How to take calculated risk

Smart and calculated risks take practice, and the more risks that you take, the smarter you become at doing the ones with the highest upside.

FI am what you would call risk-averse, but I didn’t always use to be like this.

When I was a little girl of 8 or 9, I enjoyed ripping around our acreage at top speed on my dirt bike. When I was 14, my friend and I would “borrow” my parents’ car to go on little neighborhood driving adventures. When I was 19, I traveled to Thailand and signed my life away to experience cliff jumping off of 80-foot rock formations.

These experiences got my blood flowing. These risky activities are the things I look back on and remember with fondness…..maybe even pride.

Fast forward 14 years to the present. I am now 33 years old and have encountered many experiences over the years that have greatly reduced my tolerance to risk.

My choice of partner. I married a professional ski coach who fears nothing (or very little, he admits to being afraid of catfish).

My husband is all about adventure sports. He coaches professional athletes in downhill skiing where they are flying down a mountain face at 120 km/h (75 mph). The snow is injected with water to make it as hard, icy and fast as possible. Death is a very real consequence of falling and, unfortunately, a consequence my husband has witnessed.

In addition to skiing my husband enjoys dirt-biking, skydiving and has dabbled in some ice climbing. I wish he enjoyed reading and leisurely walks, as it would be better for my heart!

I should also mention that as a result of these activities he has broken his neck, knee-cap, ankle, foot, fingers, toes, torn his Achilles tendon and suffered intense road rash from a biking accident.

So, one of my theories for why I’ve become more risk averse is that I am constantly on edge and worried about my husband. One of us has to be the responsible one, right?

Getting Older. Another theory, and one that is supported by scientific literature, is that I am becoming more risk-averse with age.

The older you get, the more you realize that you’re not invincible. As you age, your brain undergoes physiological changes that alter the way you make decisions. It happens to all of us.

At a certain point in life your knees start to crack, your back starts to hurt and it takes longer to get up when you fall. Your body starts to remind you that you aren’t what you used to be. You start to make choices that support a long life instead of always trying to cheat death.

Well, at least this is true for most of us!

Becoming a Parent. A child changes everything. Now you are responsible for the life of another human being. Your wants and needs become secondary. You will do anything to protect this new little life. You want to be around for your child, and maybe even their children, if they choose to have kids!

So, there we are, a three-point theory for my own personal risk aversion. And, while I do identify as more risk-averse I also believe in the value and necessity of risk-taking.

If you want to lead an exciting, amazing, unique and successful life, you NEED to take risks.

I’m not talking about jumping out of airplanes or quitting your job tomorrow to pursue your passion for knitting cat slippers. I’m talking about a life of calculated risk.

“It is not the things we do in life that we regret on our death bed. It is the things we do not.” Randy Pausch

What is risk?

Risk can be defined in different ways depending on the context or situation. But, when you get down to it, risk is about exposing yourself to an unwanted consequence be it danger, loss, rejection or failure.

You risk your pride when you ask someone out on a date, you risk your life when you jump out of an airplane and you risk financial ruin when you gamble with your life savings in Vegas.

Risk often gets a bad rap because it’s associated with deviant behaviors such as gambling, drinking and unprotected sex.

However, risk is also a necessary ingredient in the recipe for success.

Think about it.

The person who sits in their cubicle doing the same job on autopilot for thirty years is unlikely to achieve great things. Sure, they might get a consistent raise or bonus and possibly a pension, but that’s about it. And for many, that’s enough.

The risk takers are those people that work really hard to set up a situation where they can leave their 9 to 5, pursue their own business, build the life they want and maybe even retire at 35!

They are creative, innovative and incredibly hard working. They want to be different and achieve amazing things.

These are the Elon Musk’s, Richard Branson’s and Oprah Winfrey's of the world.

Studies have shown that entrepreneurs have an increased tendency to make risky decisions as well as the ability to make decisions in stressful situations. However, you don’t need to be born with a risk-seeking personality to become a successful entrepreneur.

The ability to make risky decisions is not necessarily a result of being more risk tolerant. Instead, entrepreneurs learn to become more tolerant of risk because it’s a necessary part of running a business.

So yes, a certain amount of calculated risk-taking is necessary for success, but, it can be learned.

Risk is not black and white. Just because you don’t want to bungee jump or swim with sharks doesn’t mean you can’t learn to take calculated risks.

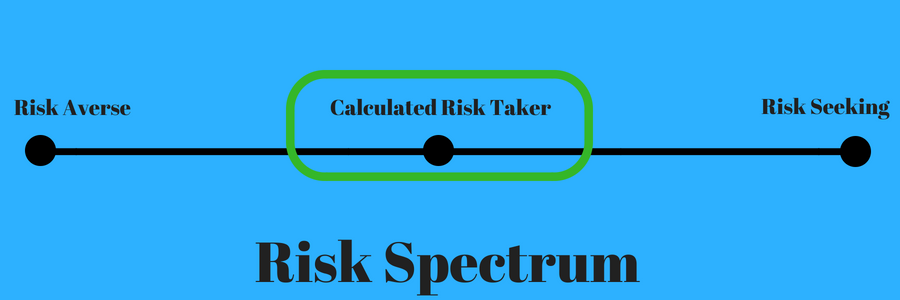

Rather than looking at risk as a binary variable, risk seeking vs. risk averse, it makes more sense to view it on a spectrum.

On one end we have the intense risk seeking individuals. The ones who only care about satisfying their short terms urges and don’t think before they do. The gamblers, the daredevils, and the addicts.

One the other end we have those who are so risk averse they’re afraid to drive in a car, walk down the street or even talk to a strange because there’s a chance they could get hurt.

Somewhere in the middle we have the sweet spot, the calculated risk takers.

5 Effortless Methods to Boost Your Income This Week

If you need extra money, you’ve come to the right spot.

Our team has compiled a list of creative ways you can fatten your bank account this week. Certainly, there’s something here that fits your needs.

This is not a long list, so go ahead and start now, but be sure to bookmark this post so you can easily return later. We’ll keep it updated as offers change or expire.

Why are some people risk-averse while others are risk-seeking?

According to psychologists Heidi Grant and E.Tory Higgins, there are two categories of people when it comes to risk, those who are prevention focused and those who are promotion focused.

Prevention focused individuals avoid risks to maintain the status quo. If things are going well they see no reason to rock the boat. They value safety and always have a plan B in case something goes wrong.

They work slowly and methodically and rarely make mistakes.

On the other hand, promotion focused individuals want more. They are dreamers, they are creative, and they are willing to take risks to achieve their goals. They are also more likely to encounter errors due to a lack of thinking things through.

Unlike the prevention-focused individual, the promotions focused person is unlikely to have a plan B. They work fast and furious to achieve their goals.

When reading the two personas, most people will immediately identify more strongly with one or the other. Unsurprisingly, I identify as prevention focused! However, over the course of a lifetime everyone will fluctuate back and forth between the two.

Why do we shift between promotion and prevention focused?

- We become more prevention-focused with age. The research demonstrates that we become more risk-averse, or prevention-focused, with age. The decisions people make in regards to how they drive, how they manage their health and even how they invest their money tend to become less risky as they get older.

- We become more prevention-focused with success. Think of the aspiring rock star. Their goal is to make it big. They put every ounce of effort into achieving their dreams. They practice all day and night, play at dive bars and tour in an old van. They do whatever it takes, no matter this risk or the sacrifice.

Then, one day all of their dreams come true and they hit it big. It’s at this point that their view of risk changes.

The goal is no longer promotion, its prevention. The priority shifts from “making it” to not losing it.

When you are prevention focused you take less risks because you are more motivated by fear. You are more worried about messing up and destroying all that you’ve built. When you are promotion focused you generally have nothing to lose.

Some people might be born risk takers. Studies have also found that some people are born with a variant of the dopamine receptor gene which equates to them having more risk seeking behavior built into their DNA.

Without getting into the technical details, dopamine is a naturally occurring drug that is responsible for the feeling of joy and increased physiological arousal.

The basic theory is that some individuals, those with the variant on the dopamine receptor gene, require more stimulation (a.k.a. more risk) to feel the same rush of joy or arousal that other people would feel with far less stimulation.

So, while you feel a surge of dopamine when you ride your bike with no hands, I need to free fall out of an airplane to get the same sensation.

It’s important to note that the research on this topic is largely mixed. While some studies have found a connection between the dopamine receptor gene and risk seeking behavior, others have not.

Not every job in the gig economy is equal. Here are the best side hustles to consider during your layoff to make the most cash.

The value of risk…calculated risk.

Many people assume that those who achieve amazing success identify exclusively as promotion focused individuals, the inherent risk takers.

From the outside the ultra-successful look as though they live life on the edge, throw caution to the wind and dive into their passions head first.

This is not entirely true.

While we’ve established a connection between risk and success, the relationship is more nuanced.

Many of the most financially successful people in the world including Warren Buffett, Richard Branson and Bill Gates have said that they do not identify as risk takers.

“Risk comes from not knowing what you’re doing.” Warren Buffett.

In an interview with entrepreneur.com Richard Branson, creator and owner of the Virgin brand namesake, is quoted saying,

“We [Virgin] take a lot of calculated risk, but we make sure that no one risk is going to topple everything. Protecting the downside is critical. One of the first big deals I did was buying a secondhand 747 from Boeing. I was going from a record company to the airline business, so the key thing in that deal was that if it didn’t work out, I could hand the 747 back to Boeing after the first year.”

As for Bill Gates. Many believe him to be a risk taker because he dropped out of one of the top schools in the world, Harvard, to pursue his business. However, this is not the whole story.

Gates was more of a calculated risk taker. While the “drop out” story might be a more attention grabbing headline, the truth is that he took a leave of absence that helped him cover himself in case his business plans went sideways.

In an interview by Forbes, Leonard C. Green, entrepreneur and professor at Babson College, one of the top schools for entrepreneurship, is quoted as telling his students that,

”Entrepreneurs are not risk takers. They are calculated risk takers.”

He goes on to say that “the difference between risk takers and calculated risk takers is the difference between failure and success.”

How to be a calculated risk taker.

Whether you identify as a born risk taker and feel like you need to reign in some of your haphazard behavior, or if you are more risk averse and want to learn how to be a little gutsier, there is hope for all of us.

The art of calculated risk taking is one that can be learned.

So, if you are interested in becoming a calculated risk taker, here are a few behaviors and practices that you can begin to implement today.

Recognize the difference between risk-taking and calculated risk-taking. I hope by this point you can understand the difference between those two things.

It’s the difference between taking a chance and making an educated decision.

Remember, the most successful people in the world are not throwing caution to the wind and risking everything on a chance or a feeling. They carefully weigh the advantages and disadvantages of every decision.

Before you make a decision, consider the risks as well as the benefits and never risk more than you are willing to lose.

Minimize your losses. Related to the previous point, once you have identified the risks and benefits you must figure out how to minimize your losses. Again, Richard Branson provides a great example of this.

When deciding to dabble in the airline industry he purchased a second hand 747 from Boeing. In an effort to protect against the downside he negotiated a deal in which he could give back the plane at the end of the first year if he was not successful. A difficult negotiation, you can be sure, but he virtually eliminated the risk associated with trying something new.

Lead with logic, not emotion. This is definitely easier said than done. Humans are emotional animals. It’s estimated that our emotions drive 80% of our choices, while logic and practicality account for about 20%.

So, how do we overcome the emotion?

To become an effective calculated risk taker you need to learn to do your homework. Prior to making a decision prepare yourself by doing some research. You want to invest in the stock market but your afraid of the risk? Do some reading. What do the experts say? Write it down. Review it. Understand it. Then make a plan. Write it down and follow it.

When you start to feel scared or emotional, go back and read it. Remember that you were in a logical state of mind when you made the plan. Trust your logical self and avoid rash, emotional decision making.

Sleep on it. People are better decision makers when they are well rested. I’m sure this is not shocking information but, it’s important to remember.

Studies show that sleep deprivation leads to poor judgement and often results in making the wrong decision. Being successful requires the ability to make decisions in stressful situations, so get your sleep.

One step at a time. Have a new business that you want to try out? You don’t have to quit your job and go all in tomorrow. A better plan is to take it one step at a time. Test the waters before you dive in. Why not start with a side hustle?

A study published in the Academy of Management journal, found that entrepreneurs who kept their day jobs while starting a new company were 33% less likely to fail then those who quit their job to pursue their new business.

Practice makes...improvement. If you want to become an effective calculated risk taker, you have to practice. Practice this skill by starting small. Take a risk. Maybe you succeed, maybe you fail. The result doesn’t matter. The value is in the practice.

Practicing will help you to learn to manage the emotions associated with risk-taking and it will help you to reframe the concept of failure. While we have been conditioned to view failure as something negative it should be viewed as an opportunity. If you’re able to learn from your previous failures then you can start to view them as instances that allow for learning and growth.

_____________________________________

About the Author: JJ is a professional researcher and aspiring freelance writer. She writes about all things related to personal finance for beginners, psychology, and education on her blog, The Financial Graduate.

Note: This article was originally published August of 2018 but has been republished using the Revise and Republish content strategy.

Frequently Asked Questions:

What is risk aversion, and how can it change over time?

Risk aversion is the reluctance to take risks and can increase with age, significant life changes, or impactful experiences. For example, engaging in adventurous activities in youth versus opting for safety and stability as responsibilities grow, like becoming more cautious with age, choosing a partner with a high-risk profession, or becoming a parent, can all contribute to a more risk-averse outlook.

How does becoming a parent influence one's approach to risk?

Parenthood introduces a profound sense of responsibility for another's life, often leading individuals to prioritize safety and long-term planning over personal desires or risky ventures. This shift is aimed at ensuring the wellbeing and security of the child and the family unit, significantly influencing decision-making processes towards risk aversion.

What are the psychological perspectives on risk-taking behavior?

Psychological research suggests there are two primary orientations towards risk: prevention-focused, where individuals aim to maintain the status quo and avoid risks, and promotion-focused, where individuals seek achievement and are more willing to take risks. People may fluctuate between these orientations based on age, success level, and personal circumstances.

Can risk-taking be beneficial, and how?

Yes, calculated risk-taking is essential for achieving success and leading a fulfilling life. It involves making informed decisions with a clear understanding of potential benefits and downsides. Successful individuals often engage in calculated risks, assessing situations to minimize losses and optimize outcomes, rather than relying on sheer luck or impulsiveness.

How can one become a calculated risk-taker?

Becoming a calculated risk-taker involves recognizing the difference between reckless risk-taking and informed decision-making, minimizing potential losses, leading with logic over emotion, and practicing incremental steps towards larger goals. This approach encourages learning from each experience, gradually improving risk assessment and management skills for better personal and professional outcomes.