spending

12 posts

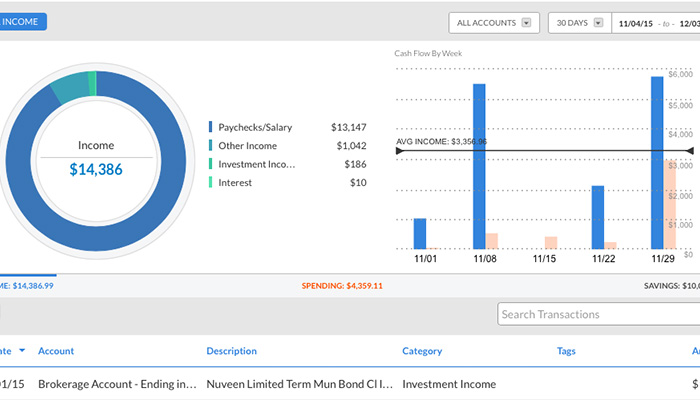

Empower Personal Capital Review: How To Track your money in 2025

S

Frugal living: Is life more difficult for those of us who are frugal?

S

How much does income affect your post-retirement lifestyle stability?

S

The truth about extended warranties, and what to do instead

S

We bought a $110 bottle of Tequila; no regrets

S

How quickly can you spot an impulse buy?

S

Despite market losses, we're up over $150k in 2015

S

Maybe spending all that money in my 20s was a good thing

S

Life is short, so live a little...they say

S

Lookie there! Spend money on experiences, not things!

S

Lookie there! Apply intermittent fasting techniques to your spending habits

S