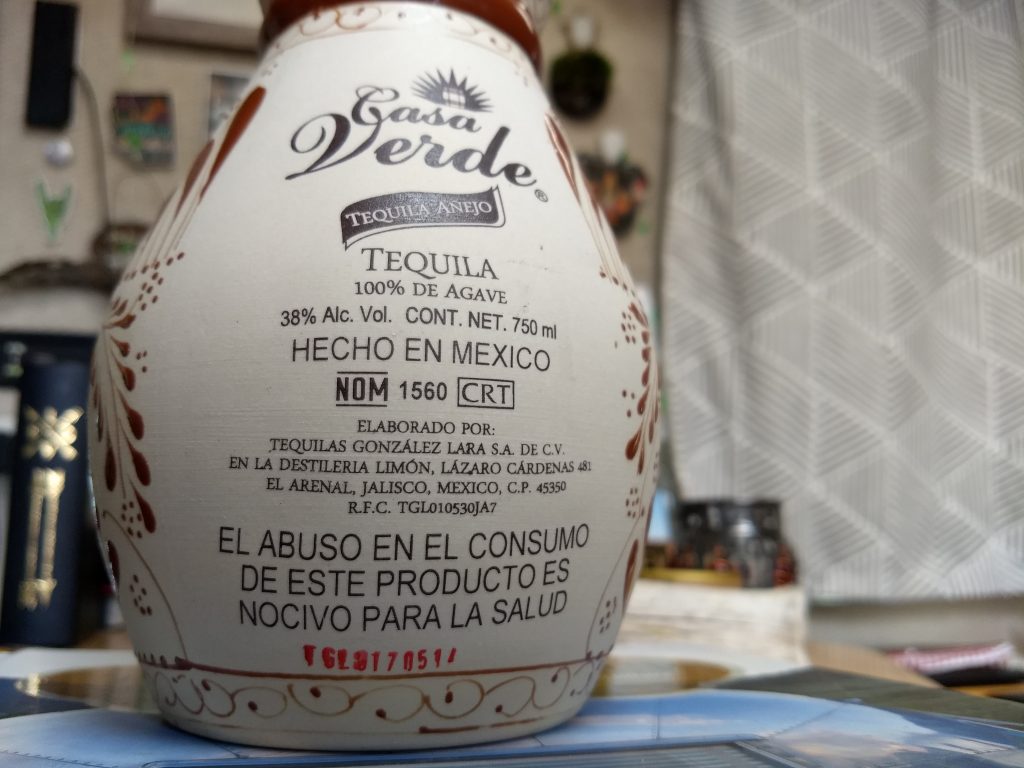

We bought a $110 bottle of Tequila; no regrets

Financial Independence isn't about not spending money. It's not some challenge to see how long you can go without buying this or that, or how minimal you can get your home.

You people know how much I hate the term "minimalism" anyway. :)

It's an over-simplification of saving money and becoming independently wealthy to chalk up the large majority of life to not spending money. While that will eventually lead to financial independence, you also risk becoming a dreadfully frustrated person, too.

Imagine cutting out everything that you like because you simply don't want to spend a dime. Fancy meals. Huge televisions. Nice watches. Whatever.

For me, I love Tequila. Actually, pretty much anything Mexican. Something tells me that I should have been born in Mexico instead of the United States, but that's neither here nor there.

Anyway - Tequila. Sipping Tequila. Pouring myself a splash of top shelf sipping Tequila over a layer of cold stones is a genuine source of happiness for me. I enjoy every sip, and our happy hour every evening is a time where my wife and I get to sit together and talk about whatever is on our minds.

On our family vacation to Puerto Vallarta, we bought an Añejo Tequila - aged three years. It's a smooth drink, crisp flavor that brings a smile to my pretty little face each time I take a sip. We also plopped down $110 USD for the privilege of taking that bottle back home with us to the United States. It was worth every penny, and I'm proud we spent it.

Spending money is okay

Get yourself away from the assumption that spending money is always bad. It isn't. We all spend money. It's natural. In the first world, it's required. We need to spend money to live and maintain a semblance of happiness while doing so. To hell with the belief that spending money is bad.

Spending money is a good thing, so long as you're spending money on those things that provide genuine happiness. And, you're moderating your behavior in a way that makes the most sense for your life. For example, we sure as heck don't buy $110 bottles of booze every week. Not even every month. We spread out those nicer bottles throughout the year so we have something extra special to look forward to.

By spreading out your larger splurge purchases, you do two things:

- Save money by not turning your splurges into a habit, and

- Make each splurge more special when they happen.

If you always splurge, it's no longer special. Destructive spending habits quickly materialize when we plop down good money for expensive shit all the time. Don't make these splurges a habit. Instead, make them count.

My wife and I haven't subscribed to cable or satellite service in years. But, if watching TV is a source of genuine happiness for you, then do it. If wearing a $5,000 Rolex is money well spent, then spend it. If you truly believe that buying an $80,000 BMW is a significant source of never-ending happiness, so be it. You aren't an incompetent boneheaded lemming for spending money (yes, even a LOT of money) on those things that provide happiness.

Just make damn sure you're making the very most out of every dollar.

For the record...I plopped down a half year's salary right out of college to buy a Corvette. I also rode around on 1,000cc sport motorcycles. I bought a house in the suburbs that quickly depreciated in value during the mortgage crash of 2009. I bought expensive camera equipment. Upgraded my cell phone nearly every year. Anything I wanted, I bought.

The problem wasn't that I was spending money. The problem was I never asked myself whether those purchases were genuinely making me a happier person. They weren't. They distracted me from a job that I didn't particularly enjoy and a life that was going nowhere, fast. But, happiness? No, not really.

Sipping top shelf Añejo?