Despite market losses, we're up over $150k in 2015

Despite market losses over the year, we still managed to pack a solid wad of cash on to our net worth through meticulous (and automatic) contributions into our retirement accounts. We don't have to think about it - through automated systems, the money gets saved where we want it.

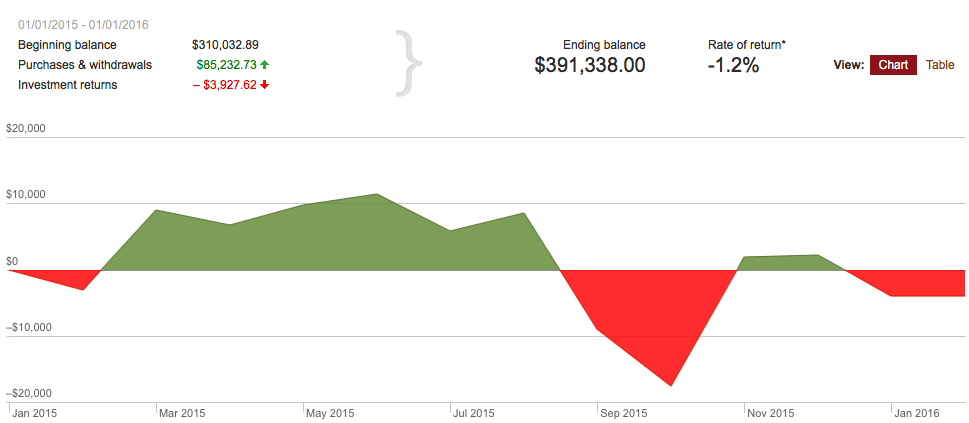

In the beginning of 2015, things were humming along normally. The market was doing well, just like it had been since 2012. We were enjoying solid monthly increases to our net worth on the order of $15k to $30k some months.

We were set to retire by the end of 2016, thinking that we'd have more than enough invested green if everything continued as it has been.

Then, September happened.

The mini-crash of September, 2015 ushered in the start of what some expected to be a "recession". Most believed the market to be overvalued and due for a correction. Oil is tanking. Stocks are volatile, at best. All in all, market conditions are looking, well, interesting.

We lost $10s of thousands of dollars in earning potential over the last 5 months of 2015. Checking my Vanguard account, our capital gains had all been wiped clean. Instead, Vanguard showed a -1.2% rate of return for 2015. Boo!

But we still ended up over $150,000 richer in 2015 ($154,132 to be exact). With such a poor market in the latter half of 2015, how did we throw another $150Gs into our investments?

The power of contributions

We dumped as much money as we possibly could into our investments over the year, averaging around 70% savings rate from month to month. Both my wife and I work full time and make respectable salaries. We have no kids. We have lots of room to save.

And save we did. In fact, we save 100% of my wife's salary and a portion of mine beyond our living expenses.

Even though our market returns over the year were slightly negative, we still managed to pack a solid wad of cash on to our net worth through meticulous (and automatic) contributions into our retirement accounts. We don't have to think about it - through automated systems, the money gets saved where we want it.

And that's the key - make saving automatic! That means we never see the money that we intend to save, and therefore, we are never tempted to spend it.

Both my wife and I maxed out our 401ks. We dumped anything extra into a Vanguard brokerage account. We also have an Ally savings account where we keep our emergency fund as well as money that will eventually go towards the purchase of our truck and Airstream.

We also made uncomfortable decisions that prioritized our future retirement over our current selves, like:

- Nixing our expensive cable television package

- Downgrading my cell phone to the cheapest Android device available

- Cooking at home almost every night rather than going out

- Saying "no" to restaurant or vacation invitations

- Generally not buying shit that we don't truly need

- Craigslisting stuff that we haven't used in over a year

- Selling our Honda Ridgeline

In the end, although it was a rough negative growth year, saving as much cash as possible remains to be the most effective way to increase your net worth. We are proof of that!

Check out our monthly net worth progress in 2015

- December 2015: $718,627.95

- November 2015: $717,730.58

- October 2015: $709,750.69

- September 2015: $691,177.31

- August 2015: $676,489.00

- July 2015: $685,012.22

- June 2015: $671,637.00

- May 2015: $671,460.66

- April 2015: $604,683.22

- March 2015: $594,485.48

- February 2015: $598,295.21

- January 2015: $564,495

How did you do in 2015? Did you manage to squeak out some capitals gains growth in the volatile latter half of 2015?