Does checking your credit score lower it?

There is a common misconception that checking your score will impact your credit.

This post may contain affiliate links and/or paid placement. Click here to read our full disclosure.

The simple answer is no!

There is a common misconception that checking your score will impact your credit. Regularly checking it is not only safe, but also important in protecting yourself against fraudulent activity.

Applications like Credit Karma or True Finance use what is called a "soft pull," when presenting the credit score. Typically has little to no impact on your credit. Soft pulls are made when you or a lender checks your credit score to see if you qualify for a loan or credit card, but doesn't actually apply for one. These types of inquiries are not typically factored into your credit score.

On the other hand, "hard pulls," which are made when you apply for a loan or credit card, can have a more significant impact on your credit score. Hard pulls are recorded on your credit report and can lower your credit score, particularly if you have several hard pulls in a short period of time. If you are not applying for any loan or credit and keeping an eye on it regularly is a good way to detect any suspicious activities or errors in your credit history.

It's worth noting that some credit scoring models, such as the VantageScore 3.0, no longer penalize consumers for rate shopping for credit cards, auto loans and other types of loans. This means that multiple hard pulls for the same type of loan within a certain window of time, such as 14 to 45 days, are treated as a single inquiry.

If you want to check your credit score to monitor your credit history, it's a good idea to check it with reputable source such as the credit bureau Equifax. We have Great news! True Finance has partnered with Equifax providing free access to your score while monitor your account against fraud.

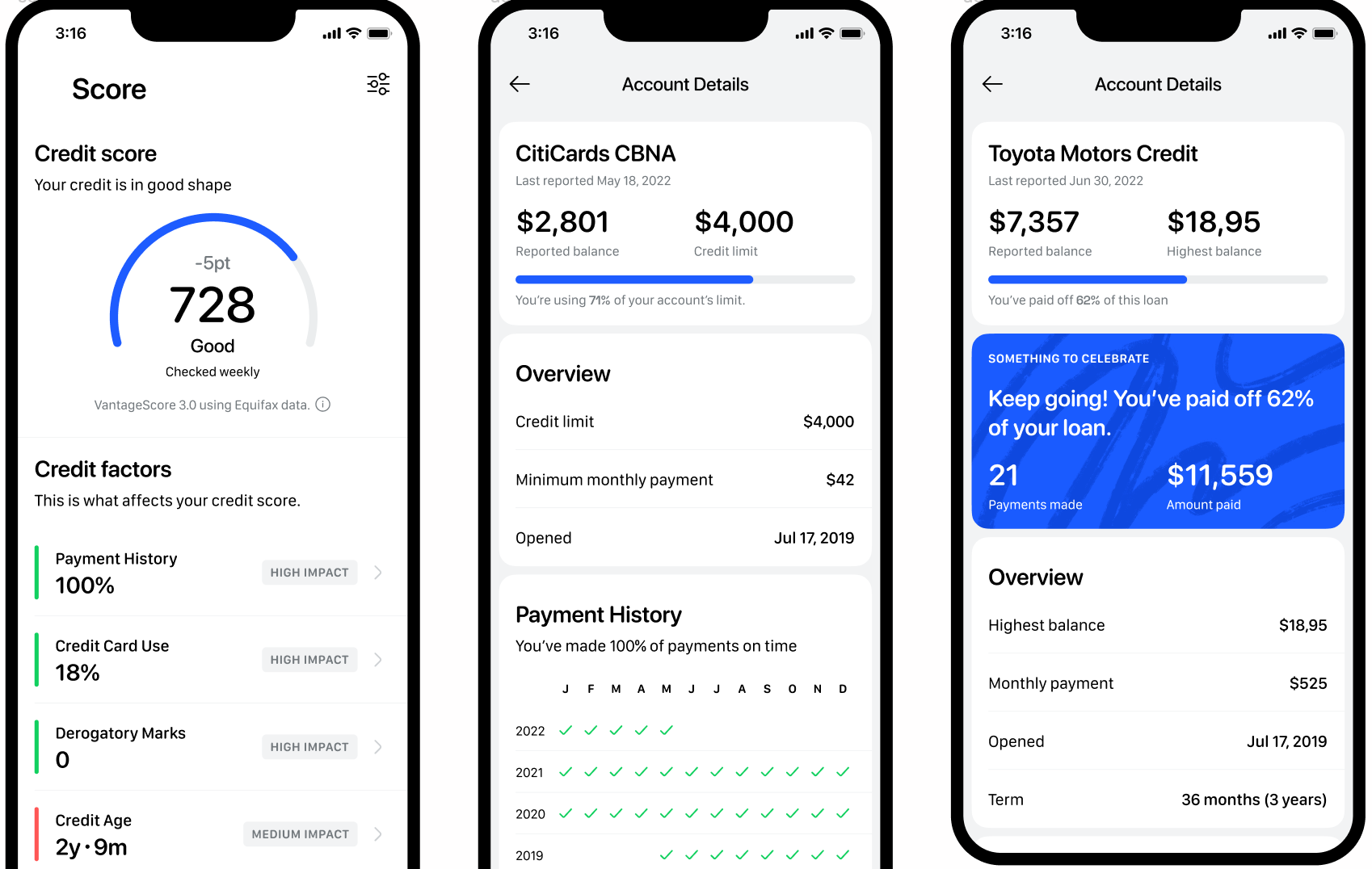

The photo above is courtesy of True Finance. Here are three things to look for when self-checking your score.

- Your Credit Score - Has your score changes in the past 30 days? A major change will indicate activity such as a new credit card being opened. If you have not applied for one in the past 30 days, you have likely detected fraud.

- Credit Score Factors - Knowledge is power. In the sample above, credit age is identified as having a negative impact. This user needs to establish their account age by not applying for new credit and not closing current account with an established history.

- Account Details - Review all accounts to ensure they belong to you and ensure you are making payments on time.

Visit True Finance today and download the app to view your credit score, recieve alerts against fraud, and access credit reports for free. Click to HERE to download the app.

Comments